Jack-强2025-08-07 02:57

打单一时爽,爆仓火葬场

扛单一时爽,爆仓火葬场

“我扛一扛就回来了”——韭菜爆仓前的最后遗言

扛单即不执行止损而坚持亏损脱损。“死抗一次,十单白干。”

即使最终侥幸获利,仍人被专业交易员视为彻底的失败操作。

交易领域有句名言,脱离系统赚到的钱都是诅咒。扛单行为如同在悬崖边上跳舞。可能一时风光,却也埋下了致命隐患。

研究表明 87%的爆仓案例直接源于扛单行为,而其中63%的交易者此前都有过扛单成功的经历。这恰恰印证了扛单成功是更大失败的开始。

市场没有义务按照你的预期回头。趋势一旦确立,短期内极难逆转,越抗越亏,可能在反弹前就爆仓。

行情一旦继续反向运行,你的亏损会随着杠杆倍数放大,最终可能导致账户资金全部清零。,抗单几乎是主动送死。止损是尊重市场,认错是保护本金,灵活是交易的王道。

合约市场容不的孤注一掷的豪赌。扛单无论短期看起来多么顽强,长期来看都是一条通向毁灭的单行道。你或许能够运气扛过无数次小危机,但是一次无法承受的大波动,就足以终结你的交易生涯。成功的合约交易者深知严格的风险管理,尤其是及时止损和敬畏市场趋势,远比抗力勇气更。

扛单的5重罪。

第一,风险失控,扛单意味着未执行止损计划,风险窗口扩大,只要失败一次,就会导致爆仓。

第二。资金占有,资金被锁定,影响流动性,错失其他机会,降低使用度。

第三,心理压力,扛丹带来巨大的心理压力,影响决策,导致情绪化交易。

第四,违背纪律,破坏交易纪律,无法养成良好的交易习惯,影响长期稳定能力。

第五,侥幸心理,扛单成功,可能自生侥幸心理,今后还会发生这种情况,

Preview

14

0

0

0

Jack-强

2025-08-07 02:58

打单一时爽,爆仓火葬场

[{"type":"paragraph","children":[{"text":"扛单一时爽,爆仓火葬场 "}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"“我扛一扛就回来了”——韭菜爆仓前的最后遗言"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"扛单即不执行止损而坚持亏损脱损。“死抗一次,十单白干。”"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"即使最终侥幸获利,仍人被专业交易员视为彻底的失败操作。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"交易领域有句名言,脱离系统赚到的钱都是诅咒。扛单行为如同在悬崖边上跳舞。可能一时风光,却也埋下了致命隐患。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"研究表明 87%的爆仓案例直接源于扛单行为,而其中63%的交易者此前都有过扛单成功的经历。这恰恰印证了扛单成功是更大失败的开始。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"市场没有义务按照你的预期回头。趋势一旦确立,短期内极难逆转,越抗越亏,可能在反弹前就爆仓。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"行情一旦继续反向运行,你的亏损会随着杠杆倍数放大,最终可能导致账户资金全部清零。,抗单几乎是主动送死。止损是尊重市场,认错是保护本金,灵活是交易的王道。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"合约市场容不的孤注一掷的豪赌。扛单无论短期看起来多么顽强,长期来看都是一条通向毁灭的单行道。你或许能够运气扛过无数次小危机,但是一次无法承受的大波动,就足以终结你的交易生涯。成功的合约交易者深知严格的风险管理,尤其是及时止损和敬畏市场趋势,远比抗力勇气更。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"扛单的5重罪。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"第一,风险失控,扛单意味着未执行止损计划,风险窗口扩大,只要失败一次,就会导致爆仓。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"第二。资金占有,资金被锁定,影响流动性,错失其他机会,降低使用度。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"第三,心理压力,扛丹带来巨大的心理压力,影响决策,导致情绪化交易。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"第四,违背纪律,破坏交易纪律,无法养成良好的交易习惯,影响长期稳定能力。"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"第五,侥幸心理,扛单成功,可能自生侥幸心理,今后还会发生这种情况,"}]}]

JuCoin Square

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

相关文章

Welcome to JU Square🚀[{"type":"paragraph","children":[{"text":"Welcome to JU Square, your dedicated social community hub where every user can share the latest trends, news topics, discussions, and insights from the crypto world. Connect with fellow traders, follow your favorite accounts, and engage with the community through likes, replies, and forwards."}]},{"type":"paragraph","children":[{"text":"\nJU Square offers an integrated social feed that keeps you on top of what the community is discussing, bringing together voices from across the JuCoin ecosystem in one dynamic space.\n"}]},{"type":"heading-three","children":[{"text":"How to Create a JU Square Account"}]},{"type":"paragraph","children":[{"text":"Every JuCoin account is automatically associated with a JU Square account. Simply create a JuCoin account by following "},{"type":"link","url":"https://support.jucoin.blog/hc/en-001/articles/41457782978969-How-to-register-for-a-JuCoin-account","children":[{"text":"this guide"}]},{"text":"."}]},{"type":"paragraph","children":[{"text":"\nOnce you have your JuCoin account, click on "},{"type":"link","url":"https://www.jucoin.com/en/community","children":[{"text":"JU Square"}]},{"text":" in the top navigation header to access the platform.\n"}]},{"type":"heading-three","children":[{"text":"How to Post Your First Article"}]},{"type":"numbered-list","children":[{"type":"list-item","children":[{"text":"From the JU Square homepage, click on "},{"text":"Profile","bold":true},{"text":" in the left-side menu"}]},{"type":"list-item","children":[{"text":"In your "},{"text":"Profile Page","bold":true},{"text":", click "},{"text":"Create Post","bold":true},{"text":", then select "},{"text":"Publish Article","bold":true}]},{"type":"list-item","children":[{"text":"You’ll be taken to a standard editor page where you can enter a "},{"text":"title","bold":true},{"text":", write your "},{"text":"content","bold":true},{"text":", use "},{"text":"editor tools","bold":true},{"text":" for additional formatting and options, add a "},{"text":"cover image","bold":true},{"text":", and select your target "},{"text":"language","bold":true},{"text":"."}]},{"type":"list-item","children":[{"text":"Add "},{"text":"hashtags ","bold":true},{"text":"to make your content easier to discover by typing “#” to see a dropdown of available hashtags and their usage frequency, or create your own"}]},{"type":"list-item","children":[{"text":"Use the "},{"text":"Preview","bold":true},{"text":" button to see how your post will appear. When satisfied with your content, click the "},{"text":"Post","bold":true},{"text":" button."}]},{"type":"list-item","children":[{"text":"Read and tick the "},{"text":"checkbox ","bold":true},{"text":"to accept the "},{"text":"Agreement Terms","bold":true},{"text":", then click "},{"text":"Post.","bold":true}]},{"type":"list-item","children":[{"text":"Your post will now appear on the feed on the homepage and under the “"},{"text":"Posted","bold":true},{"text":"” tab of your profile page. From this page, you can also change the "},{"text":"visibility ","bold":true},{"text":"of your post, make "},{"text":"edits, ","bold":true},{"text":"or "},{"text":"delete","bold":true},{"text":" it."}]},{"type":"heading-three","children":[{"text":""}]}]},{"type":"heading-three","children":[{"text":"How to Post Your First Video"}]},{"type":"numbered-list","children":[{"type":"list-item","children":[{"text":"Follow the same process as posting an article, but when you click "},{"text":"Create Post","bold":true},{"text":" in your profile page, select "},{"text":"Publish Video","bold":true},{"text":" instead."}]},{"type":"list-item","children":[{"text":"The editor provides all the same tools and fields, with one additional option: an "},{"text":"Upload Video","bold":true},{"text":" button that allows you to select a video file from your computer."}]},{"type":"list-item","children":[{"text":"Once uploaded, you can "},{"text":"preview ","bold":true},{"text":"and "},{"text":"post ","bold":true},{"text":"your video content just like an article."}]}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"How to Interact with Other Accounts"}]},{"type":"numbered-list","children":[{"type":"list-item","children":[{"text":"From the homepage feed, you’ll see posts from all accounts and recent activity. To the right of any account you’d like to follow, click the "},{"text":"Follow","bold":true},{"text":" button, which will update to "},{"text":"Following","bold":true},{"text":"."}]},{"type":"list-item","children":[{"text":"Click on any post to view the full content. At the bottom of each post, you can see:"}]}]},{"type":"numbered-list","children":[{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"Number of views"}]},{"type":"list-item","children":[{"text":"Give a like"}]},{"type":"list-item","children":[{"text":"Reply to the post"}]},{"type":"list-item","children":[{"text":"Forward to share"}]}]},{"type":"paragraph","children":[{"text":"These same interaction options are available directly from the feed view as well.\n"}]}]},{"type":"heading-three","children":[{"text":"Discovering Content"}]},{"type":"paragraph","children":[{"text":"The left-side menu offers several discovery features:"}]},{"type":"paragraph","children":[{"text":"Trending Discussions","bold":true},{"text":" – View the top-ranking topics and hashtags currently popular in the community\n"},{"text":"Popular Posts","bold":true},{"text":" – Browse the best-ranked posts based on engagement and community interaction"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"Staying Updated with Notifications"}]},{"type":"paragraph","children":[{"text":"Click "},{"text":"Notifications","bold":true},{"text":" in the left-side menu to track key activity including:"}]},{"type":"bulleted-list","children":[{"type":"list-item","children":[{"text":"Number of likes you’ve received"}]},{"type":"list-item","children":[{"text":"Replies to your posts"}]},{"type":"list-item","children":[{"text":"@mentions"}]},{"type":"list-item","children":[{"text":"Activity from creators you follow"}]},{"type":"list-item","children":[{"text":"Updates from official accounts\n"}]}]},{"type":"paragraph","children":[{"text":"For a "},{"text":"detailed guide with images","bold":true},{"text":", please click the link: "},{"type":"link","url":"https://blog.jucoin.com/ju-square-guide/","children":[{"text":"https://blog.jucoin.com/ju-square-guide/"}]},{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://blog.jucoin.com/zh-hans/ju-square-guide/","children":[{"text":""}]},{"text":"This "},{"text":"JU Square account","bold":true},{"text":" serves as an "},{"type":"link","url":"https://www.jucoin.com/en/community/user/254433991261","children":[{"text":"official channel","underline":true}]},{"text":" dedicated to posting educational content and updates exclusively related to JU Square features and community developments. Follow us to stay informed about new features, community highlights, and platform updates.Welcome to the future of crypto community engagement. We’re excited to see what conversations and connections you’ll build here! \n\n🌟"}]},{"type":"paragraph","children":[{"text":"\n\n"}]}]

FUD Made Bob Sell Everything 😱[{"type":"paragraph","children":[{"text":"FUD made Bob sell everything.... He saw the news — “Bitcoin is banned!” and panicked. 🫣 The next day? “Bitcoin hits new all-time high!” 🤯\nThis is Fear, Uncertainty, and Doubt — aka FUD."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://www.youtube.com/@JuCoin_Exchange/shorts","children":[{"text":" Check out our YouTube Channel 👉 "}]},{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"FUD","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoMeme","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"BitcoinNews","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n"}]}]

When Altcoins Start Pumping, Miracles Happen 😂[{"type":"paragraph","children":[{"text":"He was in a coma 🛌💤 for months… until the altcoins started pumping. 📈🚀 Nothing brings people back faster than green candles.\nAltcoins pumping? Miracles happen.\nDon’t miss the next rally — trade now on JuCoin!🔥"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://www.youtube.com/@JuCoin_Exchange/shorts","children":[{"text":"Check out our YouTube Channel 👉"}]},{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"AltcoinsPumping","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoMeme","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"AltcoinSeason","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":" "}]}]

Buying Crypto For the First Time 💰[{"type":"paragraph","children":[{"text":"New to crypto? \n😲"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"\n\n\nHere's everything you need to know before buying crypto for the first time. Learn how to get started safely and easily, no matter where you are in the world. 🌎"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":" \n"}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://www.youtube.com/@JuCoin_Exchange/shorts","children":[{"text":" Check out our YouTube Channel 👉 "}]},{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"buyingcrypto","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptoforbeginners","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"howtobuycrypto","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n \n"}]},{"type":"paragraph","children":[{"text":"\n "}]}]

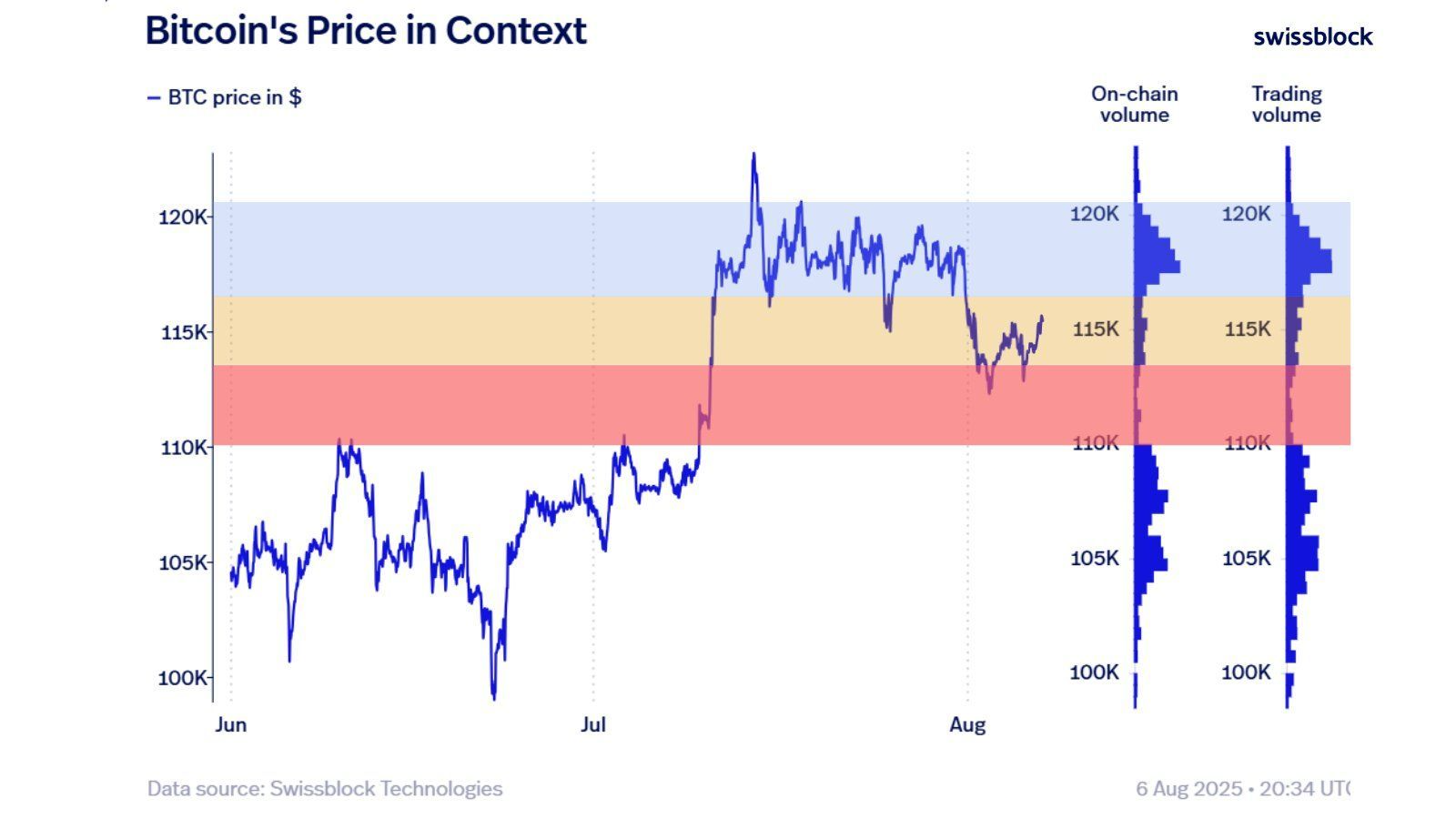

🎯 Le marché du Bitcoin est en mode "stand-by" — pas de cassure haussière, pas d’effondrement non pl[{"type":"paragraph","children":[{"text":"Mais sous cette surface calme, les zones se dessinent…"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"🟥 "},{"text":"Zone rouge","bold":true},{"text":" : le support a tenu, mais reste un terrain miné "}]},{"type":"paragraph","children":[{"text":"🟨 "},{"text":"Zone jaune","bold":true},{"text":" : entre neutralité et pivot psychologique "}]},{"type":"paragraph","children":[{"text":"🟦 "},{"text":"Zone bleue","bold":true},{"text":": un champ de bataille à fort volume. Et si le "},{"type":"coin","currencyId":7,"currency":"btc","symbolId":6,"symbol":"btc_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/btc.png","fullName":"Bitcoin","character":"BTC/USDT","children":[{"text":""}]},{"text":" l’atteint… cela pourrait enclencher un nouveau momentum."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"🔍 Ce type de configuration est souvent le théâtre de mouvements violents — et imprévisibles."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"🧠 Ce n’est pas le moment de FOMO, mais d’observer... stratégiquement."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"💬 Tu es team breakout ou team range ? Dis-moi ce que tu vois dans le graphe."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"#BTC #PriceAction #CryptoMarket"}]},{"type":"paragraph","children":[{"text":""}]}]

🔥 Guaranteed Crypto Giveaway - JuCoin Drops JuTokens, Airdrops & Hashrate![{"type":"paragraph","children":[{"text":"JuCoin is launching a massive crypto giveaway worth $1,000,000!"}]},{"type":"paragraph","children":[{"text":"\nSpin the lucky wheel and win every time — JuTokens, partner token airdrops, and even free hashrate power for mining."}]},{"type":"paragraph","children":[{"text":"\nNo losers, no catch - just pure rewards for the crypto community."}]},{"type":"paragraph","children":[{"text":"\nJoin now before the clock runs out!"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://www.youtube.com/@JuCoin_Exchange/shorts","children":[{"text":""}]},{"text":"💎 "},{"type":"link","url":"https://www.jucoin.com/en/activity/JUairdrop","children":[{"text":"Participate in the Airdrop"}]},{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://www.youtube.com/@JuCoin_Exchange/shorts","children":[{"text":""}]},{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://www.youtube.com/@JuCoin_Exchange/shorts","children":[{"text":""}]},{"text":""},{"type":"topic","character":"cryptogiveaway","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"airdrop","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"freecrypto","children":[{"text":""}]},{"text":" "}]}]