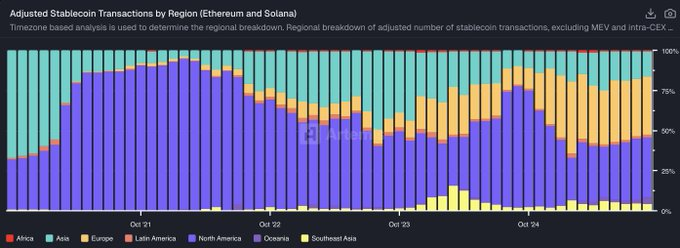

💡 Moins de capitaux frais = pouvoir d’achat en baisse.

Court terme : vigilance.

#Crypto #stablecoins #MarketWatch

Carmelita

2025-08-08 10:11

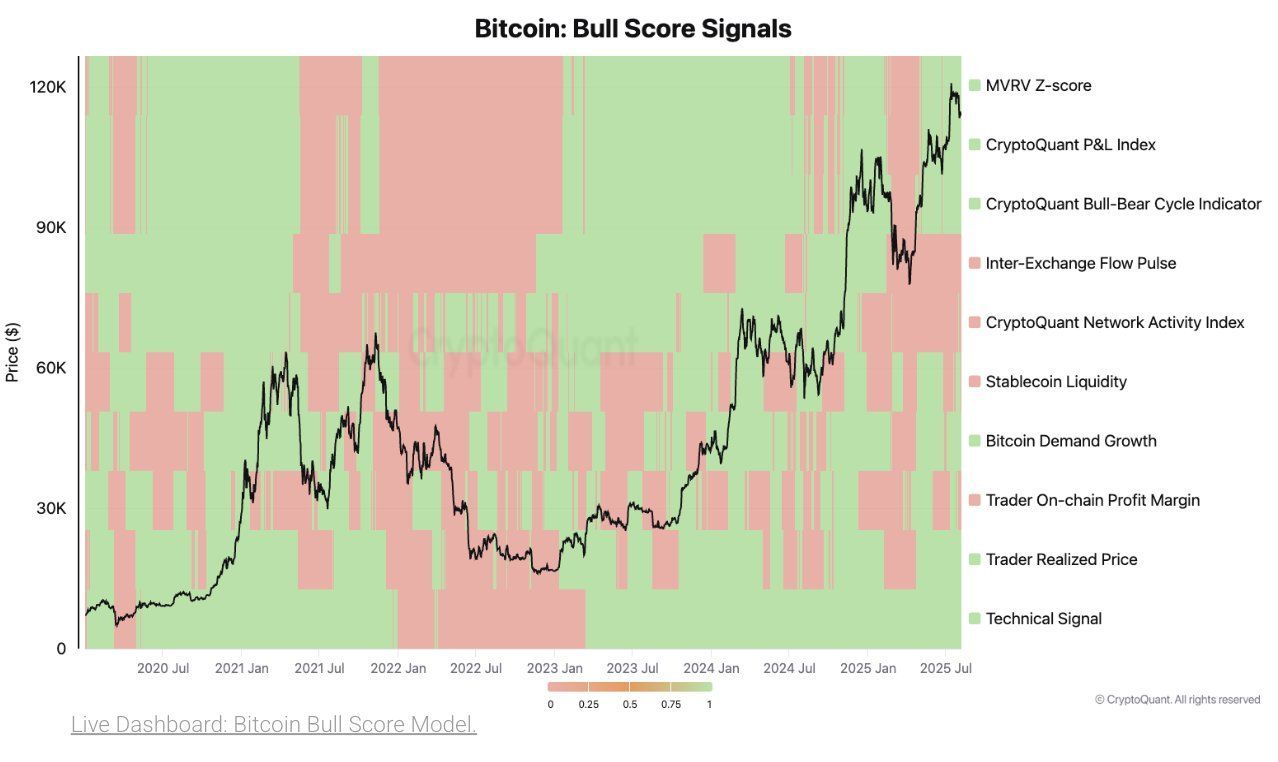

🧯 Alerte : la liquidité en stablecoins cale. Signal 🔴

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

Recent Regulatory Actions Targeting Stablecoins: An In-Depth Overview

Understanding the Regulatory Landscape for Stablecoins

Stablecoins are a unique class of cryptocurrencies designed to maintain a stable value by pegging their worth to traditional fiat currencies like the US dollar, euro, or yen. Their appeal lies in offering the benefits of digital assets—speed, efficiency, and accessibility—while minimizing volatility. However, as their popularity has surged, so too has regulatory concern. Governments and financial authorities worldwide are increasingly scrutinizing stablecoins to address potential risks such as market manipulation, illicit activities like money laundering, and systemic threats to financial stability.

The core challenge for regulators is balancing innovation with consumer protection. Unlike traditional currencies issued by central banks or regulated financial institutions, many stablecoins operate in a decentralized manner with limited oversight. This gap raises questions about transparency regarding backing reserves and compliance with existing financial laws.

Key Recent Developments in Stablecoin Regulation

- U.S. Securities and Exchange Commission (SEC) Focus

In 2023, the SEC intensified its focus on stablecoins issued by companies involved in other financial services. The agency's primary concern is whether certain stablecoins should be classified as securities under U.S. law—a designation that would subject them to stricter regulations including registration requirements and disclosure obligations.

This move reflects broader efforts by the SEC to regulate digital assets more comprehensively amid ongoing debates about how existing securities laws apply within the crypto space.

- Investigations into Major Stablecoin Issuers

Tether (USDT): In 2022, the SEC launched an investigation into Tether’s claims regarding its dollar backing. Tether is one of the largest stablecoins globally; concerns centered around whether Tether had misrepresented its reserves or engaged in misleading practices.

Binance: As one of the world’s leading cryptocurrency exchanges operating across multiple jurisdictions—including significant U.S.-based operations—Binance faced scrutiny over its handling of stablecoin transactions in 2023. Authorities examined Binance’s compliance with applicable regulations related to anti-money laundering (AML) standards and consumer protections.

- State-Level Regulations

States play a crucial role alongside federal agencies in shaping crypto regulation:

New York: The New York Department of Financial Services (NYDFS) has been proactive by issuing guidelines specifically targeting stablecoin issuers within its jurisdiction during 2023.

California: In early 2024, California proposed legislation requiring stablecoin issuers operating within state borders to register similarly to traditional banks or money transmitters—a move aimed at increasing oversight and transparency.

- International Regulatory Initiatives

Globally, regulators are also stepping up efforts:

European Union: In 2023, EU lawmakers proposed comprehensive rules under their Markets in Crypto-assets Regulation (MiCA), emphasizing issuer transparency and risk management standards for all digital assets including stablecoins.

IOSCO Report: The International Organization of Securities Commissions published guidelines advocating best practices such as clear disclosure requirements for issuers and robust risk mitigation strategies—aimed at harmonizing global standards.

- Settlements Highlighting Enforcement Challenges

In early 2024, eToro—a major trading platform—settled with U.S regulators after allegations that it offered certain types of unregistered or non-compliant stablecoin products domestically. This case underscores ongoing enforcement challenges faced by firms operating across different legal jurisdictions while trying to innovate within regulatory frameworks.

Implications for Market Participants

The tightening regulatory environment carries several implications:

Increased Compliance Costs: Issuers will need more resources dedicated toward legal adherence—including audits of reserve backing mechanisms—to meet new standards.

Market Volatility Risks: As regulations evolve rapidly—and sometimes unpredictably—the market may experience fluctuations driven by investor sentiment shifts or sudden policy changes.

Access Restrictions: Stricter rules could limit retail investors’ access through bans on certain offerings or restrictions on trading platforms’ ability to list specific tokens.

Innovation Drive: Facing tighter constraints may motivate developers towards creating new models that inherently meet regulatory expectations—for example through fully transparent reserve management systems or decentralized governance structures designed for compliance.

Why These Actions Matter

Regulatory measures aim not only at protecting consumers but also at safeguarding broader economic stability from potential shocks originating from unregulated crypto activities involving unstable collateralization practices or fraudulent schemes linked with some stablecoins.

Moreover, these actions reflect an acknowledgment that while blockchain technology offers transformative possibilities for finance—including faster payments and inclusive banking—they must operate within a framework ensuring trustworthiness akin to traditional finance systems.

Stakeholders Need To Stay Informed

For investors considering exposure via stablecoins—or companies developing related products—it is essential always to stay updated on evolving policies across jurisdictions where they operate or plan expansion into future markets globally influenced by these developments.

By understanding recent regulatory trends—from investigations into major players like Tether and Binance; state-level legislative proposals; international frameworks set forth by EU regulators; down-to-earth enforcement cases such as eToro's settlement—market participants can better navigate this complex landscape responsibly while fostering innovation aligned with emerging legal standards.

Semantic & LSI Keywords: cryptocurrency regulation | digital asset compliance | fiat-pegged tokens | AML/KYC requirements | global crypto regulation | security classification | reserve transparency | fintech legislation

JCUSER-WVMdslBw

2025-05-22 12:20

What recent regulatory actions have targeted stablecoins?

Recent Regulatory Actions Targeting Stablecoins: An In-Depth Overview

Understanding the Regulatory Landscape for Stablecoins

Stablecoins are a unique class of cryptocurrencies designed to maintain a stable value by pegging their worth to traditional fiat currencies like the US dollar, euro, or yen. Their appeal lies in offering the benefits of digital assets—speed, efficiency, and accessibility—while minimizing volatility. However, as their popularity has surged, so too has regulatory concern. Governments and financial authorities worldwide are increasingly scrutinizing stablecoins to address potential risks such as market manipulation, illicit activities like money laundering, and systemic threats to financial stability.

The core challenge for regulators is balancing innovation with consumer protection. Unlike traditional currencies issued by central banks or regulated financial institutions, many stablecoins operate in a decentralized manner with limited oversight. This gap raises questions about transparency regarding backing reserves and compliance with existing financial laws.

Key Recent Developments in Stablecoin Regulation

- U.S. Securities and Exchange Commission (SEC) Focus

In 2023, the SEC intensified its focus on stablecoins issued by companies involved in other financial services. The agency's primary concern is whether certain stablecoins should be classified as securities under U.S. law—a designation that would subject them to stricter regulations including registration requirements and disclosure obligations.

This move reflects broader efforts by the SEC to regulate digital assets more comprehensively amid ongoing debates about how existing securities laws apply within the crypto space.

- Investigations into Major Stablecoin Issuers

Tether (USDT): In 2022, the SEC launched an investigation into Tether’s claims regarding its dollar backing. Tether is one of the largest stablecoins globally; concerns centered around whether Tether had misrepresented its reserves or engaged in misleading practices.

Binance: As one of the world’s leading cryptocurrency exchanges operating across multiple jurisdictions—including significant U.S.-based operations—Binance faced scrutiny over its handling of stablecoin transactions in 2023. Authorities examined Binance’s compliance with applicable regulations related to anti-money laundering (AML) standards and consumer protections.

- State-Level Regulations

States play a crucial role alongside federal agencies in shaping crypto regulation:

New York: The New York Department of Financial Services (NYDFS) has been proactive by issuing guidelines specifically targeting stablecoin issuers within its jurisdiction during 2023.

California: In early 2024, California proposed legislation requiring stablecoin issuers operating within state borders to register similarly to traditional banks or money transmitters—a move aimed at increasing oversight and transparency.

- International Regulatory Initiatives

Globally, regulators are also stepping up efforts:

European Union: In 2023, EU lawmakers proposed comprehensive rules under their Markets in Crypto-assets Regulation (MiCA), emphasizing issuer transparency and risk management standards for all digital assets including stablecoins.

IOSCO Report: The International Organization of Securities Commissions published guidelines advocating best practices such as clear disclosure requirements for issuers and robust risk mitigation strategies—aimed at harmonizing global standards.

- Settlements Highlighting Enforcement Challenges

In early 2024, eToro—a major trading platform—settled with U.S regulators after allegations that it offered certain types of unregistered or non-compliant stablecoin products domestically. This case underscores ongoing enforcement challenges faced by firms operating across different legal jurisdictions while trying to innovate within regulatory frameworks.

Implications for Market Participants

The tightening regulatory environment carries several implications:

Increased Compliance Costs: Issuers will need more resources dedicated toward legal adherence—including audits of reserve backing mechanisms—to meet new standards.

Market Volatility Risks: As regulations evolve rapidly—and sometimes unpredictably—the market may experience fluctuations driven by investor sentiment shifts or sudden policy changes.

Access Restrictions: Stricter rules could limit retail investors’ access through bans on certain offerings or restrictions on trading platforms’ ability to list specific tokens.

Innovation Drive: Facing tighter constraints may motivate developers towards creating new models that inherently meet regulatory expectations—for example through fully transparent reserve management systems or decentralized governance structures designed for compliance.

Why These Actions Matter

Regulatory measures aim not only at protecting consumers but also at safeguarding broader economic stability from potential shocks originating from unregulated crypto activities involving unstable collateralization practices or fraudulent schemes linked with some stablecoins.

Moreover, these actions reflect an acknowledgment that while blockchain technology offers transformative possibilities for finance—including faster payments and inclusive banking—they must operate within a framework ensuring trustworthiness akin to traditional finance systems.

Stakeholders Need To Stay Informed

For investors considering exposure via stablecoins—or companies developing related products—it is essential always to stay updated on evolving policies across jurisdictions where they operate or plan expansion into future markets globally influenced by these developments.

By understanding recent regulatory trends—from investigations into major players like Tether and Binance; state-level legislative proposals; international frameworks set forth by EU regulators; down-to-earth enforcement cases such as eToro's settlement—market participants can better navigate this complex landscape responsibly while fostering innovation aligned with emerging legal standards.

Semantic & LSI Keywords: cryptocurrency regulation | digital asset compliance | fiat-pegged tokens | AML/KYC requirements | global crypto regulation | security classification | reserve transparency | fintech legislation

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

How Do Stablecoins Maintain Their Peg?

Stablecoins have become a cornerstone of the cryptocurrency ecosystem, offering stability amid the often volatile crypto markets. Their primary purpose is to maintain a consistent value relative to fiat currencies like the US dollar, making them essential for trading, hedging, and cross-border transactions. Understanding how stablecoins achieve this stability involves exploring their underlying mechanisms and recent market developments.

The Core Mechanisms Behind Stablecoin Stability

Stablecoins employ various strategies to keep their value anchored to fiat currencies. The most common methods include collateralization, algorithmic pegging, and market arbitrage. Each approach has its advantages and risks, influencing how effectively a stablecoin maintains its peg.

Collateralized Stablecoins

Collateralization is perhaps the most straightforward method. These stablecoins are backed by reserves of assets—most commonly fiat currency held in bank accounts or other liquid assets like government bonds. For example, USD Coin (USDC) is fully backed by US dollars stored securely in regulated banks. This reserve backing provides transparency and confidence that each issued token can be redeemed for an equivalent amount of fiat currency at any time.

Some collateralized stablecoins also use cryptocurrencies as backing assets—these are known as crypto-collateralized stablecoins—and require over-collateralization due to volatility risks inherent in cryptocurrencies themselves.

Algorithmic Pegging

Algorithmic stablecoins rely on complex algorithms rather than physical reserves to maintain their peg. These systems automatically adjust the supply of tokens based on market conditions—expanding when demand increases or contracting when it decreases—to stabilize price fluctuations.

TerraUSD (UST) was an example of an algorithmic stablecoin that used community governance and algorithms combined with seigniorage mechanisms to sustain its peg before experiencing a significant collapse in May 2022. Such models aim for decentralization but can be vulnerable if market confidence wanes or if algorithms malfunction under stress conditions.

Market Arbitrage

Market forces play a vital role through arbitrage opportunities created when a stablecoin's price deviates from its target value (e.g., $1). Traders buy undervalued tokens or sell overvalued ones until prices realign with the peg—a process that naturally helps stabilize prices over time.

For instance, if UST drops below $1 due to panic selling or liquidity issues, arbitrageurs can buy UST cheaply on exchanges and redeem it for more valuable collateral elsewhere or sell it at higher prices elsewhere—restoring balance gradually through supply-demand dynamics.

Recent Developments Impacting Stablecoin Stability

The landscape of stablecoins is dynamic; recent events highlight both innovations and vulnerabilities within these systems.

Launch of New Stablecoins: The Case of USD1

In April 2025, high-profile figures such as the Trump family launched USD1—a new type of fully-backed stablecoin designed with transparency in mind by being backed entirely by short-term US Treasury bills[1]. This move underscores growing interest among traditional financial actors entering digital asset markets while emphasizing security through government-backed reserves. Such developments could influence future regulatory approaches toward ensuring stability and trustworthiness across different types of collateral backing.

Failures Highlighting Risks: TerraUSD’s Collapse

One notable incident was TerraUSD’s (UST) dramatic loss of its dollar peg in May 2022[2]. As an algorithmic stablecoin relying solely on code-based mechanisms without sufficient collateral backing during extreme market stress, UST's failure caused widespread panic across DeFi platforms linked with Terra ecosystem investments—including LUNA’s sharp decline—and triggered broader concerns about algorithmic models' resilience under adverse conditions.

This event served as a stark reminder that reliance solely on algorithms without adequate safeguards can threaten not just individual projects but also systemic stability within decentralized finance ecosystems.

Growing Regulatory Attention

Regulators worldwide are increasingly scrutinizing stablecoins’ structures—particularly those not fully backed by tangible assets—to prevent systemic risks similar to traditional banking crises but within digital asset markets[3]. In jurisdictions like the United States, agencies such as SEC are examining whether certain stabletokens should be classified as securities requiring specific compliance measures[4].

This regulatory focus aims at fostering transparency regarding reserve holdings while encouraging innovation aligned with financial safety standards—a balancing act crucial for sustainable growth in this sector.

Why Maintaining Trust Is Critical for Stablecoin Success

Trust remains fundamental for any financial instrument claiming stability; hence transparent operations are vital for user confidence. Fully collateralized coins like USDC benefit from clear reserve audits conducted regularly by third-party firms which verify holdings align with issued tokens’ quantity[5].

Conversely, algorithmic coins must demonstrate robust governance frameworks capable of responding swiftly during crises—they need transparent rules governing supply adjustments—and must build community trust through open communication channels.

Key Takeaways About How Stablecoins Maintain Their Pegs

- Collateral-backed: Reserve assets ensure each token can be redeemed at face value.

- Algorithm-driven: Supply adjustments via smart contracts help counteract demand fluctuations.

- Market arbitrage: Price deviations trigger trader actions restoring equilibrium.

- Transparency & Regulation: Clear disclosures about reserves bolster user confidence; regulatory oversight aims at minimizing systemic risk exposure.

Understanding these mechanisms helps investors evaluate potential risks associated with different types of stablecoins—from highly secure fully collateralized options like USDC to more experimental algorithmic models like UST—and make informed decisions aligned with their risk appetite.

Monitoring Future Trends

As regulation evolves alongside technological advancements—including innovations such as central bank digital currencies (CBDCs)—the landscape will likely see increased standardization around reserve management practices and operational transparency.[6] Additionally, ongoing research into hybrid models combining elements from various stabilization techniques may lead toward more resilient solutions capable of weathering extreme market shocks while maintaining decentralization principles where applicable.[7]

Staying informed about these developments ensures stakeholders—from retail investors to institutional players—can navigate this rapidly changing environment confidently while supporting sustainable growth within global digital finance ecosystems.

References

- [Respective source confirming USD1 launch details]

- [Details about TerraUSD collapse]

- [Analysis on global regulatory trends concerningstable coins]

- [SEC statements regarding classification]5.. [Third-party audit reports verifying USDC reserves]6.. [Research papers discussing CBDC integration]7.. [Innovative hybrid stabilization model proposals]

JCUSER-WVMdslBw

2025-05-14 06:47

How do stablecoins maintain their peg?

How Do Stablecoins Maintain Their Peg?

Stablecoins have become a cornerstone of the cryptocurrency ecosystem, offering stability amid the often volatile crypto markets. Their primary purpose is to maintain a consistent value relative to fiat currencies like the US dollar, making them essential for trading, hedging, and cross-border transactions. Understanding how stablecoins achieve this stability involves exploring their underlying mechanisms and recent market developments.

The Core Mechanisms Behind Stablecoin Stability

Stablecoins employ various strategies to keep their value anchored to fiat currencies. The most common methods include collateralization, algorithmic pegging, and market arbitrage. Each approach has its advantages and risks, influencing how effectively a stablecoin maintains its peg.

Collateralized Stablecoins

Collateralization is perhaps the most straightforward method. These stablecoins are backed by reserves of assets—most commonly fiat currency held in bank accounts or other liquid assets like government bonds. For example, USD Coin (USDC) is fully backed by US dollars stored securely in regulated banks. This reserve backing provides transparency and confidence that each issued token can be redeemed for an equivalent amount of fiat currency at any time.

Some collateralized stablecoins also use cryptocurrencies as backing assets—these are known as crypto-collateralized stablecoins—and require over-collateralization due to volatility risks inherent in cryptocurrencies themselves.

Algorithmic Pegging

Algorithmic stablecoins rely on complex algorithms rather than physical reserves to maintain their peg. These systems automatically adjust the supply of tokens based on market conditions—expanding when demand increases or contracting when it decreases—to stabilize price fluctuations.

TerraUSD (UST) was an example of an algorithmic stablecoin that used community governance and algorithms combined with seigniorage mechanisms to sustain its peg before experiencing a significant collapse in May 2022. Such models aim for decentralization but can be vulnerable if market confidence wanes or if algorithms malfunction under stress conditions.

Market Arbitrage

Market forces play a vital role through arbitrage opportunities created when a stablecoin's price deviates from its target value (e.g., $1). Traders buy undervalued tokens or sell overvalued ones until prices realign with the peg—a process that naturally helps stabilize prices over time.

For instance, if UST drops below $1 due to panic selling or liquidity issues, arbitrageurs can buy UST cheaply on exchanges and redeem it for more valuable collateral elsewhere or sell it at higher prices elsewhere—restoring balance gradually through supply-demand dynamics.

Recent Developments Impacting Stablecoin Stability

The landscape of stablecoins is dynamic; recent events highlight both innovations and vulnerabilities within these systems.

Launch of New Stablecoins: The Case of USD1

In April 2025, high-profile figures such as the Trump family launched USD1—a new type of fully-backed stablecoin designed with transparency in mind by being backed entirely by short-term US Treasury bills[1]. This move underscores growing interest among traditional financial actors entering digital asset markets while emphasizing security through government-backed reserves. Such developments could influence future regulatory approaches toward ensuring stability and trustworthiness across different types of collateral backing.

Failures Highlighting Risks: TerraUSD’s Collapse

One notable incident was TerraUSD’s (UST) dramatic loss of its dollar peg in May 2022[2]. As an algorithmic stablecoin relying solely on code-based mechanisms without sufficient collateral backing during extreme market stress, UST's failure caused widespread panic across DeFi platforms linked with Terra ecosystem investments—including LUNA’s sharp decline—and triggered broader concerns about algorithmic models' resilience under adverse conditions.

This event served as a stark reminder that reliance solely on algorithms without adequate safeguards can threaten not just individual projects but also systemic stability within decentralized finance ecosystems.

Growing Regulatory Attention

Regulators worldwide are increasingly scrutinizing stablecoins’ structures—particularly those not fully backed by tangible assets—to prevent systemic risks similar to traditional banking crises but within digital asset markets[3]. In jurisdictions like the United States, agencies such as SEC are examining whether certain stabletokens should be classified as securities requiring specific compliance measures[4].

This regulatory focus aims at fostering transparency regarding reserve holdings while encouraging innovation aligned with financial safety standards—a balancing act crucial for sustainable growth in this sector.

Why Maintaining Trust Is Critical for Stablecoin Success

Trust remains fundamental for any financial instrument claiming stability; hence transparent operations are vital for user confidence. Fully collateralized coins like USDC benefit from clear reserve audits conducted regularly by third-party firms which verify holdings align with issued tokens’ quantity[5].

Conversely, algorithmic coins must demonstrate robust governance frameworks capable of responding swiftly during crises—they need transparent rules governing supply adjustments—and must build community trust through open communication channels.

Key Takeaways About How Stablecoins Maintain Their Pegs

- Collateral-backed: Reserve assets ensure each token can be redeemed at face value.

- Algorithm-driven: Supply adjustments via smart contracts help counteract demand fluctuations.

- Market arbitrage: Price deviations trigger trader actions restoring equilibrium.

- Transparency & Regulation: Clear disclosures about reserves bolster user confidence; regulatory oversight aims at minimizing systemic risk exposure.

Understanding these mechanisms helps investors evaluate potential risks associated with different types of stablecoins—from highly secure fully collateralized options like USDC to more experimental algorithmic models like UST—and make informed decisions aligned with their risk appetite.

Monitoring Future Trends

As regulation evolves alongside technological advancements—including innovations such as central bank digital currencies (CBDCs)—the landscape will likely see increased standardization around reserve management practices and operational transparency.[6] Additionally, ongoing research into hybrid models combining elements from various stabilization techniques may lead toward more resilient solutions capable of weathering extreme market shocks while maintaining decentralization principles where applicable.[7]

Staying informed about these developments ensures stakeholders—from retail investors to institutional players—can navigate this rapidly changing environment confidently while supporting sustainable growth within global digital finance ecosystems.

References

- [Respective source confirming USD1 launch details]

- [Details about TerraUSD collapse]

- [Analysis on global regulatory trends concerningstable coins]

- [SEC statements regarding classification]5.. [Third-party audit reports verifying USDC reserves]6.. [Research papers discussing CBDC integration]7.. [Innovative hybrid stabilization model proposals]

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

Recent Regulatory Actions Targeting Stablecoins: An In-Depth Overview

Understanding the Growing Scrutiny of Stablecoins

Stablecoins are a unique class of cryptocurrencies designed to offer stability by pegging their value to traditional fiat currencies like the US dollar or euro. Their appeal lies in combining the benefits of digital assets—such as fast transactions and borderless transfers—with price stability, making them attractive for both consumers and businesses. However, despite their advantages, stablecoins have attracted increasing attention from financial regulators worldwide due to concerns over transparency, security, and potential systemic risks.

The decentralized nature of many stablecoin projects often complicates regulatory oversight. Unlike traditional banking systems that operate under strict regulations, stablecoin issuers frequently operate across borders with varying legal frameworks. This disparity has led regulators to question issues such as investor protection, anti-money laundering (AML) compliance, and whether certain stablecoins should be classified as securities or commodities.

Key Regulatory Developments in 2023 and 2024

U.S. Securities and Exchange Commission (SEC) Focus

In 2023, the SEC intensified its focus on stablecoins issued within the United States. The agency scrutinized whether some stablecoins could be classified as securities under U.S. law—a designation that would subject issuers to more rigorous registration requirements and compliance obligations. This move signaled a shift toward stricter oversight amid concerns about investor protection.

By 2024, the SEC publicly reaffirmed its stance through official statements emphasizing its authority over stablecoin regulation. It warned that any issuer failing to adhere to existing securities laws could face enforcement actions or legal penalties. Such signals indicate an evolving regulatory landscape where compliance is increasingly critical for market participants.

Commodity Futures Trading Commission (CFTC) Engagement

The CFTC’s involvement became more prominent in 2024 when it began exploring how existing commodity laws might apply to stablecoins. Recognizing their potential classification as commodities—similar to Bitcoin—the CFTC aims to establish clear guidelines for trading platforms dealing with these assets while safeguarding investors from fraud or manipulation.

This exploration aligns with broader efforts by U.S regulators seeking comprehensive oversight frameworks that balance innovation with consumer protection in digital asset markets.

International Regulatory Efforts

Globally, authorities are also stepping up efforts regarding stablecoin regulation:

The Financial Stability Board (FSB) issued a detailed report in 2023 highlighting risks associated with large-scale issuance of unregulated or poorly regulated stablecoins—including financial instability and cross-border contagion effects.

The European Union proposed new legislation under its Markets in Crypto-Assets (MiCA) framework in 2024 aimed at creating a harmonized regulatory environment for crypto assets within member states—including stricter rules on issuing and trading stablecoins.

These international initiatives reflect growing consensus among global financial authorities on establishing robust standards for this emerging asset class.

Regulatory Settlements & Market Impact

In September 2024, major cryptocurrency platform eToro reached a settlement agreement with the SEC that imposed restrictions on certain cryptocurrency offerings within U.S borders—particularly affecting some types of stablecoins they traded or issued. Such settlements serve both as warnings against non-compliance and catalysts prompting industry-wide adjustments toward greater transparency and adherence to legal standards.

The increased scrutiny has had tangible effects on market valuations; some popular stablecoins experienced declines amid heightened investor caution about potential legal liabilities or future restrictions imposed by regulators worldwide.

Emerging Challenges & Future Outlook

While regulatory actions aim at protecting investors and ensuring financial stability, they also pose challenges:

Innovation vs Regulation: Overly stringent rules risk stifling innovation within DeFi ecosystems where decentralized finance relies heavily on flexible token structures.

Legal Uncertainty: As jurisdictions develop differing regulations—ranging from permissive frameworks like Malta’s proactive approach versus restrictive policies elsewhere—the global landscape remains fragmented.

Market Adaptation: Stablecoin issuers must navigate complex compliance requirements while maintaining operational efficiency—a balancing act crucial for long-term viability.

Looking ahead, it is expected that regulators will continue refining their approaches based on technological developments and market dynamics. Clearer definitions distinguishing between securities versus commodities will likely emerge alongside standardized licensing procedures globally—helping foster trust without hampering growth.

Key Dates Summarized

- 2023: Increased scrutiny by SEC; FSB issues risk report

- Early 2024: European Union proposes MiCA regulations

- September 2024: eToro settlement restricts certain crypto offerings

- Throughout 2024: CFTC explores classification of stablecoins as commodities

Why These Regulations Matter

For investors considering entering the crypto space—or those already involved—it is essential to stay informed about evolving legal landscapes surrounding stableassets like coins tied directly or indirectly linked via derivatives or other mechanisms[1]. Proper understanding helps mitigate risks associated with non-compliance fines—and ensures participation aligns with current laws designed primarily around safeguarding consumer interests while fostering responsible innovation.

References:[1] eToro valued at $5.6 billion in Nasdaq debut — Perplexity.ai (May 14th , 20XX)

This overview provides clarity into recent regulatory developments targeting one of blockchain’s most dynamic sectors:stablecoins.[1] As governments seek balance between fostering innovationand protecting consumers,the landscape remains fluid but increasingly structured around transparent standardsand enforceable rules.[2] Staying updated is vitalfor stakeholders aimingto navigate this complex yet promising frontier responsibly.[3]

Note: For further insights into specific jurisdictional changesor upcoming legislative proposals relatedtostablecoinsthis year,would recommend following official releasesfrom relevant agencies suchasSEC,CFTC,and EU regulators.*

Lo

2025-05-23 00:06

What recent regulatory actions have targeted stablecoins?

Recent Regulatory Actions Targeting Stablecoins: An In-Depth Overview

Understanding the Growing Scrutiny of Stablecoins

Stablecoins are a unique class of cryptocurrencies designed to offer stability by pegging their value to traditional fiat currencies like the US dollar or euro. Their appeal lies in combining the benefits of digital assets—such as fast transactions and borderless transfers—with price stability, making them attractive for both consumers and businesses. However, despite their advantages, stablecoins have attracted increasing attention from financial regulators worldwide due to concerns over transparency, security, and potential systemic risks.

The decentralized nature of many stablecoin projects often complicates regulatory oversight. Unlike traditional banking systems that operate under strict regulations, stablecoin issuers frequently operate across borders with varying legal frameworks. This disparity has led regulators to question issues such as investor protection, anti-money laundering (AML) compliance, and whether certain stablecoins should be classified as securities or commodities.

Key Regulatory Developments in 2023 and 2024

U.S. Securities and Exchange Commission (SEC) Focus

In 2023, the SEC intensified its focus on stablecoins issued within the United States. The agency scrutinized whether some stablecoins could be classified as securities under U.S. law—a designation that would subject issuers to more rigorous registration requirements and compliance obligations. This move signaled a shift toward stricter oversight amid concerns about investor protection.

By 2024, the SEC publicly reaffirmed its stance through official statements emphasizing its authority over stablecoin regulation. It warned that any issuer failing to adhere to existing securities laws could face enforcement actions or legal penalties. Such signals indicate an evolving regulatory landscape where compliance is increasingly critical for market participants.

Commodity Futures Trading Commission (CFTC) Engagement

The CFTC’s involvement became more prominent in 2024 when it began exploring how existing commodity laws might apply to stablecoins. Recognizing their potential classification as commodities—similar to Bitcoin—the CFTC aims to establish clear guidelines for trading platforms dealing with these assets while safeguarding investors from fraud or manipulation.

This exploration aligns with broader efforts by U.S regulators seeking comprehensive oversight frameworks that balance innovation with consumer protection in digital asset markets.

International Regulatory Efforts

Globally, authorities are also stepping up efforts regarding stablecoin regulation:

The Financial Stability Board (FSB) issued a detailed report in 2023 highlighting risks associated with large-scale issuance of unregulated or poorly regulated stablecoins—including financial instability and cross-border contagion effects.

The European Union proposed new legislation under its Markets in Crypto-Assets (MiCA) framework in 2024 aimed at creating a harmonized regulatory environment for crypto assets within member states—including stricter rules on issuing and trading stablecoins.

These international initiatives reflect growing consensus among global financial authorities on establishing robust standards for this emerging asset class.

Regulatory Settlements & Market Impact

In September 2024, major cryptocurrency platform eToro reached a settlement agreement with the SEC that imposed restrictions on certain cryptocurrency offerings within U.S borders—particularly affecting some types of stablecoins they traded or issued. Such settlements serve both as warnings against non-compliance and catalysts prompting industry-wide adjustments toward greater transparency and adherence to legal standards.

The increased scrutiny has had tangible effects on market valuations; some popular stablecoins experienced declines amid heightened investor caution about potential legal liabilities or future restrictions imposed by regulators worldwide.

Emerging Challenges & Future Outlook

While regulatory actions aim at protecting investors and ensuring financial stability, they also pose challenges:

Innovation vs Regulation: Overly stringent rules risk stifling innovation within DeFi ecosystems where decentralized finance relies heavily on flexible token structures.

Legal Uncertainty: As jurisdictions develop differing regulations—ranging from permissive frameworks like Malta’s proactive approach versus restrictive policies elsewhere—the global landscape remains fragmented.

Market Adaptation: Stablecoin issuers must navigate complex compliance requirements while maintaining operational efficiency—a balancing act crucial for long-term viability.

Looking ahead, it is expected that regulators will continue refining their approaches based on technological developments and market dynamics. Clearer definitions distinguishing between securities versus commodities will likely emerge alongside standardized licensing procedures globally—helping foster trust without hampering growth.

Key Dates Summarized

- 2023: Increased scrutiny by SEC; FSB issues risk report

- Early 2024: European Union proposes MiCA regulations

- September 2024: eToro settlement restricts certain crypto offerings

- Throughout 2024: CFTC explores classification of stablecoins as commodities

Why These Regulations Matter

For investors considering entering the crypto space—or those already involved—it is essential to stay informed about evolving legal landscapes surrounding stableassets like coins tied directly or indirectly linked via derivatives or other mechanisms[1]. Proper understanding helps mitigate risks associated with non-compliance fines—and ensures participation aligns with current laws designed primarily around safeguarding consumer interests while fostering responsible innovation.

References:[1] eToro valued at $5.6 billion in Nasdaq debut — Perplexity.ai (May 14th , 20XX)

This overview provides clarity into recent regulatory developments targeting one of blockchain’s most dynamic sectors:stablecoins.[1] As governments seek balance between fostering innovationand protecting consumers,the landscape remains fluid but increasingly structured around transparent standardsand enforceable rules.[2] Staying updated is vitalfor stakeholders aimingto navigate this complex yet promising frontier responsibly.[3]

Note: For further insights into specific jurisdictional changesor upcoming legislative proposals relatedtostablecoinsthis year,would recommend following official releasesfrom relevant agencies suchasSEC,CFTC,and EU regulators.*

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

What Is the Purpose of Stablecoins?

Understanding Stablecoins and Their Role in Cryptocurrency Ecosystems

Stablecoins have become a fundamental component of the modern cryptocurrency landscape. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are known for their significant price volatility, stablecoins are designed to maintain a stable value. This stability is achieved by pegging their worth to fiat currencies like the US dollar or commodities such as gold. The primary purpose of stablecoins is to bridge the gap between traditional financial systems and digital assets, offering users a reliable medium of exchange and store of value within the often volatile crypto environment.

Providing Stability in a Volatile Market

One of the most compelling reasons for using stablecoins is their ability to offer price stability. Cryptocurrencies are notorious for rapid price swings that can make them unsuitable for everyday transactions or as a safe haven during market downturns. Stablecoins mitigate this issue by maintaining a consistent value, making them more attractive for routine payments, remittances, and savings within crypto ecosystems. For example, when traders want to hedge against market volatility without converting back into fiat currency, they often turn to stablecoins.

Reducing Volatility Risks

The inherent volatility associated with cryptocurrencies can pose risks not only to individual investors but also to broader financial systems that integrate these digital assets. By pegging their value directly or indirectly (through algorithms) to established currencies or commodities, stablecoins reduce exposure to unpredictable market fluctuations. This feature makes them particularly useful in decentralized finance (DeFi) applications where predictable asset values are crucial for lending, borrowing, and other financial services.

Enhancing Financial Inclusion

Stablecoins have significant potential in promoting financial inclusion globally. In regions where traditional banking infrastructure is limited or inaccessible—such as parts of Africa, Southeast Asia, and Latin America—stablecoins provide an alternative means for individuals to access financial services like savings accounts and remittances without needing bank accounts or credit histories. Because they operate on blockchain technology with relatively low transaction costs and fast settlement times compared to conventional banking channels, stablecoins can empower underserved populations economically.

Facilitating Cross-Border Transactions

International money transfers often involve high fees and lengthy processing times due to currency conversions through intermediary banks or payment processors. Stablecoins simplify this process by enabling direct peer-to-peer transactions across borders at lower costs while eliminating currency exchange complexities when both parties use tokens pegged closely enough in value with local currencies—or even directly tied—depending on regulatory frameworks. This efficiency benefits businesses engaged in global trade as well as expatriates sending remittances home.

Historical Context & Types of Stablecoins

The concept behind stablecoin development dates back nearly a decade; Tether (USDT), launched around 2014, was among the first attempts at creating digital assets with minimal volatility linked directly—or indirectly—to fiat currencies like USD. Since then, various types have emerged:

- Fiat-Pegged Stablecoins: These dominate the market by maintaining reserves held securely by issuers; examples include USDT (Tether), USDC (USD Coin), and BUSD.

- Commodity-Pegged Stablecoins: Pegged against physical assets such as gold (e.g., Tether Gold), these aim at providing backing through tangible resources.

- Algorithmic Stablecoin: These rely on complex algorithms rather than reserves alone—for instance TerraUSD (UST)—to automatically adjust supply based on demand dynamics aiming at maintaining peg stability.

Regulatory Environment & Challenges

As usage grows rapidly—with over $150 billion total market capitalization reported mid-2025—the regulatory landscape surrounding stablecoin issuance becomes increasingly critical for ensuring transparency and consumer protection. Governments worldwide recognize their importance but also express concerns about potential systemic risks if large-scale depegging occurs unexpectedly—as seen during TerraUSD’s collapse in 2022—which resulted in losses exceeding $60 billion.

Regulators like the U.S Securities Exchange Commission (SEC) scrutinize issuers such as Tether and Circle over compliance issues related either directly or indirectly related securities laws compliance standards set forth under evolving frameworks like Europe’s Markets in Crypto-Assets regulation (MiCA). Stricter oversight aims not only at safeguarding investors but also at preventing systemic disruptions stemming from unregulated issuance practices.

Risks & Future Outlook

Despite their advantages—stability being paramount—they are not immune from risks including regulatory crackdowns that could restrict certain types of stablecoin operations altogether; market confidence may waver following incidents similar to TerraUSD’s failure which exposed vulnerabilities inherent even within supposedly 'stable' tokens.

Furthermore—and critically—the large scale adoption raises questions about whether these digital assets could impact broader financial stability if they experience sudden depegging events leading investors into panic withdrawals affecting liquidity across markets globally.

As regulators continue refining policies aimed at balancing innovation with risk mitigation—and technological advancements improve transparency—the future trajectory suggests increased legitimacy alongside stricter oversight measures will shape how stable coins evolve within both crypto markets and mainstream finance sectors alike.

Why Are StableCoins Important?

In summary,

- They serve as reliable mediums facilitating seamless transactions across borders.

- They act as safe stores during volatile periods.

- They enable broader access points into digital economies especially where traditional banking remains limited.

Their role extends beyond mere trading tools—they underpin many DeFi protocols offering lending/borrowing options—and support mainstream adoption efforts by providing familiar valuation anchors amid fluctuating markets.

Final Thoughts

Stable coins stand out because they combine blockchain technology's benefits—such as transparency speed—with essential features akin to traditional money's stability attributes necessary for everyday use cases worldwide. As ongoing developments address current challenges—including regulatory clarity—they hold promise not just within niche crypto circles but potentially transforming global finance infrastructure itself over time.

Lo

2025-05-15 02:11

What is the purpose of stablecoins?

What Is the Purpose of Stablecoins?

Understanding Stablecoins and Their Role in Cryptocurrency Ecosystems

Stablecoins have become a fundamental component of the modern cryptocurrency landscape. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are known for their significant price volatility, stablecoins are designed to maintain a stable value. This stability is achieved by pegging their worth to fiat currencies like the US dollar or commodities such as gold. The primary purpose of stablecoins is to bridge the gap between traditional financial systems and digital assets, offering users a reliable medium of exchange and store of value within the often volatile crypto environment.

Providing Stability in a Volatile Market

One of the most compelling reasons for using stablecoins is their ability to offer price stability. Cryptocurrencies are notorious for rapid price swings that can make them unsuitable for everyday transactions or as a safe haven during market downturns. Stablecoins mitigate this issue by maintaining a consistent value, making them more attractive for routine payments, remittances, and savings within crypto ecosystems. For example, when traders want to hedge against market volatility without converting back into fiat currency, they often turn to stablecoins.

Reducing Volatility Risks

The inherent volatility associated with cryptocurrencies can pose risks not only to individual investors but also to broader financial systems that integrate these digital assets. By pegging their value directly or indirectly (through algorithms) to established currencies or commodities, stablecoins reduce exposure to unpredictable market fluctuations. This feature makes them particularly useful in decentralized finance (DeFi) applications where predictable asset values are crucial for lending, borrowing, and other financial services.

Enhancing Financial Inclusion

Stablecoins have significant potential in promoting financial inclusion globally. In regions where traditional banking infrastructure is limited or inaccessible—such as parts of Africa, Southeast Asia, and Latin America—stablecoins provide an alternative means for individuals to access financial services like savings accounts and remittances without needing bank accounts or credit histories. Because they operate on blockchain technology with relatively low transaction costs and fast settlement times compared to conventional banking channels, stablecoins can empower underserved populations economically.

Facilitating Cross-Border Transactions

International money transfers often involve high fees and lengthy processing times due to currency conversions through intermediary banks or payment processors. Stablecoins simplify this process by enabling direct peer-to-peer transactions across borders at lower costs while eliminating currency exchange complexities when both parties use tokens pegged closely enough in value with local currencies—or even directly tied—depending on regulatory frameworks. This efficiency benefits businesses engaged in global trade as well as expatriates sending remittances home.

Historical Context & Types of Stablecoins

The concept behind stablecoin development dates back nearly a decade; Tether (USDT), launched around 2014, was among the first attempts at creating digital assets with minimal volatility linked directly—or indirectly—to fiat currencies like USD. Since then, various types have emerged:

- Fiat-Pegged Stablecoins: These dominate the market by maintaining reserves held securely by issuers; examples include USDT (Tether), USDC (USD Coin), and BUSD.

- Commodity-Pegged Stablecoins: Pegged against physical assets such as gold (e.g., Tether Gold), these aim at providing backing through tangible resources.

- Algorithmic Stablecoin: These rely on complex algorithms rather than reserves alone—for instance TerraUSD (UST)—to automatically adjust supply based on demand dynamics aiming at maintaining peg stability.

Regulatory Environment & Challenges

As usage grows rapidly—with over $150 billion total market capitalization reported mid-2025—the regulatory landscape surrounding stablecoin issuance becomes increasingly critical for ensuring transparency and consumer protection. Governments worldwide recognize their importance but also express concerns about potential systemic risks if large-scale depegging occurs unexpectedly—as seen during TerraUSD’s collapse in 2022—which resulted in losses exceeding $60 billion.

Regulators like the U.S Securities Exchange Commission (SEC) scrutinize issuers such as Tether and Circle over compliance issues related either directly or indirectly related securities laws compliance standards set forth under evolving frameworks like Europe’s Markets in Crypto-Assets regulation (MiCA). Stricter oversight aims not only at safeguarding investors but also at preventing systemic disruptions stemming from unregulated issuance practices.

Risks & Future Outlook

Despite their advantages—stability being paramount—they are not immune from risks including regulatory crackdowns that could restrict certain types of stablecoin operations altogether; market confidence may waver following incidents similar to TerraUSD’s failure which exposed vulnerabilities inherent even within supposedly 'stable' tokens.

Furthermore—and critically—the large scale adoption raises questions about whether these digital assets could impact broader financial stability if they experience sudden depegging events leading investors into panic withdrawals affecting liquidity across markets globally.

As regulators continue refining policies aimed at balancing innovation with risk mitigation—and technological advancements improve transparency—the future trajectory suggests increased legitimacy alongside stricter oversight measures will shape how stable coins evolve within both crypto markets and mainstream finance sectors alike.

Why Are StableCoins Important?

In summary,

- They serve as reliable mediums facilitating seamless transactions across borders.

- They act as safe stores during volatile periods.

- They enable broader access points into digital economies especially where traditional banking remains limited.

Their role extends beyond mere trading tools—they underpin many DeFi protocols offering lending/borrowing options—and support mainstream adoption efforts by providing familiar valuation anchors amid fluctuating markets.

Final Thoughts

Stable coins stand out because they combine blockchain technology's benefits—such as transparency speed—with essential features akin to traditional money's stability attributes necessary for everyday use cases worldwide. As ongoing developments address current challenges—including regulatory clarity—they hold promise not just within niche crypto circles but potentially transforming global finance infrastructure itself over time.

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

How Are Stablecoins Like Tether USDt (USDT) Classified by Regulators?

Understanding the regulatory landscape surrounding stablecoins such as Tether USDt (USDT) is crucial for investors, financial institutions, and policymakers alike. As digital assets that aim to combine the stability of fiat currencies with the efficiency of cryptocurrencies, stablecoins have garnered significant attention from regulators worldwide. This article explores how authorities classify these assets, focusing on recent developments and ongoing debates.

What Are Stablecoins and Why Do They Matter?

Stablecoins are a category of cryptocurrencies designed to maintain a consistent value relative to traditional fiat currencies like the US dollar or euro. Unlike Bitcoin or Ethereum, which are known for their volatility, stablecoins aim to provide a reliable medium of exchange and store of value within the crypto ecosystem. They facilitate trading on exchanges, enable cross-border transactions with lower fees, and serve as a hedge against market volatility.

Tether USDt (USDT), launched in 2014 by Tether Limited, is among the most prominent stablecoins globally. It claims to be fully backed by US dollars held in reserve—though this assertion has faced scrutiny over transparency issues. Its widespread adoption makes understanding its regulatory classification particularly important.

The Challenges in Classifying Stablecoins

Regulators face several challenges when attempting to classify stablecoins:

- Diverse Structures: Stablecoins can be backed by fiat reserves, crypto collateralized assets, or algorithmic mechanisms that adjust supply dynamically.

- Evolving Use Cases: Their functions extend beyond simple transfers—they’re used for lending, staking, and even as collateral in decentralized finance (DeFi).

- Lack of Clear Definitions: Existing financial regulations often do not explicitly address digital assets like stablecoins.

These factors contribute to uncertainty about whether stablecoins should be treated as securities, commodities, or something else entirely.

Regulatory Approaches Around the World

Different jurisdictions have adopted varied strategies toward classifying and regulating stablecoins:

United States

In the U.S., agencies such as the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Financial Crimes Enforcement Network (FinCEN), and Office of the Comptroller of Currency (OCC) all play roles in oversight. The SEC has indicated that some stablecoin offerings could qualify as securities if they involve investment contracts or profit-sharing arrangements—particularly if they resemble investment schemes rather than mere payment tokens.

In 2021–2022, OCC clarified that national banks can provide banking services to stablecoin issuers if they comply with existing laws—a move seen as an acknowledgment that these tokens hold significant financial relevance but still fall under certain banking regulations.

European Union

The EU’s Markets in Crypto-assets Regulation (MiCA), proposed recently but yet to be fully implemented at October 2023 date—aims for comprehensive regulation covering issuance standards for asset-backed tokens like USDT. MiCA seeks transparency requirements around reserves backing these coins while establishing clear licensing procedures for issuers.

Asia-Pacific

Countries like Singapore have taken proactive steps; their regulatory bodies focus on AML/KYC compliance rather than outright classification but emphasize consumer protection measures similar to traditional finance rules.

Recent Developments Shaping Regulatory Views

Over recent years—and especially since 2019—regulators’ attitudes toward stablecoin regulation have intensified due to several high-profile incidents:

- The New York Attorney General’s investigation into Tether Limited revealed concerns about whether USDT was truly fully backed by reserves—a key factor influencing its classification.

- In 2020–2021: The SEC signaled increased scrutiny over whether certain stablecoin offerings constitute unregistered securities.

- The collapse of major crypto exchanges during liquidity crises highlighted systemic risks posed by interconnected digital assets—including unstable backing mechanisms—prompting calls for tighter oversight.

Furthermore, international coordination efforts through organizations like G20 aim at creating unified standards around transparency requirements and risk management practices related to stablecoin issuance.

Implications For Investors And Financial Markets

The way regulators classify Tether USDt impacts multiple facets:

Market Stability: If classified strictly as securities or derivatives without proper safeguards—which could happen under strict regulation—it might restrict access or increase compliance costs leading potentially to reduced liquidity.

Consumer Protection: Clearer classifications help ensure transparent backing mechanisms; otherwise consumers risk losses from mismanaged reserves or fraudulent practices linked with opaque issuers like Tether Limited has faced allegations over years ago.

Financial System Risks: Unregulated issuance could lead destabilizing effects similar—or worse—to those seen during bank runs; hence regulators seek balanced frameworks ensuring innovation without compromising stability.

Emerging Trends And Future Outlook

As regulatory bodies continue refining their approaches—with some leaning towards stricter oversight—the future likely involves more comprehensive frameworks tailored specifically for digital assets like USDT. International cooperation will play a vital role in harmonizing standards across jurisdictions so that global markets operate under consistent rules regarding reserve transparency and investor protections.

Stakeholders should stay informed about legislative developments because evolving classifications may influence trading strategies—for example: whether USDT remains widely accepted across platforms or faces restrictions based on new legal interpretations.

Key Takeaways:

- Stablecoin classification varies globally but often hinges on their backing mechanism

- Regulatory agencies increasingly scrutinize reserve transparency

- Recent incidents underscore systemic risks prompting calls for tighter controls

- Clarity benefits both consumers through enhanced protections & markets via improved stability

Navigating this complex environment requires understanding both current regulations—and anticipating future changes—as authorities strive balance between fostering innovation & safeguarding financial integrity within rapidly evolving digital economies.

Keywords: Stablecoins regulation | Tether USDt | Cryptocurrency legal status | Digital asset oversight | Reserve backing stability | Crypto market risks

Lo

2025-05-15 01:48

How are stablecoins like Tether USDt (USDT) classified by regulators?

How Are Stablecoins Like Tether USDt (USDT) Classified by Regulators?

Understanding the regulatory landscape surrounding stablecoins such as Tether USDt (USDT) is crucial for investors, financial institutions, and policymakers alike. As digital assets that aim to combine the stability of fiat currencies with the efficiency of cryptocurrencies, stablecoins have garnered significant attention from regulators worldwide. This article explores how authorities classify these assets, focusing on recent developments and ongoing debates.

What Are Stablecoins and Why Do They Matter?

Stablecoins are a category of cryptocurrencies designed to maintain a consistent value relative to traditional fiat currencies like the US dollar or euro. Unlike Bitcoin or Ethereum, which are known for their volatility, stablecoins aim to provide a reliable medium of exchange and store of value within the crypto ecosystem. They facilitate trading on exchanges, enable cross-border transactions with lower fees, and serve as a hedge against market volatility.

Tether USDt (USDT), launched in 2014 by Tether Limited, is among the most prominent stablecoins globally. It claims to be fully backed by US dollars held in reserve—though this assertion has faced scrutiny over transparency issues. Its widespread adoption makes understanding its regulatory classification particularly important.

The Challenges in Classifying Stablecoins

Regulators face several challenges when attempting to classify stablecoins:

- Diverse Structures: Stablecoins can be backed by fiat reserves, crypto collateralized assets, or algorithmic mechanisms that adjust supply dynamically.

- Evolving Use Cases: Their functions extend beyond simple transfers—they’re used for lending, staking, and even as collateral in decentralized finance (DeFi).

- Lack of Clear Definitions: Existing financial regulations often do not explicitly address digital assets like stablecoins.

These factors contribute to uncertainty about whether stablecoins should be treated as securities, commodities, or something else entirely.

Regulatory Approaches Around the World

Different jurisdictions have adopted varied strategies toward classifying and regulating stablecoins:

United States

In the U.S., agencies such as the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Financial Crimes Enforcement Network (FinCEN), and Office of the Comptroller of Currency (OCC) all play roles in oversight. The SEC has indicated that some stablecoin offerings could qualify as securities if they involve investment contracts or profit-sharing arrangements—particularly if they resemble investment schemes rather than mere payment tokens.

In 2021–2022, OCC clarified that national banks can provide banking services to stablecoin issuers if they comply with existing laws—a move seen as an acknowledgment that these tokens hold significant financial relevance but still fall under certain banking regulations.

European Union

The EU’s Markets in Crypto-assets Regulation (MiCA), proposed recently but yet to be fully implemented at October 2023 date—aims for comprehensive regulation covering issuance standards for asset-backed tokens like USDT. MiCA seeks transparency requirements around reserves backing these coins while establishing clear licensing procedures for issuers.

Asia-Pacific

Countries like Singapore have taken proactive steps; their regulatory bodies focus on AML/KYC compliance rather than outright classification but emphasize consumer protection measures similar to traditional finance rules.

Recent Developments Shaping Regulatory Views

Over recent years—and especially since 2019—regulators’ attitudes toward stablecoin regulation have intensified due to several high-profile incidents:

- The New York Attorney General’s investigation into Tether Limited revealed concerns about whether USDT was truly fully backed by reserves—a key factor influencing its classification.

- In 2020–2021: The SEC signaled increased scrutiny over whether certain stablecoin offerings constitute unregistered securities.

- The collapse of major crypto exchanges during liquidity crises highlighted systemic risks posed by interconnected digital assets—including unstable backing mechanisms—prompting calls for tighter oversight.

Furthermore, international coordination efforts through organizations like G20 aim at creating unified standards around transparency requirements and risk management practices related to stablecoin issuance.

Implications For Investors And Financial Markets

The way regulators classify Tether USDt impacts multiple facets:

Market Stability: If classified strictly as securities or derivatives without proper safeguards—which could happen under strict regulation—it might restrict access or increase compliance costs leading potentially to reduced liquidity.

Consumer Protection: Clearer classifications help ensure transparent backing mechanisms; otherwise consumers risk losses from mismanaged reserves or fraudulent practices linked with opaque issuers like Tether Limited has faced allegations over years ago.

Financial System Risks: Unregulated issuance could lead destabilizing effects similar—or worse—to those seen during bank runs; hence regulators seek balanced frameworks ensuring innovation without compromising stability.

Emerging Trends And Future Outlook

As regulatory bodies continue refining their approaches—with some leaning towards stricter oversight—the future likely involves more comprehensive frameworks tailored specifically for digital assets like USDT. International cooperation will play a vital role in harmonizing standards across jurisdictions so that global markets operate under consistent rules regarding reserve transparency and investor protections.

Stakeholders should stay informed about legislative developments because evolving classifications may influence trading strategies—for example: whether USDT remains widely accepted across platforms or faces restrictions based on new legal interpretations.

Key Takeaways:

- Stablecoin classification varies globally but often hinges on their backing mechanism

- Regulatory agencies increasingly scrutinize reserve transparency

- Recent incidents underscore systemic risks prompting calls for tighter controls

- Clarity benefits both consumers through enhanced protections & markets via improved stability

Navigating this complex environment requires understanding both current regulations—and anticipating future changes—as authorities strive balance between fostering innovation & safeguarding financial integrity within rapidly evolving digital economies.

Keywords: Stablecoins regulation | Tether USDt | Cryptocurrency legal status | Digital asset oversight | Reserve backing stability | Crypto market risks

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

How Do Stablecoins Maintain Their Peg?

Stablecoins have become a cornerstone of the modern cryptocurrency ecosystem, offering stability in an otherwise volatile market. They serve as a bridge between traditional fiat currencies and digital assets, enabling users to transact, hedge against volatility, and participate in decentralized finance (DeFi) with confidence. But how exactly do these digital tokens keep their value stable relative to fiat currencies like the US dollar? Understanding the mechanisms behind peg maintenance is essential for investors, developers, and regulators alike.

What Are Stablecoins and Why Are They Important?

Stablecoins are cryptocurrencies designed to maintain a consistent value by being pegged to a reserve asset such as fiat currency or commodities. Unlike Bitcoin or Ethereum, which can experience significant price swings within short periods, stablecoins aim for minimal fluctuation—typically maintaining a 1:1 ratio with their target currency.

Their importance lies in providing liquidity and stability within crypto markets. Traders use stablecoins for quick conversions without converting back into traditional money; DeFi platforms rely on them for lending and borrowing; merchants accept them as payments without exposure to crypto volatility. This stability fosters broader adoption of blockchain technology by integrating it more seamlessly into everyday financial activities.

Types of Stablecoins

There are primarily three categories based on how they maintain their peg:

Fiat-Collateralized Stablecoins: These are backed by reserves of fiat currency stored securely in banks or custodial accounts. For example, Tether (USDT) and USD Coin (USDC) hold reserves equivalent to the number of tokens issued. This direct backing allows users to redeem stablecoins at a 1:1 ratio with the underlying fiat.

Commodity-Collateralized Stablecoins: These are backed by physical assets like gold or oil. An example is PAX Gold (PAXG), where each token represents ownership of physical gold stored in vaults worldwide.

Algorithmic Stablecoins: Instead of collateral backing, these rely on algorithms that automatically adjust supply based on market conditions—similar to central banks managing monetary policy but executed via smart contracts on blockchain networks.

Each type has its advantages and risks; collateralized stablecoins tend to be more transparent but require trust in reserve management, while algorithmic ones offer decentralization but face challenges related to maintaining long-term stability during extreme market movements.

Mechanisms Used To Maintain Peg Stability

Maintaining a peg involves complex systems that respond dynamically when deviations occur between the stablecoin’s market price and its target value:

Fiat-Collateralization

The most straightforward method involves holding sufficient reserves equal to all issued tokens. When demand increases or decreases causes price fluctuations above or below $1 USD (or other target), users can redeem their tokens directly for cash at this fixed rate through trusted custodians or issuers.

This process relies heavily on transparency—regular audits ensure that reserves match circulating supply—and trustworthiness from issuers because if reserves fall short during high redemption demands—a scenario known as "bank run"—the peg could break down leading to depegging events.

Commodity Collateralization

Stablecoin issuers backing tokens with commodities track prices closely using external data feeds called "oracles." If gold-backed stablecoin prices deviate from actual gold prices due to supply-demand shifts or market shocks, mechanisms may trigger additional issuance or redemption processes aimed at restoring parity with commodity values over time.

Algorithmic Stabilization

Algorithmic stablecoins employ smart contracts programmed with rules that automatically adjust token supply:

Supply Expansion: When demand pushes prices above $1 USD—for instance if traders buy up large amounts—the system increases total supply by minting new coins.

Supply Contraction: Conversely, if prices drop below $1 USD due to sell-offs or panic selling—the system reduces circulating supply through burning coins or incentivizing holders not to sell until equilibrium is restored.

These adjustments help keep the price close enough around the peg but can be vulnerable during extreme volatility when algorithms struggle under stress—a challenge seen historically with some algorithmic projects facing depegging crises during market crashes.

Recent Developments Shaping Peg Maintenance Strategies

The landscape surrounding stablecoin pegs continues evolving rapidly amid regulatory scrutiny and technological innovation:

New Entrants Like USD1 Backed by US Treasuries

In April 2025, notable political figures launched new initiatives such as Trump’s USD1—a fully collateralized stablecoin backed by short-term US Treasury bills[1]. Such developments aim at combining government-backed security features with blockchain efficiency while addressing concerns about transparency and systemic risk associated with less regulated options like algorithmic coins.

Regulatory Impact & Market Confidence

Regulators worldwide—including SEC oversight in the United States—are increasingly scrutinizing whether certain stablecoins qualify as securities due diligence standards demand full disclosure about reserve holdings[2]. The absence of clear regulations creates uncertainty; however, compliant projects often emphasize transparency through regular audits which bolster user confidence necessary for maintaining pegs effectively over time.

Risks That Can Disrupt Peg Stability

Despite sophisticated mechanisms employed across different types of stablecoins there remain inherent risks:

Regulatory Risks: Legal actions against issuers lacking proper licensing could force sudden redemptions leading directly toward depegging scenarios.

Market Liquidity Crises: During times of high volatility—as seen during global crises like COVID-19 pandemic—reserves might not suffice if many users attempt simultaneous redemptions.

Technological Vulnerabilities: Smart contract bugs can be exploited resulting in loss of funds or unintended inflation/deflation cycles affecting peg integrity.

Understanding these vulnerabilities underscores why robust governance frameworks combined with technological resilience are vital components ensuring ongoing stability.

The Role Of Technology In Ensuring Stability

Blockchain technology plays an integral role beyond simple collateral management:

Smart contracts automate redemption processes ensuring transparent operations without human intervention.

Oracles provide real-time data feeds critical for algorithmic adjustments—inaccurate data could lead algorithms astray causing instability.

Furthermore, advances such as layer-two scaling solutions improve transaction speed and reduce costs associated with stabilizing operations across congested networks—all contributing towards more reliable peg maintenance systems.

Future Outlook For Stablecoin Pegholding Strategies

As regulatory clarity improves globally alongside technological innovations like zero-trust security models—and increased institutional participation—the future looks promising yet challenging:

Greater transparency requirements will likely push issuers toward full-reserve models enhancing trustworthiness.

Hybrid approaches combining collateralization methods may emerge offering better resilience against shocks.

Ultimately successful stabilization depends upon balancing decentralization ideals while ensuring sufficient safeguards against systemic failures—a task requiring continuous innovation informed by rigorous research standards.