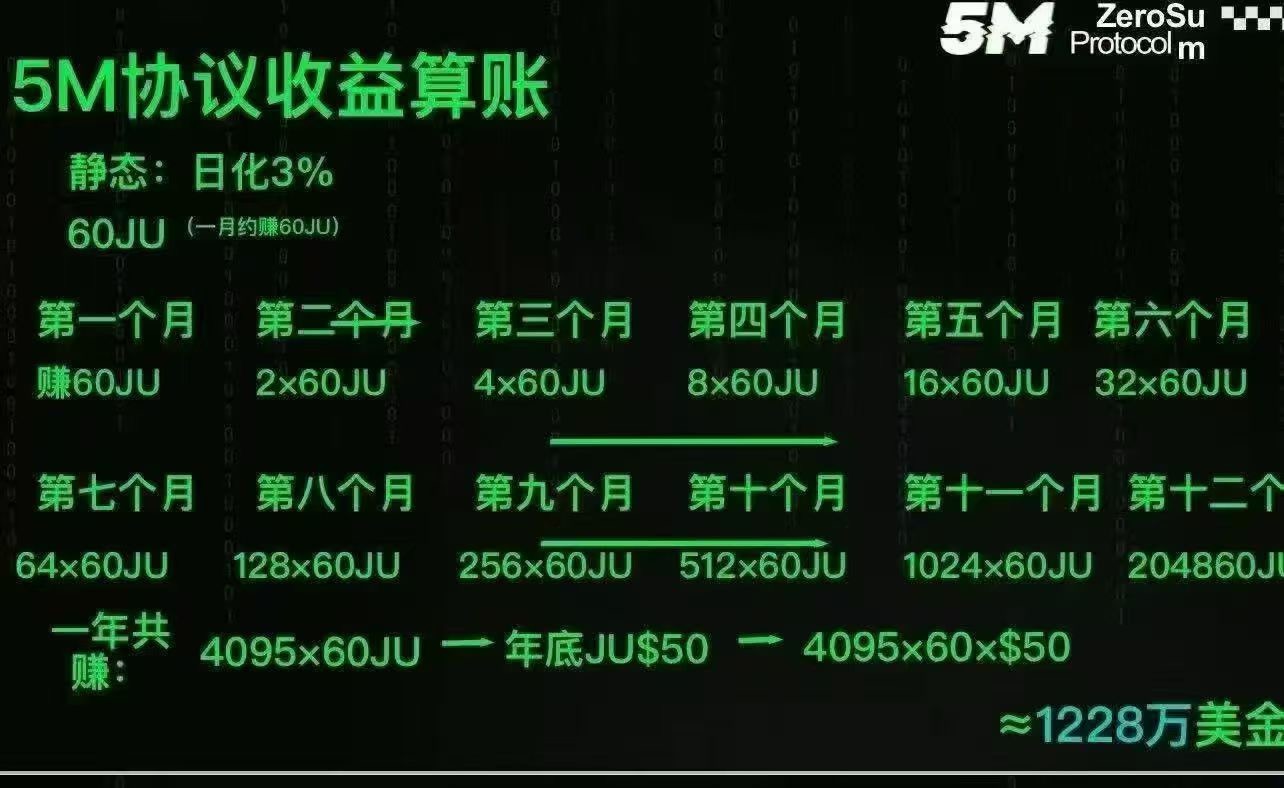

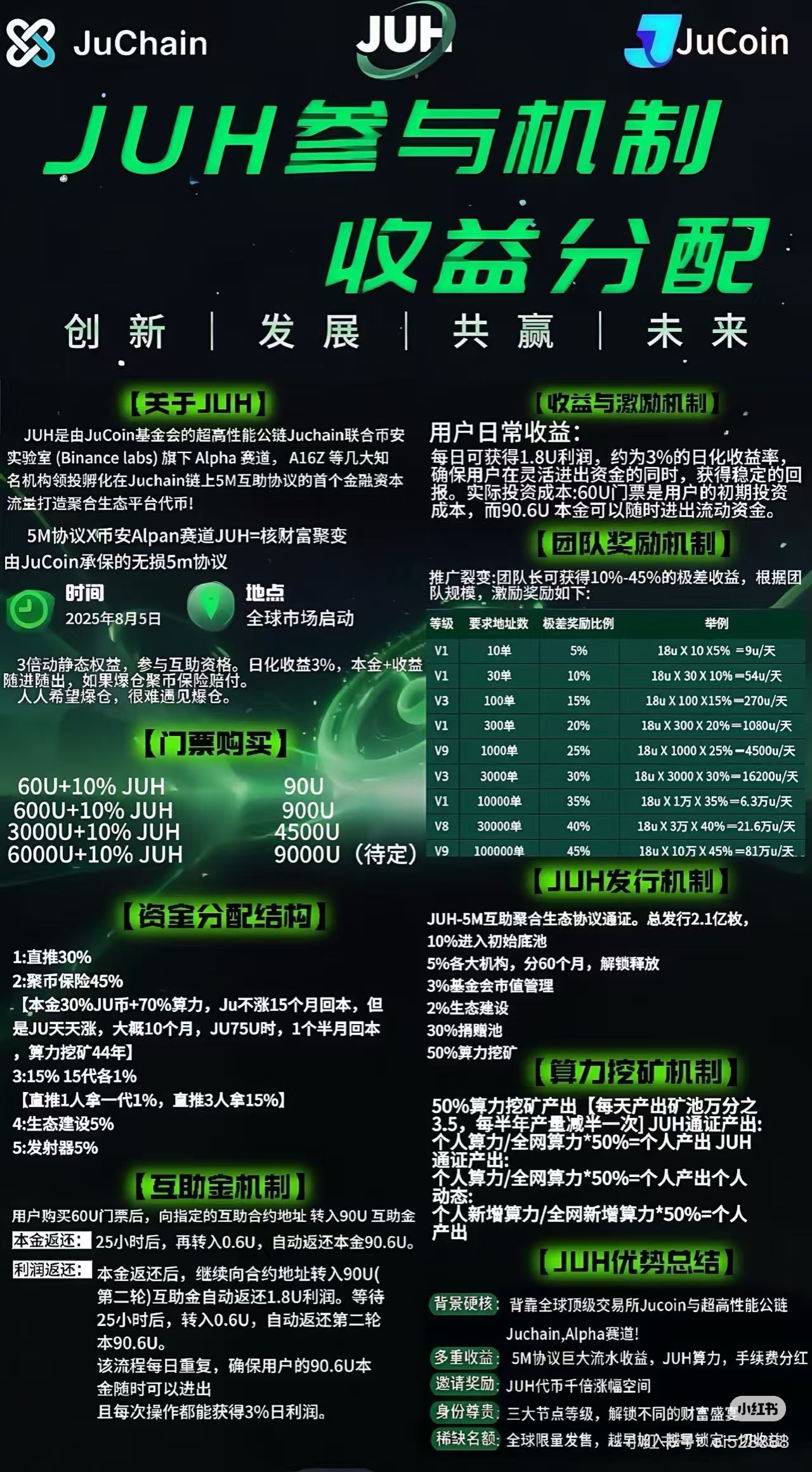

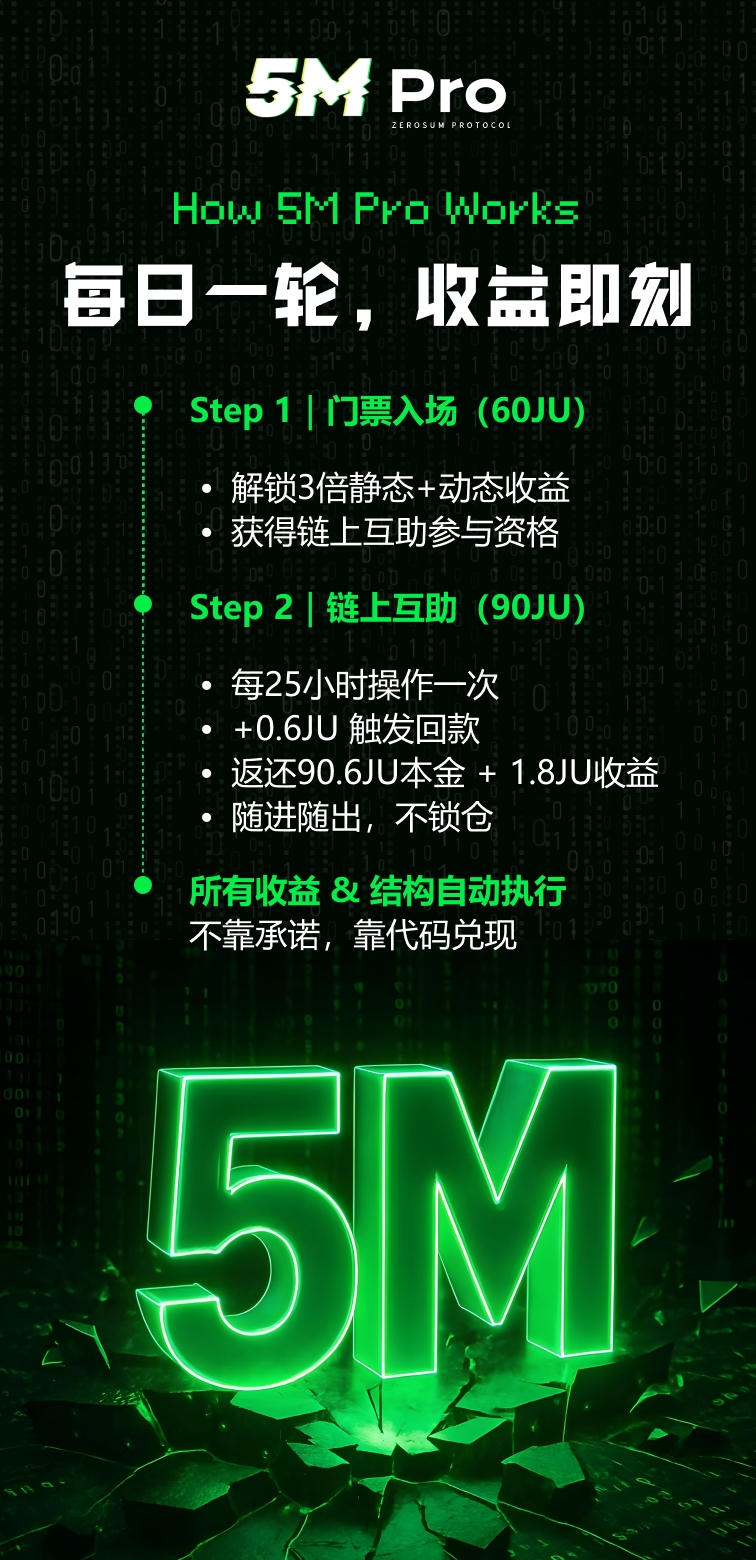

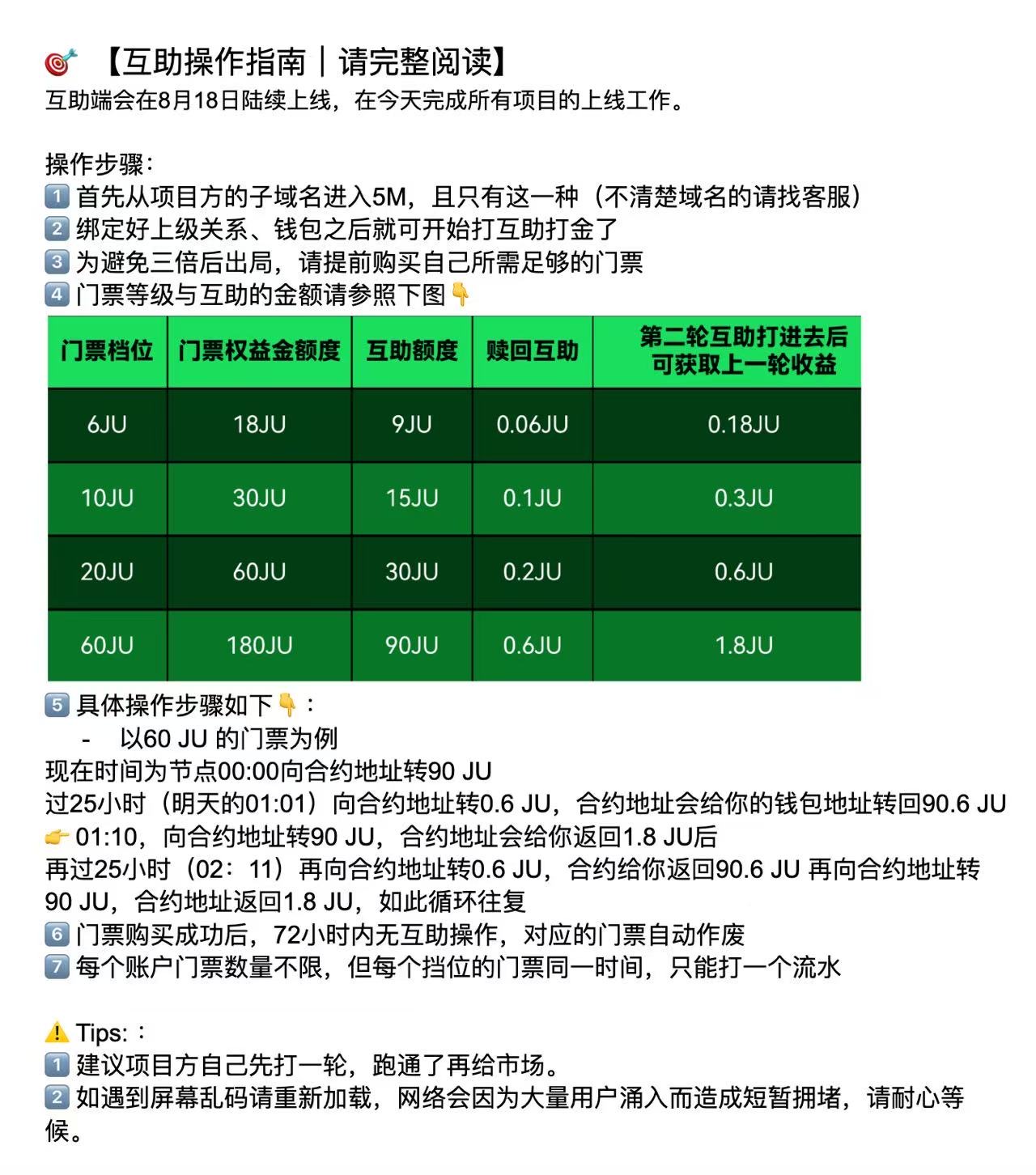

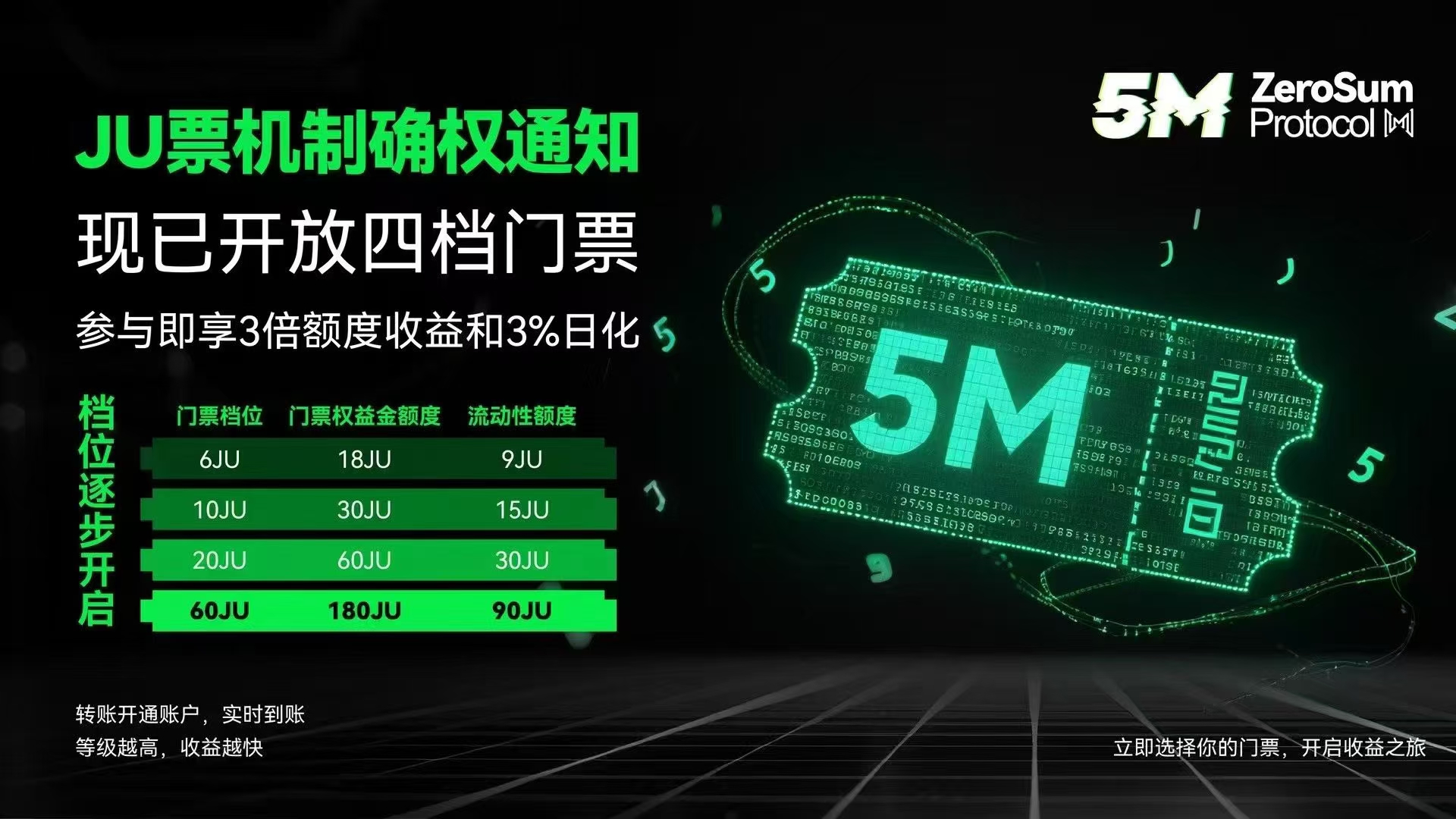

5m 20门票送5ju2025-08-31 08:41

5m最高扶持

入金送ju给你最高扶持

5M生态七大保障:

[强]1、智能合约写死,资金安全透明;

[强]2、链上自动运行,稳定高效快捷;

[强]3、数据不可篡改,安全无懈可击;

[强]4、完全去中心化,政策监管无碍;

[强]5、社区高度自治,深度强化共识!

[强]6、24小时秒变现,无需任何后台审核,

[强]7、30%现金赔付,70%ju算力挖矿!

[炸弹]不要用自己的时间去见证别人的奇迹,5M就这么给力!

Preview

Preview

Preview

Preview

Preview

Preview

33

0

0

5m 20门票送5ju

2025-08-31 08:44

5m最高扶持

[{"type":"paragraph","children":[{"text":"入金送ju给你最高扶持"}]},{"type":"paragraph","children":[{"text":"5M生态七大保障:"}]},{"type":"paragraph","children":[{"text":"[强]1、智能合约写死,资金安全透明;"}]},{"type":"paragraph","children":[{"text":"[强]2、链上自动运行,稳定高效快捷;"}]},{"type":"paragraph","children":[{"text":"[强]3、数据不可篡改,安全无懈可击;"}]},{"type":"paragraph","children":[{"text":"[强]4、完全去中心化,政策监管无碍;"}]},{"type":"paragraph","children":[{"text":"[强]5、社区高度自治,深度强化共识!"}]},{"type":"paragraph","children":[{"text":"[强]6、24小时秒变现,无需任何后台审核,"}]},{"type":"paragraph","children":[{"text":"[强]7、30%现金赔付,70%ju算力挖矿!"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"[炸弹]不要用自己的时间去见证别人的奇迹,5M就这么给力!"}]}]

JU Square

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

相关文章

JUST IN : $BNB FRAPPE UN NOUVEAU RECORD[{"type":"paragraph","children":[{"text":""},{"type":"coin","currencyId":6,"currency":"bnb","symbolId":5,"symbol":"bnb_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/bnb.png","fullName":"BNB","character":"BNB/USDT","children":[{"text":""}]},{"text":" La capitalisation atteint "},{"text":"131 Md$","bold":true},{"text":", confirmant $BNB comme le "},{"text":"3ᵉ plus grand actif crypto","bold":true},{"text":" derrière "},{"text":"Bitcoin","bold":true},{"text":" et "},{"text":"Ethereum","bold":true},{"text":"."}]},{"type":"paragraph","children":[{"text":"👉 La domination de Binance dans l’écosystème continue de se renforcer."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"BNB","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"crypto","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n"}]}]

$XLM : breakout confirmé[{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"coin","currencyId":148,"currency":"xlm","symbolId":63,"symbol":"xlm_usdt","logo":"https://storage.jucoin.online/1/currency/e489b44a-3159-4c98-9ac7-7af894b79770-1737531379258.png","fullName":"Stellar Lumens","character":"XLM/USDT","children":[{"text":""}]},{"text":" a dépassé sa zone d’accumulation sous le précédent plus bas, comme prévu."}]},{"type":"paragraph","children":[{"text":"💡 "},{"text":"Setup optimal","bold":true},{"text":" :\nEntry : "},{"text":"0,39 $","bold":true},{"text":"\nStop : "},{"text":"0,33 $","bold":true},{"text":"\n\n🎯 Premier objectif : "},{"text":"1 $","bold":true},{"text":", avec possibilité de suivre plus haut en suivant la dynamique de $XRP.\n"}]},{"type":"paragraph","children":[{"text":"👉 Opportunité pour ceux qui veulent "},{"text":"prendre position avec stratégie","bold":true},{"text":"."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"XLM","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"crypto","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n\n\n"}]}]

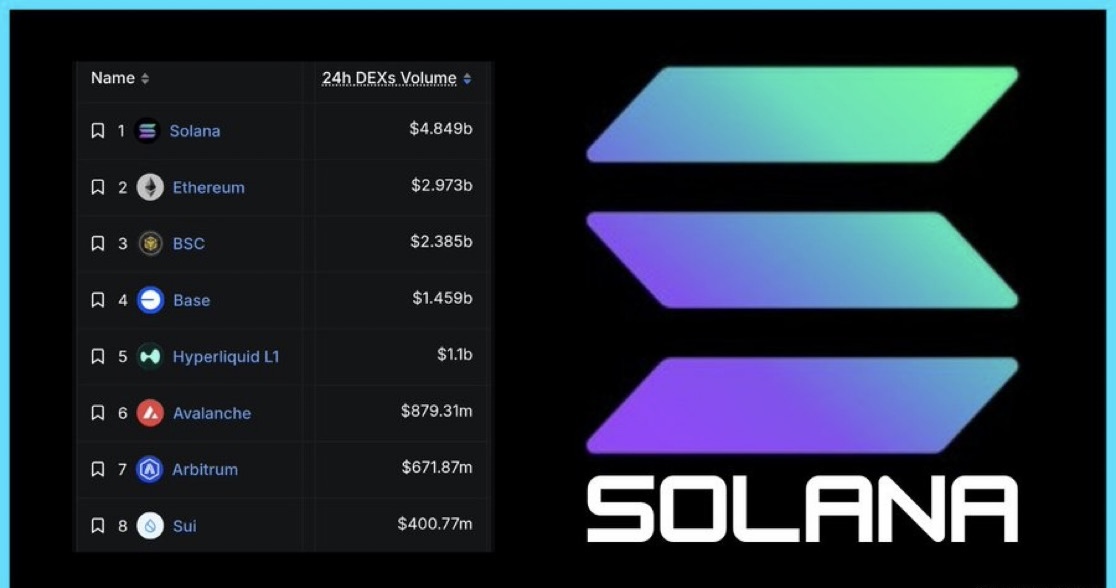

JUST IN: $SOL LEADS ALL BLOCKCHAINS IN DEX VOLUME[{"type":"paragraph","children":[{"text":"\n"},{"type":"link","url":"https://coinmarketcap.com/community/profile/cryp_joe/","children":[{"text":""}]},{"text":""}]},{"type":"paragraph","children":[{"text":"JUST IN: "},{"type":"link","url":"https://coinmarketcap.com/community/coins/solana/top/","children":[{"text":"$SOL"}]},{"text":" LEADS ALL BLOCKCHAINS IN DEX VOLUME! MORE THAN "},{"type":"link","url":"https://coinmarketcap.com/community/coins/ethereum/top/","children":[{"text":"$ETH"}]},{"text":" + ALL ETH L2'S COMBINED"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://coinmarketcap.com/community/topics/SOLANA/top/","children":[{"text":"#SOLANA"}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n"}]}]

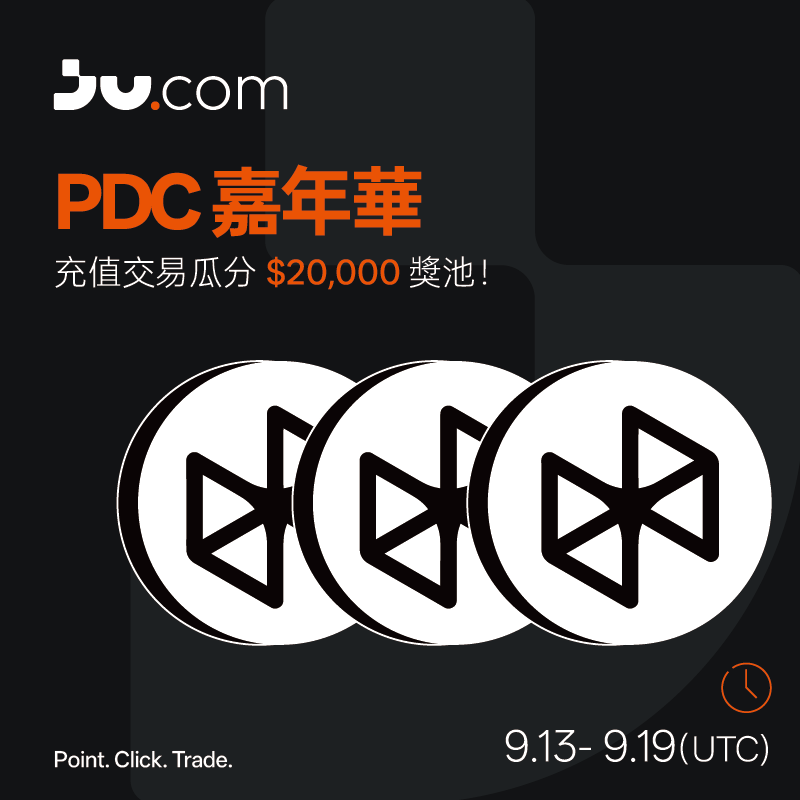

Ju.com x PDC Carnival is Live! [{"type":"paragraph","children":[{"text":"The wait is over and Ju.com is bringing you a massive $20,000 prize pool to celebrate PDC! 🚀"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"⏳ Event Period: Sept 13, 2025 19:30 – Sept 20, 2025 00:00 (UTC)"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"🔥 Here’s how you can join the fun:"}]},{"type":"paragraph","children":[{"text":"✅ Deposit PDC → Share a $5,000 prize pool"}]},{"type":"paragraph","children":[{"text":"✅ Trade PDC → Share a $15,000 prize pool"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"It’s simple: the more you participate, the bigger your rewards. Don’t miss out on this chance to grow your bags while the carnival lasts! "}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"👉 Join now: bit.ly/48fzUTn"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"#Jucom #NewUserRewards "}]},{"type":"paragraph","children":[{"text":""}]}]

🟠 From KOLs to Brokers: How Community Power Transforms into Financial Momentum![{"type":"paragraph","children":[{"text":"In the old playbook of capital markets, fundraising and underwriting have always been a game for the few. At center stage are investment banks and major institutions, deciding who gets on stage and who secures the funding. Retail investors and communities could only wait in the dim corners of the secondary market, left to hold the bag. But in the world of Web3, the plot is being rewritten."}]},{"type":"numbered-list","children":[{"type":"heading-three","children":[{"text":"I. The Old Playbook of Capital Markets: A Missing Community"}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"When a listed company needs capital, the first step is often to approach an investment bank, negotiate a discounted placement or a private offering."}]},{"type":"list-item","children":[{"text":"The capital only circulates among institutions, while ordinary investors and communities can only wait passively, entering at the secondary market."}]},{"type":"list-item","children":[{"text":"Even worse, due to a lack of buy-side support, stock prices often come under pressure after fundraising, further diminishing market confidence."}]}]},{"type":"heading-three","children":[{"text":"II. The Potential of Community: From Voice to Momentum"}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"KOLs can guide investment directions;"}]},{"type":"list-item","children":[{"text":"Community leaders can pool scattered small funds into collective strength;"}]},{"type":"list-item","children":[{"text":"If this energy has a "},{"text":"compliant, safe, and transparent mechanism for channeling it","bold":true},{"text":", it can become a new source of liquidity for financial markets."}]}]},{"type":"heading-three","children":[{"text":"III. The Emergence of XBrokers: Mechanism Innovation Led by Ju.com"}]},{"type":"numbered-list","children":[{"type":"list-item","children":[{"text":"Directed Equity Subscription Zone (Early-Bird Subscription)","bold":true},{"text":"Listed companies can launch fundraising here, not only for institutions but also open to ordinary investors who have completed KYC.Investors participate via “blind box subscription,” enjoying the benefits of discounted allocations.Recommendations by community leaders and KOLs are directly converted into purchase orders."}]},{"type":"list-item","children":[{"text":"1:1 Real Stock Trading Zone","bold":true},{"text":"Investors acquire real stocks, not token representations.Ju.com partners with licensed brokers to ensure compliant custody and trading of securities.This significantly boosts investor trust, and community-endorsed stocks can find steady secondary market support."}]},{"type":"list-item","children":[{"text":"Stock Lending and Buyback Mechanism","bold":true},{"text":"Investors can lend their stocks for 12 months and receive interest plus platform token $X incentives.The company must provide a reserve equal to 30% of the lending amount for $X buyback.This ensures fundraising funds are not just “hit and run,” but are transformed into long-term liquidity."}]}]},{"type":"heading-three","children":[{"text":"IV. The Changing Role of the Community: From Stock Recommender to Financial Participant"}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"KOLs","bold":true},{"text":": Not just recommending stocks, but truly participating in underwriting. Their influence directly drives fundraising results, and they receive corresponding incentives."}]},{"type":"list-item","children":[{"text":"Community members","bold":true},{"text":": No longer passive bag holders in the secondary market, but early shareholders able to join at a discount from the start."}]},{"type":"list-item","children":[{"text":"Listed companies","bold":true},{"text":": No longer facing institutional fundraising in isolation, but building a binding relationship with the community, enabling both capital raising and ongoing community support for market cap management."}]}]},{"type":"heading-three","children":[{"text":"V. Why Is This Important for Hong Kong?"}]},{"type":"numbered-list","children":[{"type":"list-item","children":[{"text":"Lower fundraising threshold","bold":true},{"text":": Ordinary investors can also participate in private placements, no longer locked out."}]},{"type":"list-item","children":[{"text":"More sustainable liquidity","bold":true},{"text":": The lending + buyback mechanism ensures buy-side support doesn’t vanish quickly, making market caps more stable."}]},{"type":"list-item","children":[{"text":"More compelling narrative","bold":true},{"text":": Hong Kong stocks are no longer just “an institutional market,” but an ecosystem that can be driven by the global community."}]}]},{"type":"heading-three","children":[{"text":"\nVI. Conclusion: A New Community-Driven Playbook for Finance"}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"Investment banks are no longer the sole underwriters;"}]},{"type":"list-item","children":[{"text":"The community is no longer just a bystander;"}]},{"type":"list-item","children":[{"text":"The Hong Kong capital market, for the first time, has a chance to reclaim its unique position in the global financial landscape through a liquidity revolution driven by the community."}]}]}]},{"type":"paragraph","children":[{"text":"\nFor Hong Kong, this is a new way of organizing liquidity: "},{"text":"allowing the market to regain its voice against Wall Street","bold":true},{"text":"."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"From KOL to broker, this is more than just an identity shift—it’s a rewriting of the financial narrative.Through XBrokers, Ju.com fuses community passion and KOL influence with real stock trading and compliance mechanisms, turning “voice” into real “momentum.”In this new playbook:"},{"text":"The community is not just a spectator—it is the new financial engine.","bold":true},{"text":"\n\n"},{"type":"topic","character":"JuCom","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"JuComVietnam","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Kols","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Broker","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":""}]}]

🔥AI–Web3 Trends: Scale, Convergence Points, and Impact![{"type":"paragraph","children":[{"text":"AI–Web3 will enter a “narrative-to-scale” inflection between 2025 and 2030: AI market spending continues to expand, data-center and energy constraints lift marginal costs, and Web3 fills a key gap for verifiable value settlement and data provenance. This "},{"type":"link","url":"https://blog.jucoin.com/category/crypto-compass/market-insights/","children":[{"text":"Market Insights"}]},{"text":" article provides a research-oriented, verifiable coordinate system and paths to deployment."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"Summary: By 2030, both AI economic scale and compute consumption will expand in tandem. AI–Web3 convergence will concentrate on on-chain data rights/provenance, settleable trading of compute and models,"},{"type":"link","url":"https://blog.jucoin.com/how-rwa-tokenization-unlocks-liquidity/","children":[{"text":" RWA"}]},{"text":" and payments, wallet-enabled agents, and privacy- and compliance-preserving computation. Core challenges are energy, liquidity, and regulatory alignment."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"🔸 What Is AI–Web3?","bold":true}]},{"type":"paragraph","children":[{"text":"AI–Web3 is the coupling of AI production factors (data, compute, models/apps) with on-chain primitives (identity, assets, settlement, governance): rights–measurement–settlement–governance occur on-chain, while training/inference–distribution–service occur off-chain. As AI moves to “scaled supply,” AI–Web3 makes value flows and accountability chains verifiable, auditable, and revenue-sharing by design."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"🔻 Why Talk About AI–Web3 Now?","bold":true}]},{"type":"paragraph","children":[{"text":"Three sets of data anchor “now → 2030” clearly:"}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"PwC estimates AI could add $15.7 trillion to the global economy by 2030 (+14% of GDP)."}]},{"type":"list-item","children":[{"text":"McKinsey estimates generative AI could create $2.6–4.4 trillion in additional annual value."}]},{"type":"list-item","children":[{"text":"IEA projects data-center electricity use will roughly double to ~945 TWh by 2030, with AI as a key driver."}]}]},{"type":"paragraph","children":[{"text":"Hence AI–Web3 is necessary engineering to convert value and energy constraints into settleable and governable structures."}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"heading-two","children":[{"text":"🔸 Market Size and Drivers","bold":true}]},{"type":"paragraph","children":[{"text":"AI demand is not only “model upgrades” but “industry embedding.” IDC projects AI spending to reach $632 billion by 2028 (2024 guide); IDC also assesses the cumulative economic impact of AI investments could reach $22.3 trillion by 2030 (cumulative methodology). On the supply side, the IEA baseline flags an “electricity red line” with data-center power use doubling by 2030—implying compute cost, green power, and transmission bottlenecks will be first-order constraints for AI–Web3."}]},{"type":"heading-three","children":[{"text":"🔻 2023–2025 outbreak drivers:"}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"Capital–compute spiral: model scale, inference load, and capex reinforce each other (capex → compute → application returns). McKinsey’s value range explains broadening enterprise use cases."}]},{"type":"list-item","children":[{"text":"Supply constraints surfaced: IEA’s power curve and localized grid tightness make “low-carbon, near-source” supply more scarce."}]},{"type":"list-item","children":[{"text":"Verifiability demand rises: proliferation of AI outputs, IP/privacy concerns, and provenance push “proof of source” and “licensed settlement” toward standardization—precisely AI–Web3’s entry point.\n"}]}]},{"type":"heading-two","children":[{"text":"🔸 Key Inflection: Energy, Compute, and Pricing","bold":true}]},{"type":"heading-three","children":[{"text":"🔻 Energy curve rises"}]},{"type":"paragraph","children":[{"text":"Global data-center electricity use may reach ~945 TWh by 2030; AI-optimized data centers could quadruple consumption, pressing grid and efficiency limits. AI–Web3 projects must treat “carbon/electricity” as settlement and governance parameters."}]},{"type":"heading-three","children":[{"text":"🔻 Commoditization of compute"}]},{"type":"paragraph","children":[{"text":"Compute time slices, VRAM, and bandwidth will be standardized and listed; pricing will evolve from “raw compute” to multi-factor contracts that include energy/SLA/geo."}]},{"type":"heading-three","children":[{"text":"🔻 “Financialization” of data and models"}]},{"type":"paragraph","children":[{"text":"Data licenses, fine-tuning incremental value, and inference quotas will be split into transferable claims, with AI-driven revenue sharing and buybacks."}]},{"type":"paragraph","children":[{"text":"\n\n"}]},{"type":"heading-two","children":[{"text":"🔸 Five AI–Web3 Convergence Points","bold":true}]},{"type":"heading-three","children":[{"text":"🔻 On-chain provenance, rights, and revenue sharing for data"}]},{"type":"paragraph","children":[{"text":"AI training and inference span multi-source data. On-chain proofs of origin and license credentials can fix “who provided/used what” to the ledger and automate revenue sharing by call volume—reducing infringement costs and legal uncertainty (consistent with McKinsey’s enterprise-value framing)."}]},{"type":"heading-three","children":[{"text":"🔻 Settled markets for compute and inference quotas"}]},{"type":"paragraph","children":[{"text":"Given IEA’s energy red line, compute should price by electricity cost, carbon intensity, and time of day. AI–composable settlement can package compute hours, VRAM, and bandwidth into tradable claims, with on-chain verification of delivery and reconciliation."}]},{"type":"heading-three","children":[{"text":"🔻 RWA 2.0: tokenizing from assets to “machine outputs”"}]},{"type":"paragraph","children":[{"text":"Citi projects $4–5 trillion of tokenized assets by 2030, led by bonds/real estate. With AI, “model weight versions, inference quotas, data licenses” become new “output rights,” returning cash flows via licenses or buybacks as usage accrues."}]},{"type":"heading-three","children":[{"text":"🔻 Wallet-enabled AI agents and automated settlement"}]},{"type":"paragraph","children":[{"text":"As enterprises hand workflows to AI agents, contracts and wallets define executable boundaries: budget ceilings, license scopes, and audit trails enforced on-chain reduce “uncontrolled calls.” This default “machine-to-machine” micro-payments + authorization pattern is native to AI–Web3."}]},{"type":"heading-three","children":[{"text":"🔻 Privacy computing and compliance routing"}]},{"type":"paragraph","children":[{"text":"Across domains and jurisdictions, AI–Web3 must engineer tradeoffs between MPC/TEE/ZK and compliance routing (geo/sector allowlists): encode “usability + legality” into settlement parameters to create usable, compliant infrastructure."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"🔸 Impact on the Crypto Industry","bold":true}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"Trading and clearing: AI brings metered B2B/B2C inference transactions on-chain, increasing automation and auditability."}]},{"type":"list-item","children":[{"text":"Assets and collateral: data-license fees and inference cash flows can be securitized as collateral, expanding on-chain collateral sets (aligned with Citi’s RWA scale)."}]},{"type":"list-item","children":[{"text":"Market-making and risk: new derivatives (compute/inference futures, data-license forwards) create new MM pools; energy data becomes a risk factor."}]},{"type":"list-item","children":[{"text":"Compliance and custody: enterprises will demand “whitelisted chains + compliant routing + audit reports,” upgrading compliant infra and custodial services."}]},{"type":"list-item","children":[{"text":"L1s and L2s: high-frequency, small-value AI settlement favors low-fee, high-throughput networks; expect purpose-built chains/L2s with data/compute as native assets."}]}]},{"type":"heading-two","children":[{"text":"🔸 Authoritative Figures Cited","bold":true}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"$15.7 trillion AI contribution to global economy by 2030 ("},{"type":"link","url":"https://www.pwc.com/gx/en/issues/analytics/assets/pwc-ai-analysis-sizing-the-prize-report.pdf?utm_source=chatgpt.com","children":[{"text":"PwC"}]},{"text":")"}]},{"type":"list-item","children":[{"text":"$2.6–4.4 trillion annual value from generative AI ("},{"type":"link","url":"https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-ai-the-next-productivity-frontier?utm_source=chatgpt.com","children":[{"text":"McKinsey"}]},{"text":")"}]},{"type":"list-item","children":[{"text":"Global AI spending to reach $632 billion in 2028 ("},{"type":"link","url":"https://blogs.idc.com/2024/08/21/idcs-worldwide-ai-and-generative-ai-spending-industry-outlook/?utm_source=chatgpt.com","children":[{"text":"IDC latest spending guide"}]},{"text":")"}]},{"type":"list-item","children":[{"text":"Data-center electricity to double to ~945 TWh by 2030 ("},{"type":"link","url":"https://www.iea.org/news/ai-is-set-to-drive-surging-electricity-demand-from-data-centres-while-offering-the-potential-to-transform-how-the-energy-sector-works?utm_source=chatgpt.com","children":[{"text":"IEA baseline"}]},{"text":")"}]},{"type":"list-item","children":[{"text":"$4–5 trillion in tokenized assets by 2030 ("},{"type":"link","url":"https://www.citigroup.com/global/insights/money-tokens-and-games?utm_source=chatgpt.com","children":[{"text":"Citi GPS"}]},{"text":")"}]}]},{"type":"paragraph","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"🔸 FAQ","bold":true}]},{"type":"paragraph","children":[{"text":"▫️ "},{"text":"What mainly determines AI’s growth?","bold":true},{"text":"\nA: Three things: renewable availability and electricity price curves; maturity of compliant interfaces for data and models; and the share of enterprise workflows that are “machine-executable” (whether budgets/permissions are written into on-chain wallets)."}]},{"type":"paragraph","children":[{"text":"▫️ Where do RWA and AI intersect?","bold":true},{"text":"\nA: First, the on-chain availability of traditional assets (Citi’s $4–5T provides base collateral). Second, tokenized cash-flow claims on “machine outputs,” mapping usage-derived returns into on-chain revenue shares."}]},{"type":"paragraph","children":[{"text":"Why do enterprises need on-chain settlement instead of traditional API billing?\nA: AI’s edge is automated settlement + auditable revenue sharing. When use cases span organizations and geographies, on-chain credentials and auto-sharing cut reconciliation and legal friction."}]},{"type":"paragraph","children":[{"text":"Will energy and carbon become pricing factors?\nA: Yes. The IEA’s 2030 power curve implies “carbon/electric intensity” will be priced in; AI–Web3 contracts will encode SLA + energy jointly as settlement parameters."}]},{"type":"paragraph","children":[{"text":"When researching an AI–Web3 project, what’s primary?\nA: Three checks: real usage (not just TVL); verifiable provenance/licensing with a clear revenue-share path; and whether energy/compliance parameters are embedded in contracts and reports."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"🔸 Key Takeaways","bold":true}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"By 2030, AI’s economy and energy use expand together; the IEA power curve anchors supply-side constraints, pushing AI to add “settleable and governable” layers."}]},{"type":"list-item","children":[{"text":"PwC/IDC/McKinsey provide a value/spending coordinate system: macro value, IT spend, and enterprise use cases advance in parallel."}]},{"type":"list-item","children":[{"text":"Five convergence points (provenance & revenue-share, compute settlement, RWA, agent wallets, privacy & compliance) will define AI–Web3’s moat."}]},{"type":"list-item","children":[{"text":"Industry opportunities lie in settlement & contractization, market-making & hedging, compliant custody & audit, and low-carbon supply."}]},{"type":"list-item","children":[{"text":"Key risks: energy costs, regulatory synchrony, and fragmented liquidity—necessitating “whitelisted infra + trusted credentials + unified reconciliation.”"}]}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"JuCom","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"JuComVietnam","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"JuCoin","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":""}]}]