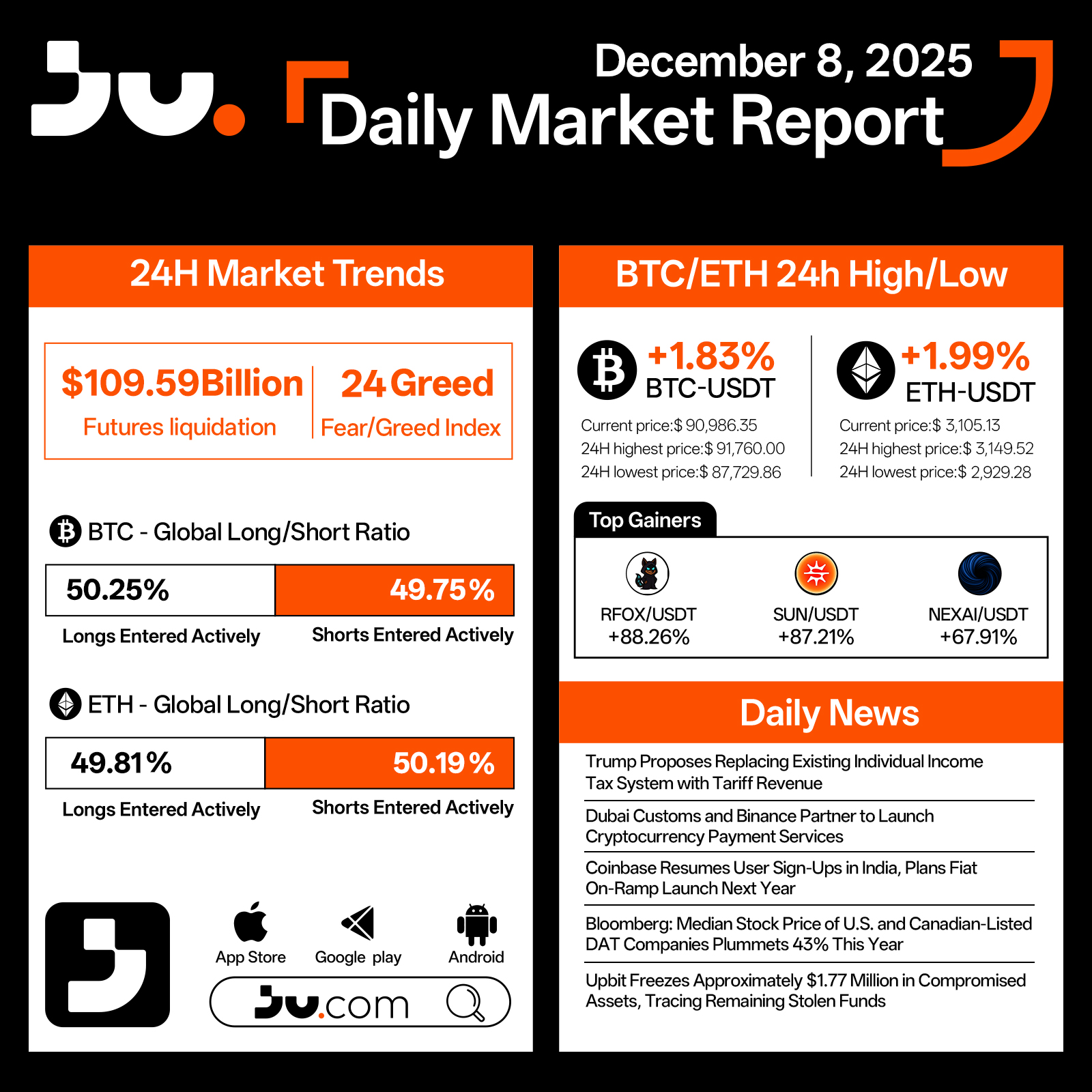

Crypto markets posted another day of modest gains on December 8, with major assets trending higher. Over the past 24 hours, total liquidations reached $109.59 billion, while the Fear & Greed Index held at 24, indicating gradually strengthening sentiment without signs of overheating. Bitcoin (BTC) rose 1.83% to $90,986.35, trading between $91,760.00 at the high and $87,729.86 at the low. Ethereum (ETH) outpaced BTC slightly, climbing 1.99% to $3,105.13, with intraday movement spanning from $3,149.52 to $2,929.28.

Derivatives data showed balanced positioning, with BTC at 50.25% longs and 49.75% shorts, while ETH recorded 49.81% longs versus 50.19% shorts. This equilibrium suggests an uncertain but gradually improving market outlook. A number of altcoins posted strong performances, led by RFOX/USDT with +88.26%, SUN/USDT with +87.21%, and NEXAI/USDT with +67.91%, highlighting ongoing speculative momentum.

In broader developments, Trump proposed replacing the current individual income tax system with tariff revenue, a policy shift that could significantly impact U.S. economic dynamics. Dubai Customs partnered with Binance to introduce cryptocurrency payment services, marking a major step for regulated digital payments in the region. Coinbase resumed sign-ups in India and announced plans to roll out fiat on-ramps next year. Bloomberg reported that the median stock price of U.S. and Canadian-listed DAT companies has plunged 43% this year, underscoring persistent market stress in high-rate environments. Upbit froze approximately $1.77 million in compromised assets and continues tracing remaining stolen funds.

Overall, the steady climb of BTC and ETH reflects improving confidence across the crypto market. With regulatory developments, payment integrations, and major platforms reactivating services, structural support for year-end market strength is gradually building.

#cryptocurrency #blockchain #finance #Blockchain

JU Blog

2025-12-08 06:47

BTC and ETH Extend Gains as Market Sentiment Continues to Improve – December 8, 2025

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

Ju.com announces a transformational $100 million JuChain Entrepreneurship Fund, marking the official start of its ecosystem expansion era. This fund positions JuChain not just as blockchain infrastructure, but as a complete growth platform integrating capital, technology, and real-world application scenarios.

💰 What This Means:

-

$100M dedicated fund for ecosystem projects

Transformation from exchange to ecosystem builder

Integration of blockchain, exchange, and payment systems into unified roadmap

Focus on real assets (RWA), AI, PayFi, and DeFi applications

Patient capital approach for long-term project development

🎯 Triple-Role Fund Structure:

1️⃣ Accelerator - Complete development path from concept to market: bootcamps, hackathons, MVP support, token economics design, and compliance frameworks

2️⃣ Investment Decision Center - Funding allocations prioritizing technical robustness, business viability, and on-chain/off-chain integration

3️⃣ Resource Orchestrator - Full access to Ju.com's traffic, listing pathways, payment scenarios, brand exposure, and global partner network

🌐 Key Opportunities for Builders:

-

AI Integration: Deploy intelligent trading agents and automated strategies with real liquidity and compliant payment rails

RWA Projects: Tokenize stocks, bonds, and yield rights with built-in compliance expertise

Payment & Consumption: Build seamless bridges between on-chain earnings and real-world utility

DeFi/GameFi/SocialFi: Leverage JuChain's account system for superior UX and composability

🏆 What Ju.com Brings to the Table:

-

Direct user traffic from established exchange platform

Integrated payment system (JuPay, JuCard, xBrokers)

Regulatory compliance frameworks

Global liquidity and listing support

Cross-border payment and settlement infrastructure

💡 Why Now?

-

Base layer competition shifting from performance to real business utility

Market demanding patient capital over short-term subsidy cycles

Convergence of real-world assets and crypto infrastructure

Timing aligned with AI + Crypto fusion and RWA narrative momentum

🎯 Target Ecosystem Profile:

-

Real assets and cash flows anchored on-chain with compliance

Developer-friendly infrastructure with user-invisible complexity

Self-sustaining ecosystem momentum through protocol composability

Bridge between traditional finance and crypto-native innovation

This is not just another blockchain fund announcement - it's a public declaration that JuChain's infrastructure is ready, and the ecosystem growth phase has officially begun. For Web3 builders seeking a committed partner with integrated resources, regulatory clarity, and real user pathways, this represents a new opportunity window worth serious evaluation.

Read the full strategic breakdown and ecosystem vision: 👇 https://blog.ju.com/juchain-100m-fund-ecosystem-growth/?utm_source=blog

#JuChain #Jucom #Web3 #Blockchain

JU Blog

2025-12-06 11:04

JuChain Launches $100M Entrepreneurship Fund - Ecosystem Breakout Year Begins!

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

What Is Ethereum’s Role in Smart Contracts?

Ethereum has become a cornerstone of blockchain technology, especially when it comes to enabling smart contracts. These self-executing agreements are transforming how transactions and digital interactions occur across various industries. Understanding Ethereum’s role in this ecosystem is essential for anyone interested in blockchain innovation, decentralized applications (dApps), or the future of digital finance.

How Ethereum Supports Smart Contracts

At its core, Ethereum provides a decentralized platform that allows developers to create and deploy smart contracts without relying on centralized authorities. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts on Ethereum automatically execute predefined rules once certain conditions are met. This automation reduces costs, increases transparency, and minimizes the risk of manipulation.

Ethereum's blockchain acts as an immutable ledger where these contracts are stored and executed. Once deployed, they run exactly as programmed—no third-party intervention needed—ensuring trustless interactions between parties. This feature makes Ethereum particularly appealing for applications requiring high security and transparency.

Programming Languages Powering Smart Contracts

One of the key strengths of Ethereum is its support for specialized programming languages designed explicitly for writing smart contracts. Solidity is by far the most popular language used within the ecosystem; it resembles JavaScript in syntax but offers features tailored to blockchain development.

Developers can craft complex logic within their smart contracts using Solidity, enabling functionalities such as token creation (ERC-20 tokens), voting mechanisms, financial derivatives, or even gaming logic. The flexibility provided by these languages allows for innovative use cases across sectors like finance (DeFi), gaming (NFTs), supply chain management, and more.

Gas Fees: The Cost of Running Smart Contracts

Executing smart contracts on Ethereum isn’t free; it involves paying gas fees measured in Ether (ETH). Gas represents computational effort required to process transactions or contract executions on the network. When users initiate a transaction involving a smart contract—say transferring tokens or executing a DeFi trade—they must pay an amount proportional to the complexity involved.

This fee mechanism helps prevent spam attacks but also introduces considerations around cost efficiency during periods of high network congestion. Recent upgrades aim to optimize gas consumption while maintaining security standards—a critical factor influencing user adoption and developer activity.

Smart Contracts’ Role in Decentralized Applications

Smart contracts form the backbone of decentralized applications (dApps). These apps operate without central servers; instead, they rely entirely on code running securely on blockchains like Ethereum. From simple token swaps via platforms like Uniswap to complex lending protocols such as Aave or Compound—these dApps leverage smart contract logic extensively.

The ability to automate processes ensures that dApps can offer services with increased transparency and reduced reliance on intermediaries—a significant advantage over traditional centralized systems. As a result, industries ranging from finance to entertainment have embraced this technology for creating innovative solutions that prioritize user control over assets and data.

Security Challenges Associated With Smart Contracts

While offering numerous benefits—including automation and decentralization—smart contracts also pose security risks if not properly coded or audited. Bugs within contract code can lead to vulnerabilities exploitable by hackers; notable incidents include The DAO hack in 2016 which resulted in millions lost due to flawed code execution.

To mitigate these risks:

- Developers conduct thorough audits before deployment.

- Specialized firms provide security assessments.

- Formal verification methods are increasingly adopted.

Despite advancements in security practices, vulnerabilities remain possible due to human error or unforeseen edge cases within complex logic structures.

Scalability Issues And Upgrades Like Ethereum 2.0

As demand grows for dApps built atop Ethereum’s platform—including DeFi projects and NFTs—the network faces scalability challenges limiting transaction throughput and increasing fees during peak times. To address this:

- Ethereum 2.x aims at transitioning from proof-of-work (PoW) consensus mechanisms toward proof-of-stake (PoS).

- It introduces sharding techniques allowing parallel processing across multiple chains.

These upgrades promise faster transaction speeds with lower costs while enhancing overall network security—a crucial step toward mainstream adoption of blockchain-based solutions involving smart contracts.

Layer 2 Solutions Enhancing Performance

In addition to core upgrades:

- Layer 2 solutions such as Polygon (formerly Matic), Optimism, Arbitrum facilitate off-chain processing.

- They enable faster transactions at reduced costs by batching operations before settling them back onto mainnet.

These innovations help bridge current performance gaps until full-scale upgrades mature.

Regulatory Environment And Its Impact On Smart Contract Adoption

Legal frameworks surrounding blockchain technology continue evolving worldwide—and their influence directly affects how businesses develop with smart contracts on platforms like Ethereum:

- Governments seek clarity around issues such as securities classification for tokens created via smart contract protocols.

- Regulatory uncertainty may hinder innovation if overly restrictive policies emerge.

Conversely:

- Clear guidelines foster trust among users,

- Encourage institutional participation,

- Promote responsible development practices aligned with legal standards.

Importance Of Compliance And Auditing

Given potential legal implications:

- Regular audits ensure compliance with applicable regulations,

- Transparent documentation builds user confidence,3.. Collaboration between developers & regulators promotes sustainable growth.

Future Outlook: Risks And Opportunities

Despite impressive progress made through recent updates like ETH 2.x enhancements:

Risks remain, including:

- Security vulnerabilities leading potentially catastrophic losses,

- Regulatory uncertainties stalling broader adoption,

- Environmental concerns related mainly to energy-intensive proof-of-work models,

Opportunities abound through ongoing innovations:

1.. Continued scalability improvements will make dApps more accessible globally,2.. Growing sectors such as DeFi & NFTs expand use cases leveraging robust smart contract capabilities,3.. Increasing regulatory clarity could accelerate institutional involvement,

By balancing technological advancements with rigorous security measures—and aligning developments with evolving legal landscapes—Ethereum continues shaping its pivotal role at the heart of modern decentralized ecosystems.

Understanding how Ethereum supports intelligent automation through secure & scalable infrastructure reveals why it's considered foundational within blockchain technology today—and why ongoing developments will determine its future trajectory amidst emerging challenges & opportunities alike

JCUSER-IC8sJL1q

2025-05-09 12:40

What is Ethereum’s role in smart contracts?

What Is Ethereum’s Role in Smart Contracts?

Ethereum has become a cornerstone of blockchain technology, especially when it comes to enabling smart contracts. These self-executing agreements are transforming how transactions and digital interactions occur across various industries. Understanding Ethereum’s role in this ecosystem is essential for anyone interested in blockchain innovation, decentralized applications (dApps), or the future of digital finance.

How Ethereum Supports Smart Contracts

At its core, Ethereum provides a decentralized platform that allows developers to create and deploy smart contracts without relying on centralized authorities. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts on Ethereum automatically execute predefined rules once certain conditions are met. This automation reduces costs, increases transparency, and minimizes the risk of manipulation.

Ethereum's blockchain acts as an immutable ledger where these contracts are stored and executed. Once deployed, they run exactly as programmed—no third-party intervention needed—ensuring trustless interactions between parties. This feature makes Ethereum particularly appealing for applications requiring high security and transparency.

Programming Languages Powering Smart Contracts

One of the key strengths of Ethereum is its support for specialized programming languages designed explicitly for writing smart contracts. Solidity is by far the most popular language used within the ecosystem; it resembles JavaScript in syntax but offers features tailored to blockchain development.

Developers can craft complex logic within their smart contracts using Solidity, enabling functionalities such as token creation (ERC-20 tokens), voting mechanisms, financial derivatives, or even gaming logic. The flexibility provided by these languages allows for innovative use cases across sectors like finance (DeFi), gaming (NFTs), supply chain management, and more.

Gas Fees: The Cost of Running Smart Contracts

Executing smart contracts on Ethereum isn’t free; it involves paying gas fees measured in Ether (ETH). Gas represents computational effort required to process transactions or contract executions on the network. When users initiate a transaction involving a smart contract—say transferring tokens or executing a DeFi trade—they must pay an amount proportional to the complexity involved.

This fee mechanism helps prevent spam attacks but also introduces considerations around cost efficiency during periods of high network congestion. Recent upgrades aim to optimize gas consumption while maintaining security standards—a critical factor influencing user adoption and developer activity.

Smart Contracts’ Role in Decentralized Applications

Smart contracts form the backbone of decentralized applications (dApps). These apps operate without central servers; instead, they rely entirely on code running securely on blockchains like Ethereum. From simple token swaps via platforms like Uniswap to complex lending protocols such as Aave or Compound—these dApps leverage smart contract logic extensively.

The ability to automate processes ensures that dApps can offer services with increased transparency and reduced reliance on intermediaries—a significant advantage over traditional centralized systems. As a result, industries ranging from finance to entertainment have embraced this technology for creating innovative solutions that prioritize user control over assets and data.

Security Challenges Associated With Smart Contracts

While offering numerous benefits—including automation and decentralization—smart contracts also pose security risks if not properly coded or audited. Bugs within contract code can lead to vulnerabilities exploitable by hackers; notable incidents include The DAO hack in 2016 which resulted in millions lost due to flawed code execution.

To mitigate these risks:

- Developers conduct thorough audits before deployment.

- Specialized firms provide security assessments.

- Formal verification methods are increasingly adopted.

Despite advancements in security practices, vulnerabilities remain possible due to human error or unforeseen edge cases within complex logic structures.

Scalability Issues And Upgrades Like Ethereum 2.0

As demand grows for dApps built atop Ethereum’s platform—including DeFi projects and NFTs—the network faces scalability challenges limiting transaction throughput and increasing fees during peak times. To address this:

- Ethereum 2.x aims at transitioning from proof-of-work (PoW) consensus mechanisms toward proof-of-stake (PoS).

- It introduces sharding techniques allowing parallel processing across multiple chains.

These upgrades promise faster transaction speeds with lower costs while enhancing overall network security—a crucial step toward mainstream adoption of blockchain-based solutions involving smart contracts.

Layer 2 Solutions Enhancing Performance

In addition to core upgrades:

- Layer 2 solutions such as Polygon (formerly Matic), Optimism, Arbitrum facilitate off-chain processing.

- They enable faster transactions at reduced costs by batching operations before settling them back onto mainnet.

These innovations help bridge current performance gaps until full-scale upgrades mature.

Regulatory Environment And Its Impact On Smart Contract Adoption

Legal frameworks surrounding blockchain technology continue evolving worldwide—and their influence directly affects how businesses develop with smart contracts on platforms like Ethereum:

- Governments seek clarity around issues such as securities classification for tokens created via smart contract protocols.

- Regulatory uncertainty may hinder innovation if overly restrictive policies emerge.

Conversely:

- Clear guidelines foster trust among users,

- Encourage institutional participation,

- Promote responsible development practices aligned with legal standards.

Importance Of Compliance And Auditing

Given potential legal implications:

- Regular audits ensure compliance with applicable regulations,

- Transparent documentation builds user confidence,3.. Collaboration between developers & regulators promotes sustainable growth.

Future Outlook: Risks And Opportunities

Despite impressive progress made through recent updates like ETH 2.x enhancements:

Risks remain, including:

- Security vulnerabilities leading potentially catastrophic losses,

- Regulatory uncertainties stalling broader adoption,

- Environmental concerns related mainly to energy-intensive proof-of-work models,

Opportunities abound through ongoing innovations:

1.. Continued scalability improvements will make dApps more accessible globally,2.. Growing sectors such as DeFi & NFTs expand use cases leveraging robust smart contract capabilities,3.. Increasing regulatory clarity could accelerate institutional involvement,

By balancing technological advancements with rigorous security measures—and aligning developments with evolving legal landscapes—Ethereum continues shaping its pivotal role at the heart of modern decentralized ecosystems.

Understanding how Ethereum supports intelligent automation through secure & scalable infrastructure reveals why it's considered foundational within blockchain technology today—and why ongoing developments will determine its future trajectory amidst emerging challenges & opportunities alike

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

What Is Web3? A Complete Overview of the Next Generation Internet

Understanding Web3: The Future of Decentralized Internet

Web3 is rapidly emerging as a transformative concept that promises to reshape how we interact with digital platforms. Unlike the traditional internet, often referred to as Web2, which is dominated by centralized servers and large corporations, Web3 aims to create a more open, user-centric online environment. Built on blockchain technology and decentralized principles, it empowers users with greater control over their data and digital assets. This shift could lead to more secure transactions, transparent interactions, and new economic models like decentralized finance (DeFi) and non-fungible tokens (NFTs).

The core idea behind Web3 is decentralization—distributing power away from centralized authorities such as tech giants or governments toward individual users and communities. This approach not only enhances privacy but also reduces reliance on intermediaries that often limit user agency. As a result, Web3 envisions an internet where users are both consumers and owners of their digital identities.

Historical Context: From Blockchain Beginnings to Modern Vision

The roots of Web3 trace back to the inception of blockchain technology with Bitcoin in 2008 by Satoshi Nakamoto. Bitcoin introduced the concept of a peer-to-peer electronic cash system without central authority oversight. Following this breakthrough, numerous projects expanded on blockchain capabilities—Ethereum being one notable example—by enabling programmable contracts known as smart contracts.

Gavin Wood, co-founder of Ethereum, popularized the term "Web3" around 2014-2015 during discussions about creating an internet infrastructure that leverages these decentralized systems. His vision was for an online ecosystem where applications operate directly on blockchain networks rather than relying on centralized servers controlled by corporations.

Key Components That Define Web3

Several technological innovations underpin the development of Web3:

- Blockchain Technology: Serves as the foundational ledger ensuring transparency and security for all transactions.

- Decentralization: Data storage across multiple nodes prevents single points of failure or control.

- Smart Contracts: Self-executing agreements written into code facilitate automated interactions without intermediaries.

- Cryptocurrencies: Digital assets like Bitcoin or Ethereum are integral but extend beyond mere currency—they enable functionalities within decentralized applications.

- Decentralized Applications (dApps): Apps built atop blockchain networks that operate without central authority influence.

- NFTs (Non-Fungible Tokens): Unique digital assets representing ownership rights over art or collectibles in virtual spaces.

These components work together to create an ecosystem where trustless transactions are possible—meaning parties can interact securely without needing mutual trust beforehand.

Recent Developments Shaping Web3 Today

The landscape surrounding Web3 continues evolving at a rapid pace:

Ethereum's Transition to Ethereum 2.0

Ethereum is undergoing a major upgrade aimed at improving scalability through proof-of-stake consensus mechanisms instead of energy-intensive proof-of-work algorithms. This transition seeks to reduce transaction costs significantly while increasing network capacity—a critical step toward mainstream adoption.Growth in Decentralized Finance (DeFi)

Platforms like Uniswap and Aave have revolutionized financial services by offering lending, borrowing, trading—all executed via smart contracts without traditional banks or brokers involved. DeFi's explosive growth signals growing confidence in decentralized financial systems outside conventional banking frameworks.NFT Market Expansion

Non-fungible tokens have gained popularity among artists, collectors—and even brands—as they provide verifiable ownership over digital art pieces or collectibles stored securely on blockchains like Ethereum or Solana platforms such as OpenSea or Rarible.Regulatory Attention & Challenges

Governments worldwide are increasingly scrutinizing cryptocurrencies and related technologies due to concerns about money laundering risks or consumer protection issues while trying not stifle innovation altogether—a delicate balance shaping policy developments globally.

Potential Risks & Challenges Facing Web3 Adoption

Despite its promising outlooks; several hurdles threaten widespread implementation:

Regulatory Uncertainty: Lack of clear legal frameworks may hinder growth; overly restrictive policies could suppress innovation.

Scalability Issues: Current blockchain networks face congestion problems when handling large volumes—solutions like layer-two protocols aim to address this but remain under development.

Security Concerns: Smart contract vulnerabilities can be exploited if not properly audited; recent high-profile hacks underscore these risks.

Environmental Impact: Proof-of-work blockchains consume significant energy resources; transitioning towards eco-friendly consensus mechanisms remains vital for sustainability efforts.

How Stakeholders Can Prepare for a Decentralized Future

For developers, investors, policymakers—and everyday users—the key lies in understanding these dynamics:

- Stay informed about technological advancements such as layer-two scaling solutions

- Advocate for balanced regulation that fosters innovation while protecting consumers

- Prioritize security measures including thorough audits before deploying smart contracts4.. Support environmentally sustainable practices within blockchain ecosystems5.. Educate oneself about managing private keys safely—the foundation for owning digital assets securely

By proactively engaging with these aspects today; stakeholders can help shape an inclusive web future rooted in decentralization principles aligned with user empowerment and transparency standards.

Exploring How Users Benefit from Moving Toward Decentralization

Web3’s promise extends beyond technological novelty—it offers tangible benefits for everyday internet users:

• Greater Data Privacy & Control – Users own their personal information rather than surrendering it wholesale to corporate entities

• Reduced Censorship – Content moderation becomes more community-driven rather than dictated solely by platform policies

• New Economic Opportunities – Participation in DeFi markets allows earning interest through lending pools; creators can monetize NFTs directly

• Enhanced Security – Distributed ledgers make tampering difficult compared with traditional databases

These advantages highlight why many see web decentralization not just as an upgrade but as a fundamental shift towards empowering individuals online.

Looking Ahead: The Future Trajectory Of Web3 Development

While still nascent compared with established web paradigms; ongoing innovations suggest robust growth potential:

– Continued improvements in scalability solutions will make dApps faster & cheaper

– Broader regulatory clarity could foster safer environments for investment & participation

– Integration across IoT devices might enable truly interconnected decentralized ecosystems

– Increased mainstream adoption driven by enterprise interest—from finance firms adopting DeFi tools—to social media platforms experimenting with NFT integrations

As stakeholders—including developers who build infrastructure,and regulators shaping policy—collaborate effectively; we may witness widespread transformation into what many envision as “the next-generation internet.”

JCUSER-F1IIaxXA

2025-05-15 03:28

What is Web3?

What Is Web3? A Complete Overview of the Next Generation Internet

Understanding Web3: The Future of Decentralized Internet

Web3 is rapidly emerging as a transformative concept that promises to reshape how we interact with digital platforms. Unlike the traditional internet, often referred to as Web2, which is dominated by centralized servers and large corporations, Web3 aims to create a more open, user-centric online environment. Built on blockchain technology and decentralized principles, it empowers users with greater control over their data and digital assets. This shift could lead to more secure transactions, transparent interactions, and new economic models like decentralized finance (DeFi) and non-fungible tokens (NFTs).

The core idea behind Web3 is decentralization—distributing power away from centralized authorities such as tech giants or governments toward individual users and communities. This approach not only enhances privacy but also reduces reliance on intermediaries that often limit user agency. As a result, Web3 envisions an internet where users are both consumers and owners of their digital identities.

Historical Context: From Blockchain Beginnings to Modern Vision

The roots of Web3 trace back to the inception of blockchain technology with Bitcoin in 2008 by Satoshi Nakamoto. Bitcoin introduced the concept of a peer-to-peer electronic cash system without central authority oversight. Following this breakthrough, numerous projects expanded on blockchain capabilities—Ethereum being one notable example—by enabling programmable contracts known as smart contracts.

Gavin Wood, co-founder of Ethereum, popularized the term "Web3" around 2014-2015 during discussions about creating an internet infrastructure that leverages these decentralized systems. His vision was for an online ecosystem where applications operate directly on blockchain networks rather than relying on centralized servers controlled by corporations.

Key Components That Define Web3

Several technological innovations underpin the development of Web3:

- Blockchain Technology: Serves as the foundational ledger ensuring transparency and security for all transactions.

- Decentralization: Data storage across multiple nodes prevents single points of failure or control.

- Smart Contracts: Self-executing agreements written into code facilitate automated interactions without intermediaries.

- Cryptocurrencies: Digital assets like Bitcoin or Ethereum are integral but extend beyond mere currency—they enable functionalities within decentralized applications.

- Decentralized Applications (dApps): Apps built atop blockchain networks that operate without central authority influence.

- NFTs (Non-Fungible Tokens): Unique digital assets representing ownership rights over art or collectibles in virtual spaces.

These components work together to create an ecosystem where trustless transactions are possible—meaning parties can interact securely without needing mutual trust beforehand.

Recent Developments Shaping Web3 Today

The landscape surrounding Web3 continues evolving at a rapid pace:

Ethereum's Transition to Ethereum 2.0

Ethereum is undergoing a major upgrade aimed at improving scalability through proof-of-stake consensus mechanisms instead of energy-intensive proof-of-work algorithms. This transition seeks to reduce transaction costs significantly while increasing network capacity—a critical step toward mainstream adoption.Growth in Decentralized Finance (DeFi)

Platforms like Uniswap and Aave have revolutionized financial services by offering lending, borrowing, trading—all executed via smart contracts without traditional banks or brokers involved. DeFi's explosive growth signals growing confidence in decentralized financial systems outside conventional banking frameworks.NFT Market Expansion

Non-fungible tokens have gained popularity among artists, collectors—and even brands—as they provide verifiable ownership over digital art pieces or collectibles stored securely on blockchains like Ethereum or Solana platforms such as OpenSea or Rarible.Regulatory Attention & Challenges

Governments worldwide are increasingly scrutinizing cryptocurrencies and related technologies due to concerns about money laundering risks or consumer protection issues while trying not stifle innovation altogether—a delicate balance shaping policy developments globally.

Potential Risks & Challenges Facing Web3 Adoption

Despite its promising outlooks; several hurdles threaten widespread implementation:

Regulatory Uncertainty: Lack of clear legal frameworks may hinder growth; overly restrictive policies could suppress innovation.

Scalability Issues: Current blockchain networks face congestion problems when handling large volumes—solutions like layer-two protocols aim to address this but remain under development.

Security Concerns: Smart contract vulnerabilities can be exploited if not properly audited; recent high-profile hacks underscore these risks.

Environmental Impact: Proof-of-work blockchains consume significant energy resources; transitioning towards eco-friendly consensus mechanisms remains vital for sustainability efforts.

How Stakeholders Can Prepare for a Decentralized Future

For developers, investors, policymakers—and everyday users—the key lies in understanding these dynamics:

- Stay informed about technological advancements such as layer-two scaling solutions

- Advocate for balanced regulation that fosters innovation while protecting consumers

- Prioritize security measures including thorough audits before deploying smart contracts4.. Support environmentally sustainable practices within blockchain ecosystems5.. Educate oneself about managing private keys safely—the foundation for owning digital assets securely

By proactively engaging with these aspects today; stakeholders can help shape an inclusive web future rooted in decentralization principles aligned with user empowerment and transparency standards.

Exploring How Users Benefit from Moving Toward Decentralization

Web3’s promise extends beyond technological novelty—it offers tangible benefits for everyday internet users:

• Greater Data Privacy & Control – Users own their personal information rather than surrendering it wholesale to corporate entities

• Reduced Censorship – Content moderation becomes more community-driven rather than dictated solely by platform policies

• New Economic Opportunities – Participation in DeFi markets allows earning interest through lending pools; creators can monetize NFTs directly

• Enhanced Security – Distributed ledgers make tampering difficult compared with traditional databases

These advantages highlight why many see web decentralization not just as an upgrade but as a fundamental shift towards empowering individuals online.

Looking Ahead: The Future Trajectory Of Web3 Development

While still nascent compared with established web paradigms; ongoing innovations suggest robust growth potential:

– Continued improvements in scalability solutions will make dApps faster & cheaper

– Broader regulatory clarity could foster safer environments for investment & participation

– Integration across IoT devices might enable truly interconnected decentralized ecosystems

– Increased mainstream adoption driven by enterprise interest—from finance firms adopting DeFi tools—to social media platforms experimenting with NFT integrations

As stakeholders—including developers who build infrastructure,and regulators shaping policy—collaborate effectively; we may witness widespread transformation into what many envision as “the next-generation internet.”

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

📹 Watch the recap video on YouTube to update all the statistics and the most impressive moments! 🚀

👉 https://www.youtube.com/shorts/cQ1YJ_YQlFg

#JuCoin #JuCoinVietnam #Crypto #Airdrop #Blockchain #Web3 #CryptoCommunity

Lee | Ju.Com

2025-08-21 07:58

🤩 #JuCoin's Million Airdrop event has officially ended!

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Xem chia sẻ của Jucoin CEO Sammi Li về chủ đề này trên DecryptMedia 👇🏻

🔗 https://decrypt.co/335292/whats-driving-ethereums-surge-and-can-it-last

#JuCoin #JucoinVietnam #Ethereum #ETH #Blockchain

Lee | Ju.Com

2025-08-15 06:24

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

The fusion of AI and blockchain is creating a revolutionary new paradigm - moving away from centralized AI controlled by tech giants toward distributed, transparent, and democratic systems. This isn't just theoretical - it's happening now with real-world applications.

🌐 Why Decentralized AI Matters:

-

Breaks Tech Monopolies: Distributes AI models and data across networks instead of centralized control

Transparency & Trust: Blockchain records AI decision-making processes, solving the "black box problem"

Enhanced Security: Eliminates single points of failure - if one node is compromised, the network continues

Data Privacy: Uses federated learning - sensitive data stays on local devices while contributing to global models

💰 Token Economics Drive the Ecosystem:

-

Payment Layer: Users pay for AI services with native tokens

Incentive System: Rewards for providing computing power, training models, and sharing datasets

Governance Rights: Token holders vote on protocol upgrades and funding decisions

Reputation Mechanism: Staking tokens signals data quality and network participation

🔧 Real-World Applications:

-

SingularityNET & Ocean Protocol: Marketplaces for AI services and datasets

Bittensor: Decentralized network rewarding machine learning model contributions

Federated Learning: Training AI models without exposing raw data

Supply Chain Optimization: AI-driven logistics with blockchain verification

🚀 Key Benefits:

-

Democratized Access: Anyone with unused GPU can contribute and earn tokens

Lower Barriers: Transforms AI development from capital-intensive to community-driven

Verifiable AI: Blockchain immutability enables auditable AI decisions

Self-Sustaining Growth: Network effects create powerful flywheel - more participants = stronger network = higher token value

💡 Investment Opportunity: You can invest in this revolution by researching and buying native tokens of leading decentralized AI projects. Always conduct thorough due diligence on whitepapers, teams, and use cases.

Bottom Line: Decentralized AI isn't just about moving computing off central servers - it's building a new economy where AI development is transparent, inclusive, and community-owned. The convergence is already producing tangible solutions across industries.

Read the complete guide on how blockchain and AI are reshaping the future: 👇 https://blog.jucoin.com/decentralized-ai-combines-blockchain/?utm_source=blog

#DecentralizedAI #Blockchain #AI #Cryptocurrency #Web3

JU Blog

2025-08-16 08:46

🤖 Decentralized AI Combines Blockchain for Secure Systems

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

Le Genesis Ark de #JuChain lance un fonds de 100 M$ pour propulser vos projets blockchain 💥 ⚡ 1s finalité • ultra-low fees • full EVM compatible

Qui est prêt à builder l’avenir ? 🔥

#JuChain #Web3 #Blockchain

Carmelita

2025-08-15 22:13

📣 Web3 Builders, c’est votre moment !

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

Zero-Knowledge Proofs have evolved from academic theory to blockchain's most transformative infrastructure technology. With market projections reaching $10 billion by 2030 and 87 billion proofs expected annually, ZK technology is revolutionizing privacy and scalability across Web3.

💰 Massive Market Opportunity:

-

Growth Trajectory: Market expanding from $97M (2025) to $1.34B+ (2030)

Proof Volume: 87 billion zero-knowledge proofs annually by 2030

Average Pricing: $0.12 per proof declining to $0.001 as efficiency improves

Revenue Drivers: ZK-rollups, cross-chain bridges, privacy apps, enterprise solutions

🧠 What Are ZK Proofs? Revolutionary cryptographic technology enabling proof of knowledge WITHOUT revealing the underlying data:

-

Privacy: Prove you're over 18 without showing your birthdate

Security: Cryptographically verify computation correctness

Efficiency: Validate complex operations with minimal data

🚀 ZK-Rollups Leading Adoption:

-

zkSync Era: 276% transaction growth quarter-over-quarter

Polygon zkEVM: $312M TVL with 240% YoY growth, full EVM compatibility

StarkNet: High-performance architecture using Cairo and STARK proofs

Key Advantage: Instant finality vs 7-day optimistic rollup delays

🌐 Real-World Applications:

-

DeFi: 40+ ZK protocols with $21B+ combined market cap

Privacy Coins: Zcash enabling confidential transactions with selective disclosure

Enterprise: Google open-sourced ZK libraries for identity verification

Gaming: Immutable X supporting millions of NFT trades with zero gas fees

Healthcare: Patient data sharing while preserving privacy

💡 Investment Landscape:

-

VC Interest: Major funding from a16z Crypto, Paradigm

Technical Breakthrough: StarkWare's mobile proving capabilities

Hardware Evolution: 10% annual cost reduction through specialized chips

⚠️ Key Risks:

-

Computational intensity and implementation complexity

Intense competition among ZK platforms

Regulatory uncertainty around privacy technologies

Dependence on continued technological advancement

🎯 Investment Evaluation Criteria:

-

Total Value Locked (TVL) growth

Transaction volume and user adoption

Developer ecosystem strength

Technical differentiation and team expertise

Bottom Line: ZK proofs solve blockchain's fundamental trilemma of security, decentralization, and scalability. This infrastructure technology parallels early cloud computing - creating massive value by enabling entirely new application categories. The transition from experimental to production-ready is happening now.

Read the complete analysis on ZK proofs market dynamics and investment opportunities: 👇 https://blog.jucoin.com/zk-proofs-market-revolution/?utm_source=blog

#ZKProofs #ZeroKnowledge #Blockchain

JU Blog

2025-08-16 08:48

🔐 ZK Proofs: $10B Revenue and Privacy Revolution

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

The privacy coin sector has exploded from the shadows with a historic rally. Zcash surged 2,200%+ from $35 to $750 in just three months, catapulting the entire privacy segment past $64 billion market cap. This isn't hype—it's a structural repricing driven by four converging forces that have been building for years.

What's Driving the Surge:

Zcash completed its second halving in November 2024, slashing block rewards and annual issuance by 50%. Even more critical: 30% of circulating ZEC is now locked in shielded pools (up from just 5% two years ago), creating a massive supply squeeze. When Bitcoin hit its second halving, it climbed from $650 to nearly $20,000—ZEC is following an almost identical supply curve, just seven years later.

Privacy has shifted from optional to essential. The 2025 U.S. Justice Department seizure of 127,000 BTC from a Cambodian syndicate proved that transparent blockchains offer zero protection against nation-state surveillance. Your wallet address is now a public wealth registry—exposing you to targeted extortion, physical threats, and sophisticated attacks. For high-net-worth individuals and corporations, privacy isn't philosophical anymore, it's a security imperative.

Zero-knowledge proof technology has gone from lab experiment to production-ready infrastructure. Zcash's Halo 2 upgrade eliminated the controversial "trusted setup," while the Orchard shielded pool and NU5/NU6 upgrades transformed user experience. Shielded pool usage has rocketed from 5% to 30% of transactions—privacy is now mainstream, not just for crypto geeks.

The Critical Divide: Zcash vs Monero

Monero insists on mandatory privacy for every transaction, making it the darknet favorite but also a regulatory target. Result: mass delistings from major exchanges, liquidity collapse, and 8-12% OTC spreads. XMR now handles 45% of darknet payments but faces an existential threat from EU regulations.

Zcash chose the pragmatic path: optional privacy with "view keys" that let users selectively disclose transaction history to auditors or regulators without giving up control. You can buy ZEC on compliant exchanges via transparent addresses, then move it into shielded pools in self-custody wallets like Zashi. This "compliant privacy" approach keeps ZEC trading on major platforms while delivering strong zero-knowledge proof protection.

The 2027 Regulatory Watershed:

The EU's Anti-Money Laundering Regulation 2024/1624 goes live July 1, 2027—less than 2 years away. Article 79 explicitly bans crypto service providers from offering "anonymity-enhancing assets." The new AMLA authority in Frankfurt will oversee 40+ major exchanges with fines up to 10% of annual revenue or €10 million, plus license revocations.

Binance already delisted Monero in early 2024. Kraken is phasing out XMR across the EEA by 2025. Coinbase never listed fully anonymous coins. But most exchanges have kept ZEC trading alive via transparent addresses, recognizing its compliance pathway. If ZEC secures formal exemptions as a "compliant privacy" standard, it could become the bridge between traditional finance and decentralized privacy—while XMR gets squeezed into gray markets.

Investment Fundamentals:

ZEC trades at a 20.34x FDV-to-earnings ratio versus Hyperliquid's 68.66x and Jupiter's 29.48x—suggesting the privacy narrative isn't overheated yet. With 60%+ of addresses holding for over a year (up from 35% in early 2023) and 30% locked in shielded pools, the "chip structure" shows genuine conviction, not speculator churn.

Grayscale's $120M ZEC trust may be small, but it proves institutional acceptability within traditional finance frameworks. If it converts to an ETF, compliant capital could flood in and reset valuation anchors permanently. Pantera Capital has held since 2016 and never exited—a long-term vote of confidence.

The Bigger Picture:

Zero-knowledge proofs are becoming Web3 infrastructure, not just a privacy coin feature. ZK rollups like zkSync and StarkNet now hold $4B+ TVL for Ethereum scaling. ZK identity systems are enabling RWA tokenization, on-chain private equity, and compliant DeFi. Zcash's Halo 2 technology is being reused across multiple projects. Holding ZEC is a bet on zero-knowledge proofs becoming a foundational paradigm for the next decade of Web3.

Real-world asset tokenization is crypto's next trillion-dollar market, and privacy will be mandatory infrastructure. Whether it's fractional real estate, on-chain private equity, or supply chain finance, institutions can't expose sensitive transaction data on transparent blockchains. ZEC's view keys and selective disclosure capabilities position it as the "compliant privacy standard" for enterprise adoption.

Three Scenarios (Ju.com Analysis):

Bear Case (30% probability): Complete regulatory ban, no exemptions, ZEC delisted from all major exchanges, use cases shrink to gray markets.

Base Case (50% probability): Tightening regulation with limited exemptions. ZEC maintains constrained compliant channels via transparent addresses. XMR retreats further underground. Privacy sector market cap contracts 30-50% but user conviction strengthens.

Bull Case (20% probability): ZEC becomes the recognized "compliant privacy" standard. Grayscale trust converts to ETF, institutional adoption in cross-border settlements and RWA. Major enterprises use ZEC for confidential transactions while maintaining auditability.

The enterprise inflection point could hit 2026-2027 as cross-border settlements, premium payment services, and audit firms deploy ZEC-based solutions at scale. Once privacy coins move from speculative assets to production tools with real cash flows, valuation shifts from narrative to fundamentals.

Investment Strategy:

Short-term: Expect 50%+ drawdowns from macro and regulatory volatility. This is not a trade, it's a multi-year thesis.

Long-term: Treat privacy coins as structural portfolio hedges with 2+ year holding periods. ZEC offers the highest probability path to institutional acceptance and compliant use cases. XMR serves as tail-risk insurance against extreme surveillance scenarios—best kept as a small allocation.

As Arthur Hayes put it: "Gold hedges inflation for nations, Bitcoin hedges inflation for people, and Zcash is humanity's last line of defense for financial privacy." Whether ZEC hits $1,000 or retraces to $100, privacy technology will reshape Web3 infrastructure over the next decade.

Investing in privacy coins isn't just betting on an asset class—it's voting for a world where people still have spaces they're not being watched.

Read the full in-depth analysis: https://blog.ju.com/privacy-coins-report/?utm_source=blog

#PrivacyCoins #Zcash#Blockchain #Zero-Knowledge Proofs

JU Blog

2025-11-26 15:54

Privacy Coins Report: From Niche to Mainstream

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

🛡 JuCoin101 — Learn how JuCoin protects your assets!👌

✅ Multi-layered security technology:

▪️Multi-signature cold storage technology, 99% of assets are stored offline.

▪️Real-time monitoring system with 24/7 risk warning.

▪️Distributed architecture ensures stable and reliable system.

✅ Leading risk control system:

▪️Experienced team of experts in traditional finance & digital assets.

▪️Intelligent risk control algorithm, real-time abnormal transaction detection.

▪️Comprehensive compliance process, strictly adhere to international security standards.

✅ Trusted by users:

▪️The number of users is constantly increasing, with daily activity leading the industry.

▪️There has never been a user asset security incident.

▪️Community reputation is increasingly consolidated, receiving many positive feedbacks from real users.

✅ 3 times protection fund to ensure user assets:

▪️The fund is managed independently, used for protection purposes only.

▪️Regular public audits with 100% transparency.

▪️Emergency response mechanism to quickly handle unexpected situations.

🎁 Get benefits now >>> https://bit.ly/3ZvWEto

👉 Register JuCoin now: https://bit.ly/3BVxlZ2

#JuCoin #JuCoinVietnam #Crypto #Blockchain #Web3 #Security #RiskControl #CryptoCommunity

Lee | Ju.Com

2025-08-21 07:53

🛡 JuCoin Insights | JuCoin101 — Learn how JuCoin protects your assets!👌

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

🌟 Fed Chair Candidates Hint at Sharp Rate Cuts: Crypto Impact Analysis!

📰 The Trump administration is considering 11 candidates for the Fed Chair position, including market strategists Sumerlin and Zervos, who advocate a 50–200 basis point rate cut. This easing policy could fuel a strong rally in the crypto market thanks to increased liquidity and risk appetite.

🔎 Read more: https://blog.jucoin.com/fed-chair-rate-cuts-crypto/

#JuCoin #JuCoinVietnam #JuCoinInsights #Crypto #Blockchain #DeFi #Web3 #CryptoNews #MarketInsights

Lee | Ju.Com

2025-08-21 07:58

📣 JuCoin Insights | Fed Chair Candidates Hint at Sharp Rate Cuts: Crypto Impact Analysis! 🌟

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

📹 Watch the recap video on YouTube to update all the statistics and the most impressive moments! 🚀

👉 https://www.youtube.com/shorts/cQ1YJ_YQlFg

#JuCoin #JuCoinVietnam #Crypto #Airdrop #Blockchain #Web3 #CryptoCommunity

Lee | Ju.Com

2025-08-20 12:02

🤩 #JuCoin's Million Airdrop event has officially ended!

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

↗️ Challenge your prediction skills every week! Predict the closing price of #BTC and comment your prediction

🎁 Top 10 people who predict closest to the closing price at 11:00 on 26/08/2025 (UTC+7) will share 50 USDT!

📢 How to participate:

1️⃣ Join https://t.me/Jucoin_Vietnam, post in Telegram group with syntax: :#BTCPriceGuess + price. Example: #BTCPriceGuess $116,980.01"

2️⃣ Make sure to submit your prediction before 11:00 on 25/08/2025 (UTC+7)

3️⃣ Each person can only predict once, no editing allowed. If many people choose the same price, the reward will go to the person who submitted first.

🛫 Join us every week and seize the chance to win!

#JuCoin #JuCoinVietnam #Crypto #BTC #Blockchain #Web3 #JuCoinTrading #CryptoCommunity

Lee | Ju.Com

2025-08-20 12:05

🎰 JuCoin Fortune Wednesday Event – Predict the price, get cash rewards!💰

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

Start your new week full of energy with the journey of exploring crypto, trading smart and building the future of Web3 today with #JuCoin! 🌱✨

👉 Experience and Register JuCoin now: https://bit.ly/3BVxlZ2

#JuCoin #JucoinVietnam #Crypto #Web3 #Blockchain #Trading

Lee | Ju.Com

2025-08-18 06:30

🌟 GM GM! New Week, New Opportunities with #JuCoin 🚀

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

Tokenization has transformed from a niche crypto concept into a major force reshaping global finance, with the market for tokenized real-world assets (RWAs) surging past $25 billion in Q2 2025.

💰 Key Evolution Phases:

-

Phase 1: Crypto-native assets (ERC-20 tokens, stablecoins like USDC)

Phase 2: NFTs and unique digital assets (ERC-721 standard)

Phase 3: Real-world assets - physical/financial assets on blockchain (real estate, treasuries, private equity, fine art)

🎯 Why Institutions Are Adopting: 1️⃣ Fractional Ownership: Democratizes access to luxury assets through divisible tokens 2️⃣ Enhanced Liquidity: Transform illiquid assets into 24/7 tradeable tokens 3️⃣ Transparency & Trust: Immutable blockchain records eliminate intermediaries 4️⃣ Efficiency & Cost Savings: Near-instant settlement vs weeks/months in traditional systems

🏆 Key Benefits Comparison:

-

Traditional: All-or-nothing ownership, low liquidity, days to settle

Tokenized: Fractional ownership, high liquidity, instant settlement

💡 Future Trends Shaping 2025+:

-

Regulatory Clarity: Global frameworks for tokenized securities emerging

Interoperability: Cross-chain protocols enabling seamless asset transfers

Sophisticated Products: Beyond treasuries to derivatives, carbon credits, complex financial instruments

🔗 Token Standards Driving Growth:

-

ERC-20: Fungible tokens (stablecoins)

ERC-721: Unique NFTs

ERC-1400: Security tokens with compliance features

With institutional demand accelerating and regulatory frameworks maturing, tokenization is creating a more efficient and equitable financial system for the future.

Read the complete analysis: 👇 https://blog.jucoin.com/explore-the-evolution-of-tokenized-assets/?utm_source=blog

#Tokenization #RWA #Blockchain #DeFi

JU Blog

2025-08-11 11:59

🚀 The Evolution of Tokenized Assets: From Crypto to Real-World Financial Infrastructure

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

📰 The Trump administration is considering 11 candidates for the Fed Chair position, including market strategists Sumerlin and Zervos, who advocate a 50–200 basis point rate cut. This easing policy could fuel a strong rally in the crypto market thanks to increased liquidity and risk appetite.

🔎 Read more: https://blog.jucoin.com/fed-chair-rate-cuts-crypto/

#JuCoin #JuCoinVietnam #JuCoinInsights #Crypto #Blockchain #DeFi #Web3 #CryptoNews #MarketInsights

Lee | Ju.Com

2025-08-20 12:02

📣 JuCoin Insights | Fed Chair Candidates Hint at Sharp Rate Cuts: Crypto Impact Analysis! 🌟

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

📰 Leading financial institutions are developing proprietary blockchains to:

⚡️ Capture transaction fees

⚡️ Control their own economic model

⚡️ Reduce dependence on external networks

👉 The blockchain market in the banking industry is expected to reach $40.9 billion by 2029 with a CAGR of 39.4%! 📈

🔎 Read more: https://blog.jucoin.com/financial-companies-building-blockchains/

#JuCoin #JuCoinVietnam #JuCoinInsights #Blockchain #Web3 #Crypto

Lee | Ju.Com

2025-08-18 06:29

📣 JuCoin Insights | Why are financial giants building their own blockchains? 🌟

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

📣 Token $JU officially surpassed the $18 mark, setting a new all-time high (ATH) and is trading at $18.56! 🚀

🔗 Trade now: http://jucoin.com/trade/ju_usdt

👉 Register for JuCoin now: https://bit.ly/3BVxlZ2

🔥 The power of the community and the #JuCoin ecosystem is booming.

#JuCoin #JuCoinVietnam #JUtoken #ATH #Layer1 #Blockchain #Crypto #Web3 #Altcoin #CryptoUpdate

Lee | Ju.Com

2025-08-18 06:27

📣Token $JU officially surpassed the $18 mark, setting a new all-time high (ATH)!

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

The blockchain space is fragmented into hundreds of isolated networks - Bitcoin's security, Ethereum's smart contracts, faster chains for low costs. This "silo problem" limits DeFi potential and user experience. Here's why cross-chain connectivity is the future:

🔗 What Is Interoperability:

-

Enables different blockchains to communicate and share data

Allows seamless asset transfers between networks

Creates a unified decentralized ecosystem like the early internet

⚙️ How It Works:

-

Cross-Chain Bridges: Lock assets on one chain, mint wrapped versions on another (like WBTC)

IBC Protocols: Direct message passing between compatible blockchains (Cosmos hub-and-spoke model)

Atomic Swaps: Peer-to-peer exchanges without centralized intermediaries

Oracles: Connect blockchains to external data and other networks

💡 Benefits of Connected Future:

-

Massive liquidity improvement and capital efficiency

Access wider range of services regardless of asset origin

Developers can leverage strengths of multiple chains

Simplified user experience - one wallet, seamless access

⚠️ Current Challenges:

-

Security vulnerabilities (billions lost in bridge exploits)

Complex technical specifications across different chains

Lack of standardized protocols

Single points of failure in cross-chain solutions

🎯 Key Impact: Without interoperability, blockchains remain "walled gardens" limiting innovation. Future solutions like native IBC and atomic swaps promise more secure connectivity, unlocking new use cases and creating the seamless Web3 experience users expect.

The race is on to solve the interoperability puzzle - whoever cracks it will unlock the true potential of a connected blockchain ecosystem.

Read the full deep-dive analysis: 👇 https://blog.jucoin.com/blockchain-interoperability-why-it-matters/

#Blockchain #Interoperability #CrossChain #DeFi #Web3

JU Blog

2025-08-06 10:43

🌐 Blockchain Interoperability: Breaking Down the Silos!

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.