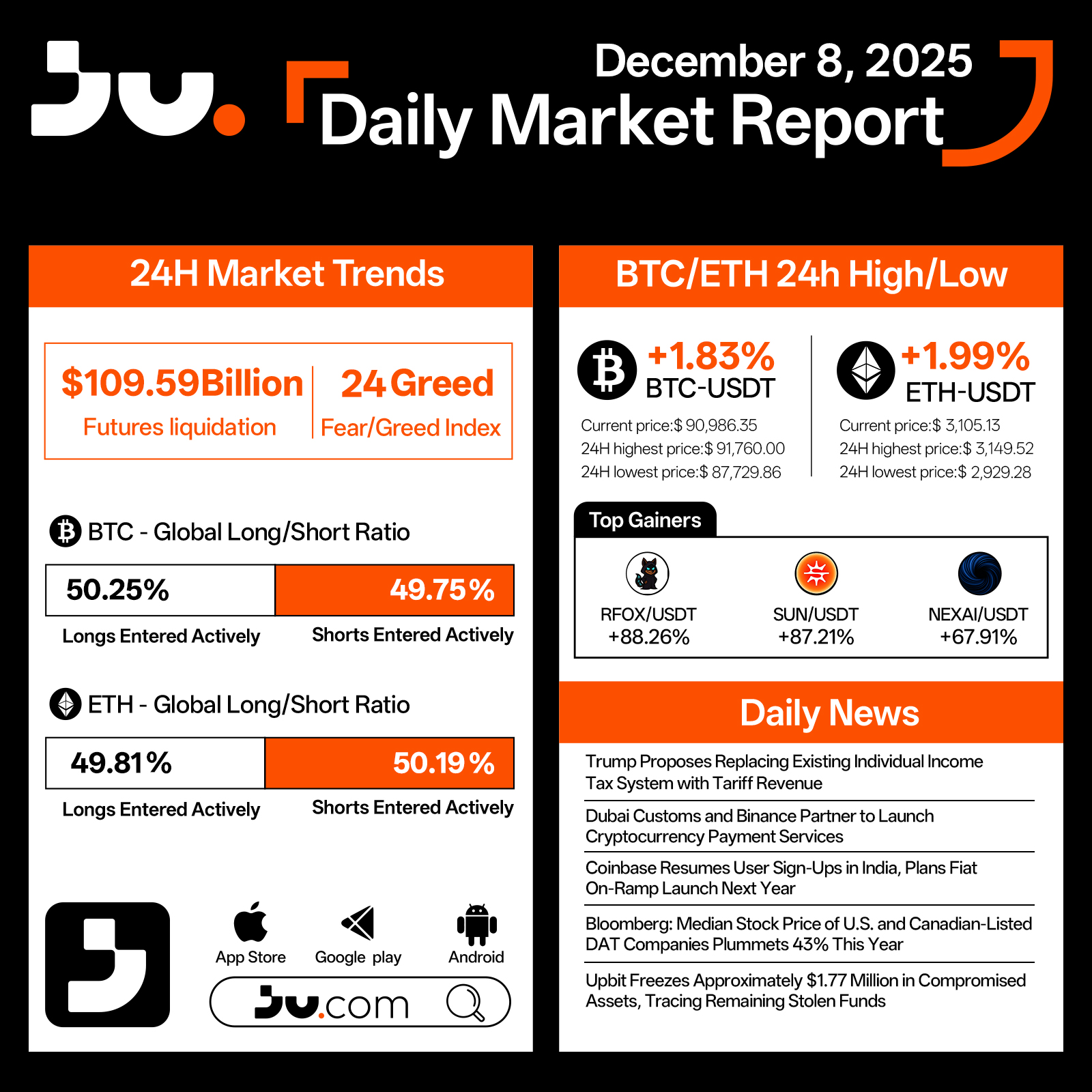

Crypto markets posted another day of modest gains on December 8, with major assets trending higher. Over the past 24 hours, total liquidations reached $109.59 billion, while the Fear & Greed Index held at 24, indicating gradually strengthening sentiment without signs of overheating. Bitcoin (BTC) rose 1.83% to $90,986.35, trading between $91,760.00 at the high and $87,729.86 at the low. Ethereum (ETH) outpaced BTC slightly, climbing 1.99% to $3,105.13, with intraday movement spanning from $3,149.52 to $2,929.28.

Derivatives data showed balanced positioning, with BTC at 50.25% longs and 49.75% shorts, while ETH recorded 49.81% longs versus 50.19% shorts. This equilibrium suggests an uncertain but gradually improving market outlook. A number of altcoins posted strong performances, led by RFOX/USDT with +88.26%, SUN/USDT with +87.21%, and NEXAI/USDT with +67.91%, highlighting ongoing speculative momentum.

In broader developments, Trump proposed replacing the current individual income tax system with tariff revenue, a policy shift that could significantly impact U.S. economic dynamics. Dubai Customs partnered with Binance to introduce cryptocurrency payment services, marking a major step for regulated digital payments in the region. Coinbase resumed sign-ups in India and announced plans to roll out fiat on-ramps next year. Bloomberg reported that the median stock price of U.S. and Canadian-listed DAT companies has plunged 43% this year, underscoring persistent market stress in high-rate environments. Upbit froze approximately $1.77 million in compromised assets and continues tracing remaining stolen funds.

Overall, the steady climb of BTC and ETH reflects improving confidence across the crypto market. With regulatory developments, payment integrations, and major platforms reactivating services, structural support for year-end market strength is gradually building.

#cryptocurrency #blockchain #finance #Blockchain

JU Blog

2025-12-08 06:47

BTC and ETH Extend Gains as Market Sentiment Continues to Improve – December 8, 2025

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

The passage of stablecoin legislation in the United States has sparked a debate on Wall Street: will stablecoins actually significantly strengthen the dollar and become the primary source of demand for short-term U.S. Treasury bonds (T-bills)?

- While officials like Treasury Secretary Scott Bessent predict the dollar-denominated stablecoin market will grow from around $300 billion to $3 trillion by 2030, institutions like JPMorgan Chase, Deutsche Bank, and Goldman Sachs emphasize that current optimistic forecasts are overstated.📌📌📌

- The new law requires stablecoins to be fully backed by short-term Treasury securities and cash equivalents.

- While this may create some increased demand, the zero-interest rate structure reduces its appeal, making it difficult to encourage large-scale capital outflows from savings or money markets.

- Furthermore, even if capital outflows do occur, the effect is largely a substitution of holders rather than a real increase in aggregate demand for Treasury bonds. ⏸⏸⏸

- Globally, the potential for stablecoin growth is seen as a major risk to emerging market banking systems.

- Standard Chartered predicts that developing countries could face up to $1 trillion in capital outflows, leading to tighter regulations.

Analysts generally believe that stablecoins will indeed grow in the coming years, but their contribution to US Treasury bonds and the dollar system is likely to be a “marginal improvement” rather than a major tool for addressing debt and deficit pressures.

#Stablecoins #cryptocurrency #Jucom #blockchain #Finance $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-12-08 03:34

🌐Surging Demand for Stablecoins: Can the US Ease Deficit Pressure?

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

Bitcoin bags are getting blown out today, as the price of BTC falls to nearly $80,000 and marks a new seven-month low.

- The continued downward pressure on its price has pushed Bitcoin into a so-called death cross—when the average price of an asset over the short term falls below the average price over the long term. It’s a technical pattern that typically signals extended bearish momentum. For traders who study charts, it confirms what permabulls don’t want to hear: It’s over—at least for now.

- It’s happening as the crypto market as a whole shrinks to $2.91 trillion, shedding nearly $60 billion in the past 24 hours alone. Almost every single coin in the top 100 by market cap is bleeding red.

- The Fear and Greed Index, which measures market sentiment on a scale from 0 to 100, has cratered to 14 points—just four points above the year's low of 10 back in February. When this index drops below 20, it signals "extreme fear," and right now, traders are absolutely terrified.

- But it's not just crypto drama driving the market selloff. The macro picture is turning nasty. Just weeks ago, markets were pricing in a 97% chance the Federal Reserve would cut interest rates in December. Now? Those odds have collapsed to somewhere between 22% and 43%, depending on which metric you check.

- Fed officials are openly divided, with many signaling they'd prefer to keep rates unchanged through year-end. For risk assets like crypto that thrive on easy money, this is poison.

- On Myriad, a prediction market developed by Decrypt’s parent company Dastan, traders are now overwhelmingly convinced that Bitcoin will not mark a new all-time high this year, placing odds at almost 90% that BTC will not top the $126K mark that it hit on October 6.

- The bearish vibes are so strong, Myriad traders also currently place 40% odds that Bitcoin falls as low as $69K. So how low will it go? Here’s what the charts say.

- Bitcoin opened today at $86,691 and immediately sold off, hitting an intraday low of $80,620 before bouncing slightly to its current price at $85,187. That's a 1.61% drop on the day after being almost 5% down over the last 24 hours. More importantly, for traders, it further confirms the death cross pattern that's been progressively forming since its all-time high in early October. The death cross pattern was first confirmed on Wednesday as Bitcoin slid to around $88,000—now it’s fallen deeper.

- Here's what's happening on the charts: Exponential Moving Averages, or EMAs, help traders identify trend direction by tracking the average price of an asset over the short, medium, and long term. When the short-term 50-day EMA falls below the longer-term 200-day EMA, it means bears are in control and the longer-term bull market structure has been broken.

- For Bitcoin, the 50-day EMA has now decisively crossed below the 200-day EMA. In short, this tells traders market momentum has shifted from bullish to bearish. The gap between both EMAs increases the more the price of BTC trades below those targets—and the bigger the gap, the stronger the trend.

- The price of Bitcoin is now trading well below both EMAs, which creates a situation where each bounce attempt faces immediate resistance, increasing the gap between the two EMAs, making the bearish trend even stronger. Bulls trying to push higher will need to first reclaim the 50-day EMA, then tackle the 200-day—a double wall of resistance that's historically tough to crack in one go.

- As for other technical indicators, the Average Directional Index, or ADX, sits at 41, which is considered "strong." ADX measures trend strength regardless of direction, with readings above 25 indicating a clear trend is in place. At 41, this tells us we’re not seeing just a minor correction, but a potentially extended move lower.

- The Relative Strength Index, or RSI, has plunged to 23.18, placing Bitcoin deep in oversold territory. RSI measures momentum on a scale from 0 to 100, with readings below 30 signaling oversold conditions where assets are potentially undervalued. However, "oversold" doesn't mean the selling has to stop—in strong downtrends, RSI can remain in oversold territory for extended periods as prices continue grinding lower. But, yes, this also provides hopium for momentum traders as it signals that the worst of it may be over. (The worst being an accelerated crash, not necessarily a steady drop.)

- The Squeeze Momentum Indicator is flashing "bearish impulse," meaning selling pressure is intensifying rather than easing. Meanwhile, the Volume Profile Visible Range (VPVP) shows the price of Bitcoin trading "below" key volume nodes, suggesting there's not much buying interest at current levels.

- So, everything is bearish, clearly. But where's the next support? How low can the price of BTC go? The chart reveals several key horizontal levels to watch.

- The immediate danger zone is $80,697, which briefly held today but looked shaky. If that breaks, the next major support sits at $74,555, followed by $65,727, and potentially all the way down to $53,059 if panic really sets in during a crypto winter. Those price levels have previous consolidation zones where significant trading volume accumulated, making them natural landing spots for oversold bounces.

- For resistances, traders will watch for BTC’s price breaking past $90,000 again and look at $100,000 as the major psychological target.

- Ethereum opened at $2,830.7 and dropped as low as $2,621 intraday before stabilizing around $2,798—a 1.16% loss on the day. While not as dramatic as Bitcoin's selloff, ETH's technical picture is equally concerning.

- Unlike Bitcoin, Ethereum hasn't fully confirmed its death cross yet—the 50-day EMA is still technically above the 200-day, giving it a "long" signal on an indicator that is obviously hours away from changing to bearish. The gap is razor-thin and closing fast. More importantly, ETH’s price is trading well below both EMAs, rendering that technical distinction somewhat meaningless. The bearish momentum is clearly established.

- A good way to see the natural support zones is using the Fibonacci retracements: a set of natural clusters that appear during a trend, showing supports and resistances in a specific timeframe—not because of price, but because of natural proportions.

- Right now, ETH is testing the 0.618 Fibonacci level at approximately $2,755. If this level breaks, the next Fibonacci support doesn't appear until $2,180, which would represent a massive 22% drop from current prices, and would resolve a price market on Myriad betting on ETH’s moon or doom.

- The ADX for Ethereum is even stronger than Bitcoin's at 46, indicating the downtrend is rock-solid. Meanwhile, RSI sits at 28.46—not quite as oversold as Bitcoin but definitely in stressed territory. The Squeeze Momentum Indicator shows "bearish impulse" here too, confirming sellers are in control.

- XRP is showing relative strength compared to its larger peers, down just 0.50% to close at $1.98 after opening at $1.99 and hitting an intraday low of $1.81796. Don't let that modest percentage fool you though—the technical damage is real.

- Like Bitcoin, the Ripple-linked XRP has confirmed a full death cross with its 50-day EMA now below the 200-day. The price of XRP is trading beneath both EMAs, and with an ADX of 32, the downtrend has enough strength to continue. While 32 isn't as extreme as Bitcoin's 41 or Ethereum's 46, it's still well above the 25 threshold that confirms a trend is in place rather than just random chop.

- The RSI at 32.86 shows XRP is approaching oversold territory but hasn't quite reached the extreme stress levels of Bitcoin and Ethereum. This could mean two things: either XRP has more downside before finding equilibrium, or it's showing genuine relative strength that could make it a safer harbor if the broader market continues tanking.

- XRP had such a crazy year that its price action shows only two major horizontal support levels that should concern XRP holders—and that would be very painful for hodlers, considering the movement from the all-time high to those targets.

- The next major support zone sits at $1.589, which represents a potential 20% drop from current levels. If that breaks, there's very little support until $0.66, a catastrophic 67% plunge from current prices and almost 80% from all-time high zone that would take XRP back to early 2024 levels.

The Squeeze Momentum Indicator is showing "bearish impulse," and like the other coins, the volume profile indicates XRP’s price is trading below key volume levels, meaning there's not much buying interest stepping in to defend current prices.

#Bitcoin #BitcoinDeathCross #Jucom #cryptocurrency #blockchain $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-11-22 13:17

😱 Bitcoin in a Death Cross: How Low Will We Go?📛📛

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

The price of Cardano (ADA) was down on Friday after the blockchain suffered an unexpected chain split, which was caused by a malformed delegation transaction that triggered a software flaw. That created problems for Cardano users, and prompted a public apology from the user who claimed that they caused it.

- Intersect, the Cardano ecosystem’s governance organization, said in an incident report that the divergence began when the malformed transaction passed validation on newer node versions, but nodes running older software rejected it.

- “This exploited a bug in an underlying software library that was not trapped by validation code,” Intersect wrote. “The execution of this transaction caused a divergence in the blockchain, effectively splitting the network into two distinct chains: one containing the ‘poisoned’ transaction and a ‘healthy’ chain without it.”

- Earlier that day, Cardano co-founder Charles Hoskinson posted on X that it was a “premeditated attack from a disgruntled [stake pool operator]” who was “actively looking at ways to harm the brand and reputation of [Cardano developer Input/Output Global].”

- According to Hoskinson, all Cardano users were impacted. The price of Cardano’s token ADA was down more than 6% recently, following the incident.

- According to the incident report, the mismatch caused operators to build blocks on different branches of the chain until patched node software was deployed. Developers and service providers coordinated an emergency response, and operators were urged to upgrade to rejoin the main chain.

- Intersect said the wallet responsible for the malformed transaction has been identified, while Hoskinson said it will take weeks to clean up the mess.

- “Forensic analysis suggests links to a participant from the Incentivized Testnet (ITN) era,” Intersect wrote. “As this incident constitutes a potential cyberattack on a digital network, relevant authorities, including the Federal Bureau of Investigation, are being engaged to investigate.”

- Hours after the incident, an X user posting under the name Homer J. said they were responsible for submitting the transaction that triggered the split.

- “Sorry Cardano folks, it was me who endangered the network with my careless action yesterday evening,” they wrote, describing the attempt as a personal challenge to reproduce the “bad transaction” and said he relied on AI-generated instructions while blocking traffic on their server.

- “I've felt awful as soon as I realized the scale of what I've caused. I know there's nothing I can do to make up for all the pain and stress I've caused over the past X hours,” they added. “Difficult to quantify the negligence on my behalf. I am sorry, I truly am. I didn't have evil intentions.”

- Homer wrote that he did not sell or short ADA, did not coordinate with anyone else, and did not act for financial gain. “I'm ashamed of my carelessness and take full responsibility for it and whatever consequences will follow,” he said.

- According to Intersect, no user funds were lost, and most retail wallets were unaffected because they were running node components that handled the malformed transaction safely.

- Hoskinson, the outspoken co-founder of Cardano, claimed in a video message that the network “didn’t go down,” though users did encounter issues before the problem was fixed.

“It is important to note that the network did not stall. Block production continued on both chains throughout the incident, and at least some identical transactions appeared on both chains,” Intersect wrote. “However, to ensure the integrity of the ledger, exchanges and third-party providers largely paused deposits and withdrawals as a precautionary measure.”

#Cardano #CardanoNetwork #Jucom #cryptocurrency #blockchain $ADA/USDT $JU/USDT $BTC/USDT

Lee | Ju.Com

2025-11-22 13:03

📛 Cardano Network Disrupted by 'Poisoned' Transaction Attack.

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

What Is the Total Number of Transactions on the Bitcoin Network?

Understanding the total number of transactions on the Bitcoin network is essential for grasping how active and widely used this pioneering cryptocurrency truly is. This metric offers insights into user engagement, network health, and overall adoption trends. In this article, we will explore what influences transaction volume, recent developments in 2023, and what these figures mean for investors and users alike.

How Does Transaction Volume Reflect Network Activity?

The total number of Bitcoin transactions indicates how frequently users are transferring funds or engaging with blockchain-based applications. On average, as of 2023, around 250,000 to 300,000 transactions occur daily. These fluctuations are driven by various factors such as market sentiment—bullish periods tend to see increased activity—as well as regulatory environments that can either encourage or restrict usage.

High transaction volumes suggest a vibrant ecosystem where users actively buy, sell, or transfer Bitcoin. Conversely, dips may signal reduced interest or external pressures like stricter regulations. Monitoring these numbers helps stakeholders gauge whether Bitcoin remains a popular medium for peer-to-peer payments or speculative trading.

Factors Influencing Transaction Counts

Several key elements impact how many transactions are recorded on the blockchain:

- Market Conditions: Bull markets often lead to increased trading activity as investors seek opportunities.

- Regulatory Changes: Stricter laws can temporarily suppress transaction volumes; conversely, favorable policies may boost activity.

- Network Congestion: When many users transact simultaneously—such as during major price swings—transaction fees rise due to limited block space.

- Technological Developments: Improvements like SegWit (Segregated Witness) have optimized transaction processing times and costs over time.

These factors collectively shape daily transaction counts and influence user behavior across different periods.

Recent Trends in 2023: Fluctuations in Transaction Numbers

In April 2023, the Bitcoin network experienced a notable surge in transaction volume driven by heightened market speculation amid potential regulatory shifts in major economies. This increase was partly fueled by traders reacting to news about possible government interventions that could impact cryptocurrency markets globally.

However, May saw an uptick in average transaction fees—about a 20% rise compared to previous months—which reflects higher network congestion. Elevated fees can discourage smaller transactions from occurring frequently because they become less cost-effective for everyday use cases like micro-payments or casual transfers.

These recent trends highlight how external events directly influence not only how much activity occurs but also its economic viability for typical users.

Blockchain Size and Its Impact on Transactions

The size of the Bitcoin blockchain itself provides context about overall network activity; it stood at approximately 400 GB in early 2023—a significant increase from previous years due to continuous addition of new blocks containing transactional data.

A larger blockchain signifies more historical data stored across nodes worldwide but also raises concerns regarding scalability:

- Larger blockchains require more storage capacity.

- Synchronization times increase for new nodes joining the network.

- Higher data loads can contribute to slower confirmation times during peak periods unless scaling solutions are implemented effectively.

Efforts such as Lightning Network aim to address these scalability challenges by enabling faster off-chain transactions while maintaining security through underlying blockchain settlement layers.

The Role of Miners and Validation Processes

Miners play a crucial role in maintaining accurate records by validating transactions through complex computational puzzles—a process known as proof-of-work (PoW). They compete within seconds to add new blocks containing pending transactions onto the chain; successful miners receive rewards plus associated fees paid by transacting parties.

This validation process ensures integrity but is energy-intensive: estimates suggest that mining consumes substantial electricity globally. As demand increases with higher transaction volumes during active periods like April-May 2023’s surge,

the environmental footprint becomes more prominent concern among regulators and advocates alike.

Key Points About Mining:

- Miners validate hundreds of thousands of daily transactions

- Validation ensures decentralization & security

- Rising demand impacts energy consumption

Regulatory Environment's Effect on Transaction Volumes

Government policies significantly influence user participation levels on the Bitcoin network. In early 2023,

several countries introduced stricter regulations targeting crypto exchanges,which temporarily dampened trading activities reflected through decreased transaction counts initially observed after policy announcements.

However,

some jurisdictions adopted clearer frameworks encouraging institutional involvement,potentially stabilizing or increasing future transactional activity once compliance mechanisms were established.

Summary:

Regulatory uncertainty remains one of the most unpredictable factors affecting total bitcoin transactions; ongoing legislative developments will continue shaping usage patterns moving forward.

Future Outlook: Scalability Solutions & Adoption Trends

As interest grows among retail investors and institutions alike,

scalability solutions such as Taproot upgrades,Lightning Network implementations,and sidechains aim to facilitate faster processing at lower costs.

These technological advancements could help sustain higher throughput levels necessary for mainstream adoption while reducing congestion-related fee hikes seen earlier this year.

Moreover,

wider acceptance from merchants accepting bitcoin payments directly enhances real-world utility beyond speculative trading,

potentially leading toward sustained growth in total number of daily transactions over coming years.

By continuously monitoring metrics like total bitcoin transaction count alongside technological improvements and regulatory changes,

stakeholders—from individual users to large-scale investors—can better understand market dynamics

and make informed decisions aligned with evolving industry conditions.

References

- CoinDesk — General information on Bitcoin networks

- Blockchain.com Charts — Historical data analysis

- Blockchain Size Data — Blockchain growth insights

- Transaction Fees & Congestion — Impact analysis

- Bitcoin Mining Process — Technical validation overview

- Regulatory Impact Reports — Policy effects assessment

Understanding how many people transact using Bitcoin provides valuable insight into its current state—and future potential—as both an investment asset and a decentralized payment system amidst an ever-changing global landscape

Lo

2025-05-06 07:37

What is the total number of transactions on the Bitcoin network?

What Is the Total Number of Transactions on the Bitcoin Network?

Understanding the total number of transactions on the Bitcoin network is essential for grasping how active and widely used this pioneering cryptocurrency truly is. This metric offers insights into user engagement, network health, and overall adoption trends. In this article, we will explore what influences transaction volume, recent developments in 2023, and what these figures mean for investors and users alike.

How Does Transaction Volume Reflect Network Activity?

The total number of Bitcoin transactions indicates how frequently users are transferring funds or engaging with blockchain-based applications. On average, as of 2023, around 250,000 to 300,000 transactions occur daily. These fluctuations are driven by various factors such as market sentiment—bullish periods tend to see increased activity—as well as regulatory environments that can either encourage or restrict usage.

High transaction volumes suggest a vibrant ecosystem where users actively buy, sell, or transfer Bitcoin. Conversely, dips may signal reduced interest or external pressures like stricter regulations. Monitoring these numbers helps stakeholders gauge whether Bitcoin remains a popular medium for peer-to-peer payments or speculative trading.

Factors Influencing Transaction Counts

Several key elements impact how many transactions are recorded on the blockchain:

- Market Conditions: Bull markets often lead to increased trading activity as investors seek opportunities.

- Regulatory Changes: Stricter laws can temporarily suppress transaction volumes; conversely, favorable policies may boost activity.

- Network Congestion: When many users transact simultaneously—such as during major price swings—transaction fees rise due to limited block space.

- Technological Developments: Improvements like SegWit (Segregated Witness) have optimized transaction processing times and costs over time.

These factors collectively shape daily transaction counts and influence user behavior across different periods.

Recent Trends in 2023: Fluctuations in Transaction Numbers

In April 2023, the Bitcoin network experienced a notable surge in transaction volume driven by heightened market speculation amid potential regulatory shifts in major economies. This increase was partly fueled by traders reacting to news about possible government interventions that could impact cryptocurrency markets globally.

However, May saw an uptick in average transaction fees—about a 20% rise compared to previous months—which reflects higher network congestion. Elevated fees can discourage smaller transactions from occurring frequently because they become less cost-effective for everyday use cases like micro-payments or casual transfers.

These recent trends highlight how external events directly influence not only how much activity occurs but also its economic viability for typical users.

Blockchain Size and Its Impact on Transactions

The size of the Bitcoin blockchain itself provides context about overall network activity; it stood at approximately 400 GB in early 2023—a significant increase from previous years due to continuous addition of new blocks containing transactional data.

A larger blockchain signifies more historical data stored across nodes worldwide but also raises concerns regarding scalability:

- Larger blockchains require more storage capacity.

- Synchronization times increase for new nodes joining the network.

- Higher data loads can contribute to slower confirmation times during peak periods unless scaling solutions are implemented effectively.

Efforts such as Lightning Network aim to address these scalability challenges by enabling faster off-chain transactions while maintaining security through underlying blockchain settlement layers.

The Role of Miners and Validation Processes

Miners play a crucial role in maintaining accurate records by validating transactions through complex computational puzzles—a process known as proof-of-work (PoW). They compete within seconds to add new blocks containing pending transactions onto the chain; successful miners receive rewards plus associated fees paid by transacting parties.

This validation process ensures integrity but is energy-intensive: estimates suggest that mining consumes substantial electricity globally. As demand increases with higher transaction volumes during active periods like April-May 2023’s surge,

the environmental footprint becomes more prominent concern among regulators and advocates alike.

Key Points About Mining:

- Miners validate hundreds of thousands of daily transactions

- Validation ensures decentralization & security

- Rising demand impacts energy consumption

Regulatory Environment's Effect on Transaction Volumes

Government policies significantly influence user participation levels on the Bitcoin network. In early 2023,

several countries introduced stricter regulations targeting crypto exchanges,which temporarily dampened trading activities reflected through decreased transaction counts initially observed after policy announcements.

However,

some jurisdictions adopted clearer frameworks encouraging institutional involvement,potentially stabilizing or increasing future transactional activity once compliance mechanisms were established.

Summary:

Regulatory uncertainty remains one of the most unpredictable factors affecting total bitcoin transactions; ongoing legislative developments will continue shaping usage patterns moving forward.

Future Outlook: Scalability Solutions & Adoption Trends

As interest grows among retail investors and institutions alike,

scalability solutions such as Taproot upgrades,Lightning Network implementations,and sidechains aim to facilitate faster processing at lower costs.

These technological advancements could help sustain higher throughput levels necessary for mainstream adoption while reducing congestion-related fee hikes seen earlier this year.

Moreover,

wider acceptance from merchants accepting bitcoin payments directly enhances real-world utility beyond speculative trading,

potentially leading toward sustained growth in total number of daily transactions over coming years.

By continuously monitoring metrics like total bitcoin transaction count alongside technological improvements and regulatory changes,

stakeholders—from individual users to large-scale investors—can better understand market dynamics

and make informed decisions aligned with evolving industry conditions.

References

- CoinDesk — General information on Bitcoin networks

- Blockchain.com Charts — Historical data analysis

- Blockchain Size Data — Blockchain growth insights

- Transaction Fees & Congestion — Impact analysis

- Bitcoin Mining Process — Technical validation overview

- Regulatory Impact Reports — Policy effects assessment

Understanding how many people transact using Bitcoin provides valuable insight into its current state—and future potential—as both an investment asset and a decentralized payment system amidst an ever-changing global landscape

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

What is Wallet Address Clustering?

Wallet address clustering is a crucial technique in the blockchain and cryptocurrency ecosystem that involves grouping multiple wallet addresses based on shared transaction behaviors or characteristics. This process helps analysts, security professionals, and regulators better understand how digital assets move across the network, identify potential illicit activities, and improve privacy measures for users.

Understanding Wallet Addresses in Cryptocurrency

In the world of cryptocurrencies like Bitcoin and Ethereum, each user interacts with the blockchain through wallet addresses—unique alphanumeric strings that serve as digital bank accounts. These addresses are generated cryptographically to ensure pseudonymity; they do not directly reveal personal identities. However, despite this pseudonymity, all transactions linked to these addresses are publicly recorded on the blockchain ledger.

As transaction volumes grow exponentially over time, it becomes increasingly difficult to maintain complete anonymity for individual users. Every transaction leaves a trail that can potentially be traced back to specific entities or behaviors if analyzed correctly. This is where wallet address clustering comes into play—it aims to analyze patterns across multiple addresses to infer relationships or groupings.

How Does Wallet Address Clustering Work?

Wallet address clustering employs various algorithms and analytical techniques designed to detect similarities among different addresses based on their activity patterns. These methods include:

- Transaction Pattern Analysis: Examining transfer amounts, timing between transactions, and frequency.

- Behavioral Signatures: Identifying common usage habits such as recurring transfers or specific asset types.

- Graph-Based Clustering: Creating visual maps of interconnected addresses based on shared inputs or outputs within transactions.

Popular algorithms used in this context include k-means clustering (which partitions data into predefined groups), hierarchical clustering (which builds nested clusters), and density-based methods like DBSCAN (which identifies clusters of varying shapes). Each has its strengths depending on dataset complexity and analysis goals.

Why Is Wallet Address Clustering Important?

The significance of wallet address clustering extends across several key areas:

Enhancing Privacy

While cryptocurrencies are often touted for their privacy features, true anonymity remains elusive due to transparent transaction records. By grouping related addresses together through clustering techniques, third parties find it more challenging to link individual transactions back to specific users—especially when combined with other privacy-preserving tools like mixers or privacy coins.

Security Monitoring

Clustering enables security teams and law enforcement agencies to detect suspicious activities such as money laundering schemes or fraud rings by spotting unusual patterns—like rapid transfers between clustered groups or large volume spikes—that deviate from typical user behavior.

Regulatory Compliance

Financial institutions operating within regulatory frameworks use wallet address analysis for anti-money laundering (AML) efforts and know-your-customer (KYC) procedures. While full anonymization isn't always possible with effective clustering tools, these techniques help create a more compliant environment by providing insights into transactional relationships without exposing sensitive details unnecessarily.

Recent Advances in Wallet Address Clustering

Over recent years, significant progress has been made in refining clustering methodologies:

- Improved Algorithms: Researchers have developed sophisticated models capable of handling vast datasets efficiently while uncovering complex behavioral patterns.

- Integration Into Blockchain Analytics Platforms: Major analytics providers now incorporate advanced clustering features into their tools—enabling users ranging from law enforcement agencies to financial firms—to gain deeper insights.

- Privacy-Centric Cryptocurrencies: Some projects have integrated cluster-aware features directly into their protocols—for example, enhancing user privacy while still allowing legitimate analysis under certain conditions—which reflects ongoing innovation balancing transparency with confidentiality.

Challenges & Ethical Considerations

Despite its benefits, wallet address clustering raises important concerns:

Regulatory Dilemmas: As authorities seek greater oversight over illicit activities like money laundering or terrorist financing via blockchain analysis tools—including those employing clustering—they face challenges balancing user privacy rights against compliance needs.

Potential for Misuse: If improperly implemented—or used without proper safeguards—clustering could inadvertently obscure legitimate transactions involving businesses or individuals who rely on enhanced privacy measures.

Ethical Debates: The debate continues around whether such analytical techniques should be solely used for security purposes—or if they risk infringing upon personal freedoms by enabling pervasive surveillance without adequate oversight.

Timeline of Key Developments

Understanding how wallet address clustering has evolved provides context about its current state:

- 2020: Academic research focused on evaluating different algorithms' effectiveness at preserving user privacy while enabling meaningful analysis.

- 2021: Major blockchain analytics platforms began integrating advanced cluster detection features amid rising demand from compliance-focused clients.

- 2022: The rise of privacy-centric cryptocurrencies prompted developers to embed cluster-aware mechanisms directly within protocols themselves.

- 2023: Regulatory discussions intensified regarding how best practices can balance effective AML/KYC processes with respecting individual rights—a debate ongoing today.

By grasping what wallet address clustering entails—and recognizing both its capabilities and limitations—you can better appreciate its role within broader efforts toward secure yet private cryptocurrency usage. Whether you're an investor seeking insight into transaction behaviors—or a regulator aiming at compliance—the evolving landscape underscores the importance of understanding this powerful analytical tool in today's digital economy.

Keywords: cryptocurrency wallets | blockchain analysis | transaction pattern recognition | crypto privacy | AML compliance | crypto security | decentralized finance

Lo

2025-05-15 03:19

What is wallet address clustering?

What is Wallet Address Clustering?

Wallet address clustering is a crucial technique in the blockchain and cryptocurrency ecosystem that involves grouping multiple wallet addresses based on shared transaction behaviors or characteristics. This process helps analysts, security professionals, and regulators better understand how digital assets move across the network, identify potential illicit activities, and improve privacy measures for users.

Understanding Wallet Addresses in Cryptocurrency

In the world of cryptocurrencies like Bitcoin and Ethereum, each user interacts with the blockchain through wallet addresses—unique alphanumeric strings that serve as digital bank accounts. These addresses are generated cryptographically to ensure pseudonymity; they do not directly reveal personal identities. However, despite this pseudonymity, all transactions linked to these addresses are publicly recorded on the blockchain ledger.

As transaction volumes grow exponentially over time, it becomes increasingly difficult to maintain complete anonymity for individual users. Every transaction leaves a trail that can potentially be traced back to specific entities or behaviors if analyzed correctly. This is where wallet address clustering comes into play—it aims to analyze patterns across multiple addresses to infer relationships or groupings.

How Does Wallet Address Clustering Work?

Wallet address clustering employs various algorithms and analytical techniques designed to detect similarities among different addresses based on their activity patterns. These methods include:

- Transaction Pattern Analysis: Examining transfer amounts, timing between transactions, and frequency.

- Behavioral Signatures: Identifying common usage habits such as recurring transfers or specific asset types.

- Graph-Based Clustering: Creating visual maps of interconnected addresses based on shared inputs or outputs within transactions.

Popular algorithms used in this context include k-means clustering (which partitions data into predefined groups), hierarchical clustering (which builds nested clusters), and density-based methods like DBSCAN (which identifies clusters of varying shapes). Each has its strengths depending on dataset complexity and analysis goals.

Why Is Wallet Address Clustering Important?

The significance of wallet address clustering extends across several key areas:

Enhancing Privacy

While cryptocurrencies are often touted for their privacy features, true anonymity remains elusive due to transparent transaction records. By grouping related addresses together through clustering techniques, third parties find it more challenging to link individual transactions back to specific users—especially when combined with other privacy-preserving tools like mixers or privacy coins.

Security Monitoring

Clustering enables security teams and law enforcement agencies to detect suspicious activities such as money laundering schemes or fraud rings by spotting unusual patterns—like rapid transfers between clustered groups or large volume spikes—that deviate from typical user behavior.

Regulatory Compliance

Financial institutions operating within regulatory frameworks use wallet address analysis for anti-money laundering (AML) efforts and know-your-customer (KYC) procedures. While full anonymization isn't always possible with effective clustering tools, these techniques help create a more compliant environment by providing insights into transactional relationships without exposing sensitive details unnecessarily.

Recent Advances in Wallet Address Clustering

Over recent years, significant progress has been made in refining clustering methodologies:

- Improved Algorithms: Researchers have developed sophisticated models capable of handling vast datasets efficiently while uncovering complex behavioral patterns.

- Integration Into Blockchain Analytics Platforms: Major analytics providers now incorporate advanced clustering features into their tools—enabling users ranging from law enforcement agencies to financial firms—to gain deeper insights.

- Privacy-Centric Cryptocurrencies: Some projects have integrated cluster-aware features directly into their protocols—for example, enhancing user privacy while still allowing legitimate analysis under certain conditions—which reflects ongoing innovation balancing transparency with confidentiality.

Challenges & Ethical Considerations

Despite its benefits, wallet address clustering raises important concerns:

Regulatory Dilemmas: As authorities seek greater oversight over illicit activities like money laundering or terrorist financing via blockchain analysis tools—including those employing clustering—they face challenges balancing user privacy rights against compliance needs.

Potential for Misuse: If improperly implemented—or used without proper safeguards—clustering could inadvertently obscure legitimate transactions involving businesses or individuals who rely on enhanced privacy measures.

Ethical Debates: The debate continues around whether such analytical techniques should be solely used for security purposes—or if they risk infringing upon personal freedoms by enabling pervasive surveillance without adequate oversight.

Timeline of Key Developments

Understanding how wallet address clustering has evolved provides context about its current state:

- 2020: Academic research focused on evaluating different algorithms' effectiveness at preserving user privacy while enabling meaningful analysis.

- 2021: Major blockchain analytics platforms began integrating advanced cluster detection features amid rising demand from compliance-focused clients.

- 2022: The rise of privacy-centric cryptocurrencies prompted developers to embed cluster-aware mechanisms directly within protocols themselves.

- 2023: Regulatory discussions intensified regarding how best practices can balance effective AML/KYC processes with respecting individual rights—a debate ongoing today.

By grasping what wallet address clustering entails—and recognizing both its capabilities and limitations—you can better appreciate its role within broader efforts toward secure yet private cryptocurrency usage. Whether you're an investor seeking insight into transaction behaviors—or a regulator aiming at compliance—the evolving landscape underscores the importance of understanding this powerful analytical tool in today's digital economy.

Keywords: cryptocurrency wallets | blockchain analysis | transaction pattern recognition | crypto privacy | AML compliance | crypto security | decentralized finance

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

A UK operation against Russian sanctions evasion has resulted in 128 arrests and the seizure of $32.6 million in cryptocurrency and cash.

The UK's National Crime Agency (NCA) has revealed that a UK-led operation to crack down on Russian sanctions evasion has resulted in the arrest of 128 people and the seizure of $32.6 million in cryptocurrency and cash.🚨🚨🚨

The operation, dubbed "Operation Destabilize," was first announced in 2024. As of December last year, it had resulted in 84 arrests and the seizure of $25.5 million.💡💡💡

However, the latest NCA data shows that the operation has also resulted in the arrest of a further 45 people suspected of money laundering and the seizure of more than $6.6 million in cash.⭐️⭐️⭐️

#InternationalNews #cryptocurrency #blockchain #Jucom #finance $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-22 04:50

⭐️⭐️⭐️#InternationalNews

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

What Is Blockchain Interoperability? A Complete Overview

Understanding Blockchain Interoperability

Blockchain interoperability refers to the ability of different blockchain networks to communicate, share data, and transfer assets seamlessly. Unlike traditional financial systems where institutions can easily exchange information through standardized protocols, blockchain ecosystems are often isolated due to differing architectures and protocols. Interoperability aims to bridge these gaps, creating a more interconnected decentralized environment. This capability is essential for enabling cross-chain transactions, expanding the utility of digital assets, and fostering innovation across various blockchain platforms.

Why Is Interoperability Important in Blockchain Technology?

As blockchain technology matures, its applications have diversified into areas like decentralized finance (DeFi), non-fungible tokens (NFTs), supply chain management, and more. These use cases often require interaction between multiple blockchains—for example, transferring an NFT from one platform to another or executing a DeFi trade across different networks. Without interoperability, users face fragmentation; they must navigate multiple interfaces or convert assets manually through exchanges.

Interoperability enhances user experience by allowing smooth asset transfers and data sharing without intermediaries or complex procedures. It also promotes scalability by enabling specialized blockchains optimized for specific tasks while still maintaining connectivity with broader ecosystems.

Types of Blockchain Interoperability

There are primarily two types of interoperability based on how blockchains connect:

Homogeneous Interoperability: This involves different chains that share similar consensus mechanisms and protocols—think of it as connecting similar "languages." For example, two Ethereum-compatible chains can communicate more straightforwardly because they follow compatible standards.

Heterogeneous Interoperability: This connects fundamentally different blockchains with distinct architectures—such as Bitcoin and Ethereum—requiring more complex solutions like cross-chain bridges or protocol adapters.

Technologies Enabling Cross-Chain Communication

Several innovative technologies facilitate interoperability:

Cross-Chain Atomic Swaps: These enable the direct exchange of assets between two separate blockchains without intermediaries. They rely on smart contracts that ensure both parties fulfill their obligations simultaneously.

Sidechains: Smaller chains linked to a main chain via pegging mechanisms allow assets to move back and forth securely while leveraging the main chain’s security features.

Layer 2 Solutions: Technologies like Lightning Network (Bitcoin) or Optimism (Ethereum) improve scalability and enable faster cross-chain interactions by processing transactions off the main chain before settling them on-chain.

Interoperability Protocols:

- Cosmos IBC: The Inter-Blockchain Communication protocol allows independent zones within Cosmos’ ecosystem—and beyond—to transfer data securely.

- Polkadot Relay Chain: Acts as a central hub connecting various parachains (independent but connected chains), facilitating asset transfers across diverse networks.

Challenges Facing Blockchain Interoperability

Despite promising advancements, several hurdles remain:

Scalability Concerns: Ensuring rapid transaction speeds without compromising security is challenging when connecting multiple networks with varying capacities.

Security Risks: Cross-chain bridges are vulnerable points; exploits could lead to significant losses if not properly secured against attacks such as double-spending or 51% attacks.

Regulatory Uncertainty: Different jurisdictions impose varying rules on cryptocurrencies which complicate compliance efforts during cross-border transactions involving multiple legal frameworks.

Recent Developments in Cross-Chain Compatibility

The landscape has seen notable progress recently:

Cosmos launched its IBC protocol in 2020, enabling seamless communication among Cosmos-based chains—a significant step toward an interconnected ecosystem.

Polkadot’s Relay Chain has been operational since 2020; it facilitates asset transfers between parachains within its network while exploring connections outside its ecosystem.

Binance Smart Chain has integrated several interoperability solutions including atomic swaps and sidechain integrations with Ethereum-compatible projects.

Solana is actively exploring partnerships aimed at bridging its high-performance network with Ethereum through technological collaborations designed for cross-platform compatibility.

Potential Risks & Future Outlook

While these developments mark substantial progress toward interconnectedness in blockchain space, potential risks could impact adoption:

Security vulnerabilities remain a concern if bridges aren’t implemented correctly—they could be exploited leading to loss of funds or data breaches.

Regulatory challenges may arise as authorities develop frameworks around cross-border digital asset movements; inconsistent policies might hinder seamless integration globally.

Market sentiment can also be affected by technological failures or delays in deploying robust interoperability solutions—affecting investor confidence and asset prices alike.

Looking ahead,

the push towards universal compatibility continues driven by demand from users seeking streamlined experiences across platforms. As technical standards mature alongside regulatory clarity,

blockchain interoperability promises not only enhanced functionality but also increased mainstream adoption of decentralized technologies.

Understanding how diverse networks connect will be vital for developers aiming at building scalable dApps,

investors seeking diversified portfolios,

and regulators working towards balanced oversight that fosters innovation without compromising security.

By addressing current challenges head-on through collaborative efforts among industry stakeholders,

the vision of an fully interoperable blockchain universe becomes increasingly attainable—one where digital assets flow freely regardless of underlying architecture.

This comprehensive overview underscores why blockchain interoperability is fundamental for advancing decentralized technology's potential—and why ongoing innovations will shape the future landscape significantly

JCUSER-IC8sJL1q

2025-05-15 03:34

What is interoperability between blockchains?

What Is Blockchain Interoperability? A Complete Overview

Understanding Blockchain Interoperability

Blockchain interoperability refers to the ability of different blockchain networks to communicate, share data, and transfer assets seamlessly. Unlike traditional financial systems where institutions can easily exchange information through standardized protocols, blockchain ecosystems are often isolated due to differing architectures and protocols. Interoperability aims to bridge these gaps, creating a more interconnected decentralized environment. This capability is essential for enabling cross-chain transactions, expanding the utility of digital assets, and fostering innovation across various blockchain platforms.

Why Is Interoperability Important in Blockchain Technology?

As blockchain technology matures, its applications have diversified into areas like decentralized finance (DeFi), non-fungible tokens (NFTs), supply chain management, and more. These use cases often require interaction between multiple blockchains—for example, transferring an NFT from one platform to another or executing a DeFi trade across different networks. Without interoperability, users face fragmentation; they must navigate multiple interfaces or convert assets manually through exchanges.

Interoperability enhances user experience by allowing smooth asset transfers and data sharing without intermediaries or complex procedures. It also promotes scalability by enabling specialized blockchains optimized for specific tasks while still maintaining connectivity with broader ecosystems.

Types of Blockchain Interoperability

There are primarily two types of interoperability based on how blockchains connect:

Homogeneous Interoperability: This involves different chains that share similar consensus mechanisms and protocols—think of it as connecting similar "languages." For example, two Ethereum-compatible chains can communicate more straightforwardly because they follow compatible standards.

Heterogeneous Interoperability: This connects fundamentally different blockchains with distinct architectures—such as Bitcoin and Ethereum—requiring more complex solutions like cross-chain bridges or protocol adapters.

Technologies Enabling Cross-Chain Communication

Several innovative technologies facilitate interoperability:

Cross-Chain Atomic Swaps: These enable the direct exchange of assets between two separate blockchains without intermediaries. They rely on smart contracts that ensure both parties fulfill their obligations simultaneously.

Sidechains: Smaller chains linked to a main chain via pegging mechanisms allow assets to move back and forth securely while leveraging the main chain’s security features.

Layer 2 Solutions: Technologies like Lightning Network (Bitcoin) or Optimism (Ethereum) improve scalability and enable faster cross-chain interactions by processing transactions off the main chain before settling them on-chain.

Interoperability Protocols:

- Cosmos IBC: The Inter-Blockchain Communication protocol allows independent zones within Cosmos’ ecosystem—and beyond—to transfer data securely.

- Polkadot Relay Chain: Acts as a central hub connecting various parachains (independent but connected chains), facilitating asset transfers across diverse networks.

Challenges Facing Blockchain Interoperability

Despite promising advancements, several hurdles remain:

Scalability Concerns: Ensuring rapid transaction speeds without compromising security is challenging when connecting multiple networks with varying capacities.

Security Risks: Cross-chain bridges are vulnerable points; exploits could lead to significant losses if not properly secured against attacks such as double-spending or 51% attacks.

Regulatory Uncertainty: Different jurisdictions impose varying rules on cryptocurrencies which complicate compliance efforts during cross-border transactions involving multiple legal frameworks.

Recent Developments in Cross-Chain Compatibility

The landscape has seen notable progress recently:

Cosmos launched its IBC protocol in 2020, enabling seamless communication among Cosmos-based chains—a significant step toward an interconnected ecosystem.

Polkadot’s Relay Chain has been operational since 2020; it facilitates asset transfers between parachains within its network while exploring connections outside its ecosystem.

Binance Smart Chain has integrated several interoperability solutions including atomic swaps and sidechain integrations with Ethereum-compatible projects.

Solana is actively exploring partnerships aimed at bridging its high-performance network with Ethereum through technological collaborations designed for cross-platform compatibility.

Potential Risks & Future Outlook

While these developments mark substantial progress toward interconnectedness in blockchain space, potential risks could impact adoption:

Security vulnerabilities remain a concern if bridges aren’t implemented correctly—they could be exploited leading to loss of funds or data breaches.

Regulatory challenges may arise as authorities develop frameworks around cross-border digital asset movements; inconsistent policies might hinder seamless integration globally.

Market sentiment can also be affected by technological failures or delays in deploying robust interoperability solutions—affecting investor confidence and asset prices alike.

Looking ahead,

the push towards universal compatibility continues driven by demand from users seeking streamlined experiences across platforms. As technical standards mature alongside regulatory clarity,

blockchain interoperability promises not only enhanced functionality but also increased mainstream adoption of decentralized technologies.

Understanding how diverse networks connect will be vital for developers aiming at building scalable dApps,

investors seeking diversified portfolios,

and regulators working towards balanced oversight that fosters innovation without compromising security.

By addressing current challenges head-on through collaborative efforts among industry stakeholders,

the vision of an fully interoperable blockchain universe becomes increasingly attainable—one where digital assets flow freely regardless of underlying architecture.

This comprehensive overview underscores why blockchain interoperability is fundamental for advancing decentralized technology's potential—and why ongoing innovations will shape the future landscape significantly

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

It’s been just over a month since Bitcoin hit an All-Time-High of $126,272.76 on October 6 , but things have gone from bad to worse since then. Now, that peak seems like a distant memory.

- Bitcoin fell more than 9% in the week ending November 14 , and was trading below $92,000 on Monday. The sharp decline — partly due to whales selling — has pushed BTC below several key technical levels.

- Last week, Bitcoin entered a “bear market,” meaning it fell 20% or more from its recent peak. Over the weekend, BTC also appeared in a “death cross” technical pattern — when the 50-day moving Medium crossed below the 200-day Medium . Not only that, Bitcoin officially wiped out all of its gains for 2025 .

- All these signals indicate that negative sentiment is surrounding Bitcoin. But does that mean “crypto winter” is coming?

- “ I don’t think we’re in a crypto winter. I think we’re seeing Bitcoin mature ,” Louis LaValle, CEO of Frontier Investments, told MarketWatch.

- He argues that this is not a typical recession model where people give up, prices crash 70–80%, liquidation disappears, and interest evaporates. Instead, Bitcoin is going through a market structure shift , not a traditional bear cycle.

Beware of margin call risk

- Kevin Kelly — portfolio manager at Amplify ETFs — said that in the past, Bitcoin has often fallen in price without institutional involvement.

- But this bear cycle is quite different because BTC is now a “mature asset,” with more liquidation and more institutional acceptance, such as JP Morgan reportedly accepting Bitcoin as collateral .

- Data from CryptoQuant shows that investors who are selling BTC are still profitable , meaning there are no signs of capitulation or margin calls. However, retail investors are not buying the Dip , while whales are buying at low prices.

- CryptoQuant's Julio Moreno said that the amount of BTC held in US ETFs has dropped sharply from 441,000 BTC on October 10 to just 271,000 BTC, reflecting weak demand from the US. At the same time, the " Medium order" in the spot market also shows that retail has not returned.

Technical perspective

- While on-chain data hasn't shown anything too serious, weak demand hasn't been enough to stop the sell-off.

- Analyst Luke Lango said the recent death cross is a worrying sign. He noted that over the past 13 years, every time Bitcoin broke the 50-week moving Medium during a bull run, the market crashed in the following 1-2 years.

- BTC is now down about 27% from its recent peak — still within “normal range,” as the Medium Bitcoin bear market decline is about 30.8% (based on data going back to 2014). In 2022, there have been two declines of more than 45%.

- Kelly said that tightening global liquidation , the Fed's delay in cutting interest rates, and the TGA's withdrawal of liquidation from the system have made BTC much more vulnerable.

- He assessed the current situation as a combination of weak liquidation , continuous sell-offs, and declining sentiment , rather than a single shock.

“The Zone of Extreme Fear”

- The market has entered “extreme fear territory” after Bitcoin failed to hold the psychological $100,000 mark, according to Kelly.

- But investors have not lost interest. After the hot growth period since the January 2023 Dip , a “digestion wave” is normal.

- History also shows that when the market falls into “extreme fear zones,” it is a good opportunity to cash in — especially for long-term investors who Medium over time.

Macro still favors Bitcoin

- Frank Holmes — co-founder of HIVE Digital Technologies — says the macro backdrop is becoming more positive for both Bitcoin and gold.

- “ Excessive government spending and constant money printing create long-term support for scarce and decentralized assets ,” he observed.

Holmes also emphasized that even if new user growth slows in the short term, structural trends such as rising debt, monetary expansion, and geopolitical Shard still favor Bitcoin in the long term.

#Bitcoin #CryptoMarket #Jucom #cryptocurrency #blockchain $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-19 11:27

💢 Bitcoin Just Wiped Out All Its 2025 Gains. What Would a “Crypto Winter” Look Like?

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

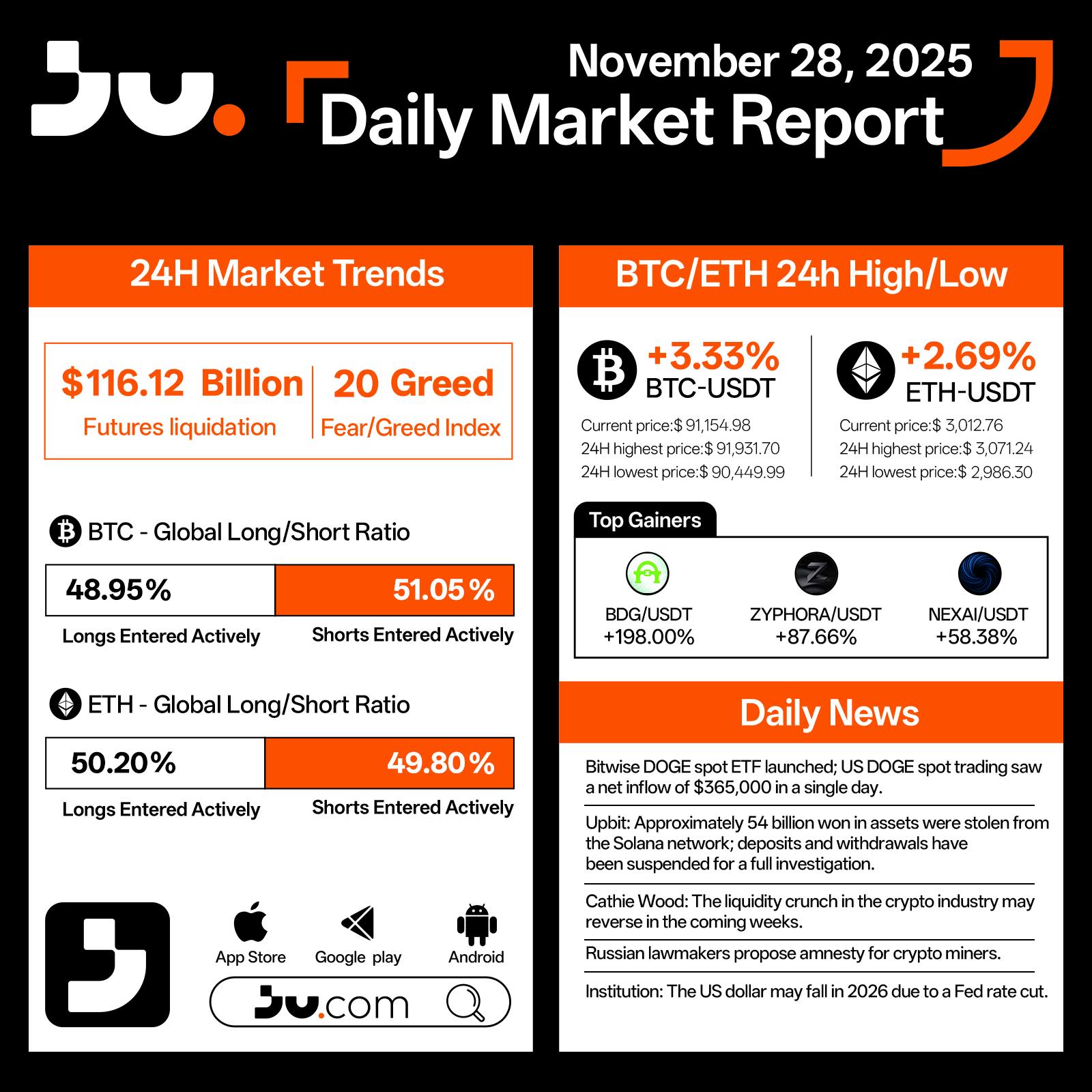

Daily Market Report - Nov 28, 2025

Crypto markets strengthened further on November 28, with sentiment showing noticeable improvement. Total futures liquidations over the past 24 hours dropped to $116.12 billion, while the Fear & Greed Index rose to 20, marking the most optimistic reading of the week. Bitcoin (BTC) climbed 3.33% to $91,154.98, trading between a high of $91,931.70 and a low of $90,449.99. Ethereum (ETH) followed with a 2.69% gain, settling at $3,012.76, with intraday volatility ranging from $3,071.24 down to $2,986.30.

BTC’s global long–short ratio remained slightly bearish with 48.95% longs and 51.05% shorts, while ETH maintained a mild long bias at 50.20% longs versus 49.80% shorts, showing a cautiously optimistic market posture. Among the day’s top performers, BDG/USDT surged 198%, ZYPHORA/USDT rose 87.66%, and NEXAI/USDT advanced 58.38%, highlighting strong speculative flows within specific high-momentum sectors.

Several major developments shaped today’s narrative. The Bitwise DOGE spot ETF officially launched, recording a $365,000 net inflow in its first day of trading. South Korea’s Upbit suffered a significant security breach involving approximately 54 billion KRW in Solana-based assets, prompting an immediate suspension of deposits and withdrawals. Cathie Wood suggested that liquidity conditions in the crypto sector may shift in the coming weeks, potentially marking the beginning of a new capital cycle. Russian lawmakers proposed an amnesty policy for crypto miners, signaling a shift toward more structured regulatory oversight. Meanwhile, institutional analysts projected that the US dollar could weaken again in 2026, driven by expectations of a Federal Reserve rate cut.

With BTC and ETH extending their upward momentum and speculative activity gaining strength, market sentiment has clearly improved. As the month draws to a close, traders will closely monitor ETF flows, regulatory developments, and security risks to gauge whether this recovery can sustain into early December.

#cryptocurrency #blockchain #Bitcoin #ETH

JU Blog

2025-11-28 04:48

BTC and ETH Extend Rally as Market Sentiment Improves - November 28, 2025

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

What Are Blockchain Analytics Tools?

Blockchain analytics tools are software platforms designed to analyze and interpret data from blockchain networks. These tools help users track transactions, monitor network activity, assess market trends, and ensure compliance with regulatory standards. As blockchain technology becomes more widespread, the need for transparent and reliable analytics has grown exponentially. Whether you're an investor, regulator, or developer, understanding how these tools work is essential for navigating the complex landscape of cryptocurrencies and decentralized finance (DeFi).

These platforms leverage advanced algorithms to sift through vast amounts of on-chain data—such as transaction histories, wallet addresses, token movements—and present insights in a user-friendly manner. They also incorporate features like risk assessment and compliance checks to help institutions meet legal requirements while maintaining transparency.

Leading Blockchain Analytics Platforms

Several key players dominate the blockchain analytics space today. Each offers unique features tailored to different needs within the ecosystem:

Chainalysis

Chainalysis stands out as one of the most comprehensive solutions available for blockchain analysis. It provides real-time transaction monitoring that helps identify suspicious activities such as money laundering or fraud attempts. Its detailed reports on cryptocurrency flows assist law enforcement agencies and financial institutions in tracking illicit transactions across multiple blockchains.

In 2023, Chainalysis introduced "CryptoSlate," a feature that delivers deeper insights into market performance trends—making it easier for users to understand broader industry shifts alongside individual transaction data.

Elliptic

Elliptic specializes in anti-money laundering (AML) and know-your-customer (KYC) compliance solutions tailored for financial institutions operating within crypto markets. Its platform offers advanced risk scoring models based on transaction patterns and wallet behaviors.

Recent updates in 2024 expanded Elliptic’s coverage to include more cryptocurrencies beyond Bitcoin and Ethereum—covering emerging tokens used in DeFi applications—and broadened its client base among banks and exchanges seeking regulatory adherence.

Glassnode

Unlike traditional analytics focusing solely on transactional data, Glassnode emphasizes on-chain metrics that gauge network health and market sentiment. Metrics like Network Value to Transactions (NVT) ratio or Market Value to Realized Value (MVRV) provide insights into whether a cryptocurrency is overbought or undervalued.

In 2025, Glassnode launched new analytical ratios such as "NVT Ratio" which helps traders assess whether current prices reflect underlying network activity—a vital tool during periods of high volatility when quick decision-making is crucial.

CryptoSlate

CryptoSlate acts as an aggregator platform pulling data from various sources—including other analytics tools—to offer comprehensive reports about crypto markets globally. It combines real-time price feeds with news updates relevant to ongoing developments within blockchain ecosystems.

The platform's recent expansion in 2024 included enhanced NFT tracking features—allowing users not only to monitor token sales but also analyze buying patterns across digital art marketplaces—a reflection of NFT market maturation.

Nansen

Nansen focuses heavily on decentralized finance (DeFi) protocols and non-fungible tokens (NFTs). Its strength lies in providing granular insights into user behavior—such as large wallet movements or protocol-specific risk factors—which are invaluable for investors looking at yield farming strategies or NFT investments.

In 2025, Nansen partnered with major DeFi projects aiming at improving its risk assessment capabilities further—helping users avoid scams while optimizing their investment strategies based on behavioral signals observed across protocols.

Recent Trends Shaping Blockchain Analytics Tools

The development of these platforms has been influenced by several recent industry trends:

Regulatory Environment: Governments worldwide have increased scrutiny over crypto activities since 2023. Tools like Chainalysis have played pivotal roles by helping exchanges comply with AML/KYC regulations through detailed transaction monitoring.

Market Volatility: The unpredictable swings seen recently make real-time analysis more critical than ever; platforms like Glassnode provide timely metrics that inform trading decisions during turbulent periods.

Growth of DeFi: Decentralized finance continues expanding rapidly; Nansen’s focus on DeFi protocols allows investors to navigate this complex sector effectively.

NFT Market Expansion: The surge in digital collectibles has prompted analytic providers like CryptoSlate to develop specialized modules tracking NFT sales volumes & buyer behaviors.

Challenges Facing Blockchain Analytics Solutions

Despite their advantages, these tools face several hurdles:

Regulatory Risks: As authorities impose stricter rules around privacy & transparency standards—for example GDPR-like regulations—they may limit what data can be collected & analyzed legally.

Data Privacy Concerns: Large-scale collection raises questions about user privacy rights; balancing transparency with confidentiality remains a delicate issue.

Market Fluctuations Impact Accuracy: Rapid price swings can distort metrics temporarily; analytic models must adapt quickly without producing misleading signals.

Intense Competition & Innovation Pressure: With many startups entering this space regularly—from niche providers focusing solely on NFTs or specific chains—the landscape demands continuous innovation.

Why Blockchain Analytics Matter Today

Understanding how these tools function is crucial not just for traders but also regulators seeking transparency within increasingly complex networks. They enable detection of illicit activities such as frauds or money laundering while supporting compliance efforts globally—a vital aspect considering evolving legal frameworks around cryptocurrencies worldwide.

Moreover, they empower investors by providing actionable insights derived from deep analysis rather than speculation alone — especially important amid volatile markets where timing can significantly impact profitability.

Future Outlook: Evolving Capabilities & Industry Needs

As blockchain technology matures further—with innovations like layer-two scaling solutions—the role of analytics will become even more significant. Future developments may include enhanced AI-driven predictive models capable of forecasting market movements before they happen or improved cross-chain analysis enabling seamless tracking across multiple networks simultaneously.

Furthermore:

- Increased integration between different analytical platforms could foster richer datasets.*

- Privacy-preserving techniques might emerge allowing detailed analysis without compromising user confidentiality.*

- Regulatory frameworks will likely shape product offerings further—as companies adapt their services accordingly.*

Staying informed about these advancements ensures stakeholders remain equipped with cutting-edge tools necessary for navigating this dynamic environment effectively.

Keywords: blockchain analytics tools , cryptocurrency monitoring software , DeFi analysis platforms , NFT trend trackers , AML/KYC solutions , real-time transaction monitoring

JCUSER-IC8sJL1q

2025-05-14 08:49

What tools exist for blockchain analytics?

What Are Blockchain Analytics Tools?

Blockchain analytics tools are software platforms designed to analyze and interpret data from blockchain networks. These tools help users track transactions, monitor network activity, assess market trends, and ensure compliance with regulatory standards. As blockchain technology becomes more widespread, the need for transparent and reliable analytics has grown exponentially. Whether you're an investor, regulator, or developer, understanding how these tools work is essential for navigating the complex landscape of cryptocurrencies and decentralized finance (DeFi).

These platforms leverage advanced algorithms to sift through vast amounts of on-chain data—such as transaction histories, wallet addresses, token movements—and present insights in a user-friendly manner. They also incorporate features like risk assessment and compliance checks to help institutions meet legal requirements while maintaining transparency.

Leading Blockchain Analytics Platforms

Several key players dominate the blockchain analytics space today. Each offers unique features tailored to different needs within the ecosystem:

Chainalysis

Chainalysis stands out as one of the most comprehensive solutions available for blockchain analysis. It provides real-time transaction monitoring that helps identify suspicious activities such as money laundering or fraud attempts. Its detailed reports on cryptocurrency flows assist law enforcement agencies and financial institutions in tracking illicit transactions across multiple blockchains.

In 2023, Chainalysis introduced "CryptoSlate," a feature that delivers deeper insights into market performance trends—making it easier for users to understand broader industry shifts alongside individual transaction data.

Elliptic

Elliptic specializes in anti-money laundering (AML) and know-your-customer (KYC) compliance solutions tailored for financial institutions operating within crypto markets. Its platform offers advanced risk scoring models based on transaction patterns and wallet behaviors.

Recent updates in 2024 expanded Elliptic’s coverage to include more cryptocurrencies beyond Bitcoin and Ethereum—covering emerging tokens used in DeFi applications—and broadened its client base among banks and exchanges seeking regulatory adherence.

Glassnode

Unlike traditional analytics focusing solely on transactional data, Glassnode emphasizes on-chain metrics that gauge network health and market sentiment. Metrics like Network Value to Transactions (NVT) ratio or Market Value to Realized Value (MVRV) provide insights into whether a cryptocurrency is overbought or undervalued.

In 2025, Glassnode launched new analytical ratios such as "NVT Ratio" which helps traders assess whether current prices reflect underlying network activity—a vital tool during periods of high volatility when quick decision-making is crucial.

CryptoSlate

CryptoSlate acts as an aggregator platform pulling data from various sources—including other analytics tools—to offer comprehensive reports about crypto markets globally. It combines real-time price feeds with news updates relevant to ongoing developments within blockchain ecosystems.

The platform's recent expansion in 2024 included enhanced NFT tracking features—allowing users not only to monitor token sales but also analyze buying patterns across digital art marketplaces—a reflection of NFT market maturation.

Nansen

Nansen focuses heavily on decentralized finance (DeFi) protocols and non-fungible tokens (NFTs). Its strength lies in providing granular insights into user behavior—such as large wallet movements or protocol-specific risk factors—which are invaluable for investors looking at yield farming strategies or NFT investments.

In 2025, Nansen partnered with major DeFi projects aiming at improving its risk assessment capabilities further—helping users avoid scams while optimizing their investment strategies based on behavioral signals observed across protocols.

Recent Trends Shaping Blockchain Analytics Tools

The development of these platforms has been influenced by several recent industry trends:

Regulatory Environment: Governments worldwide have increased scrutiny over crypto activities since 2023. Tools like Chainalysis have played pivotal roles by helping exchanges comply with AML/KYC regulations through detailed transaction monitoring.

Market Volatility: The unpredictable swings seen recently make real-time analysis more critical than ever; platforms like Glassnode provide timely metrics that inform trading decisions during turbulent periods.

Growth of DeFi: Decentralized finance continues expanding rapidly; Nansen’s focus on DeFi protocols allows investors to navigate this complex sector effectively.

NFT Market Expansion: The surge in digital collectibles has prompted analytic providers like CryptoSlate to develop specialized modules tracking NFT sales volumes & buyer behaviors.

Challenges Facing Blockchain Analytics Solutions

Despite their advantages, these tools face several hurdles: