牛市结束了吗?

现在市场有两个主流声音:

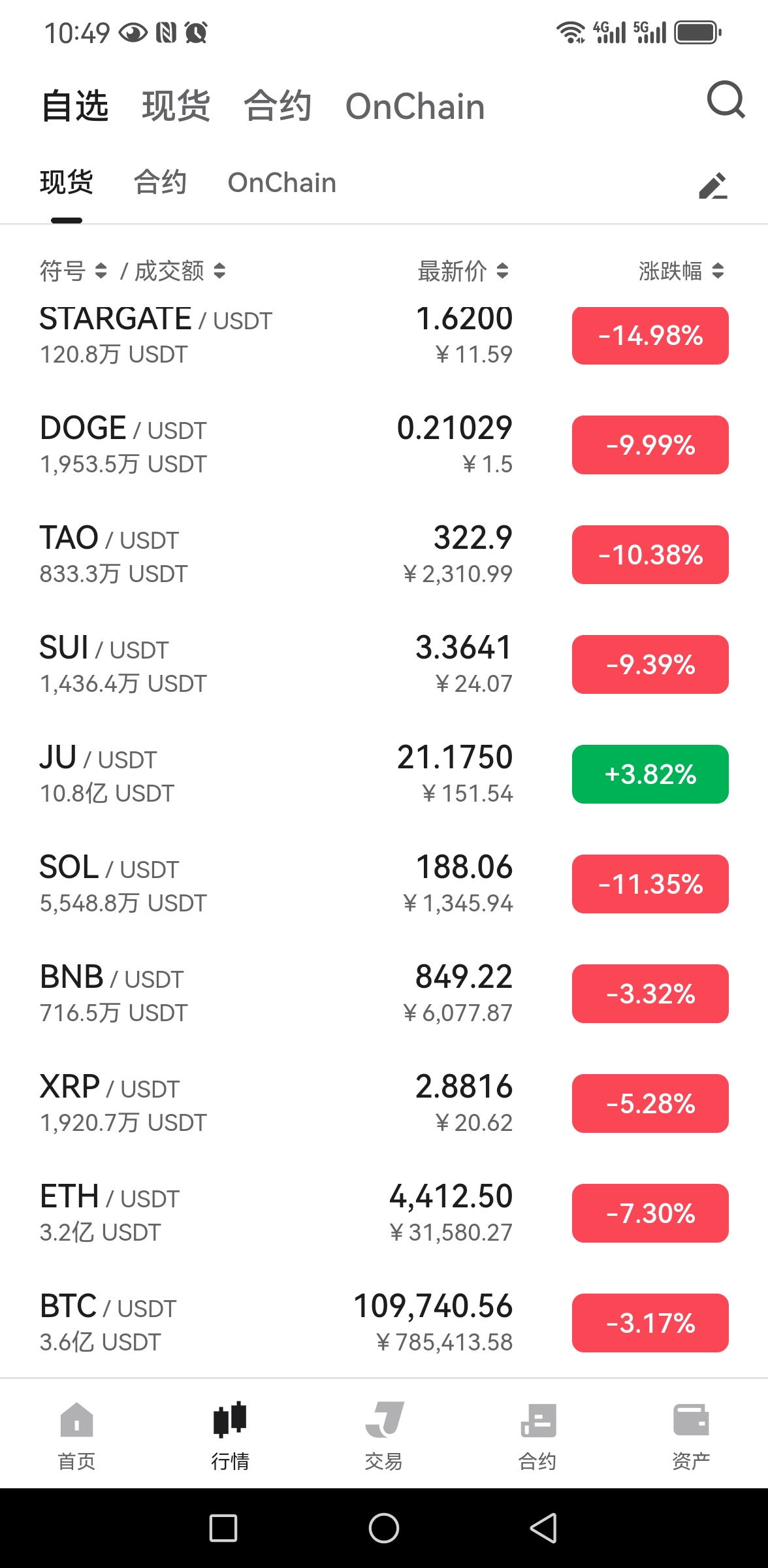

1. 见顶派:这一轮牛市已见顶

理由:BTC周线顶背离+MACD死叉,比特币十年以上OG频繁出货,大户清仓,比特币ETF资金持续净流出。

2.疯牛派,大的要来了

山寨季要来临,依据4年周期论,目前BTC见顶暴跌,资金流出到ETH和山寨,接下来ETH和山寨将最后疯涨3-4个月,9月降息提供流动性支持,狂暴大牛市来了你无法想象。

我们社区的观点:8月底和9月上旬先暴跌一波把疯牛派满仓期待的山寨季干成山寨祭,让见顶派嚣张一段时间,把疯牛派洗到绝望,等降息落地流动性释放,ETH带领山寨迎来最后一波行情,把见顶派和疯牛派彻底涨服,让他们FOMO上车再砸盘,一起套在山顶。

理由就是现在基本面的问题:之前回调洗盘不彻底没完成,被鲍威尔奶了一口,ETH带领山寨币打了一针鸡血,但是比特币没有太大反应,现在又跌出新低(比特币机构化,比散户集中的山寨更冷静);

以前也说过,事件引起的涨跌最终都会回归正常,只是延长或者推迟了原本的进程。

现在美联储9月降息还没有落地,并且降息的资金流进市场也需要时间,这两个问题留下的时间差,主力肯定会用来洗盘!因为现在车太重。

所以现在应该是预防大跌洗盘的阶段,而不是幻想新高的事情,见好就收依然是主题。

这一段时间我像个空军头子!只是因为经历过5.19/3.12,见过太多吃人不吐骨头的时刻,牛市里韭菜亏的比熊市里更多、更惨,因为牛市给了太多人不切实际的幻想。

当然,就算是今年3月、4月大跌时,我也说过,今年下半年的牛市该来的都会来,就看你有没有勇气越跌越买,然后到时候越涨越卖,这个市场会止盈其实才是更重要的事情---这是韭菜与高手的根本区别。

晴朗财经

2025-08-26 03:03

牛市结束了吗?

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

What Is the Total Number of Transactions on the Bitcoin Network?

Understanding the total number of transactions on the Bitcoin network is essential for grasping how active and widely used this pioneering cryptocurrency truly is. This metric offers insights into user engagement, network health, and overall adoption trends. In this article, we will explore what influences transaction volume, recent developments in 2023, and what these figures mean for investors and users alike.

How Does Transaction Volume Reflect Network Activity?

The total number of Bitcoin transactions indicates how frequently users are transferring funds or engaging with blockchain-based applications. On average, as of 2023, around 250,000 to 300,000 transactions occur daily. These fluctuations are driven by various factors such as market sentiment—bullish periods tend to see increased activity—as well as regulatory environments that can either encourage or restrict usage.

High transaction volumes suggest a vibrant ecosystem where users actively buy, sell, or transfer Bitcoin. Conversely, dips may signal reduced interest or external pressures like stricter regulations. Monitoring these numbers helps stakeholders gauge whether Bitcoin remains a popular medium for peer-to-peer payments or speculative trading.

Factors Influencing Transaction Counts

Several key elements impact how many transactions are recorded on the blockchain:

- Market Conditions: Bull markets often lead to increased trading activity as investors seek opportunities.

- Regulatory Changes: Stricter laws can temporarily suppress transaction volumes; conversely, favorable policies may boost activity.

- Network Congestion: When many users transact simultaneously—such as during major price swings—transaction fees rise due to limited block space.

- Technological Developments: Improvements like SegWit (Segregated Witness) have optimized transaction processing times and costs over time.

These factors collectively shape daily transaction counts and influence user behavior across different periods.

Recent Trends in 2023: Fluctuations in Transaction Numbers

In April 2023, the Bitcoin network experienced a notable surge in transaction volume driven by heightened market speculation amid potential regulatory shifts in major economies. This increase was partly fueled by traders reacting to news about possible government interventions that could impact cryptocurrency markets globally.

However, May saw an uptick in average transaction fees—about a 20% rise compared to previous months—which reflects higher network congestion. Elevated fees can discourage smaller transactions from occurring frequently because they become less cost-effective for everyday use cases like micro-payments or casual transfers.

These recent trends highlight how external events directly influence not only how much activity occurs but also its economic viability for typical users.

Blockchain Size and Its Impact on Transactions

The size of the Bitcoin blockchain itself provides context about overall network activity; it stood at approximately 400 GB in early 2023—a significant increase from previous years due to continuous addition of new blocks containing transactional data.

A larger blockchain signifies more historical data stored across nodes worldwide but also raises concerns regarding scalability:

- Larger blockchains require more storage capacity.

- Synchronization times increase for new nodes joining the network.

- Higher data loads can contribute to slower confirmation times during peak periods unless scaling solutions are implemented effectively.

Efforts such as Lightning Network aim to address these scalability challenges by enabling faster off-chain transactions while maintaining security through underlying blockchain settlement layers.

The Role of Miners and Validation Processes

Miners play a crucial role in maintaining accurate records by validating transactions through complex computational puzzles—a process known as proof-of-work (PoW). They compete within seconds to add new blocks containing pending transactions onto the chain; successful miners receive rewards plus associated fees paid by transacting parties.

This validation process ensures integrity but is energy-intensive: estimates suggest that mining consumes substantial electricity globally. As demand increases with higher transaction volumes during active periods like April-May 2023’s surge,

the environmental footprint becomes more prominent concern among regulators and advocates alike.

Key Points About Mining:

- Miners validate hundreds of thousands of daily transactions

- Validation ensures decentralization & security

- Rising demand impacts energy consumption

Regulatory Environment's Effect on Transaction Volumes

Government policies significantly influence user participation levels on the Bitcoin network. In early 2023,

several countries introduced stricter regulations targeting crypto exchanges,which temporarily dampened trading activities reflected through decreased transaction counts initially observed after policy announcements.

However,

some jurisdictions adopted clearer frameworks encouraging institutional involvement,potentially stabilizing or increasing future transactional activity once compliance mechanisms were established.

Summary:

Regulatory uncertainty remains one of the most unpredictable factors affecting total bitcoin transactions; ongoing legislative developments will continue shaping usage patterns moving forward.

Future Outlook: Scalability Solutions & Adoption Trends

As interest grows among retail investors and institutions alike,

scalability solutions such as Taproot upgrades,Lightning Network implementations,and sidechains aim to facilitate faster processing at lower costs.

These technological advancements could help sustain higher throughput levels necessary for mainstream adoption while reducing congestion-related fee hikes seen earlier this year.

Moreover,

wider acceptance from merchants accepting bitcoin payments directly enhances real-world utility beyond speculative trading,

potentially leading toward sustained growth in total number of daily transactions over coming years.

By continuously monitoring metrics like total bitcoin transaction count alongside technological improvements and regulatory changes,

stakeholders—from individual users to large-scale investors—can better understand market dynamics

and make informed decisions aligned with evolving industry conditions.

References

- CoinDesk — General information on Bitcoin networks

- Blockchain.com Charts — Historical data analysis

- Blockchain Size Data — Blockchain growth insights

- Transaction Fees & Congestion — Impact analysis

- Bitcoin Mining Process — Technical validation overview

- Regulatory Impact Reports — Policy effects assessment

Understanding how many people transact using Bitcoin provides valuable insight into its current state—and future potential—as both an investment asset and a decentralized payment system amidst an ever-changing global landscape