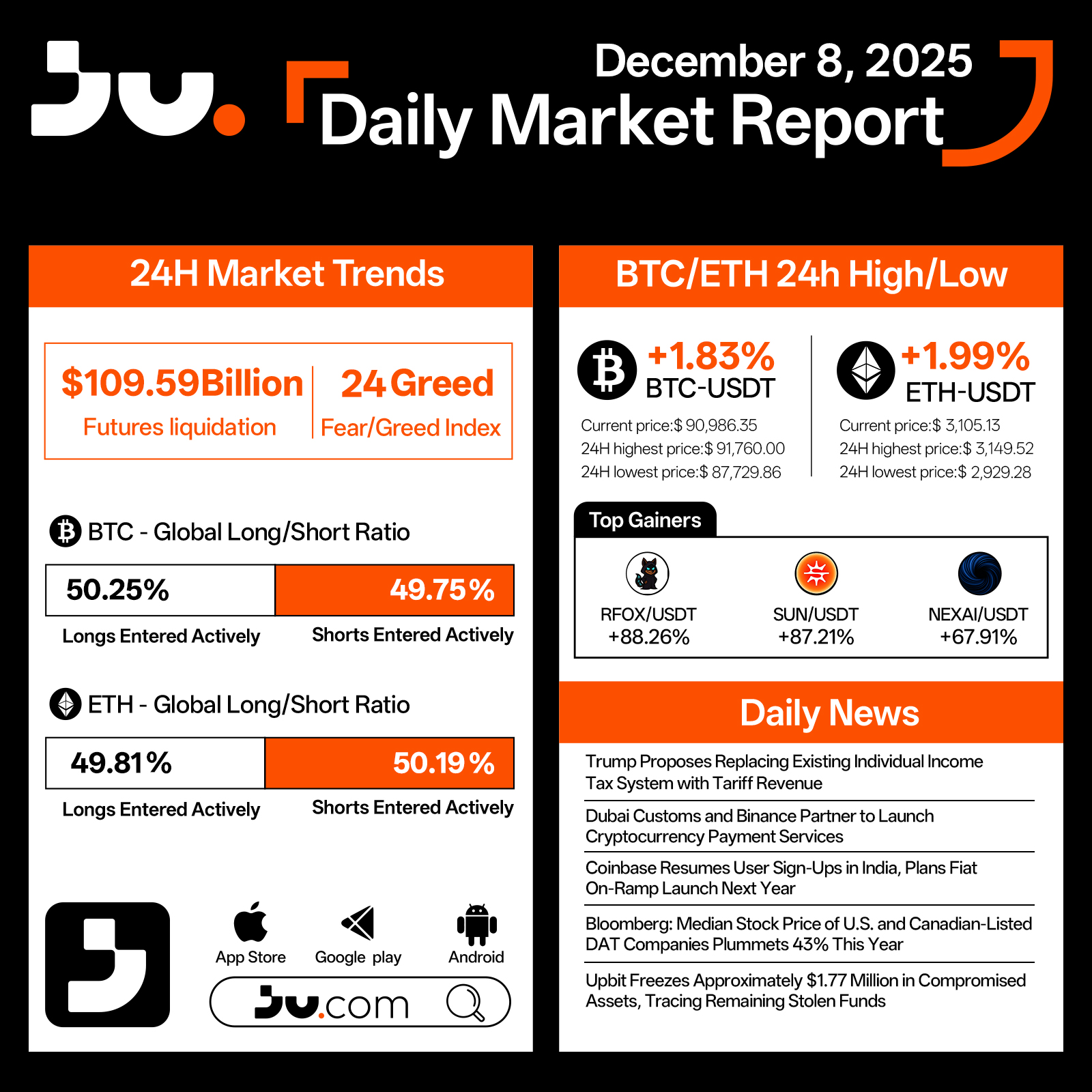

Market Daily Report

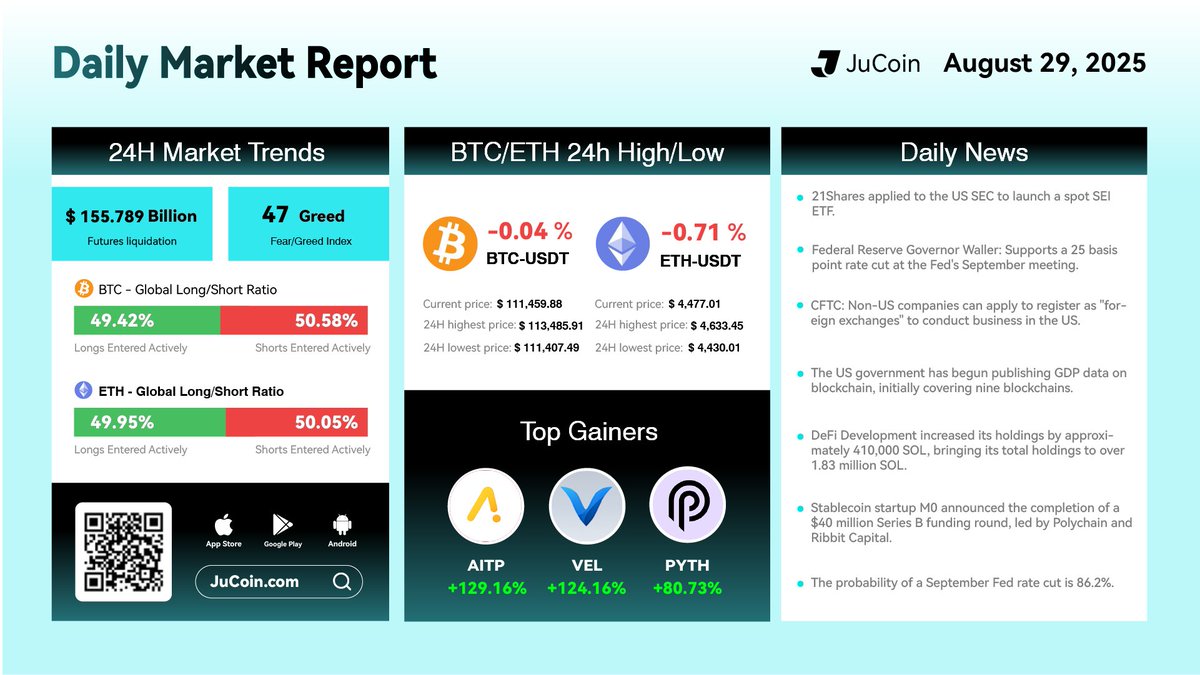

Today’s Top Gainers:

$AITP/USDT: 129%

$VEL/USDT: 124%$PYTH/USDT : 80%

$JU Token is close to reach $22 a new ATH

#cryptocurrency #blockchain #finance

Mrconfamm

2025-08-29 07:37

Market Daily Report

Descargo de responsabilidad:Contiene contenido de terceros. No es asesoramiento financiero.

Consulte los Términos y Condiciones.

What Are the Inherent Risks of Interacting with DeFi Protocols?

Decentralized Finance (DeFi) has emerged as a transformative force in the financial industry, offering innovative ways to lend, borrow, trade, and earn yields without traditional intermediaries. While DeFi provides increased accessibility and transparency, it also introduces a range of inherent risks that users must understand before engaging. This article explores these risks comprehensively to help users navigate the complex landscape of DeFi safely.

Understanding Smart Contract Vulnerabilities

At the core of DeFi protocols are smart contracts—self-executing code that automates financial transactions based on predefined rules. Although they enable trustless operations, smart contracts are susceptible to bugs and vulnerabilities. Historically significant incidents like the DAO hack in 2016 demonstrated how exploited vulnerabilities could lead to massive losses; approximately 3.6 million Ether were drained due to a reentrancy bug[1]. These vulnerabilities often stem from coding errors or overlooked edge cases during development. As smart contracts are immutable once deployed, fixing such issues post-launch can be challenging and costly.

To mitigate this risk, rigorous security audits by third-party firms are essential before deploying new protocols or updates. Additionally, ongoing monitoring and bug bounty programs incentivize community participation in identifying potential flaws early.

Liquidity Risks in Decentralized Pools

Liquidity is vital for smooth trading and borrowing activities within DeFi ecosystems. Many protocols rely on liquidity pools—collections of tokens supplied by users—to facilitate transactions without centralized order books[2]. However, these pools can face liquidity shortages during periods of high volatility or market downturns. Insufficient liquidity can lead to slippage—where trades execute at unfavorable prices—or even transaction failures.

For example, during sudden market crashes or large trades (known as "whale" movements), prices may swing sharply due to low liquidity levels[3]. Users participating in yield farming or providing liquidity should be aware that their assets might become illiquid if market conditions deteriorate unexpectedly.

Market Volatility Impact

Cryptocurrencies used within DeFi platforms are inherently volatile assets; their values can fluctuate dramatically over short periods[3]. Such volatility directly affects collateral valuations in lending protocols and impacts yield calculations for farmers earning interest or rewards. A sudden price drop could trigger liquidation events where collateral is sold off automatically at unfavorable rates—a process known as "liquidation risk."

This unpredictability underscores the importance for users engaging with leverage-based strategies or staking assets: they must closely monitor market trends and set appropriate risk parameters like collateralization ratios to avoid unexpected losses.

Regulatory Uncertainty Surrounding DeFi

The regulatory landscape for DeFi remains largely undefined globally[4]. Governments and regulators are increasingly scrutinizing decentralized platforms due to concerns about consumer protection, money laundering risks, tax evasion potential—and whether existing laws apply effectively within decentralized environments.

This ambiguity exposes users and platform operators to legal uncertainties; regulations could change abruptly leading to restrictions on certain activities or shutdowns of platforms altogether[4]. Staying informed about evolving legal frameworks is crucial for participants who wish to avoid unintended compliance violations while maintaining access.

Security Threats: Phishing & Hacks

Beyond technical vulnerabilities within smart contracts themselves lies an array of security threats targeting individual users’ funds[5]. Phishing attacks remain prevalent—attackers impersonate legitimate services via fake websites or emails designed specifically to steal private keys or seed phrases necessary for wallet access(5). Once compromised, hackers can drain user accounts instantly.

High-profile hacks such as Wormhole’s $320 million breach in 2022 highlight how security lapses at bridge infrastructure points pose significant risks [10], emphasizing that no component is immune from attack vectors targeting cross-chain interoperability solutions used widely across DeFi ecosystems.

Users should adopt best practices including multi-factor authentication (MFA), hardware wallets when possible—and always verify URLs—to reduce susceptibility toward phishing schemes [5].

Reentrancy Attacks: A Persistent Threat

Reentrancy attacks exploit specific vulnerabilities where malicious actors repeatedly call functions within a contract before previous executions complete[6]. This loophole allows attackers unauthorized access—potentially draining funds from affected protocols if not properly guarded against reentrant calls(6).

The infamous DAO hack was an early example illustrating this threat’s severity [1], prompting developers worldwide toward implementing safeguards like mutexes (mutual exclusions) into their codebases today [6].

Ensuring robust coding standards combined with formal verification methods significantly reduces reentrancy-related exploits' likelihood across new protocol deployments.

Front-Running & Sandwich Attacks Exploiting Transaction Ordering

In blockchain networks where transaction ordering isn’t strictly controlled by centralized authorities—the phenomenon known as front-running becomes problematic.[7] Traders with faster access may observe pending transactions via mempool data—and place their own orders ahead intentionally (“front-run”) —altering prices unfavorably for others(7).

Sandwich attacks take this further by placing one order just before a target trade while another immediately afterward—effectively “sandwiching” it—to manipulate asset prices temporarily.[7] These tactics undermine fair trading principles within DEXs like Uniswap but also pose financial risks for regular traders unfamiliar with such exploits.[7]

Mitigation strategies include implementing time-weighted average pricing mechanisms (TWAP)and utilizing privacy-preserving techniques such as zero-knowledge proofs where feasible .

Dependence on Oracles & Data Integrity Issues

Many advanced DeFi applications depend heavily on external data sources called “oracles” — which provide real-time information like asset prices,[8] interest rates,[8] etc., necessary for executing automated decisions accurately(8). However , inaccuracies stemming from faulty data feeds—or malicious manipulation—can cause severe miscalculations leading either into unwarranted liquidationsor incorrect payouts(8).

Protocols employing multiple independent oracle sources coupled with decentralization techniques aimto improve resilience against false data injection but cannot eliminate all associated risks entirely .

Navigating the Risks: Best Practices & Future Outlook

While inherent dangers exist across various facets—from technical bugs through regulatory shifts—the key lies in adopting comprehensive risk management strategies . Regularly auditing codebases , diversifying investments , employing secure wallets , staying updated about legal developments ,and understanding protocol mechanics form partof prudent engagement practices .

Recent developments indicate increased focus on enhancing security measures—including more rigorous audits post-hack incidents—as well as efforts towards clearer regulation frameworks aimed at protecting investors while fostering innovation . As the ecosystem matures—with improved standards around transparency,safety,and compliance—the overall safety profile will likely improve over time—but vigilance remains essentialfor all participants involvedin decentralized finance activities.