JCUSER-1Wsd8YQL2025-09-28 09:43

学做合约毁了我的老公

自从老公迷上了合约交易,他整个人就像变了个物种。 以前下班第一句话是“老婆我回来了”,现在一开口就是:“刚刚被强平,心态炸了。” 我喊他去倒垃圾,他居然盯着我说:“等一下,我要先设置个止损,不然我心里没安全感。” 我愣了三秒,以为我嫁了个交易机器人。 客厅在他嘴里成了“行情战场”,卧室被他叫“回撤空间”。吃饭的时候他也不说“好吃”,非要说:“这口饭的胜率至少有70%,回报风险比完美。” 我夹了块菜问他咋样,他一脸严肃:“这叫伽马风险,不到最后不能下结论。” 他写备忘录也不写“明天买菜”,偏要写成:“若BTC四小时线突破压力位,则顺路买葱姜蒜。” 我劝他别这么魔怔,他还瞪我:“你这是基本面思维,缺乏技术派格局。” 最离谱的是他喜欢玩“杠杆修辞”。 有次我说“最近挺累”,他立马反驳:“错!你这是10倍杠杆下的情绪回撤,爆仓只是时间问题。” 说完还递给我一本《合约交易心理学》。那一刻我真怀疑自己是不是嫁错了人。 现在我最怕的,就是跟他吵架时,他能一口气甩我一堆K线图,还顺带报仓位和爆仓价。到时候我估计只能回一句:“喂?110吗?我老公用合约逻辑攻击我!” 后来我才知道,其实问题不在合约,而在他缺个省钱利器。朋友推荐我用 Feeback ——交易省手续费,还能返佣,至少不用天天被“爆仓文学”洗脑了。 👉 想让你的老公少点杠杆,多点生活?去看看 Feeback 吧。

3

0

0

JCUSER-1Wsd8YQL

2025-09-28 09:43

学做合约毁了我的老公

[{"type":"paragraph","children":[{"text":"自从老公迷上了合约交易,他整个人就像变了个物种。\n以前下班第一句话是“老婆我回来了”,现在一开口就是:“刚刚被强平,心态炸了。”\n\n我喊他去倒垃圾,他居然盯着我说:“等一下,我要先设置个止损,不然我心里没安全感。”\n我愣了三秒,以为我嫁了个交易机器人。\n\n客厅在他嘴里成了“行情战场”,卧室被他叫“回撤空间”。吃饭的时候他也不说“好吃”,非要说:“这口饭的胜率至少有70%,回报风险比完美。”\n我夹了块菜问他咋样,他一脸严肃:“这叫伽马风险,不到最后不能下结论。”\n\n他写备忘录也不写“明天买菜”,偏要写成:“若BTC四小时线突破压力位,则顺路买葱姜蒜。”\n我劝他别这么魔怔,他还瞪我:“你这是基本面思维,缺乏技术派格局。”\n\n最离谱的是他喜欢玩“杠杆修辞”。\n有次我说“最近挺累”,他立马反驳:“错!你这是10倍杠杆下的情绪回撤,爆仓只是时间问题。”\n说完还递给我一本《合约交易心理学》。那一刻我真怀疑自己是不是嫁错了人。\n\n现在我最怕的,就是跟他吵架时,他能一口气甩我一堆K线图,还顺带报仓位和爆仓价。到时候我估计只能回一句:“喂?110吗?我老公用合约逻辑攻击我!”\n\n后来我才知道,其实问题不在合约,而在他缺个省钱利器。朋友推荐我用 Feeback ——交易省手续费,还能返佣,至少不用天天被“爆仓文学”洗脑了。\n\n👉 想让你的老公少点杠杆,多点生活?去看看 Feeback 吧。\n\n"}]}]

JU Square

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

相关文章

⚡ $QUSDT en Préparation pour un Rebond ?[{"type":"paragraph","children":[{"text":"📊 Setup technique : Double bottom + triangle ascendant sur le H4."}]},{"type":"paragraph","children":[{"text":"💡 Un breakout au-dessus du $0.0281–$0.0287 valide le pattern et ouvre la voie à une entrée longue."}]},{"type":"paragraph","children":[{"text":"🎯 Targets : Objectif initial du bottom jusqu’au neckline : $0.0339."}]},{"type":"paragraph","children":[{"text":"⚠️ Gestion du risque : Stop loss conseillé juste sous la bougie de breakout pour éviter les sweeps de liquidité."}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":"👉Spotter ce genre de configuration peut offrir un rapport risque/rendement attractif pour les traders techniques."}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":null,"children":[{"text":""},{"type":"topic","character":"CryptoTrading","children":[{"text":""}]},{"text":""}]},{"text":""},{"type":"topic","character":"altcoins","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n"}]}]

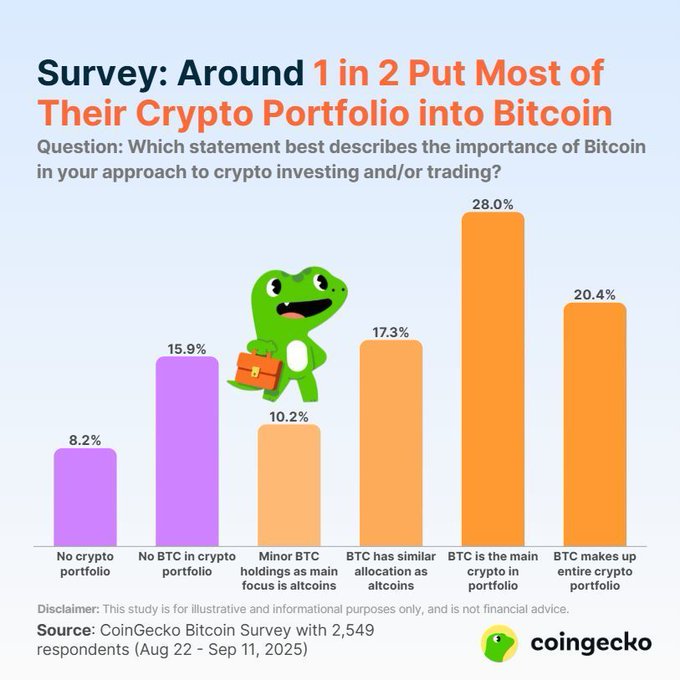

🔥 Près d’un investisseur crypto sur deux mise tout sur le Bitcoin[{"type":"paragraph","children":[{"text":""},{"type":"coin","currencyId":7,"currency":"btc","symbolId":6,"symbol":"btc_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/btc.png","fullName":"Bitcoin","character":"BTC/USDT","children":[{"text":""}]},{"text":" est leur allocation principale (avec quelques alts en complément).\n\n👉 20% disent que leur portefeuille est 100% Bitcoin."}]},{"type":"paragraph","children":[{"text":"Presque la moitié des holders voient #Bitcoin comme l’ancre incontournable, tandis que l’autre moitié préfère jouer la carte “risk-on” avec les altcoins. Deux stratégies différentes… mais le même terrain de jeu. 🎯"}]},{"type":"paragraph","children":[{"text":""},{"type":"coin","currencyId":7,"currency":"btc","symbolId":6,"symbol":"btc_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/btc.png","fullName":"Bitcoin","character":"BTC/USDT","children":[{"text":""}]},{"text":" ou mix alts + BTC ?"}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"Bitcoin","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoInvesting","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n\n\n\n\n"}]}]

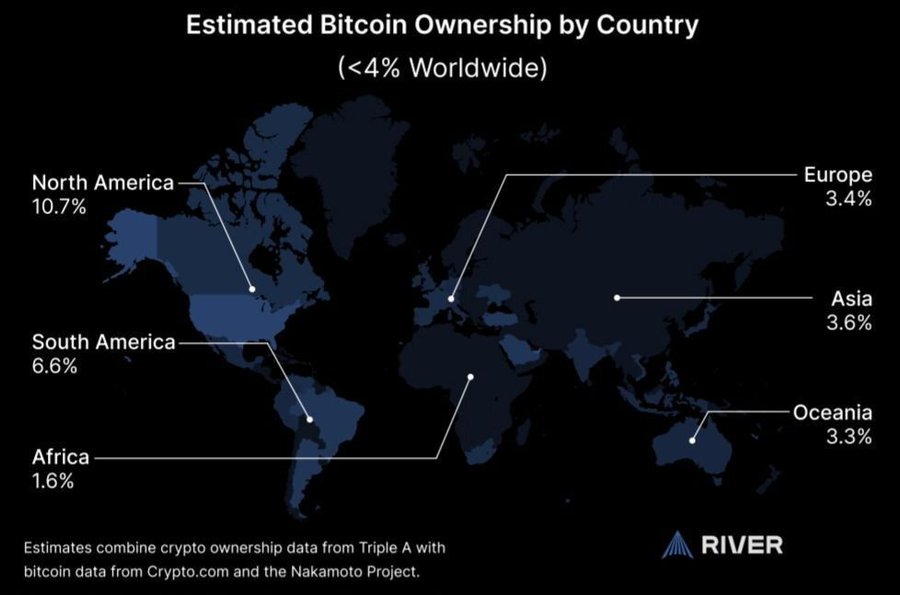

⚡ Moins de 4% du monde détient du Bitcoin [{"type":"paragraph","children":[{"text":"👉 Cela signifie que "},{"text":"96% sont encore en dehors du jeu","bold":true},{"text":".\n\n👉 Avec une offre fixe et une demande institutionnelle qui ne cesse de croître… le potentiel reste gigantesque. "}]},{"type":"paragraph","children":[{"text":"On parle souvent d’être “trop tard” — la réalité, c’est qu’on n’a fait qu’effleurer la surface. L’adoption de masse n’a pas encore commencé."}]},{"type":"paragraph","children":[{"text":"👉 Question : êtes-vous déjà dans le 4%… ou encore dans le 96% ? 👀"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"Bitcoin","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoAdoption","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n\n"}]}]

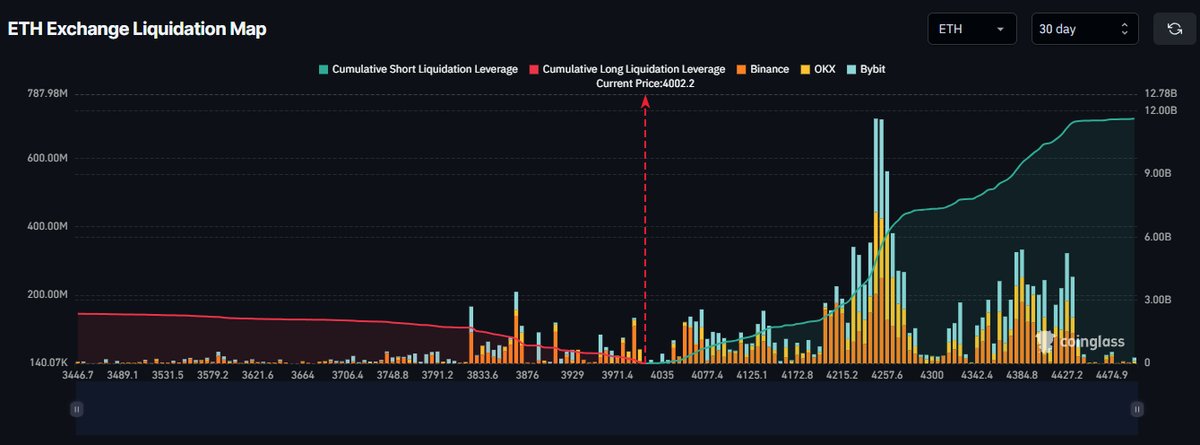

⚠️ Short Squeeze Géant sur Ethereum ! 🚨[{"type":"paragraph","children":[{"text":""},{"type":"coin","currencyId":8,"currency":"eth","symbolId":7,"symbol":"eth_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/eth.png","fullName":"Ethereum","character":"ETH/USDT","children":[{"text":""}]},{"text":" franchit un "},{"text":"nouvel ATH","bold":true},{"text":", plus de "},{"text":"11,6 MILLIARDS $","bold":true},{"text":" de positions short seront liquidées."}]},{"type":"paragraph","children":[{"text":"Les liquidations massives ne sont pas juste des chiffres — elles agissent comme un catalyseur, propulsant le prix plus haut tout en forçant les bears à sortir."}]},{"type":"paragraph","children":[{"text":"👉 À surveiller : chaque ATH peut créer une cascade de mouvements forcés, amplifiant le momentum."}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"Ethereum","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoTrading","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n\n\n\n\n"}]}]

💣 Black September Replayed? Bitcoin’s Plunge Triggers On-Chain Capital Flight[{"type":"paragraph","children":[{"text":"“Black September” is a meme most of us know well. Each time the calendar flips to September, Bitcoin, Ethereum, and the broader market seem cursed: weak rallies, frequent sell-offs. As the most infamous risk month of the year, September’s poor performance isn’t unique to crypto — traditional markets like equities can’t escape it either. Amusingly, the phrase “Black September” actually originated from the stock market."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"This September delivered on that reputation again. Bitcoin broke key support, on-chain stablecoins rushed for the exits, and fear spread. As some joked: “Black September isn’t a legend — it’s a required course every year.”"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"The September Curse: Seasonal Anxiety in Crypto"}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"1. The market memory of an “unlucky September”"}]},{"type":"paragraph","children":[{"text":"Historical stats in U.S. equities show September has the lowest average monthly return, and the effect is even more pronounced in crypto."}]},{"type":"paragraph","children":[{"text":"From 2017 to 2022, Bitcoin posted negative returns six Septembers in a row. Although this seasonal effect eased somewhat in 2023 and 2024, the “September curse” remains deeply etched in investors’ minds. Come September, even a small gust of wind can amplify fear."}]},{"type":"paragraph","children":[{"text":"This time, BTC slipping below $110,000 and ETH breaking under $3,900 is a textbook case of “historical shadow + market expectations” applying dual pressure."}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"2. Why does September so often underperform?"}]},{"type":"paragraph","children":[{"text":"• Tighter liquidity: Overseas markets enter earnings season, capital tilts toward traditional assets, and risk appetite falls.\n• Macro policy sensitivity: The Fed, ECB, and others often hold rate meetings in September; markets are hypersensitive to rate expectations.\n• Market psychology: History nudges investors to take profits or cut exposure early, creating a self-fulfilling loop."}]},{"type":"paragraph","children":[{"text":"In other words, September is often not a “trend-deciding month,” but a “risk-pre-release month.”"}]},{"type":"heading-two","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"Behind the BTC and ETH Plunge: Liquidations Are Only the Surface"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"This sell-off once again reveals crypto’s brutality. Many headlines emphasized “longs and shorts liquidated” in derivatives. Data show over 250,000 traders liquidated in 24 hours, with more than $1.1 billion wiped out. On the tape, it looks like a classic leverage cascade."}]},{"type":"paragraph","children":[{"text":"But pinning the drop solely on liquidations only grasps the surface. What truly drove the abrupt downturn was an imbalance of inflows vs. outflows, cooling narratives, a tighter macro backdrop, and the stacking effect of black swans."}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"1. Institutional flows cool: ETF net outflows exacerbate the drop"}]},{"type":"paragraph","children":[{"text":"Over the past two years, “institutionalization” was the market’s biggest certainty. Spot ETFs opened the gates for Wall Street capital, directly propelling BTC and ETH to new highs. Many investors even viewed ETFs as a “base-position backstop.”"}]},{"type":"paragraph","children":[{"text":"But in September, the tide turned:\n• ETH ETFs recorded multiple consecutive days of net outflows, totaling over $500 million.\n• Bitcoin ETFs also posted net outflows three times this week, totaling around $480 million."}]},{"type":"paragraph","children":[{"text":"\nTranslation: institutions trimmed risk and left. The “backstop bid” vanished. Remember, ETFs are merely pipes for money in and out — they don’t only flow one way. Plenty of retail traders fantasized that “with ETFs, it won’t drop,” but reality shows that when institutions see risk > return, they pull liquidity too."}]},{"type":"paragraph","children":[{"text":"In short, ETFs are a double-edged sword. They can bring incremental capital, and they can also amplify downside when the market cools."}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"2. The DAT narrative cools: valuations re-anchor to NAV"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"Beyond institutions, “narratives” powered this summer’s rally — especially the Digital Asset Treasury (DAT) model, which gave ETH a sizable premium.\n• In the hot July–August phase: weighted mNAV for ETH DATs once exceeded 5×, capital poured in, and volumes hit records.\n• By September: that story’s pull faded quickly; mNAV fell back near 1×, with almost no premium left.\n• Related projects’ on-chain activity dropped sharply; investor enthusiasm ebbed fast."}]},{"type":"paragraph","children":[{"text":"This means the market is de-story-fying, re-anchoring capital to true net asset value (NAV). Without narrative support, ETH struggled to maintain lofty valuations — so a break below $3,900 became natural. It’s a reminder that crypto narratives are highly cyclical. From “AI + Crypto” to “RWA” to “DAT,” each story has a shelf life. When the buzz fades and capital turns rational, prices correct."}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"3. Macro factors: The Fed’s uncertainty"}]},{"type":"paragraph","children":[{"text":"Macro remains an inescapable variable. Recent U.S. data stayed strong — especially jobs and consumption — reinforcing views of a resilient economy. The fallout:\n• Hopes for an October rate cut were clearly reduced.\n• The Fed is split internally on whether to cut this year.\n• The U.S. dollar index strengthened, and global risk appetite fell."}]},{"type":"paragraph","children":[{"text":"For BTC and ETH, that’s undeniably bearish. In global investors’ eyes, they remain high-volatility risk assets. When rate expectations wobble and the dollar strengthens, capital naturally flows out of crypto and back into more stable assets."}]},{"type":"paragraph","children":[{"text":"Put simply, macro headwinds formed the essential backdrop for this drop. Without macro “help,” the negatives from ETF outflows and narrative cooling might not have been amplified so quickly."}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"4. Black swans: On-chain attacks fan the flames"}]},{"type":"paragraph","children":[{"text":"To make matters worse, recent security incidents on-chain helped fuel panic:\n• UXLINK was attacked, losing $11.3 million, alongside malicious minting.\n• On BNB Chain, GAIN was exploited for 5 billion tokens, and the price instantly plunged 90%.\n• The Hyperdrive stablecoin protocol account was attacked; all money markets were paused."}]},{"type":"paragraph","children":[{"text":"By dollar value, these weren’t massive. But amid fragile sentiment, any black swan can be magnified into a stampede. Especially for retail, seeing “hack, crash, mint” triggers first-order selling. In that sense, exploits acted as fuses that fully released fear."}]},{"type":"paragraph","children":[{"text":"In sum, calling this BTC and ETH plunge a derivatives liquidation cascade only captures the result, not the cause. The core logic was a turn in flows and sentiment:\n• Institutions withdrew via ETFs, draining liquidity.\n• The DAT narrative cooled, and valuations reverted to rational anchors.\n• Macro tightened, with Fed policy expectations unstable.\n• Black swans added fuel, amplifying panic."}]},{"type":"paragraph","children":[{"text":"For investors, it’s another reminder: no single variable explains crypto price action. To understand volatility, you must track capital flows, narrative strength, and the macro — otherwise it’s easy to be fooled by appearances."}]},{"type":"heading-two","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"Can October Bring a Turnaround? Here’s What the Market Is Saying"}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"1. The bull case"}]},{"type":"paragraph","children":[{"text":"• Seasonality reversal: History shows October is often a “turnaround month” for Bitcoin, with mostly positive returns in recent years.\n• Policy catalysts: The U.S. Congress and regulators are advancing market-structure legislation for crypto; passage could lift confidence.\n• Institutional holding trend intact: VanEck data show 290+ companies hold a combined $163+ billion in BTC; institutional demand remains a long-term support.\n• A new ETH narrative: As treasury assets tilt toward ETH allocation, ETH could become the next institutional favorite."}]},{"type":"heading-three","children":[{"text":""}]},{"type":"heading-three","children":[{"text":"2. The cautious view"}]},{"type":"paragraph","children":[{"text":"• Technicals not yet stabilized: BTC’s key support is near $109,500; a break could trigger a second leg down.\n• Unsteady flows: ETF inflows remain choppy; another stretch of net outflows would keep pressure on.\n• Macro risks linger: The Fed’s policy uncertainty is still the Sword of Damocles overhead."}]},{"type":"heading-two","children":[{"text":""}]},{"type":"heading-two","children":[{"text":"Conclusion"}]},{"type":"paragraph","children":[{"text":"This BTC and ETH sell-off once again validated the power of the September curse. In the short run, the market may keep chopping in fear; in the long run, crypto’s foundational logic hasn’t changed:\n• BTC remains the world’s strongest store-of-value asset.\n• ETH remains the most promising on-chain economic infrastructure.\n• Black September is a cyclical wobble point, not the end of the trend."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"After weathering storms, healthier rallies can follow. October just might be the next rebound’s starting point."}]},{"type":"paragraph","children":[{"text":"\n"},{"type":"topic","character":"JuExchange","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"BlackSeptember","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Bitcoin","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Fed","children":[{"text":""}]},{"text":" \n\n\n"}]}]

🦈 Baby Shark token crashes 99% on Story Protocol[{"type":"paragraph","children":[{"text":"💥 The Baby Shark token (PINKFONG) went viral on Story Protocol, hitting $500M market cap within hours thanks to KOL hype and Story’s official push. But soon after, price plunged 99%."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"👉 Pinkfong, the Korean company behind Baby Shark, denied any link and warned of legal action, recognizing only BABYSHARK (Solana) and BSU (BNB Chain)."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"⚖️ Issuer IP.World claimed valid licensing through BBF and BSU, but conflicting statements from Pinkfong co-founders exposed off-chain disputes."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"🔍 Bubblemaps flagged insider wallets buying 70M tokens (~7% supply, $35M) at launch."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"📉 Fallout also hit Story’s IP token, dropping from $12.9 → $7.2. The case shows how off-chain IP chaos + on-chain manipulation left retail investors burned—ironically reinforcing the need for transparent on-chain IP management."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"BabyShark","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"StoryProtocol","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoNews","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"JuExchange","children":[{"text":""}]},{"text":" "}]}]