Akatsuki BNB2025-08-31 16:02

JuCoin mở rộng tại Việt Nam với nền tảng pháp lý mới

Khung pháp lý rõ ràng đồng nghĩa với tăng trưởng mạnh mẽ hơn — và JuCoin đang dẫn đầu xu hướng này. Đọc toàn bộ bài viết: https://vir.com.vn/digital-assets-set-for-expansion-in-vietnam-amid-new-legal-foundation-135323.html

#JuCoin #Vietnam #JuCoinVietnam #Blockchain #Crypto #Web3 #DigitalAssets #CryptoNews

507

0

0

Akatsuki BNB

2025-08-31 16:03

JuCoin mở rộng tại Việt Nam với nền tảng pháp lý mới

[{"type":"paragraph","children":[{"text":"\nK"},{"type":"link","url":null,"children":[{"text":""}]},{"text":"hung pháp lý rõ ràng đồng nghĩa với tăng trưởng mạnh mẽ hơn — và JuCoin đang dẫn đầu xu hướng này. Đọc toàn bộ bài viết: "},{"type":"link","url":"https://vir.com.vn/digital-assets-set-for-expansion-in-vietnam-amid-new-legal-foundation-135323.html","children":[{"text":"https://vir.com.vn/digital-assets-set-for-expansion-in-vietnam-amid-new-legal-foundation-135323.html"}]},{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://l.facebook.com/l.php?u=https://vir.com.vn/digital-assets-set-for-expansion-in-vietnam-amid-new-legal-foundation-135323.html?fbclid=IwZXh0bgNhZW0CMTAAYnJpZBExMEFSZVhheFhtZmtTaUhDaQEeQwlm0YaS5h6HY7FIOwJ0rWXnNl2Jn3seHFhbi_VsfbbhWQjqzONkoYjF56U_aem_pY7PdH0KtqvPotpSUezb0A&h=AT0uY9KVfkGZvxt0ZPwb4lcwl-vFGfgZPsGP4E-k2XhjHN92WIqeqZNWzbVILFcheWH5uIstEnYvcIERP8W86XPO0YnifM5cHsZEymh24IB0EArRV3jeP3_ImmszdnTE5zjYv2ctysm4lWb6xpZdVNvIRNgrv9wd_Q&__tn__=-UK-R&c[0]=AT1tumChEGXywoWmSoUUbjwZmJPcW06tDiBSZ_F79fN21s-nuu9VBiEGO5f3utd5IgEra4-ZqyL20xOwxmcywKl_uSKVdEVzgz21WX6fwgij8gU7Wgc0-meAmema6IHFECk3gu-UikKofaYOoaFwRZrqlEM8Rl2LLnBj68_wuAg","children":[{"text":""}]},{"text":""},{"type":"link","url":"https://www.facebook.com/hashtag/jucoin?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#JuCoin"}]},{"text":" "},{"type":"link","url":"https://www.facebook.com/hashtag/vietnam?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#Vietnam"}]},{"text":" "},{"type":"link","url":"https://www.facebook.com/hashtag/jucoinvietnam?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#JuCoinVietnam"}]},{"text":" "},{"type":"link","url":"https://www.facebook.com/hashtag/blockchain?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#Blockchain"}]},{"text":" "},{"type":"link","url":"https://www.facebook.com/hashtag/crypto?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#Crypto"}]},{"text":" "},{"type":"link","url":"https://www.facebook.com/hashtag/web3?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#Web3"}]},{"text":" "},{"type":"link","url":"https://www.facebook.com/hashtag/digitalassets?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#DigitalAssets"}]},{"text":" "},{"type":"link","url":"https://www.facebook.com/hashtag/cryptonews?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"#CryptoNew"}]},{"text":""},{"type":"link","url":"https://www.facebook.com/hashtag/cryptonews?__eep__=6&__cft__[0]=AZWGn7tkHM50Ilga06mgXpF_siYJNVdh73wDJOYn-J4vXxzqbohUO65hJJkjxoMFtvuZIGW1BDrV269fKyUP-7qbVNdfdT1RDv667QRM4v4stmWba__mDz7Nv8bS8VEHPG8tXBT9keHLlajJp8W0GeDL&__tn__=*NK-R","children":[{"text":"s"}]},{"text":" \n\n"}]}]

JU Square

Tuyên bố miễn trừ trách nhiệm:Chứa nội dung của bên thứ ba. Không phải lời khuyên tài chính.

Xem Điều khoản và Điều kiện.

Bài Đăng Liên Quan

Ju.com Lists STABLE Token: Tether's Revolutionary Layer 1 Blockchain Governance Token[{"type":"paragraph","children":[{"text":"Ju.com announces the listing of STABLE, the governance token for Stable blockchain's mainnet launch on December 8, 2025. This groundbreaking \"stablechain\" represents the first Layer 1 network where USDT functions as the native gas token, eliminating volatile transaction costs."}]},{"type":"paragraph","children":[{"text":"💰 "},{"text":"What Makes STABLE Unique:","bold":true}]},{"type":"bulleted-list","children":[{"text":"\nFirst blockchain using USDT as native gas token for all transactions\n$28M seed funding from Bitfinex, Hack VC, Franklin Templeton, and PayPal Ventures\n100 billion fixed supply with zero inflation\nSub-second block finality via StableBFT consensus\nFull EVM compatibility for seamless dApp migration\nLayerZero integration for gas-free cross-chain USDT0 transfers\n"}]},{"type":"paragraph","children":[{"text":"🎯 "},{"text":"Tokenomics Breakdown:","bold":true}]},{"type":"bulleted-list","children":[{"text":"\nEcosystem & Community: 40%\nTeam & Advisors: 20% (4-year vesting, 1-year cliff)\nStrategic Investors: 20% (4-year vesting, 1-year cliff)\nGenesis Distribution: 10% (fully unlocked)\nFoundation Reserve: 10%\n"}]},{"type":"paragraph","children":[{"text":"🏆 "},{"text":"Key Features:","bold":true}]},{"type":"bulleted-list","children":[{"text":"\nGovernance-only utility model for protocol upgrades and ecosystem decisions\nStaking rewards paid in USDT from transaction fees (real yield, not inflation)\nEnterprise-grade features: guaranteed blockspace, batch processing, confidential transfers\nTargets $200+ billion stablecoin market with purpose-built infrastructure\n"}]},{"type":"paragraph","children":[{"text":"💡 "},{"text":"Market Context:","bold":true}]},{"type":"bulleted-list","children":[{"text":"\nPhase 2 pre-deposit attracted $1.1B+ from 10,000+ wallets\nBacked by Tether, issuer of world's largest stablecoin\n2026 roadmap includes parallel transaction processing and enhanced developer tools\nInstitutional backing signals confidence in specialized stablecoin networks\n"}]},{"type":"paragraph","children":[{"text":"⚠️ "},{"text":"Investment Considerations:","bold":true}]},{"type":"bulleted-list","children":[{"text":"\nGovernance-only token with no direct revenue sharing from fees\nValue depends on network growth and governance importance\nCompetition from established L1s and emerging stablecoin chains\nEnterprise adoption focus differentiates from DeFi speculation\n"}]},{"type":"paragraph","children":[{"text":"Trade STABLE on Ju.com and access Tether-backed Layer 1 infrastructure designed for the global stablecoin economy. With fixed supply, institutional backing, and USDT-native settlement, STABLE offers unique exposure to purpose-built payment blockchain technology."}]},{"type":"paragraph","children":[{"text":"Learn more: "},{"type":"link","url":"https://www.stable.xyz/","children":[{"text":"https://www.stable.xyz/"}]},{"text":" | "},{"type":"link","url":"https://docs.stable.xyz/","children":[{"text":"https://docs.stable.xyz/"}]},{"text":""}]},{"type":"paragraph","children":[{"text":"Read the complete analysis: 👇\n"},{"type":"link","url":"https://blog.ju.com/jucom-lists-stable-token/?utm_source=blog","children":[{"text":"https://blog.ju.com/jucom-lists-stable-token/?utm_source=blog"}]},{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"STABLE","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Tether","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"USDT","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Layer1","children":[{"text":""}]},{"text":" "}]}]

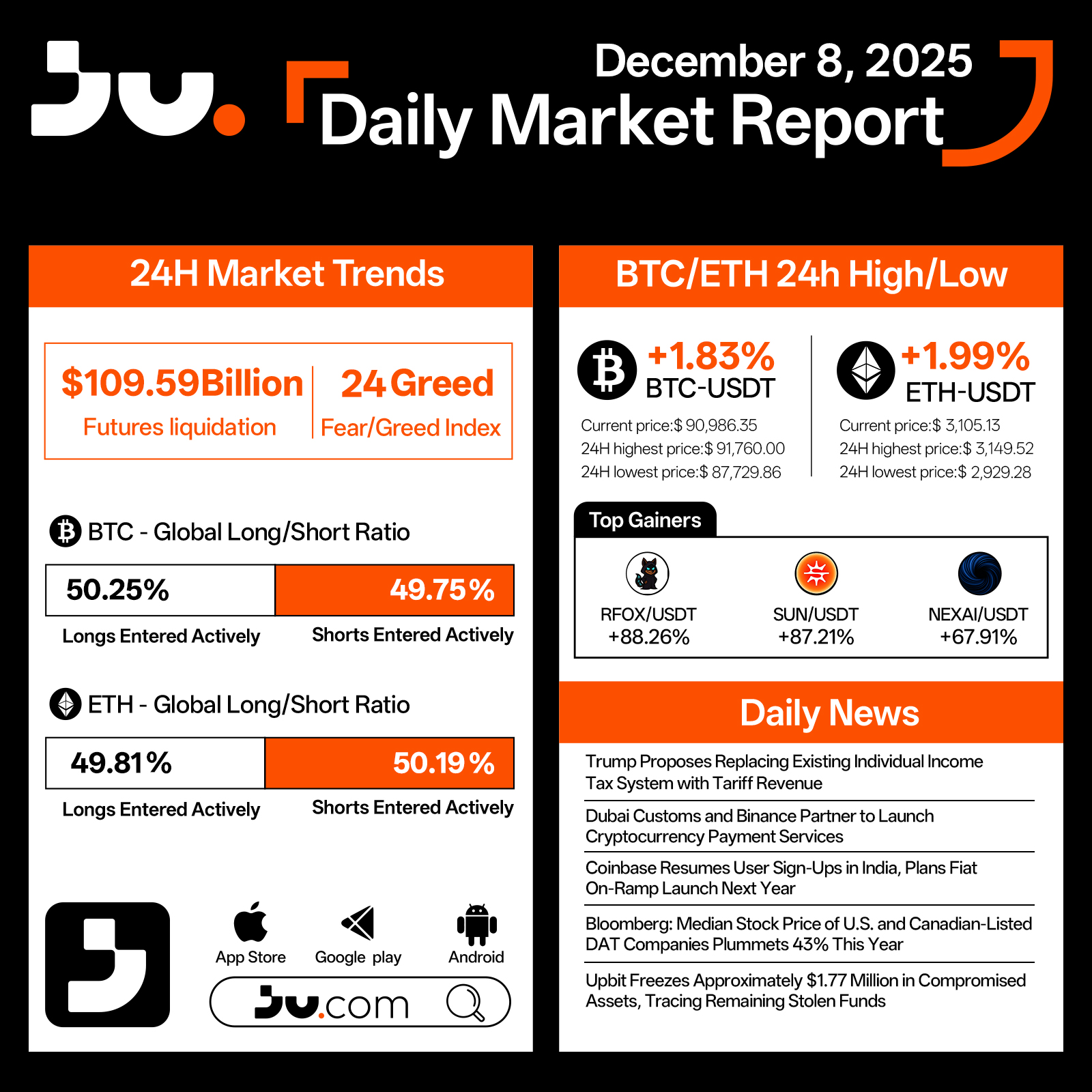

BTC and ETH Extend Gains as Market Sentiment Continues to Improve – December 8, 2025[{"type":"paragraph","children":[{"text":"Crypto markets posted another day of modest gains on December 8, with major assets trending higher. Over the past 24 hours, total liquidations reached "},{"text":"$109.59 billion","bold":true},{"text":", while the Fear & Greed Index held at "},{"text":"24","bold":true},{"text":", indicating gradually strengthening sentiment without signs of overheating. "},{"type":"link","url":"https://blog.jucoin.com/what-is-bitcoin-btc-decentralized-cryptocurrency/","children":[{"text":"Bitcoin"}]},{"text":" ("},{"type":"link","url":"https://www.jucoin.com/en/trade/btc_usdt?utm_source=blog","children":[{"text":"BTC"}]},{"text":") rose "},{"text":"1.83%","bold":true},{"text":" to "},{"text":"$90,986.35","bold":true},{"text":", trading between "},{"text":"$91,760.00","bold":true},{"text":" at the high and "},{"text":"$87,729.86","bold":true},{"text":" at the low. "},{"type":"link","url":"https://blog.jucoin.com/what-is-ethereum-eth-smart-contracts-dapps/","children":[{"text":"Ethereum"}]},{"text":" ("},{"type":"link","url":"https://www.jucoin.com/en/trade/eth_usdt?utm_source=blog","children":[{"text":"ETH"}]},{"text":") outpaced BTC slightly, climbing "},{"text":"1.99%","bold":true},{"text":" to "},{"text":"$3,105.13","bold":true},{"text":", with intraday movement spanning from "},{"text":"$3,149.52","bold":true},{"text":" to "},{"text":"$2,929.28","bold":true},{"text":"."}]},{"type":"paragraph","children":[{"text":"Derivatives data showed balanced positioning, with BTC at "},{"text":"50.25% longs","bold":true},{"text":" and "},{"text":"49.75% shorts","bold":true},{"text":", while ETH recorded "},{"text":"49.81% longs","bold":true},{"text":" versus "},{"text":"50.19% shorts","bold":true},{"text":". This equilibrium suggests an uncertain but gradually improving market outlook. A number of altcoins posted strong performances, led by "},{"type":"link","url":"https://www.jucoin.com/en/trade/rfox_usdt/?utm_source=blog","children":[{"text":"RFOX/USDT"}]},{"text":" with "},{"text":"+88.26%","bold":true},{"text":", "},{"type":"link","url":"https://www.jucoin.com/en/trade/sun_usdt/?utm_source=blog","children":[{"text":"SUN/USDT"}]},{"text":" with "},{"text":"+87.21%","bold":true},{"text":", and "},{"type":"link","url":"https://www.jucoin.com/en/trade/nexai_usdt/?utm_source=blog","children":[{"text":"NEXAI/USDT"}]},{"text":" with "},{"text":"+67.91%","bold":true},{"text":", highlighting ongoing speculative momentum."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"In broader developments, Trump proposed replacing the current individual income tax system with tariff revenue, a policy shift that could significantly impact U.S. economic dynamics. Dubai Customs partnered with Binance to introduce cryptocurrency payment services, marking a major step for regulated digital payments in the region. Coinbase resumed sign-ups in India and announced plans to roll out fiat on-ramps next year. Bloomberg reported that the median stock price of U.S. and Canadian-listed DAT companies has plunged "},{"text":"43%","bold":true},{"text":" this year, underscoring persistent market stress in high-rate environments. Upbit froze approximately "},{"text":"$1.77 million","bold":true},{"text":" in compromised assets and continues tracing remaining stolen funds."}]},{"type":"paragraph","children":[{"text":"Overall, the steady climb of BTC and ETH reflects improving confidence across the crypto market. With regulatory developments, payment integrations, and major platforms reactivating services, structural support for year-end market strength is gradually building."}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"finance","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Blockchain","children":[{"text":""}]},{"text":" "}]}]

🌐Surging Demand for Stablecoins: Can the US Ease Deficit Pressure?[{"type":"paragraph","children":[{"text":"The passage of stablecoin legislation in the United States has sparked a debate on Wall Street: will stablecoins actually significantly strengthen the dollar and become the primary source of demand for short-term U.S. Treasury bonds (T-bills)? "}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"While officials like Treasury Secretary Scott Bessent predict the dollar-denominated stablecoin market will grow from around $300 billion to $3 trillion by 2030, institutions like JPMorgan Chase, Deutsche Bank, and Goldman Sachs emphasize that current optimistic forecasts are overstated.📌📌📌"}]},{"type":"list-item","children":[{"text":"The new law requires stablecoins to be fully backed by short-term Treasury securities and cash equivalents."}]},{"type":"list-item","children":[{"text":"While this may create some increased demand, the zero-interest rate structure reduces its appeal, making it difficult to encourage large-scale capital outflows from savings or money markets."}]},{"type":"list-item","children":[{"text":"Furthermore, even if capital outflows do occur, the effect is largely a substitution of holders rather than a real increase in aggregate demand for Treasury bonds. ⏸⏸⏸"}]},{"type":"list-item","children":[{"text":"Globally, the potential for stablecoin growth is seen as a major risk to emerging market banking systems."}]},{"type":"list-item","children":[{"text":"Standard Chartered predicts that developing countries could face up to $1 trillion in capital outflows, leading to tighter regulations."}]}]},{"type":"paragraph","children":[{"text":"Analysts generally believe that stablecoins will indeed grow in the coming years, but their contribution to US Treasury bonds and the dollar system is likely to be a “marginal improvement” rather than a major tool for addressing debt and deficit pressures."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"Stablecoins","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Jucom","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Finance","children":[{"text":""}]},{"text":" "},{"type":"coin","currencyId":7,"currency":"btc","symbolId":6,"symbol":"btc_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/btc.png","fullName":"Bitcoin","character":"BTC/USDT","children":[{"text":""}]},{"text":" "},{"type":"coin","currencyId":128,"currency":"ju","symbolId":73,"symbol":"ju_usdt","logo":"https://storage.webstatic.cc/1/currency/3908d2d8-94c4-4db9-9fc5-9a5bdaae5860-1758872417826.png","fullName":"JU","character":"JU/USDT","children":[{"text":""}]},{"text":" "},{"type":"coin","currencyId":8,"currency":"eth","symbolId":7,"symbol":"eth_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/eth.png","fullName":"Ethereum","character":"ETH/USDT","children":[{"text":""}]},{"text":" "}]}]

JBANK | Secure, Scalable, and Built for Global Adoption[{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":"Many crypto platforms fail to scale, collapse when demand increases, or suffer from weak architecture.\n\nJBank takes a different approach — engineered for "},{"text":"scalability, security, and global user growth","bold":true},{"text":" from day one."}]},{"type":"paragraph","children":[{"text":"With a professionally audited smart-contract system and a treasury-backed economy, JBank grows stronger as the community expands, not weaker."}]},{"type":"paragraph","children":[{"text":"This is not another temporary crypto hype — it's a "},{"text":"true long-term ecosystem","bold":true},{"text":"."}]},{"type":"paragraph","children":[{"text":"#ScalingCrypto #Web3Security #JBank","bold":true}]},{"type":"paragraph","children":[{"text":"For more information:","bold":true},{"text":"\n\nLinktree: "},{"type":"link","url":"https://linktr.ee/jbankglobal","children":[{"text":"https://linktr.ee/jbankglobal"}]},{"text":"\n\nEmail: "},{"type":"link","url":null,"children":[{"text":"[email protected]"}]},{"text":"\n\nOfficial Website: "},{"type":"link","url":"https://jbank.pro","children":[{"text":"https://jbank.pro"}]},{"text":""}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n\n\n"}]}]

JBANK | The Stability Investors Want in a Volatile Crypto Market[{"type":"paragraph","children":[{"text":"Crypto markets can rise and crash within hours — but JBank provides something rare in Web3: stability with predictable return cycles."}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":"Designed with treasury-backed reserves and an audited staking mechanism, JBank gives members confidence knowing their assets are working consistently, regardless of market shocks."}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":"The result?"}]},{"type":"paragraph","children":[{"text":"Long-term growth, lower stress, and true passive earning."}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":"#CryptoStability #SmartStaking #JBank"}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":"For more information:"}]},{"type":"paragraph","children":[{"text":"Linktree: https://linktr.ee/jbankglobal"}]},{"type":"paragraph","children":[{"text":"Email: [email protected]"}]},{"type":"paragraph","children":[{"text":"Official Website: https://jbank.pro"}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n\n\n\n\n\n\n\n\n\n"}]}]

JuChain Launches $100M Entrepreneurship Fund - Ecosystem Breakout Year Begins![{"type":"paragraph","children":[{"text":"Ju.com announces a transformational $100 million JuChain Entrepreneurship Fund, marking the official start of its ecosystem expansion era. This fund positions JuChain not just as blockchain infrastructure, but as a complete growth platform integrating capital, technology, and real-world application scenarios."}]},{"type":"paragraph","children":[{"text":"💰 What This Means:"}]},{"type":"bulleted-list","children":[{"text":"\n$100M dedicated fund for ecosystem projects\nTransformation from exchange to ecosystem builder\nIntegration of blockchain, exchange, and payment systems into unified roadmap\nFocus on real assets (RWA), AI, PayFi, and DeFi applications\nPatient capital approach for long-term project development\n"}]},{"type":"paragraph","children":[{"text":"🎯 Triple-Role Fund Structure:"}]},{"type":"paragraph","children":[{"text":"1️⃣ Accelerator - Complete development path from concept to market: bootcamps, hackathons, MVP support, token economics design, and compliance frameworks"}]},{"type":"paragraph","children":[{"text":"2️⃣ Investment Decision Center - Funding allocations prioritizing technical robustness, business viability, and on-chain/off-chain integration"}]},{"type":"paragraph","children":[{"text":"3️⃣ Resource Orchestrator - Full access to Ju.com's traffic, listing pathways, payment scenarios, brand exposure, and global partner network"}]},{"type":"paragraph","children":[{"text":"🌐 Key Opportunities for Builders:"}]},{"type":"bulleted-list","children":[{"text":"\nAI Integration: Deploy intelligent trading agents and automated strategies with real liquidity and compliant payment rails\nRWA Projects: Tokenize stocks, bonds, and yield rights with built-in compliance expertise\nPayment & Consumption: Build seamless bridges between on-chain earnings and real-world utility\nDeFi/GameFi/SocialFi: Leverage JuChain's account system for superior UX and composability\n"}]},{"type":"paragraph","children":[{"text":"🏆 What Ju.com Brings to the Table:"}]},{"type":"bulleted-list","children":[{"text":"\nDirect user traffic from established exchange platform\nIntegrated payment system (JuPay, JuCard, xBrokers)\nRegulatory compliance frameworks\nGlobal liquidity and listing support\nCross-border payment and settlement infrastructure\n"}]},{"type":"paragraph","children":[{"text":"💡 Why Now?"}]},{"type":"bulleted-list","children":[{"text":"\nBase layer competition shifting from performance to real business utility\nMarket demanding patient capital over short-term subsidy cycles\nConvergence of real-world assets and crypto infrastructure\nTiming aligned with AI + Crypto fusion and RWA narrative momentum\n"}]},{"type":"paragraph","children":[{"text":"🎯 Target Ecosystem Profile:"}]},{"type":"bulleted-list","children":[{"text":"\nReal assets and cash flows anchored on-chain with compliance\nDeveloper-friendly infrastructure with user-invisible complexity\nSelf-sustaining ecosystem momentum through protocol composability\nBridge between traditional finance and crypto-native innovation\n"}]},{"type":"paragraph","children":[{"text":"This is not just another blockchain fund announcement - it's a public declaration that JuChain's infrastructure is ready, and the ecosystem growth phase has officially begun. For Web3 builders seeking a committed partner with integrated resources, regulatory clarity, and real user pathways, this represents a new opportunity window worth serious evaluation."}]},{"type":"paragraph","children":[{"text":"Read the full strategic breakdown and ecosystem vision: 👇\n"},{"type":"link","url":"https://blog.ju.com/zh-hant/juchain-100m-fund-ecosystem-growth/?utm_source=blog","children":[{"text":"https://blog.ju.com/juchain-100m-fund-ecosystem-growth/?utm_source=blog"}]},{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"JuChain","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Jucom","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Web3","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Blockchain","children":[{"text":""}]},{"text":""}]}]