安全与监管,正在成为加密市场的核心变量

放眼当下的加密市场,安全事件频发、监管动态此起彼伏,似乎每周都有新的黑客攻击或政策公告。有人可能认为这是行业风险加剧的信号,但更深层看,这其实是加密市场规模扩张后的必然结果:当加密世界逐步融入更广泛的金融体系,安全性和合规性便不再是可有可无的选项,而成了生存与竞争的关键要素。

先看安全层面。过去一年里,区块链安全事件总量和损失数额依然惊人。慢雾科技报告统计,2023年全球发生了464起区块链安全事件,造成损失高达约24.86亿美元。虽然较2022年的37.7亿美元已有所下降,但这个数字依然表明安全漏洞对行业信心的巨大冲击。DeFi平台仍是重灾区,2023年约有282起针对DeFi的攻击事件,占比六成,损失约7.73亿美元。这些包括智能合约漏洞被利用、跨链桥被黑、私钥管理不善等多种类型。与此同时,加密诈骗、Rug Pull(跑路)等恶性事件频仍,美国2023年因加密骗局损失金额创下新高。如此高的风险暴露,放在一个数千亿美元市值的行业里,是难以长久持续的。

再看监管层面,各国正以前所未有的速度完善加密法规。据普华永道《2023全球加密货币法规报告》,今年全球有25个国家/地区出台了稳定币相关立法或监管举措。欧盟率先通过MiCA法规对加密资产进行全面监管,美国也不断通过执法行动和听证会向市场释放监管信号,亚洲的日本、新加坡等则更新规则以平衡创新和风险。监管的“阳光”正在照进过去灰暗的加密角落:交易所必须加强KYC/AML,项目方要考虑代币是否构成证券,DeFi开发者开始研究如何嵌入合规模块。在传统金融机构大举进军加密领域的背景下,合规经营已成为进入这个市场的敲门砖。

可以预见,未来加密行业的竞争格局将发生改变。曾几何时,拼的是谁更敢于激进创新、谁能在灰色地带跑马圈地;而今往后,比拼的将是谁更稳健安全、谁更透明合规。具备强大安全团队、能及时修补漏洞的平台,将赢得用户信任;拥抱监管、愿意配合审计披露的项目,将获得机构资金青睐。反之,忽视安全的交易所可能因一次黑客事件倾覆,不守法的项目则可能被逐出主流市场。

总而言之,加密市场已步入“成人礼”阶段。安全与监管这两大变量,正从外围走向舞台中央,成为决定项目成败和行业走向的关键因素。这并非加密创新的终结,恰恰相反,这是行业成熟的标志。只有建立在稳固安全防线和清晰监管框架上的创新,才能走得更远、更久。对于投资者而言,也应相应地调整心态:评价加密项目,不再仅仅看其涨跌和噱头,更要看其安全记录是否可靠、合规态度是否积极。能够“又稳又透明又可持续”的玩家,才是未来加密江湖中笑到最后的那一批。

土澳小狮弟

2026-01-04 12:10

安全与监管,正在成为加密市场的核心变量

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

To seize the global opportunities brought about by the rapid development of artificial intelligence (AI) technology and to further promote the deep integration of cutting-edge technology with the real economy and the digital economy, Ju.com officially announces the establishment of a $30 million AI special investment fund.

This fund will systematically invest around core AI technologies and the next generation of intelligent product forms. Key investment areas include, but are not limited to: • AI foundational models and underlying technologies • AI Agent products and solutions, encompassing autonomous decision-making, task execution, and automation scenarios • Intelligent robotics-related products, including software-driven robots, Embodied AI, and human-robot collaboration systems • Convergent applications of AI and Blockchain / Web3, such as smart contract automation, on-chain governance and risk control, and decentralized intelligent execution systems • Commercialization and implementation of AI in fields like fintech, enterprise services, content generation, and data analytics

This special fund will invite several listed companies and industrial capital to co-invest. By leveraging synergies from industrial resources, application scenarios, and financial support, it aims to provide portfolio projects with full-cycle empowerment, from technology validation and commercial implementation to long-term strategic partnerships.

Ju.com has always adhered to a long-term value and technological innovation-oriented approach, continuously building an open, robust, and sustainable technology investment ecosystem. The establishment of this AI special fund represents a crucial strategic move by Ju.com in the context of cutting-edge technology and the intelligent trend, and also reflects our high recognition of the long-term industrial value of AI, AI Agent, and robotics technologies.

In the future, Ju.com will collaborate with outstanding entrepreneurial teams, technical talent, and industrial partners worldwide to jointly promote the large-scale application and industrial upgrading of the next generation of intelligent products.

This is hereby announced.

#AI #Jucom

On January 4, the crypto market carried forward its early-year momentum, with Bitcoin decisively breaking through a key resistance level and lifting overall sentiment. Over the past 24 hours, market activity expanded notably, with total turnover and liquidations reaching $107.27 billion, while the Fear & Greed Index climbed to 40, signaling a clear rebound in risk appetite compared with year-end conditions.

Bitcoin rose 1.13% to $91,144.55, posting an intraday high of $91,574.40 and a low of $89,314.02. The successful break above the $91,000 level and subsequent consolidation suggest sustained bullish momentum. Ethereum followed with a 0.77% gain to $3,145.37, trading within a $3,166.41–$3,076.75 range and maintaining a steady correlation with BTC’s upward move. Positioning remained balanced, with BTC longs at 49.88% and ETH longs at 49.62%, indicating that the advance has been driven more by spot demand and trend-following capital than by excessive leverage.

Structural opportunities remained active across smaller-cap assets. FMC/X surged 70.24%, while NEXAI/USDT and PIPPIN/USDT advanced 41.53% and 24.14%, respectively. These moves reflect selective capital rotation as traders respond to Bitcoin’s breakout without broad-based risk expansion.

Macro and fundamental signals added depth to the move. The U.S. government disclosed that its cryptocurrency holdings now exceed $30 billion, with Bitcoin accounting for 97% of the total, reinforcing BTC’s status as the dominant digital reserve asset. On the Ethereum front, Vitalik Buterin stated that ZK-EVM and PeerDAS will transform Ethereum into a new form of high-performance decentralized network, strengthening long-term scalability and data availability narratives. Despite heightened geopolitical headlines, including reports of U.S. military strikes in Venezuela, Bitcoin prices remained resilient, underscoring its growing role as an asset capable of withstanding external shocks.

Overall, the opening days of 2026 show a market regaining directional clarity. Bitcoin’s breakout provides a clear technical anchor, while Ethereum’s roadmap supports medium-term confidence. With liquidity and sentiment improving in tandem, the crypto market appears to be entering the early phase of a new structural advance.

#cryptocurrency #blockchain

2025 marked prediction markets' breakthrough into mainstream consciousness. Polymarket alone processed over 95 million trades with $21.5 billion in volume, while the entire ecosystem reached $40-44 billion. With 1.77 million total users and monthly actives stabilizing at 400,000-500,000, these numbers dwarf many DeFi protocols.

💰 The Reality Check: Why 95% Lose

Only 5.08% of wallets realized profits over $1,000, with just 30.2% profitable overall. The top 0.04% of addresses captured over 70% of total profits, accumulating $4 billion in realized gains. This zero-sum game demands strategy over speculation.

🔄 The Turning Point: ICE's $2B Investment

In October 2025, the NYSE parent company ICE valued Polymarket at $9 billion with a $2 billion investment. The platform acquired a CFTC-licensed exchange for U.S. market re-entry and announced migration from Polygon to its own Ethereum L2 (POLY). Market expects token generation event after the 2026 World Cup.

🚨 Risk Controls: The Zero Line of Defense

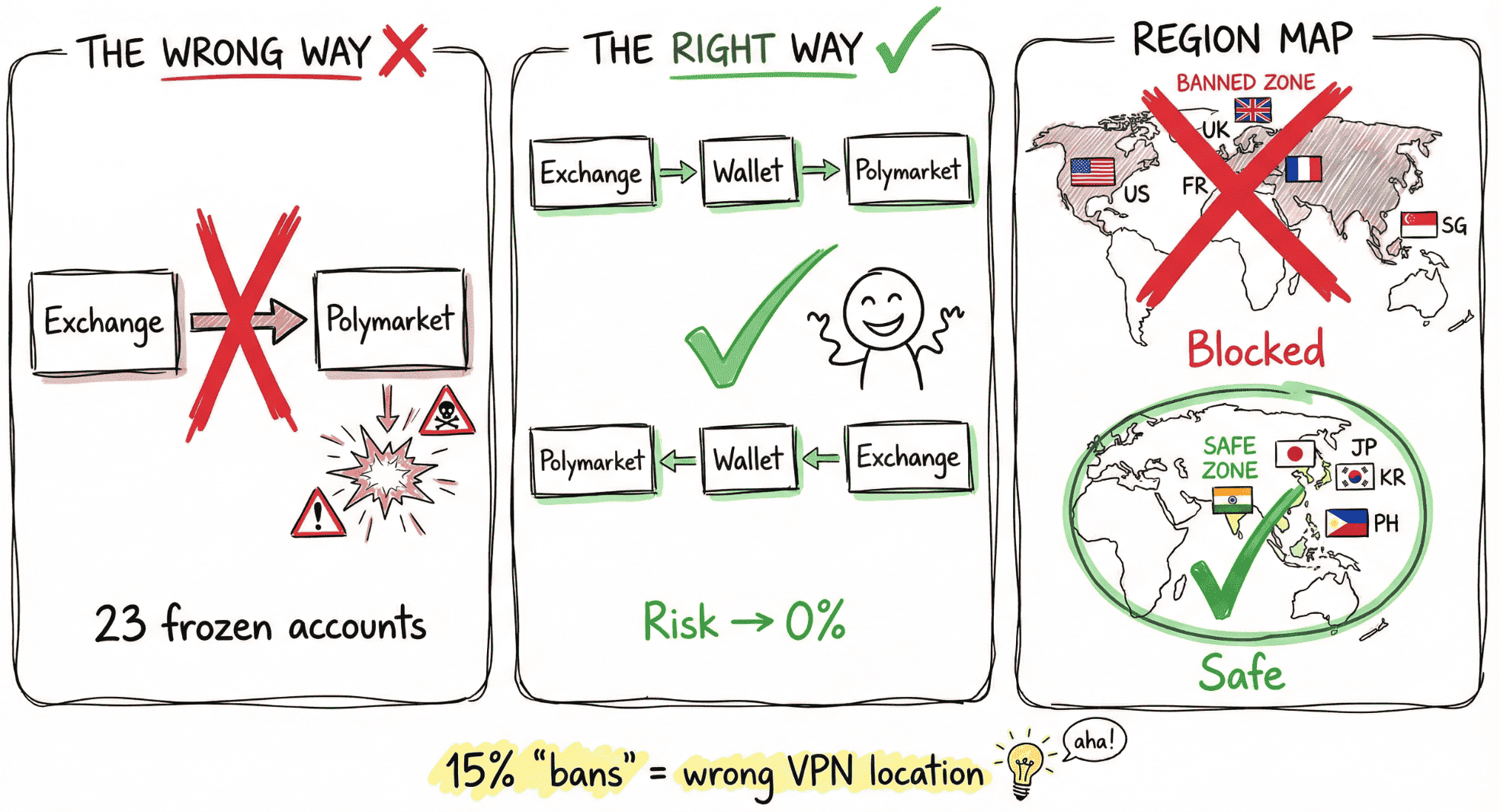

Never withdraw directly from exchanges to Polymarket. The correct flow is Exchange → Wallet → Polymarket for deposits, and reverse for withdrawals. This extra step costs minimal gas but eliminates account freeze risks. Explicitly prohibited regions include USA, UK, France, Ontario, Singapore, Poland, Thailand, and Taiwan. Recommended regions are Japan, Korea, India, Philippines, Spain, Portugal, and Netherlands.

📊 Airdrop Positioning: Become a High-Quality User

The platform values users who keep markets efficient and participate in price discovery. Key weight factors include Maker orders over Taker orders, Split/Merge operations for ~4% annual position rewards, diverse market participation across crypto/politics/sports/culture/economics, multiple time horizons from short-term to long-term markets, and sustained holding periods. The optimal trade size is $50-$500, with behavioral diversity and holding time carrying the highest weights.

🎯 Six Arbitrage Strategies for Profit

Cross-platform arbitrage exploits price differences where YES on Platform A plus NO on Platform B totals under $1. Multi-outcome arbitrage buys all mutually exclusive options when their combined YES prices sum below $1. Cross-event arbitrage identifies semantically identical events priced differently on the same platform. Term structure spread trades mispriced time value, buying longer-dated options while selling shorter ones. Rule-edge trading focuses on settlement criteria rather than headlines, finding value in the fine print. High-probability compounding targets events over 90% probability with under 72 hours to settlement, generating 80-150% annualized returns through disciplined execution.

💡 The Long-Term Builder's Edge

Prediction markets are approaching their "iPhone moment." Technology is ready, early user education is complete, and breakout events are imminent. Success rewards those who build information advantages, understand underlying mechanics, and prepare systematically. Don't chase short-term gains—build repeatable edges through compliant fund flows, line-by-line rule verification, and disciplined execution from low-risk arbitrage to late-stage strategies.

Read the complete survival guide with advanced strategies and risk mitigation: 👇 https://blog.ju.com/polymarket-prediction-markets/?utm_source=blog

#Polymarket #PredictionMarkets #Crypto #DeFi

The consolidation of major crypto assets within key price ranges does not necessarily signal the end of a trend. It more likely reflects a shift in market rhythm following increased institutional participation.

ETF flows have allocation characteristics, and their behavioral patterns differ significantly from retail sentiment. When volatility declines and options markets become more cautious, it often indicates that the market is waiting for new external variables.

In such phases, emotion-driven trading strategies tend to be less effective.

A listing wave among domestic chip companies. Recently, a number of domestic AI chip firms have accelerated capitalization: Moore Threads listed on Shanghai’s STAR Market with a market cap that once exceeded RMB 300 billion (longbridge.com); MetaX followed; Biren Technology launched a Hong Kong IPO plan targeting about $600 million in fundraising (finance.yahoo.com). This wave suggests that in AI chips, “domestic substitution” has become a clear direction strongly favored by capital markets. Even though domestic GPUs still lag global leaders in near-term performance, investors remain willing to support these companies at high valuations.

Certainty carries a premium. Under high geopolitical uncertainty, the certainty of domestic substitution itself commands a premium. Compared with projects that may be technically superior but strategically uncertain, domestic AI chips offer a clearer investment logic: regardless of external conditions, China’s demand for sovereign and controllable compute is structural and increasing. That certainty is why capital pays. In other words, capital does not always chase the theoretical “best” solution; it often favors the most sustainable solution. As domestic substitution becomes a national strategy and a market consensus, companies aligned with that direction are viewed as having long-term value. This explains the strong investor enthusiasm even when short-term profitability remains limited.

A shift in market preferences. The listing boom reflects a shift in how markets evaluate opportunities. In earlier cycles, investors chased high-growth, high-risk concepts; now, amid geopolitical and supply-chain risks, certainty and controllability have become key evaluation criteria. For companies, this implies that aligning with strategic national direction and delivering indispensable value improves the chance of sustained capital support. Domestic AI chip companies are leveraging this tailwind to grow rapidly, strengthening industrial resilience while creating a synergy between industry and capital.

PancakeSwap incubates the prediction market platform Probable, which is far more than just adding a product feature. It also reveals the strategic evolution of top DeFi applications: Expanding from a single "trading venue" to a comprehensive "on-chain casino/casino" ecosystem.

Strategic logic deduction:

1. User retention and value-added: The prediction market has strong entertainment and user stickiness , which can effectively improve user engagement rate and stay time, guide traffic to the PancakeSwap main station and create new sources of income.

2. Ecosystem collaboration: Probable seamlessly integrates PancakeSwap's liquidity and exchange functions to form an experience loop. Its automatic token conversion is the best example.

3. Seize the track: The prediction market is regarded as a key track in 2026 by institutions such as a16z, with huge trading volume (the peak of the sector in 2025 will reach $10 billion per month). PancakeSwap seizes the position in advance through incubation.

Challenge: Faced with the Network Effect and Liquidity Depth of mature platforms such as Polymarket (with monthly trading volume exceeding $2 billion), Probable needs to prove that its "zero commission" strategy is enough to attract users to migrate.

Analysis of ecosystem strategy:https://blog.ju.com/probable-prediction-market-bnb-chain/?utm_source=blog #DeFi #ecosystem #strategy #competition #PancakeSwap