💥 UBS, PostFinance, Sygnum and the Swiss Bankers Association have completed a proof-of-concept exploring Deposit Tokens - tokenized bank deposits - on a public blockchain.

🧠 Key points:

🔸Legally recognized bank deposits

🔸Enable direct interbank payments without legacy systems

🔸Could power payments & tokenized asset settlements

📌 Why it matters:

🔸Bridges traditional finance with blockchain/Web3

🔸Faster, cheaper, and more transparent transactions

🔸Paves the way for decentralized interbank payment systems

⚡️ This is just a pilot, but it’s a big leap for global finance.

#JuExchange #JuVietnam #JuInsights #Crypto #CryptoNews #JuTrending

Lee | Ju.Com

2025-09-17 06:46

🚨 BREAKING - Swiss Banking Giants Dive Into Blockchain!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📰 Circle reports Q2 revenue growth of $658 million, driven by a 90% increase in USDC circulation to $65.2 billion.

⚠️ Despite posting a net loss of $482 million due to IPO expenses, adjusted EBITDA increased 52% to $126 million, demonstrating strong operating performance.

🔎 Read more: https://blog.jucoin.com/circle-q2-earnings-usdc-analysis/

#JuCoin #JuCoinVietnam #USDC #Circle #CryptoNews #Crypto #DeFi #Web3 #Blockchain

Lee | Ju.Com

2025-08-19 06:39

🌟 Circle Q2 2025 Financial Report: USDC Revenue Soars 53%!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

1️⃣Stripe and Paradigm launch new L1 chain

◻️Stripe and Paradigm investment fund cooperate to introduce layer-1 blockchain called Tempo, specifically designed for payment purposes.

2️⃣Mega Matrix files with SEC for stablecoin governance token treasury strategy

◻️Mega Matrix (MPU) has filed a $2 billion shelf registration with the SEC to conduct a treasury strategy focused on stablecoin governance tokens - especially Ethena's ENA token

3️⃣Ukraine officially votes in favor of legalizing and taxing crypto

◻️The Ukrainian parliament has voted with a result of 246/321 votes in favor, moving towards legalizing and taxing the crypto market.

4️⃣World Liberty blacklists Justin Sun's wallet address

◻️World Liberty has frozen Justin Sun's address, locking billions of dollars in WLFI tokens after $9 million was transferred to exchanges, although Sun denies selling.

5️⃣19:30 tonight, the US releases non-farm payroll data for August:

◻️Unemployment rate expected at 4.3% (previously 4.2%).

◻️New jobs (Non-farm) forecast to increase by 75,000 (previously 73,000)

◻️This information will have a strong impact on Fed expectations and the risk asset market, especially crypto

🔔 Connect with JuCoin now to not miss hot news about Crypto, financial policy and global geopolitics!

#JuCoin #CryptoNews #Stripe #Paradigm #MegaMatrix #ENAtoken #Stablecoin #DeFi #NFP #Ukraine

Lee | Ju.Com

2025-09-05 12:45

📰Crypto News 24h With #JuCoin! (05/09/2025)

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 Token Unlock Schedule This Week: August 18 – August 23!

🔓 Tokens to Watch: $FTN $MELANIA $ZRO $KAITO $ZK $SOON

👉 Trade Now: https://bit.ly/3BVxlZ2

👉 Join the JuCoin Vietnam Community: https://t.me/Jucoin_Vietnam

📢 Stay up to date with JuCoin to not miss the latest news from the market!

#JuCoin #JuCoinVietnam #JuCoinInsights #TokenUnlock #CryptoNews #CryptoTrading #BlockchainUpdates #Web3 #Altcoins #CryptoCommunity

Lee | Ju.Com

2025-08-19 06:37

🚨 JuCoin Insights | Token Unlock Schedule This Week: August 18 – August 23!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📣 Daily Crypto Market Report!

⏰ August 19, 2025

🔥 Stay updated with the latest crypto market trends with #JuCoin!

🔸 Sign up for JuCoin now: https://bit.ly/3BVxlZ2

🔹 Join the JuCoin Vietnam community: https://t.me/Jucoin_Vietnam

🔸 JuCoin Blog: https://blog.jucoin.com/crypto-daily-market-report-aug19-2025/

#JuCoin #JuCoinVietnam #JuCoinInsights #Crypto #CryptoNews #JucoinTrending

Lee | Ju.Com

2025-08-19 06:37

📣 JuCoin Insights | Daily Crypto Market Report!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔓 Tokens to Watch: $S, $MOVE, $BB, $IO, $APT, $PEAQ, $CHEEL

👉 Trade Now: https://bit.ly/3BVxlZ2

👉 Join the JuCoin Vietnam Community: https://t.me/Jucoin_Vietnam

📢 Stay up to date with JuCoin to not miss the latest news from the market!

#JuCoin #JuCoinVietnam #JuCoinInsights #TokenUnlock #CryptoNews #CryptoTrading #BlockchainUpdates #Web3 #Altcoins #CryptoCommunity

Lee | Ju.Com

2025-09-08 13:06

🚨 JuCoin Insights | Token Unlock Schedule This Week: September 9 – September 13!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Bucket provides collateralized debt positions (CDPs) and fixed-cost borrowing on Sui. Users can mint the BUCK stablecoin by collateralizing assets such as SUI, LSTs, and ETH. The protocol stabilizes the peg via PSM, redemption, and the Tank mechanism, and benefits from the rollout of native stablecoins on Sui. This Token Insights piece systematically analyzes its positioning, core mechanisms, the BUT token, and ecosystem roadmap.

Summary: Bucket is a major CDP protocol on Sui: post collateral → borrow BUCK with predictable fees; maintain the peg using PSM/redemptions/Tank; BUT is used for governance/incentives; the ecosystem is growing alongside Sui’s native stablecoin expansion.

🟠 What is Bucket?

Bucket calls itself a “decentralized stablecoin protocol.” Users deposit collateral into the contract to open CDPs and mint BUCK, a USD-pegged stablecoin. The project emphasizes “fixed (or predictable) borrowing costs” to reduce funding uncertainty. Official docs state BUCK is over-collateralized and supports multiple collateral types (SUI, SUI LSTs, ETH, etc.).

🟠 Why on Sui?

In 2024, Sui onboarded native stablecoins (USDC, AUSD, FDUSD, USDY), significantly improving DeFi capital efficiency. Its Move object model plus parallel execution allow collateralization and liquidations to be processed concurrently with low latency—well-suited to Bucket’s high-frequency settlement needs.

🔻 Architecture and Mechanisms: BUCK’s “Three-Pronged” Peg

🟠 PSM: 1:1 Channels with USDC/USDT

The PSM maintains its own vault with a minimum collateral ratio of 100%, enabling direct 1:1 swaps between BUCK and USDC/USDT (PSM in fee 0%, PSM out 0.3%), which quickly pulls price back to $1 during deviations.

🟠 Redemptions: Face-Value Swap for Collateral, Prioritizing Low-CR Vaults

BUCK holders can redeem at face value for any whitelisted collateral. The system reduces debt from vaults in ascending order of collateralization ratio, protecting overall solvency (exceptions include TCR < 110% or redemptions disabled within 14 days of deployment, both codified in rules).

🟠 Tank and Liquidations: Settling Debt with BUCK to Receive Collateral

When a vault is liquidated, the Tank repays debt by burning BUCK and receives collateral in return, allowing participants to acquire collateral at a discount. This sustains system solvency and reinforces the peg. Sui’s ecosystem directory lists PSM/CDP/Tank/Redeem as a coordinated “stability combo,” enabling developers to integrate them modularly.

🟠 Technical Notes: Why Bucket Fits Sui

Sui’s object model and parallel execution let independent transactions confirm simultaneously, reducing congestion risk during redemptions and liquidations. Bucket’s modules align with Move’s object-centric design (collateral, vaults, PSM vaults are all objects), recording “who holds what and when” more directly.

🟠 Fixed Cost and Product Form

The website and socials repeatedly stress “fixed rate/predictable cost,” designing leverage and compounding paths for users “long SUI and BTC/ETH,” reducing interest-rate volatility in position management. With native Sui stablecoins live, BUCK–USDC/FDUSD/USDY trading/settlement routes are smoother, offering a practical “USD base” for collateralized borrowing and cross-protocol liquidity.

🟠 Token and Economic Model: BUCK vs. BUT

- BUCK: Bucket’s USD-pegged stablecoin.

- BUT: The protocol token used for governance, incentives, and ecosystem distribution (with a deBUT locking model). The terminology page clearly distinguishes their roles and data scopes.

🟠 BUT Supply and Circulation

The official BUT overview and dashboards show: total supply 1 billion; circulating ~395 million (time-varying), plus cumulative slashing and staking/unlock metrics. Some third-party trackers list a public sale window and size in 2025-01. Official sources and reputable aggregators prevail.

🟠 deBUT: Updated Locking and Incentive Model

In an Aug 2025 Medium post, the team updated deBUT to bind long-term participants via a clearer lock–weight–incentive relationship, aiming to “make the system friendlier to long-term supporters.”

🟠 Ecosystem Position and Data Corroboration

Stablecoin Indicators

Aggregator dashboards show BUCK market cap around $69.66 million, along with issuance/redemption flows, reflecting Bucket’s share in Sui’s stablecoin track. Price-tracker pages also show BUCK trading tightly around $1 over the past 24 hours.

🟠 Official Milestones

The team’s retrospectives note that after launch, Bucket entered Sui’s top-10 protocols with TVL climbing to about $38 million (historical reading; current TVL should follow real-time dashboards/official disclosures).

🟠 Multi-Collateral and Front-End Tools

Ecosystem directories and wallet/aggregator pages indicate Bucket supports SUI, LSTs, ETH, BTC, and other collateral types, and offers a Swap SDK so front ends can serve as stable exchange gateways.

Some public dashboards have yet to standardize protocol-level TVL for Bucket, but BUCK market cap, trading pairs, and mechanism modules cross-validate its activity and importance in Sui DeFi.

🟠 Recent Progress and Timeline

Mechanism hardening: completed PSM/redemption/Tank docs and parameters; clarified fees and thresholds.

Asset expansion/activities: socials announced acceptance of certain LP tokens as collateral and ecosystem campaigns, improving composability and reach.

BUT data pages: launched BUT overview and staking stats, revealing total supply, circulation, and deBUT metrics.

🟠 Future Plans

Stablecoin depth: continue “strong peg” via PSM × redemptions; broaden BUCK–USDC/FDUSD/USDY accessibility across primary and secondary markets.

Collateral spectrum: expand LST/LP/blue-chip collateral under a risk framework, with finer-grained liquidation parameters.

Token and governance: lengthen the “lock–weight–revenue share” design around BUT/deBUT to increase market-making and risk participation. The above projections align with official direction.

🟠 FAQ

🟧 How are borrowing costs made predictable? By exposing fixed/predictable rates and clear parameters, users can estimate carry at vault creation, reducing uncertainty from “usage-driven rate spikes.”

🟧 Why does BUCK trade close to $1? Through the 1:1 PSM channel, face-value redemptions, and Tank-backed liquidations, creating arbitrage and mean-reversion forces when price deviates.

🟧 What’s BUCK’s relationship with Sui’s native stablecoins? In 2024, Sui onboarded USDC, AUSD, FDUSD, and USDY, giving Bucket smoother pegs, market-making, and settlement environments.

🟧 What’s the difference between BUT and BUCK? BUCK is the stablecoin users mint and use; BUT is the protocol token for governance and incentives (including the deBUT locking model).

🟧 Is there an authoritative TVL figure now? Historically, Bucket entered Sui’s top-10 with TVL ≈ $38m; real-time scale should follow official and reputable dashboards, while BUCK market cap and depth serve as indirect evidence.

🟠 Key Takeaways

Bucket: a Sui-based CDP protocol supporting multi-asset collateral and fixed-cost BUCK borrowing.

Peg toolkit: PSM (1:1 USDC/USDT) + redemptions + Tank jointly maintain $1.

BUT/deBUT: 1B total supply, circulating and staking data displayed; governance/incentives are iterating.

Ecosystem fit: Sui’s native stables, parallel execution, and object model reduce congestion and liquidation friction.

Data corroboration: BUCK market cap ~ $69.66m and multi-collateral whitelist highlight Bucket’s importance in Sui’s stablecoin track.

#Jucom #JuComVietnam #JuCoin #CryptoNews

Lee | Ju.Com

2025-09-13 05:43

🔉 Bucket Research: BUCK and CDPs on Sui!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 Baisse des taux de la FED prévue le 29 octobre ?

📉 Selon WalletHub, la FED devrait réduire à nouveau ses taux le 29 octobre… mais 65 % des Américains affirment ne pas s’en soucier.

💡 Pour les traders, c’est une autre histoire : chaque mouvement de taux peut réorienter les flux de capitaux vers les actifs à risque, notamment $BTC/USDT et #crypto.

👉 Notez la date 🗓 — la volatilité pourrait bien être de retour.

#CryptoNews #financial markets #cryptocurrency

Carmelita

2025-10-23 09:09

🚨 Baisse des taux de la FED prévue le 29 octobre

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🌟 Ju.com Blog | A new era, a new journey together — Ju.com Coming to TOKEN2049 Singapore!

📌 As a leading global cryptocurrency exchange platform and Web3 ecosystem builder, Ju.com announces its participation in TOKEN2049 Singapore as a Platinum Sponsor.

🔍 Read more: https://blog.ju.com/vi/jucom-token2049-singapore-preview/

#JuBlog #JuExchange #JuVietnam #Stablecoin #CryptoNews #Blockchain #Web3

Lee | Ju.Com

2025-09-29 05:03

🌟 Ju.com Blog | A new era, a new journey together!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚦 The green light is on – it’s time to break out with JuCoin!

⏳ Only 1 day left to count down before the big opportunity explodes. Nothing is impossible when you join us. 💪

🔸 Register for JuCoin now: https://bit.ly/3BVxlZ2

👉 Are you ready?

#JuCoin #ImPossible #1DayCountdown #Crypto #CryptoNews #JucoinTrending

Lee | Ju.Com

2025-09-09 10:06

🚦 The green light is on – it’s time to break out with JuCoin!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 CZ (Binance) déclare : “Tokeniser l’or, ce n’est pas de l’or on-chain.”

💬 Une mise au point claire du fondateur de Binance, rappelant que la tokenisation ne remplace pas la détention réelle de l’actif, mais en propose une représentation numérique dépendante d’un tiers.

💡 Ce débat relance la réflexion sur la vraie décentralisation des actifs tokenisés : posséder le jeton ne signifie pas toujours posséder la valeur.

👉 La confiance, plus que la technologie, reste le véritable actif.

#CryptoNews #Tokenization #cryptocurrency #blockchain

Carmelita

2025-10-23 09:04

🚨 CZ (Binance) déclare : “Tokeniser l’or, ce n’es

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 JUST IN: KAZAKHSTAN GOES CRYPTO! 🇰🇿

Bloomberg reports that Kazakhstan will launch a $1 billion crypto reserve fund by 2026, financed through seized assets.

The move signals a bold shift — turning past corruption into future innovation. 💥 From oil wealth to digital reserves, the nation’s betting big on blockchain.

#CryptoNews #Kazakhstan #blockchain $BTC/USDT

Carmelita

2025-11-07 13:25

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

⚡️ Kalshi dépasse les 4 milliards $ de volume de trading sur les 30 derniers jours ! 💥

📈 La plateforme de prédiction enregistre son meilleur mois historique, confirmant l’essor fulgurant du trading événementiel et l’intérêt croissant des investisseurs pour les marchés basés sur la probabilité.

💡 Kalshi s’impose désormais comme un acteur clé du Web3 et de la finance prédictive, reliant économie réelle et marché crypto.

👉 Les prédictions ne sont plus un jeu… mais une nouvelle classe d’actifs.

#CryptoNews #PredictionMarkets #cryptocurrency

Carmelita

2025-10-25 11:32

⚡️ Kalshi dépasse les 4 milliards $ de volume de t

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

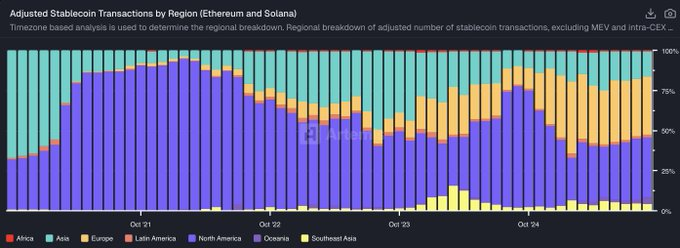

🔥 L’activité stablecoin explose en Europe ! 🇪🇺

💥 Les transactions de stablecoins sur $ETH/USDT et $SOL/USDT ont bondi ces derniers jours pour atteindre 8,8 millions, représentant désormais 36 % de toutes les transactions mondiales.

💡 Ce boom illustre la montée en puissance de l’adoption crypto en Europe, portée par la régulation MiCA et la confiance accrue dans les paiements on-chain.

👉 Les stablecoins ne dorment plus : ils redessinent le futur du paiement numérique.

#stablecoins #CryptoNews #blockchain #cryptocurrency

Carmelita

2025-10-25 18:30

🔥 L’activité stablecoin explose en Europe ! 🇪🇺�

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 Le rouble russe bondit de 40 % face au dollar américain depuis le début de l’année 🇷🇺🇺🇸

💥 Une performance spectaculaire qui reflète un rééquilibrage géopolitique et économique en pleine mutation.

Alors que le dollar perd du terrain, le rouble s’impose comme un symbole de résistance financière — soutenu par les échanges énergétiques et la dédollarisation croissante.

💡 Ce mouvement pourrait renforcer les discussions autour d’un système monétaire multipolaire, où les cryptos et les CBDC trouvent leur place.

👉 Le pouvoir monétaire se redessine sous nos yeux.

#CryptoNews #financial markets #cryptocurrency

Carmelita

2025-10-23 09:06

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 ALERTE : les données de l’inflation US tombent aujourd’hui ! 🇺🇸

📊 Le CPI sera publié à 8h30 (ET) — et les marchés sont en mode attente sous tension. Les traders s’attendent à une forte volatilité sur les actions et les cryptos, selon la direction que prendra l’inflation.

💡 Un chiffre trop chaud, et la FED pourrait resserrer le jeu. Trop froid, et le marché rallume le feu du risk-on.

👉 Préparez vos graphiques… la séance s’annonce explosive. 🔥

#CryptoNews #financial markets #cryptocurrency

Carmelita

2025-10-24 11:47

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 21SHARES FILES FOR #XRP ETF!

The Swiss asset manager 21Shares has officially submitted its $XRP/USDT ETF application to the SEC.

The regulator now has 20 days to respond, meaning it could go live by Nov 27 if left unchallenged.

After years of speculation, Ripple’s moment on Wall Street might finally be here. 👀

Carmelita

2025-11-08 11:41

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 BREAKING: Michael Saylor strikes again! ⚡️

MicroStrategy has just confirmed another $BTC/USDT purchase during the dip — proving once again that volatility is just an entry point for the bold.

💬 Saylor’s mantra stays the same: “We don’t sell. We stack.”

Every correction fuels his conviction… and the market knows it.

#Bitcoin #BTC #MicroStrategy #Saylor #CryptoNews

Carmelita

2025-10-26 11:38

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

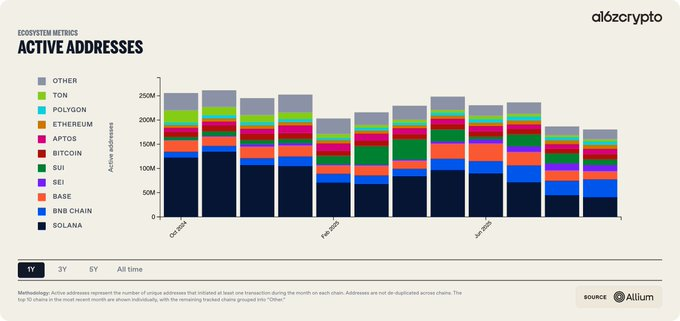

⚡ $SEI/USDT dépasse Sui, Polygon et Aptos en adresses actives pour septembre 2025 !

📊 Selon a16z, le réseau SEI a pris la tête du classement, confirmant sa croissance fulgurante et l’efficacité de son infrastructure optimisée pour le trading on-chain.

💡 Ce momentum positionne $SEI/USDT comme l’un des L1 les plus utilisés du moment, porté par une communauté de builders et de traders de plus en plus engagée.

👉 Les blockchains se multiplient, mais l’activité réelle parle d’elle-même. SEI vient d’envoyer un message clair.

#SEI #CryptoNews #cryptocurrency #blockchain

Carmelita

2025-10-23 09:08

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚨 Le Kirghizistan crée une “Réserve nationale de cryptomonnaies” incluant du $BNB/USDT 🇰🇬

💥 CZ, le fondateur de Binance, vient de confirmer cette initiative historique : le pays intègre désormais les actifs numériques dans ses réserves nationales, une première mondiale.

💡 En incluant $BNB/USDT , le Kirghizistan envoie un signal fort sur la reconnaissance institutionnelle des crypto-actifs comme réserves de valeur stratégiques.

👉 La tokenisation des réserves nationales ? Elle vient de commencer.

#BNB #CryptoNews #cryptocurrency #blockchain

Carmelita

2025-10-25 11:42

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.