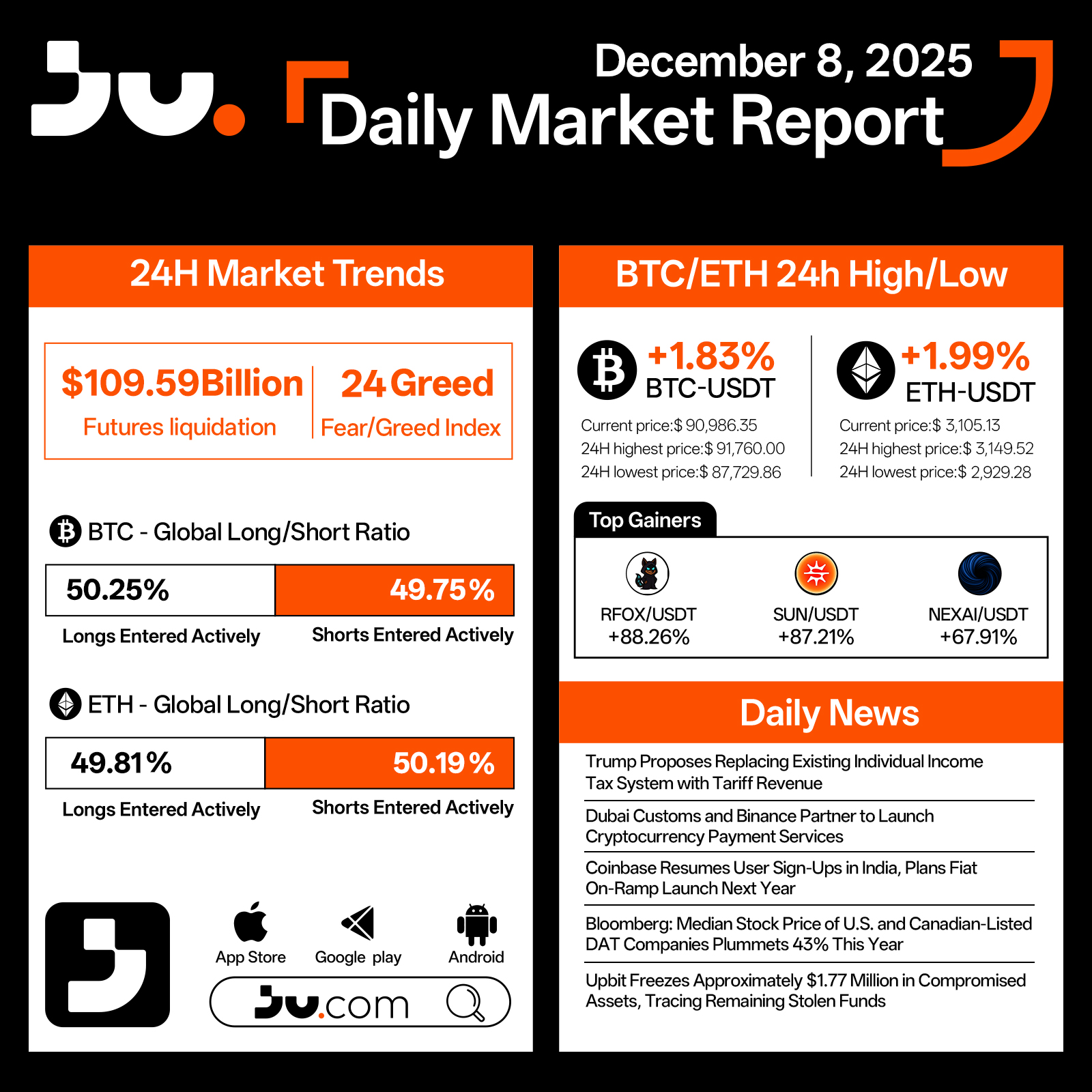

Crypto markets posted another day of modest gains on December 8, with major assets trending higher. Over the past 24 hours, total liquidations reached $109.59 billion, while the Fear & Greed Index held at 24, indicating gradually strengthening sentiment without signs of overheating. Bitcoin (BTC) rose 1.83% to $90,986.35, trading between $91,760.00 at the high and $87,729.86 at the low. Ethereum (ETH) outpaced BTC slightly, climbing 1.99% to $3,105.13, with intraday movement spanning from $3,149.52 to $2,929.28.

Derivatives data showed balanced positioning, with BTC at 50.25% longs and 49.75% shorts, while ETH recorded 49.81% longs versus 50.19% shorts. This equilibrium suggests an uncertain but gradually improving market outlook. A number of altcoins posted strong performances, led by RFOX/USDT with +88.26%, SUN/USDT with +87.21%, and NEXAI/USDT with +67.91%, highlighting ongoing speculative momentum.

In broader developments, Trump proposed replacing the current individual income tax system with tariff revenue, a policy shift that could significantly impact U.S. economic dynamics. Dubai Customs partnered with Binance to introduce cryptocurrency payment services, marking a major step for regulated digital payments in the region. Coinbase resumed sign-ups in India and announced plans to roll out fiat on-ramps next year. Bloomberg reported that the median stock price of U.S. and Canadian-listed DAT companies has plunged 43% this year, underscoring persistent market stress in high-rate environments. Upbit froze approximately $1.77 million in compromised assets and continues tracing remaining stolen funds.

Overall, the steady climb of BTC and ETH reflects improving confidence across the crypto market. With regulatory developments, payment integrations, and major platforms reactivating services, structural support for year-end market strength is gradually building.

#cryptocurrency #blockchain #finance #Blockchain

JU Blog

2025-12-08 06:47

BTC and ETH Extend Gains as Market Sentiment Continues to Improve – December 8, 2025

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

A UK operation against Russian sanctions evasion has resulted in 128 arrests and the seizure of $32.6 million in cryptocurrency and cash.

The UK's National Crime Agency (NCA) has revealed that a UK-led operation to crack down on Russian sanctions evasion has resulted in the arrest of 128 people and the seizure of $32.6 million in cryptocurrency and cash.🚨🚨🚨

The operation, dubbed "Operation Destabilize," was first announced in 2024. As of December last year, it had resulted in 84 arrests and the seizure of $25.5 million.💡💡💡

However, the latest NCA data shows that the operation has also resulted in the arrest of a further 45 people suspected of money laundering and the seizure of more than $6.6 million in cash.⭐️⭐️⭐️

#InternationalNews #cryptocurrency #blockchain #Jucom #finance $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-22 04:50

⭐️⭐️⭐️#InternationalNews

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

What Are the Inherent Risks of Interacting with DeFi Protocols?

Decentralized Finance (DeFi) has emerged as a transformative force in the financial industry, offering innovative ways to lend, borrow, trade, and earn yields without traditional intermediaries. While DeFi provides increased accessibility and transparency, it also introduces a range of inherent risks that users must understand before engaging. This article explores these risks comprehensively to help users navigate the complex landscape of DeFi safely.

Understanding Smart Contract Vulnerabilities

At the core of DeFi protocols are smart contracts—self-executing code that automates financial transactions based on predefined rules. Although they enable trustless operations, smart contracts are susceptible to bugs and vulnerabilities. Historically significant incidents like the DAO hack in 2016 demonstrated how exploited vulnerabilities could lead to massive losses; approximately 3.6 million Ether were drained due to a reentrancy bug[1]. These vulnerabilities often stem from coding errors or overlooked edge cases during development. As smart contracts are immutable once deployed, fixing such issues post-launch can be challenging and costly.

To mitigate this risk, rigorous security audits by third-party firms are essential before deploying new protocols or updates. Additionally, ongoing monitoring and bug bounty programs incentivize community participation in identifying potential flaws early.

Liquidity Risks in Decentralized Pools

Liquidity is vital for smooth trading and borrowing activities within DeFi ecosystems. Many protocols rely on liquidity pools—collections of tokens supplied by users—to facilitate transactions without centralized order books[2]. However, these pools can face liquidity shortages during periods of high volatility or market downturns. Insufficient liquidity can lead to slippage—where trades execute at unfavorable prices—or even transaction failures.

For example, during sudden market crashes or large trades (known as "whale" movements), prices may swing sharply due to low liquidity levels[3]. Users participating in yield farming or providing liquidity should be aware that their assets might become illiquid if market conditions deteriorate unexpectedly.

Market Volatility Impact

Cryptocurrencies used within DeFi platforms are inherently volatile assets; their values can fluctuate dramatically over short periods[3]. Such volatility directly affects collateral valuations in lending protocols and impacts yield calculations for farmers earning interest or rewards. A sudden price drop could trigger liquidation events where collateral is sold off automatically at unfavorable rates—a process known as "liquidation risk."

This unpredictability underscores the importance for users engaging with leverage-based strategies or staking assets: they must closely monitor market trends and set appropriate risk parameters like collateralization ratios to avoid unexpected losses.

Regulatory Uncertainty Surrounding DeFi

The regulatory landscape for DeFi remains largely undefined globally[4]. Governments and regulators are increasingly scrutinizing decentralized platforms due to concerns about consumer protection, money laundering risks, tax evasion potential—and whether existing laws apply effectively within decentralized environments.

This ambiguity exposes users and platform operators to legal uncertainties; regulations could change abruptly leading to restrictions on certain activities or shutdowns of platforms altogether[4]. Staying informed about evolving legal frameworks is crucial for participants who wish to avoid unintended compliance violations while maintaining access.

Security Threats: Phishing & Hacks

Beyond technical vulnerabilities within smart contracts themselves lies an array of security threats targeting individual users’ funds[5]. Phishing attacks remain prevalent—attackers impersonate legitimate services via fake websites or emails designed specifically to steal private keys or seed phrases necessary for wallet access(5). Once compromised, hackers can drain user accounts instantly.

High-profile hacks such as Wormhole’s $320 million breach in 2022 highlight how security lapses at bridge infrastructure points pose significant risks [10], emphasizing that no component is immune from attack vectors targeting cross-chain interoperability solutions used widely across DeFi ecosystems.

Users should adopt best practices including multi-factor authentication (MFA), hardware wallets when possible—and always verify URLs—to reduce susceptibility toward phishing schemes [5].

Reentrancy Attacks: A Persistent Threat

Reentrancy attacks exploit specific vulnerabilities where malicious actors repeatedly call functions within a contract before previous executions complete[6]. This loophole allows attackers unauthorized access—potentially draining funds from affected protocols if not properly guarded against reentrant calls(6).

The infamous DAO hack was an early example illustrating this threat’s severity [1], prompting developers worldwide toward implementing safeguards like mutexes (mutual exclusions) into their codebases today [6].

Ensuring robust coding standards combined with formal verification methods significantly reduces reentrancy-related exploits' likelihood across new protocol deployments.

Front-Running & Sandwich Attacks Exploiting Transaction Ordering

In blockchain networks where transaction ordering isn’t strictly controlled by centralized authorities—the phenomenon known as front-running becomes problematic.[7] Traders with faster access may observe pending transactions via mempool data—and place their own orders ahead intentionally (“front-run”) —altering prices unfavorably for others(7).

Sandwich attacks take this further by placing one order just before a target trade while another immediately afterward—effectively “sandwiching” it—to manipulate asset prices temporarily.[7] These tactics undermine fair trading principles within DEXs like Uniswap but also pose financial risks for regular traders unfamiliar with such exploits.[7]

Mitigation strategies include implementing time-weighted average pricing mechanisms (TWAP)and utilizing privacy-preserving techniques such as zero-knowledge proofs where feasible .

Dependence on Oracles & Data Integrity Issues

Many advanced DeFi applications depend heavily on external data sources called “oracles” — which provide real-time information like asset prices,[8] interest rates,[8] etc., necessary for executing automated decisions accurately(8). However , inaccuracies stemming from faulty data feeds—or malicious manipulation—can cause severe miscalculations leading either into unwarranted liquidationsor incorrect payouts(8).

Protocols employing multiple independent oracle sources coupled with decentralization techniques aimto improve resilience against false data injection but cannot eliminate all associated risks entirely .

Navigating the Risks: Best Practices & Future Outlook

While inherent dangers exist across various facets—from technical bugs through regulatory shifts—the key lies in adopting comprehensive risk management strategies . Regularly auditing codebases , diversifying investments , employing secure wallets , staying updated about legal developments ,and understanding protocol mechanics form partof prudent engagement practices .

Recent developments indicate increased focus on enhancing security measures—including more rigorous audits post-hack incidents—as well as efforts towards clearer regulation frameworks aimed at protecting investors while fostering innovation . As the ecosystem matures—with improved standards around transparency,safety,and compliance—the overall safety profile will likely improve over time—but vigilance remains essentialfor all participants involvedin decentralized finance activities.

JCUSER-WVMdslBw

2025-05-22 08:07

What are the inherent risks involved in interacting with DeFi protocols?

What Are the Inherent Risks of Interacting with DeFi Protocols?

Decentralized Finance (DeFi) has emerged as a transformative force in the financial industry, offering innovative ways to lend, borrow, trade, and earn yields without traditional intermediaries. While DeFi provides increased accessibility and transparency, it also introduces a range of inherent risks that users must understand before engaging. This article explores these risks comprehensively to help users navigate the complex landscape of DeFi safely.

Understanding Smart Contract Vulnerabilities

At the core of DeFi protocols are smart contracts—self-executing code that automates financial transactions based on predefined rules. Although they enable trustless operations, smart contracts are susceptible to bugs and vulnerabilities. Historically significant incidents like the DAO hack in 2016 demonstrated how exploited vulnerabilities could lead to massive losses; approximately 3.6 million Ether were drained due to a reentrancy bug[1]. These vulnerabilities often stem from coding errors or overlooked edge cases during development. As smart contracts are immutable once deployed, fixing such issues post-launch can be challenging and costly.

To mitigate this risk, rigorous security audits by third-party firms are essential before deploying new protocols or updates. Additionally, ongoing monitoring and bug bounty programs incentivize community participation in identifying potential flaws early.

Liquidity Risks in Decentralized Pools

Liquidity is vital for smooth trading and borrowing activities within DeFi ecosystems. Many protocols rely on liquidity pools—collections of tokens supplied by users—to facilitate transactions without centralized order books[2]. However, these pools can face liquidity shortages during periods of high volatility or market downturns. Insufficient liquidity can lead to slippage—where trades execute at unfavorable prices—or even transaction failures.

For example, during sudden market crashes or large trades (known as "whale" movements), prices may swing sharply due to low liquidity levels[3]. Users participating in yield farming or providing liquidity should be aware that their assets might become illiquid if market conditions deteriorate unexpectedly.

Market Volatility Impact

Cryptocurrencies used within DeFi platforms are inherently volatile assets; their values can fluctuate dramatically over short periods[3]. Such volatility directly affects collateral valuations in lending protocols and impacts yield calculations for farmers earning interest or rewards. A sudden price drop could trigger liquidation events where collateral is sold off automatically at unfavorable rates—a process known as "liquidation risk."

This unpredictability underscores the importance for users engaging with leverage-based strategies or staking assets: they must closely monitor market trends and set appropriate risk parameters like collateralization ratios to avoid unexpected losses.

Regulatory Uncertainty Surrounding DeFi

The regulatory landscape for DeFi remains largely undefined globally[4]. Governments and regulators are increasingly scrutinizing decentralized platforms due to concerns about consumer protection, money laundering risks, tax evasion potential—and whether existing laws apply effectively within decentralized environments.

This ambiguity exposes users and platform operators to legal uncertainties; regulations could change abruptly leading to restrictions on certain activities or shutdowns of platforms altogether[4]. Staying informed about evolving legal frameworks is crucial for participants who wish to avoid unintended compliance violations while maintaining access.

Security Threats: Phishing & Hacks

Beyond technical vulnerabilities within smart contracts themselves lies an array of security threats targeting individual users’ funds[5]. Phishing attacks remain prevalent—attackers impersonate legitimate services via fake websites or emails designed specifically to steal private keys or seed phrases necessary for wallet access(5). Once compromised, hackers can drain user accounts instantly.

High-profile hacks such as Wormhole’s $320 million breach in 2022 highlight how security lapses at bridge infrastructure points pose significant risks [10], emphasizing that no component is immune from attack vectors targeting cross-chain interoperability solutions used widely across DeFi ecosystems.

Users should adopt best practices including multi-factor authentication (MFA), hardware wallets when possible—and always verify URLs—to reduce susceptibility toward phishing schemes [5].

Reentrancy Attacks: A Persistent Threat

Reentrancy attacks exploit specific vulnerabilities where malicious actors repeatedly call functions within a contract before previous executions complete[6]. This loophole allows attackers unauthorized access—potentially draining funds from affected protocols if not properly guarded against reentrant calls(6).

The infamous DAO hack was an early example illustrating this threat’s severity [1], prompting developers worldwide toward implementing safeguards like mutexes (mutual exclusions) into their codebases today [6].

Ensuring robust coding standards combined with formal verification methods significantly reduces reentrancy-related exploits' likelihood across new protocol deployments.

Front-Running & Sandwich Attacks Exploiting Transaction Ordering

In blockchain networks where transaction ordering isn’t strictly controlled by centralized authorities—the phenomenon known as front-running becomes problematic.[7] Traders with faster access may observe pending transactions via mempool data—and place their own orders ahead intentionally (“front-run”) —altering prices unfavorably for others(7).

Sandwich attacks take this further by placing one order just before a target trade while another immediately afterward—effectively “sandwiching” it—to manipulate asset prices temporarily.[7] These tactics undermine fair trading principles within DEXs like Uniswap but also pose financial risks for regular traders unfamiliar with such exploits.[7]

Mitigation strategies include implementing time-weighted average pricing mechanisms (TWAP)and utilizing privacy-preserving techniques such as zero-knowledge proofs where feasible .

Dependence on Oracles & Data Integrity Issues

Many advanced DeFi applications depend heavily on external data sources called “oracles” — which provide real-time information like asset prices,[8] interest rates,[8] etc., necessary for executing automated decisions accurately(8). However , inaccuracies stemming from faulty data feeds—or malicious manipulation—can cause severe miscalculations leading either into unwarranted liquidationsor incorrect payouts(8).

Protocols employing multiple independent oracle sources coupled with decentralization techniques aimto improve resilience against false data injection but cannot eliminate all associated risks entirely .

Navigating the Risks: Best Practices & Future Outlook

While inherent dangers exist across various facets—from technical bugs through regulatory shifts—the key lies in adopting comprehensive risk management strategies . Regularly auditing codebases , diversifying investments , employing secure wallets , staying updated about legal developments ,and understanding protocol mechanics form partof prudent engagement practices .

Recent developments indicate increased focus on enhancing security measures—including more rigorous audits post-hack incidents—as well as efforts towards clearer regulation frameworks aimed at protecting investors while fostering innovation . As the ecosystem matures—with improved standards around transparency,safety,and compliance—the overall safety profile will likely improve over time—but vigilance remains essentialfor all participants involvedin decentralized finance activities.

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

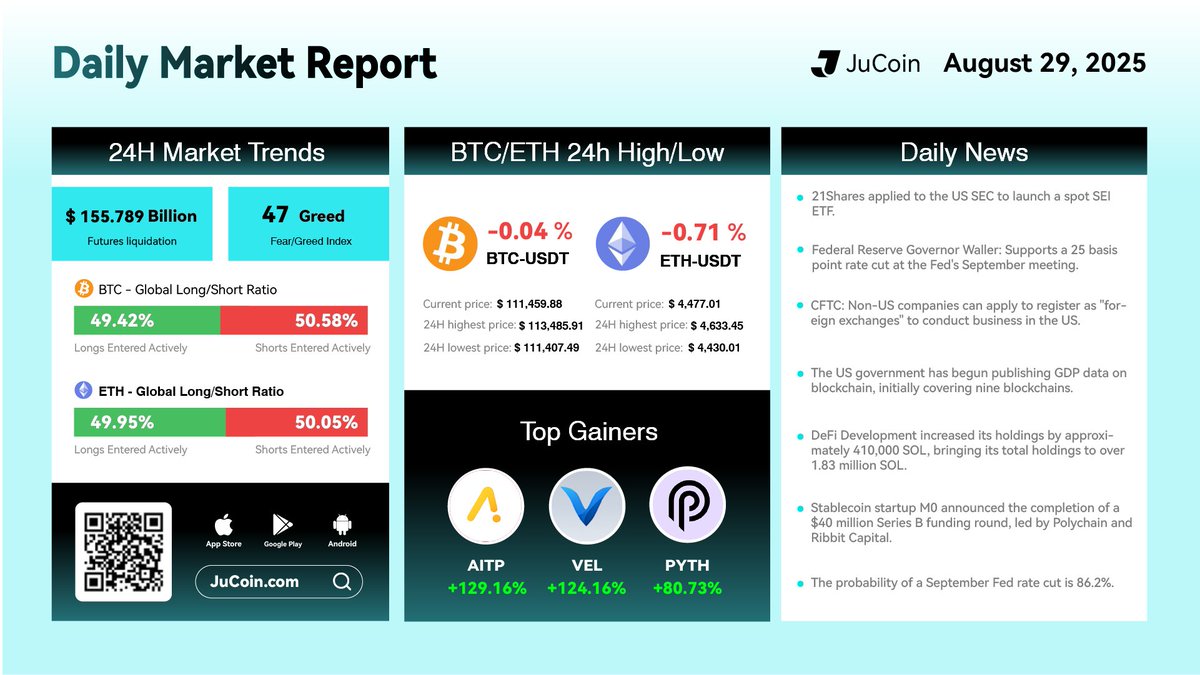

Today’s Top Gainers:

$AITP/USDT: 129%

$VEL/USDT: 124%$PYTH/USDT : 80%

$JU Token is close to reach $22 a new ATH

#cryptocurrency #blockchain #finance

Mrconfamm

2025-08-29 07:37

Market Daily Report

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

What is the FATF Travel Rule and How Does It Impact Transfers?

Understanding the FATF Travel Rule

The FATF (Financial Action Task Force) Travel Rule is an international regulation designed to improve transparency in virtual asset transactions, including cryptocurrencies. Originally established to combat money laundering and terrorist financing, this rule mandates that financial institutions involved in virtual asset transfers collect and verify specific information about both parties involved in a transaction. Its primary goal is to prevent illicit activities by ensuring that authorities can trace the flow of funds across borders.

This regulation applies not only to traditional banks but also extends to cryptocurrency exchanges, custodial wallets, and other service providers handling virtual assets. By requiring detailed information about originators and beneficiaries—such as names, addresses, account numbers, or other identifying data—the Travel Rule aims to create a more secure environment for digital transactions.

Scope of the FATF Travel Rule

The scope of this regulation covers all entities engaged in transferring virtual assets. This includes:

- Cryptocurrency exchanges

- Wallet providers

- Payment processors dealing with digital currencies

- Any platform facilitating virtual asset transfers

The rule's implementation varies globally; some countries have fully adopted it into their legal frameworks while others are still developing compliance measures. This inconsistency can create challenges for cross-border transactions involving multiple jurisdictions.

How the Travel Rule Changes Cryptocurrency Transfers

Traditionally, cryptocurrency transactions are pseudonymous—meaning they do not require personal identification details at each transfer stage. The introduction of the Travel Rule shifts this paradigm by necessitating additional verification steps before completing transfers.

For users engaging in crypto transactions, this means providing personal identification information when sending or receiving funds through compliant platforms. These platforms must then verify identities according to local regulations before processing transfers further. As a result:

- Transactions may take longer due to added verification procedures.

- Users might need to submit documents like ID cards or proof of address.

- Smaller or less regulated platforms may struggle with compliance costs or technical implementation.

While these measures enhance security and reduce illicit activity risks, they also introduce friction into what was once a relatively quick process.

Implementation Challenges Across Countries

Different countries have adopted varying approaches toward enforcing the FATF Travel Rule:

- United States: Enforces regulations under existing laws such as the Bank Secrecy Act (BSA), requiring crypto businesses to implement KYC (Know Your Customer) procedures aligned with AML (Anti-Money Laundering) standards.

- European Union: Is working on integrating these requirements within its Anti-Money Laundering Directive (AMLD), aiming for harmonized rules across member states.

- Other Jurisdictions: Some nations are still drafting legislation or lack clear enforcement mechanisms altogether.

This patchwork creates regulatory uncertainty for industry players operating internationally because compliance strategies must adapt based on jurisdictional requirements.

Impact on Cryptocurrency Industry and Users

The adoption of the FATF Travel Rule has significant implications for both industry operators and end-users:

For Financial Institutions & Service Providers:

- Increased operational costs due to implementing new compliance infrastructure.

- Need for advanced technology solutions such as decentralized identity systems and data analytics tools.

- Potential reduction in transaction speed owing to additional verification steps.

For Users:

- Greater privacy concerns since more personal data is collected during transfers.

- Possible delays in transaction processing times.

- Enhanced security features that help prevent fraud but could complicate user experience if not well-managed.

Despite these challenges, many industry stakeholders see compliance with global standards like those set by FATF as essential for legitimizing cryptocurrencies within mainstream finance systems.

Recent Developments & Future Outlook

Since its initial proposal in 2019, several key milestones have shaped how countries approach enforcement:

- 2021 Guidance Release: The FATF issued comprehensive guidelines emphasizing robust customer due diligence (CDD) practices alongside ongoing monitoring processes.

- 2022 Enforcement Actions: Countries like the US began actively enforcing regulations under existing AML frameworks; meanwhile, EU regulators worked towards formalizing their own rules.

- Industry Adaptation: Crypto firms developed new tools such as decentralized identity solutions aimed at balancing privacy with regulatory demands while maintaining user trust.

Looking ahead, broader adoption worldwide seems inevitable given increasing international cooperation against financial crimes related to digital assets—a trend likely leading toward more uniform global standards over time.

Key Takeaways About How It Affects Transfers

To summarize how the FATF Travel Rule impacts cryptocurrency transfers:

- Adds mandatory collection and verification of sender/receiver information

- Extends transfer times due to extra checks

- Raises operational costs for compliant service providers

- Introduces privacy considerations around sharing personal data

- Creates regulatory complexity across different jurisdictions

Understanding these factors helps users navigate an evolving landscape where transparency meets innovation—balancing security needs against seamless user experiences remains central as regulators continue refining policies around virtual assets worldwide.

Semantic Keywords & Related Terms:cryptocurrency regulation | AML/KYC compliance | cross-border crypto transfer | blockchain transparency | digital asset oversight | anti-money laundering laws | crypto industry adaptation | identity verification protocols

JCUSER-IC8sJL1q

2025-05-22 23:59

What is the FATF Travel Rule and how does it impact transfers?

What is the FATF Travel Rule and How Does It Impact Transfers?

Understanding the FATF Travel Rule

The FATF (Financial Action Task Force) Travel Rule is an international regulation designed to improve transparency in virtual asset transactions, including cryptocurrencies. Originally established to combat money laundering and terrorist financing, this rule mandates that financial institutions involved in virtual asset transfers collect and verify specific information about both parties involved in a transaction. Its primary goal is to prevent illicit activities by ensuring that authorities can trace the flow of funds across borders.

This regulation applies not only to traditional banks but also extends to cryptocurrency exchanges, custodial wallets, and other service providers handling virtual assets. By requiring detailed information about originators and beneficiaries—such as names, addresses, account numbers, or other identifying data—the Travel Rule aims to create a more secure environment for digital transactions.

Scope of the FATF Travel Rule

The scope of this regulation covers all entities engaged in transferring virtual assets. This includes:

- Cryptocurrency exchanges

- Wallet providers

- Payment processors dealing with digital currencies

- Any platform facilitating virtual asset transfers

The rule's implementation varies globally; some countries have fully adopted it into their legal frameworks while others are still developing compliance measures. This inconsistency can create challenges for cross-border transactions involving multiple jurisdictions.

How the Travel Rule Changes Cryptocurrency Transfers

Traditionally, cryptocurrency transactions are pseudonymous—meaning they do not require personal identification details at each transfer stage. The introduction of the Travel Rule shifts this paradigm by necessitating additional verification steps before completing transfers.

For users engaging in crypto transactions, this means providing personal identification information when sending or receiving funds through compliant platforms. These platforms must then verify identities according to local regulations before processing transfers further. As a result:

- Transactions may take longer due to added verification procedures.

- Users might need to submit documents like ID cards or proof of address.

- Smaller or less regulated platforms may struggle with compliance costs or technical implementation.

While these measures enhance security and reduce illicit activity risks, they also introduce friction into what was once a relatively quick process.

Implementation Challenges Across Countries

Different countries have adopted varying approaches toward enforcing the FATF Travel Rule:

- United States: Enforces regulations under existing laws such as the Bank Secrecy Act (BSA), requiring crypto businesses to implement KYC (Know Your Customer) procedures aligned with AML (Anti-Money Laundering) standards.

- European Union: Is working on integrating these requirements within its Anti-Money Laundering Directive (AMLD), aiming for harmonized rules across member states.

- Other Jurisdictions: Some nations are still drafting legislation or lack clear enforcement mechanisms altogether.

This patchwork creates regulatory uncertainty for industry players operating internationally because compliance strategies must adapt based on jurisdictional requirements.

Impact on Cryptocurrency Industry and Users

The adoption of the FATF Travel Rule has significant implications for both industry operators and end-users:

For Financial Institutions & Service Providers:

- Increased operational costs due to implementing new compliance infrastructure.

- Need for advanced technology solutions such as decentralized identity systems and data analytics tools.

- Potential reduction in transaction speed owing to additional verification steps.

For Users:

- Greater privacy concerns since more personal data is collected during transfers.

- Possible delays in transaction processing times.

- Enhanced security features that help prevent fraud but could complicate user experience if not well-managed.

Despite these challenges, many industry stakeholders see compliance with global standards like those set by FATF as essential for legitimizing cryptocurrencies within mainstream finance systems.

Recent Developments & Future Outlook

Since its initial proposal in 2019, several key milestones have shaped how countries approach enforcement:

- 2021 Guidance Release: The FATF issued comprehensive guidelines emphasizing robust customer due diligence (CDD) practices alongside ongoing monitoring processes.

- 2022 Enforcement Actions: Countries like the US began actively enforcing regulations under existing AML frameworks; meanwhile, EU regulators worked towards formalizing their own rules.

- Industry Adaptation: Crypto firms developed new tools such as decentralized identity solutions aimed at balancing privacy with regulatory demands while maintaining user trust.

Looking ahead, broader adoption worldwide seems inevitable given increasing international cooperation against financial crimes related to digital assets—a trend likely leading toward more uniform global standards over time.

Key Takeaways About How It Affects Transfers

To summarize how the FATF Travel Rule impacts cryptocurrency transfers:

- Adds mandatory collection and verification of sender/receiver information

- Extends transfer times due to extra checks

- Raises operational costs for compliant service providers

- Introduces privacy considerations around sharing personal data

- Creates regulatory complexity across different jurisdictions

Understanding these factors helps users navigate an evolving landscape where transparency meets innovation—balancing security needs against seamless user experiences remains central as regulators continue refining policies around virtual assets worldwide.

Semantic Keywords & Related Terms:cryptocurrency regulation | AML/KYC compliance | cross-border crypto transfer | blockchain transparency | digital asset oversight | anti-money laundering laws | crypto industry adaptation | identity verification protocols

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

Daily Market Report - Nov 27, 2025

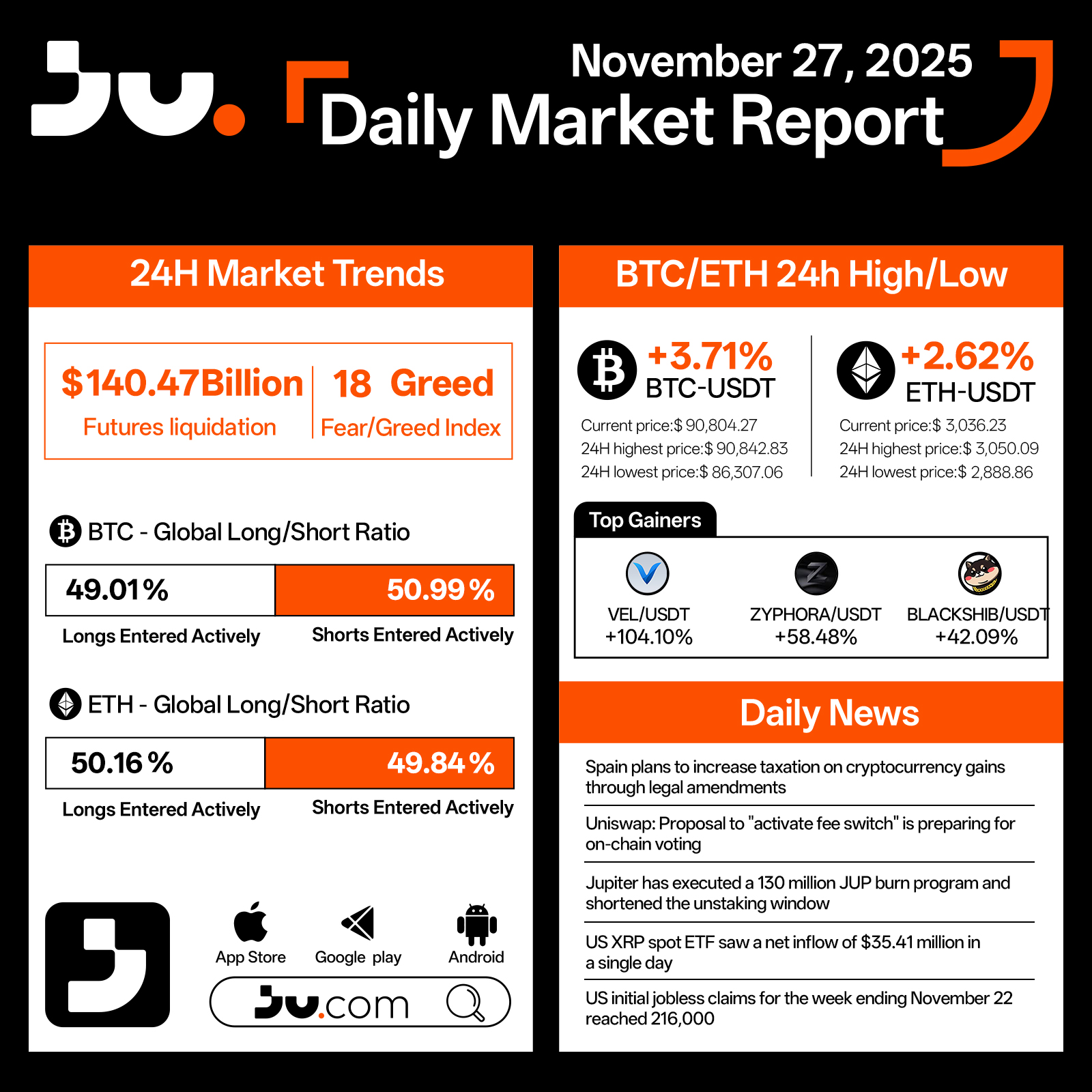

Crypto markets strengthened on November 27, showing a notable rebound in momentum. Total futures liquidations reached $140.47 billion, while the Fear & Greed Index climbed to 18, suggesting that although sentiment remains cautious, panic is gradually easing. Bitcoin (BTC) rose 3.71% to $90,804.27, trading between a high of $90,842.83 and a low of $86,307.06 over the past 24 hours. Ethereum (ETH) gained 2.62%, last trading at $3,036.23, with intraday movements ranging from $3,050.09 to $2,888.86.

Long–short ratios remain balanced but cautious. BTC saw 49.01% longs versus 50.99% shorts, while ETH skewed slightly bullish at 50.16% longs and 49.84% shorts, reflecting a market that is stabilizing but still hesitant to take strong directional positions. Among top-performing tokens, VEL/USDT surged 104.10%, ZYPHORA/USDT advanced 58.48%, and BLACKSHIB/USDT gained 42.09%, highlighting strong speculative activity in select high-volatility assets.

Regulatory and macro developments contributed to today’s narrative. Spain announced plans to increase taxes on cryptocurrency gains through upcoming legal amendments, underscoring the tightening regulatory climate across Europe. Uniswap’s proposal to activate its “fee switch” is moving toward on-chain voting, potentially reshaping the protocol’s long-term revenue design.

Jupiter executed a 130 million JUP burn program and shortened its unlocking schedule, reinforcing its commitment to token value management. Meanwhile, the US XRP spot ETF recorded an impressive $354.41 million net inflow in a single day, reflecting ongoing institutional appetite for digital assets. U.S. initial jobless claims for the week ending November 22 reached 216,000, indicating a gradually cooling labor market.

With BTC and ETH both staging strong rebounds, market sentiment shows signs of recovery, though investors remain highly sensitive to regulatory shifts and macroeconomic indicators. As the month draws to a close, liquidity conditions and policy developments will play an increasingly important role in shaping short-term market direction.

#cryptocurrency #blockchain #finance #Bitcoin

JU Blog

2025-11-27 03:25

Market Sentiment Improves as BTC and ETH Rally - November 27, 2025

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

How Many Indicators Can MT4 Display Simultaneously?

MetaTrader 4 (MT4) remains one of the most popular trading platforms among forex traders and financial analysts worldwide. Its user-friendly interface, extensive charting tools, and customizable features have made it a preferred choice for both beginners and experienced traders. However, despite its versatility, MT4 has a notable limitation that can impact comprehensive technical analysis: the maximum number of indicators that can be displayed on a single chart.

Understanding MT4’s Indicator Limit

One of the key constraints in MT4 is its built-in cap on simultaneous indicator display. The platform allows up to 28 indicators per chart, which might seem sufficient at first glance but can become restrictive when traders rely on multiple complex or layered indicators for detailed analysis.

This limit has been consistent since the early versions of MT4, with no significant updates from MetaQuotes—the developer behind MT4—over the years to increase this capacity. As such, traders often find themselves needing to prioritize which indicators are most critical or seek alternative solutions.

Why Is There a Limit on Indicators?

The restriction primarily stems from technical considerations related to system performance and stability. Rendering numerous indicators simultaneously requires significant processing power and memory resources. By capping this number at 28, MetaQuotes aims to balance functionality with platform stability across various hardware configurations.

Furthermore, some complex indicators or custom scripts may also consume considerable resources; thus, limiting their number helps prevent potential crashes or lag during trading sessions.

Impact on Traders’ Technical Analysis

For many traders who prefer using multiple overlapping tools—such as moving averages combined with oscillators like RSI or Bollinger Bands—the indicator limit can be frustrating. It forces them into making strategic choices about which tools are essential for their trading style.

In practice:

- Traders might need to combine certain signals into composite indicators.

- They may use different charts for different sets of analyses.

- Some opt for third-party software integrations that bypass these restrictions altogether.

This limitation emphasizes the importance of efficient indicator management and strategic planning in technical analysis workflows within MT4's environment.

Workarounds and Alternatives

Given this constraint, many users turn to workarounds:

- Multiple Charts: Spreading different sets of indicators across several charts within the same workspace allows broader coverage without exceeding individual chart limits.

- Custom Scripts & Expert Advisors: Advanced users develop custom scripts that combine multiple signals into fewer overlays.

- Third-party Tools: Several third-party platforms or add-ons claim to extend indicator capacity beyond what native MT4 offers—though these often come at additional costs or require more technical expertise.

However, it's important to note that relying heavily on workarounds may introduce new challenges such as increased complexity in managing multiple charts or compatibility issues with updates.

Recent Developments & Future Outlook

As of May 2025, there have been no official announcements from MetaQuotes regarding an increase in this indicator limit. The platform remains largely unchanged since its initial release in 2005 concerning this aspect—a testament perhaps to prioritizing stability over feature expansion in this area.

The absence of updates suggests that traders seeking higher flexibility might consider transitioning toward other platforms like MetaTrader 5 (MT5), which supports more advanced features including an increased number of simultaneous indicators (up to 100). Nonetheless, many still prefer sticking with MT4 due to familiarity and widespread adoption among brokers worldwide.

How This Limitation Affects Trading Strategies

The inability to display unlimited indicators directly influences how traders develop their strategies:

- It encourages more streamlined setups focusing only on essential signals.

- Traders must optimize their use by selecting multi-purpose tools rather than numerous individual ones.

- For those requiring extensive analytical layers—such as institutional investors—it may necessitate integrating external software solutions outside native MT4 capabilities.

This constraint underscores a broader theme within trading technology: balancing feature richness against system performance and user experience is crucial but sometimes results in trade-offs like these limitations.

Final Thoughts

While MetaTrader 4 remains highly regarded for its reliability and ease-of-use within retail forex trading circles, its maximum indicator display limit continues to be a point worth considering when planning your analytical approach. For casual traders conducting straightforward analyses, 28 indicators often suffice; however, professional analysts demanding deeper insights might need supplementary tools or consider upgrading platforms altogether.

Key Takeaways

- Maximum Indicators per Chart: Typically capped at 28 in standard MT4 installations.

- Historical Consistency: No significant changes since initial release (2005).

- Workarounds: Use multiple charts; employ custom scripts; explore third-party software solutions.

- Future Prospects: No official plans from MetaQuotes yet; alternatives like MT5 offer higher capacities.

Understanding these limitations helps set realistic expectations while encouraging efficient strategy development tailored within existing platform constraints—and highlights areas where technological advancements could improve trader experience moving forward.

JCUSER-WVMdslBw

2025-05-26 12:50

How many indicators can MT4 display simultaneously?

How Many Indicators Can MT4 Display Simultaneously?

MetaTrader 4 (MT4) remains one of the most popular trading platforms among forex traders and financial analysts worldwide. Its user-friendly interface, extensive charting tools, and customizable features have made it a preferred choice for both beginners and experienced traders. However, despite its versatility, MT4 has a notable limitation that can impact comprehensive technical analysis: the maximum number of indicators that can be displayed on a single chart.

Understanding MT4’s Indicator Limit

One of the key constraints in MT4 is its built-in cap on simultaneous indicator display. The platform allows up to 28 indicators per chart, which might seem sufficient at first glance but can become restrictive when traders rely on multiple complex or layered indicators for detailed analysis.

This limit has been consistent since the early versions of MT4, with no significant updates from MetaQuotes—the developer behind MT4—over the years to increase this capacity. As such, traders often find themselves needing to prioritize which indicators are most critical or seek alternative solutions.

Why Is There a Limit on Indicators?

The restriction primarily stems from technical considerations related to system performance and stability. Rendering numerous indicators simultaneously requires significant processing power and memory resources. By capping this number at 28, MetaQuotes aims to balance functionality with platform stability across various hardware configurations.

Furthermore, some complex indicators or custom scripts may also consume considerable resources; thus, limiting their number helps prevent potential crashes or lag during trading sessions.

Impact on Traders’ Technical Analysis

For many traders who prefer using multiple overlapping tools—such as moving averages combined with oscillators like RSI or Bollinger Bands—the indicator limit can be frustrating. It forces them into making strategic choices about which tools are essential for their trading style.

In practice:

- Traders might need to combine certain signals into composite indicators.

- They may use different charts for different sets of analyses.

- Some opt for third-party software integrations that bypass these restrictions altogether.

This limitation emphasizes the importance of efficient indicator management and strategic planning in technical analysis workflows within MT4's environment.

Workarounds and Alternatives

Given this constraint, many users turn to workarounds:

- Multiple Charts: Spreading different sets of indicators across several charts within the same workspace allows broader coverage without exceeding individual chart limits.

- Custom Scripts & Expert Advisors: Advanced users develop custom scripts that combine multiple signals into fewer overlays.

- Third-party Tools: Several third-party platforms or add-ons claim to extend indicator capacity beyond what native MT4 offers—though these often come at additional costs or require more technical expertise.

However, it's important to note that relying heavily on workarounds may introduce new challenges such as increased complexity in managing multiple charts or compatibility issues with updates.

Recent Developments & Future Outlook

As of May 2025, there have been no official announcements from MetaQuotes regarding an increase in this indicator limit. The platform remains largely unchanged since its initial release in 2005 concerning this aspect—a testament perhaps to prioritizing stability over feature expansion in this area.

The absence of updates suggests that traders seeking higher flexibility might consider transitioning toward other platforms like MetaTrader 5 (MT5), which supports more advanced features including an increased number of simultaneous indicators (up to 100). Nonetheless, many still prefer sticking with MT4 due to familiarity and widespread adoption among brokers worldwide.

How This Limitation Affects Trading Strategies

The inability to display unlimited indicators directly influences how traders develop their strategies:

- It encourages more streamlined setups focusing only on essential signals.

- Traders must optimize their use by selecting multi-purpose tools rather than numerous individual ones.

- For those requiring extensive analytical layers—such as institutional investors—it may necessitate integrating external software solutions outside native MT4 capabilities.

This constraint underscores a broader theme within trading technology: balancing feature richness against system performance and user experience is crucial but sometimes results in trade-offs like these limitations.

Final Thoughts

While MetaTrader 4 remains highly regarded for its reliability and ease-of-use within retail forex trading circles, its maximum indicator display limit continues to be a point worth considering when planning your analytical approach. For casual traders conducting straightforward analyses, 28 indicators often suffice; however, professional analysts demanding deeper insights might need supplementary tools or consider upgrading platforms altogether.

Key Takeaways

- Maximum Indicators per Chart: Typically capped at 28 in standard MT4 installations.

- Historical Consistency: No significant changes since initial release (2005).

- Workarounds: Use multiple charts; employ custom scripts; explore third-party software solutions.

- Future Prospects: No official plans from MetaQuotes yet; alternatives like MT5 offer higher capacities.

Understanding these limitations helps set realistic expectations while encouraging efficient strategy development tailored within existing platform constraints—and highlights areas where technological advancements could improve trader experience moving forward.

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

Interest Rate Decisions and Chart Patterns in Cryptocurrency Markets

Understanding how interest rate decisions influence cryptocurrency chart patterns is essential for traders, investors, and analysts aiming to navigate the volatile digital asset landscape. Central banks, such as the Federal Reserve, play a pivotal role in shaping market sentiment through their monetary policy actions. When these institutions adjust interest rates, they trigger a cascade of effects that can alter price movements and chart formations across various cryptocurrencies.

Impact of Interest Rate Changes on Cryptocurrency Volatility

One of the most immediate effects of interest rate adjustments is increased market volatility. Higher interest rates tend to make risk-free assets like government bonds more attractive compared to riskier investments such as cryptocurrencies. This shift often results in decreased demand for digital assets, leading to sharp price declines or increased downward pressure on charts. Conversely, when central banks lower interest rates, borrowing becomes cheaper and investor confidence tends to rise. This environment encourages risk-taking behavior, often reflected in upward trends or bullish chart patterns within crypto markets.

For example, recent rate hikes by the Federal Reserve have been associated with heightened volatility in cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These moves can cause rapid swings—sometimes breaking through established support or resistance levels—making technical analysis more challenging but also offering trading opportunities based on pattern recognition.

Trend Reversals Triggered by Monetary Policy Announcements

Interest rate decisions frequently serve as catalysts for trend reversals in cryptocurrency markets. An unexpected increase might lead investors to liquidate holdings quickly due to fears of reduced liquidity or declining economic prospects. Such sell-offs are visible on charts as sharp drops following central bank announcements—a classic reversal signal that traders watch closely.

Similarly, a surprise rate cut can boost investor optimism about economic growth prospects and risk appetite. This shift often manifests as bullish reversals where previous downtrends are halted or reversed into upward trajectories with recognizable chart patterns like double bottoms or ascending triangles forming during recovery phases.

Shifts in Support and Resistance Levels Due to Market Expectations

Market participants anticipate future monetary policy moves based on economic data releases and central bank guidance. These expectations influence support and resistance levels—the key horizontal lines that indicate potential turning points on price charts.

When an interest rate hike is expected but not fully priced into current prices, markets may experience sudden volatility once the decision is announced—breaking through previous support levels during sell-offs or surpassing resistance zones amid buying surges. Technical analysts monitor these shifts carefully because they signal changes in market sentiment driven by macroeconomic factors rather than just supply-demand dynamics alone.

Market Sentiment: The Psychological Aspect

Interest rate decisions significantly impact investor psychology within cryptocurrency markets. A higher-rate environment generally signals a robust economy but reduces appetite for speculative assets like altcoins due to perceived increased risks elsewhere—in traditional equities or fixed-income securities.

On the other hand, lower rates foster optimism about future growth prospects for digital currencies as alternative investments become less attractive financially. This change enhances demand-driven momentum visible through rising chart patterns such as flags or pennants indicating strong buying pressure fueled by positive sentiment shifts.

Recent Developments Highlighting Interest Rate Effects

In 2025 alone, multiple Federal Reserve rate hikes have exemplified how monetary policy influences crypto markets profoundly:

- The April 2025 announcement triggered notable declines across many tokens including Cryptonite USD (XCNUSD), illustrating sensitivity among certain assets.

- Cryptocurrencies like Bitcoin showed resilience historically; however, altcoins such as Litecoin (LTC) experienced sharper reactions aligned with broader market sentiment.

- Economic indicators suggesting slowing growth due to higher borrowing costs further complicated technical analysis by increasing unpredictability around key chart levels.

These developments underscore that understanding macroeconomic policies enhances predictive accuracy regarding potential pattern formations—and helps traders adapt strategies accordingly.

Key Factors Connecting Interest Rates With Chart Patterns

Several core concepts link monetary policy actions directly with technical analysis outcomes:

- Sensitivity: Cryptocurrencies tend to react more intensely than traditional assets because they are viewed both as speculative investments and stores of value.

- Volatility: Rate changes amplify fluctuations; thus larger candlestick bodies appear during periods surrounding major announcements.

- Sentiment Influence: Market mood swings driven by policy expectations shape breakout points at critical support/resistance zones.

- Historical Trends: Past data shows consistent impacts where certain pattern formations precede significant macroeconomic events related to interest rates—serving as valuable signals for informed trading decisions.

Dates That Marked Significant Interest Rate Impacts

Tracking specific dates helps contextualize how monetary policies influence crypto charts:

- April 2025 – Fed’s aggressive rate hike led directly to heightened volatility across multiple tokens.

- May 2025 – Litecoin Trust (LTCN) experienced notable price movements reflecting broader market reactions.

- May 8th – The BetaPro Silver ETF (HZD.TO) saw its value fluctuate sharply amid ongoing economic developments tied closely with fiscal policies affecting liquidity conditions globally.

How Traders Can Use These Insights

For those involved in cryptocurrency trading:

- Keep abreast of upcoming central bank meetings via financial news outlets.

- Monitor key support/resistance levels around scheduled announcement dates.

- Watch for breakout signals post-announcement indicating trend reversals influenced by changing macro conditions.

By integrating fundamental insights about interest rates with technical analysis tools—including candlestick patterns like dojis or engulfings—you enhance your ability not only to interpret current market conditions but also anticipate future movements rooted in macroeconomic fundamentals.

Understanding the Relationship Between Macro Policies And Technical Patterns

Ultimately, recognizing how central bank policies shape investor behavior provides deeper context beyond raw numbers displayed on charts alone—it adds an analytical layer grounded in real-world economic dynamics known collectively under E-A-T principles (Expertise–Authoritativeness–Trustworthiness). As global economies evolve amidst ongoing monetary adjustments worldwide—including those from major institutions—the importance of aligning fundamental knowledge with technical skills becomes paramount for successful navigation within volatile cryptocurrency environments.

JCUSER-F1IIaxXA

2025-05-09 23:28

How can interest rate decisions impact chart patterns?

Interest Rate Decisions and Chart Patterns in Cryptocurrency Markets

Understanding how interest rate decisions influence cryptocurrency chart patterns is essential for traders, investors, and analysts aiming to navigate the volatile digital asset landscape. Central banks, such as the Federal Reserve, play a pivotal role in shaping market sentiment through their monetary policy actions. When these institutions adjust interest rates, they trigger a cascade of effects that can alter price movements and chart formations across various cryptocurrencies.

Impact of Interest Rate Changes on Cryptocurrency Volatility

One of the most immediate effects of interest rate adjustments is increased market volatility. Higher interest rates tend to make risk-free assets like government bonds more attractive compared to riskier investments such as cryptocurrencies. This shift often results in decreased demand for digital assets, leading to sharp price declines or increased downward pressure on charts. Conversely, when central banks lower interest rates, borrowing becomes cheaper and investor confidence tends to rise. This environment encourages risk-taking behavior, often reflected in upward trends or bullish chart patterns within crypto markets.

For example, recent rate hikes by the Federal Reserve have been associated with heightened volatility in cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These moves can cause rapid swings—sometimes breaking through established support or resistance levels—making technical analysis more challenging but also offering trading opportunities based on pattern recognition.

Trend Reversals Triggered by Monetary Policy Announcements

Interest rate decisions frequently serve as catalysts for trend reversals in cryptocurrency markets. An unexpected increase might lead investors to liquidate holdings quickly due to fears of reduced liquidity or declining economic prospects. Such sell-offs are visible on charts as sharp drops following central bank announcements—a classic reversal signal that traders watch closely.

Similarly, a surprise rate cut can boost investor optimism about economic growth prospects and risk appetite. This shift often manifests as bullish reversals where previous downtrends are halted or reversed into upward trajectories with recognizable chart patterns like double bottoms or ascending triangles forming during recovery phases.

Shifts in Support and Resistance Levels Due to Market Expectations

Market participants anticipate future monetary policy moves based on economic data releases and central bank guidance. These expectations influence support and resistance levels—the key horizontal lines that indicate potential turning points on price charts.

When an interest rate hike is expected but not fully priced into current prices, markets may experience sudden volatility once the decision is announced—breaking through previous support levels during sell-offs or surpassing resistance zones amid buying surges. Technical analysts monitor these shifts carefully because they signal changes in market sentiment driven by macroeconomic factors rather than just supply-demand dynamics alone.

Market Sentiment: The Psychological Aspect

Interest rate decisions significantly impact investor psychology within cryptocurrency markets. A higher-rate environment generally signals a robust economy but reduces appetite for speculative assets like altcoins due to perceived increased risks elsewhere—in traditional equities or fixed-income securities.

On the other hand, lower rates foster optimism about future growth prospects for digital currencies as alternative investments become less attractive financially. This change enhances demand-driven momentum visible through rising chart patterns such as flags or pennants indicating strong buying pressure fueled by positive sentiment shifts.

Recent Developments Highlighting Interest Rate Effects

In 2025 alone, multiple Federal Reserve rate hikes have exemplified how monetary policy influences crypto markets profoundly:

- The April 2025 announcement triggered notable declines across many tokens including Cryptonite USD (XCNUSD), illustrating sensitivity among certain assets.

- Cryptocurrencies like Bitcoin showed resilience historically; however, altcoins such as Litecoin (LTC) experienced sharper reactions aligned with broader market sentiment.

- Economic indicators suggesting slowing growth due to higher borrowing costs further complicated technical analysis by increasing unpredictability around key chart levels.

These developments underscore that understanding macroeconomic policies enhances predictive accuracy regarding potential pattern formations—and helps traders adapt strategies accordingly.

Key Factors Connecting Interest Rates With Chart Patterns

Several core concepts link monetary policy actions directly with technical analysis outcomes:

- Sensitivity: Cryptocurrencies tend to react more intensely than traditional assets because they are viewed both as speculative investments and stores of value.

- Volatility: Rate changes amplify fluctuations; thus larger candlestick bodies appear during periods surrounding major announcements.

- Sentiment Influence: Market mood swings driven by policy expectations shape breakout points at critical support/resistance zones.

- Historical Trends: Past data shows consistent impacts where certain pattern formations precede significant macroeconomic events related to interest rates—serving as valuable signals for informed trading decisions.

Dates That Marked Significant Interest Rate Impacts

Tracking specific dates helps contextualize how monetary policies influence crypto charts:

- April 2025 – Fed’s aggressive rate hike led directly to heightened volatility across multiple tokens.

- May 2025 – Litecoin Trust (LTCN) experienced notable price movements reflecting broader market reactions.

- May 8th – The BetaPro Silver ETF (HZD.TO) saw its value fluctuate sharply amid ongoing economic developments tied closely with fiscal policies affecting liquidity conditions globally.

How Traders Can Use These Insights

For those involved in cryptocurrency trading:

- Keep abreast of upcoming central bank meetings via financial news outlets.

- Monitor key support/resistance levels around scheduled announcement dates.

- Watch for breakout signals post-announcement indicating trend reversals influenced by changing macro conditions.

By integrating fundamental insights about interest rates with technical analysis tools—including candlestick patterns like dojis or engulfings—you enhance your ability not only to interpret current market conditions but also anticipate future movements rooted in macroeconomic fundamentals.

Understanding the Relationship Between Macro Policies And Technical Patterns

Ultimately, recognizing how central bank policies shape investor behavior provides deeper context beyond raw numbers displayed on charts alone—it adds an analytical layer grounded in real-world economic dynamics known collectively under E-A-T principles (Expertise–Authoritativeness–Trustworthiness). As global economies evolve amidst ongoing monetary adjustments worldwide—including those from major institutions—the importance of aligning fundamental knowledge with technical skills becomes paramount for successful navigation within volatile cryptocurrency environments.

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

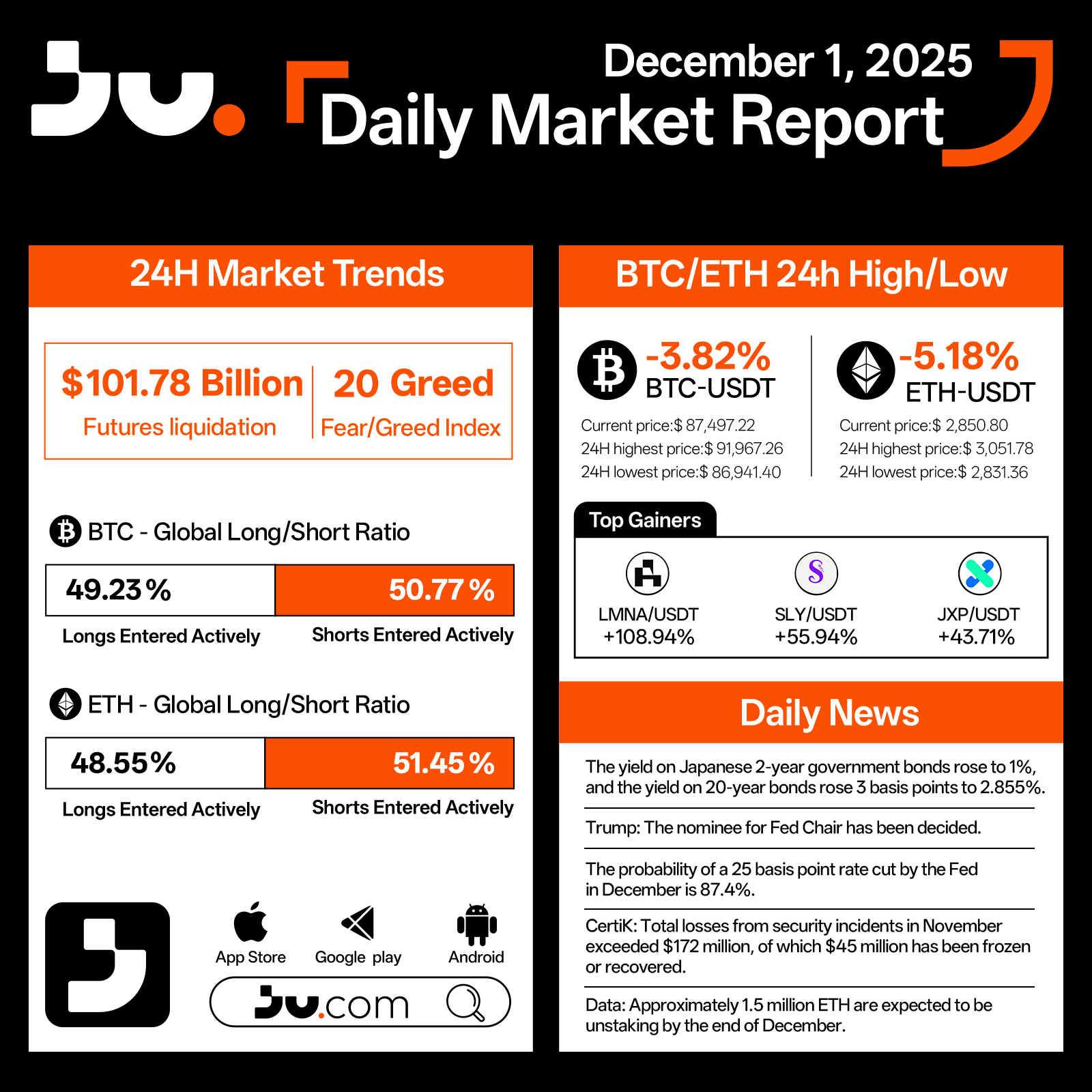

On December 1, 2025, Ju.com announced the successful completion of the merger between its trial-run stock and the official Hong Kong stock listing. The test stock code 0XXXX.HK was officially switched to 01959.HK (Century United Holdings Limited) at 18:00 (UTC+8) today, marking the full validation—under real market conditions—of the “zero-distance stock trading + stock liquidity rewards” mechanism. With this milestone, Ju.com becomes the world’s first platform to support zero-distance stock trading while providing on-chain incentives for stock liquidity.

Maintenance began at 16:00, and three hours later, users’ test-phase holdings were automatically converted into real listed company shares based on market value. This merger essentially served as a comprehensive stress test of the “real-stock custody + on-chain incentives” architecture. All holdings were settled at the closing price, with stock data verified by the broker before being fully mapped.

The significance of this step lies in the fact that trading data, withdrawal records, and user feedback gathered during the trial phase have now become the foundational samples and parameter inputs for full-scale operation. From the launch of the trial on October 20 to the stock switch on December 1—a total of 42 days—Ju.com validated a previously nonexistent trading logic: when a user buys a stock, they simultaneously inject liquidity into the market, enabling the listed company to achieve better pricing efficiency, while the holder, in addition to standard shareholder rights, can also earn additional liquidity rewards based on clear rules.

The Barriers of Traditional Brokers and Ju.com’s Strategic Path

In the traditional brokerage system, investors who wish to trade Hong Kong stocks must typically open an offshore account—often requiring substantial asset proof—while also bearing FX conversion losses, cross-border remittance fees, and per-trade commissions. Geographic barriers are also significant; for investors outside Hong Kong, many small- and mid-cap stocks suffer from extremely limited liquidity, with orders often left unfilled for long periods.

For more than a decade, Hong Kong has ranked among the top three global IPO fundraising hubs. However, secondary-market trading has remained heavily concentrated in a handful of blue-chip names, leaving a large number of small-cap stocks stagnant, illiquid, or effectively untradeable. This structural liquidity challenge makes it difficult for even long-term-oriented individual investors to consistently contribute liquidity at reasonable cost.

Ju.com dramatically lowers these barriers. After completing KYC, investors can convert USDT into HKDJ, a Hong Kong dollar-pegged stablecoin, and directly trade real Hong Kong stocks. Geographic restrictions are greatly reduced, and investors across time zones share the same order book and depth. More importantly, the act of buying stocks can be tied to staking and on-chain incentive mechanisms, meaning trading behavior is directly recognized as a liquidity contribution.

For example, when User A buys Tencent shares through Ju.com, the order is mapped 1:1 via a partner broker into real custodial holdings under User A’s name. Tencent receives genuine buying interest from global investors, improving secondary-market liquidity. Meanwhile, User A—according to predefined rules—can continue to earn long-term liquidity incentive rewards.

The core of this model is transforming liquidity from an abstract financial concept into a quantifiable, incentivized contribution. In the traditional system, investor returns primarily depend on price appreciation or dividends. In the Ju.com system, because trading behavior improves market efficiency, users gain an additional earnings path via liquidity rewards.

The Reserve Fund Mechanism: Underpinning the Incentive Model

The token incentive system is supported by a reserve fund pool jointly contributed by listed companies participating in the ecosystem. Each Hong Kong-listed company integrated into the Ju.com and xBrokers ecosystem allocates reserve funds equal to 30% of its market capitalization. These funds are dedicated to repurchasing ecosystem tokens in the secondary market and providing liquidity, thereby supporting token value and enhancing the sustainability of the incentive model.

When users receive token rewards, the reserve fund pool repurchases tokens according to set rules, generating continuous buy-side pressure. As more Hong Kong companies join, the size of the reserve fund grows, strengthening token liquidity and value stability over time. Users thus receive incentives backed by real financial resources.

This design addresses a common issue in crypto markets: when token prices fall, mining yields shrink, leading to user attrition, which further pressures the token price—a negative feedback loop. The reserve fund mechanism introduces external capital flows from listed companies, easing this internal circular pressure. As long as more companies join the system, the reserve pool continues to expand, giving the token stronger fundamental support.

A Three-Layer Closed Loop: Subscription, Trading, and Staking

The xBrokers ecosystem on Ju.com consists of three interconnected sectors corresponding to stock financing, secondary-market liquidity, and long-term incentives.

The Early-Bird Subscription Zone allows users to participate in early-stage Hong Kong stock offerings. Traditional IPO allocations are typically reserved for institutions; retail investors either cannot participate or must buy at higher secondary-market prices. On Ju.com, the subscription threshold is significantly lower, and users can participate using supported crypto assets. After subscription, stocks enter a staking period during which users earn token rewards while retaining full shareholder rights such as dividends.

The Free-Trading Zone provides secondary-market trading mapped 1:1 to real shares. All corresponding stocks are held by licensed brokers, and mapping data is stored on-chain for transparency. Users can withdraw stocks to any brokerage account that supports Hong Kong trading, verifying their authenticity. During the trial, several users successfully completed withdrawals, offering real validation of the “on-chain trading + broker custody” model.

The Stock-Staking Mining Zone turns static assets into yield-generating tools. Users stake their Hong Kong stocks to earn token incentives. Shareholder rights remain unaffected during staking—dividends continue as normal. Once the staking period ends, the stocks automatically unlock, and users may choose to hold, sell, or stake again.

Together, these three sectors form a complete cycle: the Subscription Zone introduces new quality assets, the Trading Zone provides liquidity for them, and the Staking Zone offers ongoing incentives for long-term holders. Users obtain shares in the Subscription Zone, freely trade them in the Trading Zone, and earn liquidity rewards through staking—each step reinforces the next.

Phase-One Validation Results and Future Direction

The December 1 stock merger was both a critical technical action and a phase-one validation of the entire architecture.

Trial results show that combining on-chain trading with traditional finance is fully viable. Users execute trades on-chain, stocks are held 1:1 by brokers, and shareholder rights follow traditional securities rules. This architecture preserves blockchain transparency and efficiency while meeting compliance requirements of traditional finance.

Liquidity incentives performed well during the trial. Data such as trading activity, order book depth, and bid-ask spreads provide a foundation for further optimization. Early participants reported that incentives significantly improved their willingness to trade previously illiquid assets.

Global participation paths have been successfully activated. Ju.com's diverse user base ensures that trading volumes are more evenly distributed across time zones, attracting global incremental liquidity into the Hong Kong market. For companies long constrained by liquidity shortages, this model provides a new structural solution.

After the trial, Ju.com will continue optimizing xBrokers mechanisms based on real-world operational data, focusing on the two core features: zero-distance stock trading and liquidity incentives, ensuring stable ecosystem development.

From 0XXXX.HK to 01959.HK, this merger has pushed the entire mechanism beyond white-paper theory and simulation into real-market execution. Earning liquidity incentives while buying stocks has now produced the first real trading dataset in the Hong Kong market. As more companies and institutions join, the architecture built around “zero-distance stock trading + liquidity incentives” will continue to be tested across a broader sample, and the incremental value it unlocks will be distributed to listed companies and long-term holders participating in the system.

#Jucom #xBrokers #RWA #finance #cryptocurrency

JU Blog

2025-12-01 06:18

Ju.com Completes Trial Stock Merger, Launches World's First Zero-Distance Stock Trading Platform

면책 조항:제3자 콘텐츠를 포함하며 재정적 조언이 아닙니다.

이용약관을 참조하세요.

How Can Standard Deviation Be Applied to Price Analysis?

Understanding how prices fluctuate in financial markets is essential for investors, traders, and analysts. One of the most effective statistical tools used for this purpose is standard deviation. It provides a clear measure of volatility and risk, helping market participants make informed decisions. This article explores how standard deviation can be applied to price analysis across various assets, including stocks and cryptocurrencies, highlighting recent developments and potential risks.

What Is Standard Deviation in Price Analysis?

Standard deviation measures the dispersion or variability of data points around an average value. In finance and cryptocurrency markets, it quantifies how much asset prices deviate from their mean over a specific period. A low standard deviation indicates that prices tend to stay close to the average—implying stability—while a high standard deviation suggests significant fluctuations or volatility.

This metric is vital because it translates raw price data into actionable insights about market behavior. For example, investors seeking stable investments prefer assets with low volatility (low standard deviation), whereas traders aiming for quick gains might target more volatile assets with higher deviations.

Practical Applications of Standard Deviation in Price Analysis

1. Measuring Market Volatility

One primary use of standard deviation is assessing an asset’s volatility level. By calculating the historical price deviations over time, traders can determine whether an asset's current movement aligns with its typical behavior or signals increased risk.

For instance:

- High Standard Deviation: Indicates rapid price swings; common during market shocks or speculative bubbles.

- Low Standard Deviation: Suggests steadier prices; often seen in mature markets or during periods of economic stability.

Volatility measurement helps traders decide when to enter or exit positions based on their risk appetite.

2. Risk Management and Portfolio Diversification

Investors utilize standard deviation as part of broader risk management strategies:

- Estimating potential losses based on historical fluctuations.

- Comparing different assets’ volatilities to diversify portfolios effectively.

Assets with lower deviations are generally considered safer but may offer lower returns; those with higher deviations could provide higher gains but come with increased risks.

3. Technical Indicators and Trading Strategies

Standard deviation forms the backbone of several technical analysis tools:

- Bollinger Bands: These bands consist of a moving average plus/minus two times the standard deviation, helping identify overbought or oversold conditions.

- Volatility Breakouts: Sudden increases in standard deviation can signal upcoming significant price movements worth monitoring closely.

These tools assist traders in timing entries/exits more precisely by understanding current volatility levels relative to historical norms.

4. Comparing Asset Stability

Using standardized metrics like the coefficient of variation (standard deviation divided by mean), analysts compare different assets' relative stability regardless of their scale:

- A stock might have a high absolute fluctuation but be relatively stable compared to its own average return.

- Cryptocurrencies often exhibit much higher deviations than traditional stocks due to their speculative nature but may still be assessed comparatively using these metrics.

This comparative approach aids investors in aligning their choices with desired risk profiles across diverse markets.

Recent Developments Enhancing Price Analysis Using Standard Deviation

Cryptocurrency Market Volatility Trends

The cryptocurrency space has seen unprecedented volatility recently—Bitcoin's dramatic surges followed by sharp corrections exemplify this trend. During such periods, calculating the standard deviation reveals extreme fluctuations that highlight heightened risks associated with digital assets compared to traditional investments like stocks or bonds.

Market analysts now routinely incorporate these calculations into trading algorithms and dashboards for real-time monitoring—helping both institutional players and retail investors navigate turbulent waters more effectively.

Advanced Tools & Software Integration

Modern analytical platforms such as TradingView, MetaTrader, and specialized statistical software have simplified computing complex metrics like moving averages combined with multiple layers of standard deviations (e.g., Bollinger Bands). These tools enable users without advanced statistical backgrounds to visualize market conditions clearly—and adapt strategies accordingly—enhancing decision-making precision.

Machine Learning & Predictive Modeling

The integration of machine learning models has further expanded applications involving standard deviations:

- Algorithms analyze vast datasets incorporating technical indicators (like volatility measures).

- They generate predictive insights about future price movements based on patterns identified historically through statistical dispersion metrics.

Such innovations are transforming traditional reactive trading into proactive strategies grounded on robust quantitative analysis.

Risks Associated With High Volatility Indicated by Standard Deviations

While high-standard-deviation signals opportunities for profit through rapid trades during volatile periods, it also warns about potential pitfalls:

Market Crashes: Elevated dispersion often precedes sharp declines—as seen during crypto crashes in 2022—that can wipe out substantial portions of investment portfolios if not managed carefully.

Investor Behavior: Awareness that certain assets exhibit extreme variability influences investor psychology—prompting cautious approaches during turbulent phases which could lead either toward safer havens or missed opportunities if misjudged.

Regulatory Implications: As authorities recognize increasing reliance on statistical measures like standard deviations within crypto markets’ frameworks—for assessing systemic risks—they may implement regulations aimed at curbing excessive speculation driven by unpredictable swings.

Incorporating Standard Deviation Into Your Investment Strategy

To leverage this powerful tool effectively:

- Analyze Historical Data Regularly: Calculate daily/weekly/monthly standards deviations for your holdings.

- Use Technical Indicators: Integrate Bollinger Bands into your charts for real-time signals.

- Compare Assets: Employ coefficients like CVs when choosing between different investment options based on your risk tolerance.

- Stay Updated With Market News: Recognize that external factors influence volatility beyond what historical data shows—a sudden regulatory change can spike uncertainty unexpectedly.

- Combine Quantitative & Qualitative Insights: Use statistics alongside fundamental analysis for comprehensive decision-making.

By doing so, you align your investment approach closer to empirical evidence while maintaining awareness about inherent uncertainties present within volatile markets such as cryptocurrencies today.

In summary, applying standardized measures like standard deviation enhances understanding around asset price behaviors significantly—from gauging current market conditions through technical indicators up to managing overall portfolio risks amid evolving financial landscapes—including rapidly changing sectors like digital currencies.

Lo

2025-05-09 05:40

How can standard deviation be applied to price analysis?